DamianKuzdak

We previously covered Pfizer (NYSE:NYSE:PFE) in September 2023, discussing its pessimistic performance as the decelerating COVID-19 portfolio and underperforming bolt-on acquisitions had contributed to its lowered FY2023 guidance range.

Combined with the overly aggressive R&D efforts, expensive acquisitions, and deteriorating balance sheet, we had preferred to cautiously rate the stock as a Hold then.

In this article, we shall converse why our downgraded rating has proven to be right, with the PFE stock advance tumbling by -25.86% since then, attributed to the underwhelming FY2024 guidance post-Seagen acquisition.

While the pharmaceutical company’s fundamental performance remains somewhat decent, it is apparent that bullish uphold has fled for greener pastures, such as generative-AI and weight loss stocks, with it remaining to be seen when a floor may materialize.

PFE’s Best Days Are Over For Now

With the closing of the Seagen deal, the PFE management has reiterated their FY2023 revenue guidance of $59.5B (-40.6% YoY) and adj EPS guidance of $1.55 (-76.4% YoY) at the midpoint.

However, readers may also want to note that the number has been lowered from the previous midpoint number of $69B (-31.2% YoY) and $3.35 (-49% YoY) offered in the FQ4’22 earnings call.

It may be critical to grasp that the final FY2023 revenue guidance comprises approximately $46.65B in non-COVID products (+7% YoY) and $12.85B in COVID sales (-77.3% YoY).

Most importantly, despite the hefty $43B price tag, Seagen is only expected to contribute approximately $3.1B to PFE’s sales, bringing the latter’s overall FY2024 revenue guidance to $60B (+0.8% YoY) and adj EPS to $2.15 at the midpoint (+38.7% YoY).

Based on the management’s commentary, it appears that its non-COVID products may create up to $50.84B in sales (+9% YoY) with an impacted COVID sales of $9.16B (-28.7% YoY).

There is two ways to look at these numbers, to be honest.

On the one hand, PFE’s non-COVID’s pipeline growth appears to be excellent indeed, compared to its historical growth trend of +0.2% in FY2019. It is apparent that the management’s efforts to bolster its pipeline has been working as intended, partly to offset the upcoming LOEs in 2026.

On the other hand, it is apparent that Mr. Market expects the erosion in PFE’s COVID sales to be less steep, based on the previous FY2024 consensus revenue estimates of $63.2B (+6.2% YoY) and adj EPS estimates of $3.17 (+104.5% YoY).

Its bottom line prospects appear to be underwhelming as well, attributed to the FY2024 adj R&D expense guidance of $11.5B (inline YoY/ +48.9% from FY2019 levels of $7.72B) and the -$0.40 impact on its adj EPS attributed to the unprofitable Seagen.

Therefore, while the management has raised their annual net cost savings target by $500M to at least $4B by the end of 2024, it remains to be seen when sentiments may better, with market analysts likely pricing another lowered COVID sales guidance ahead.

This is on top of the pessimistic outlook for PFE’s weight loss pills, with two of its pipeline already failing to perform as expected and only one awaiting early data by H1’24.

This advance delays its reversal, with Eli Lilly (LLY) and Novo Nordisk (NVO) notably taking the direct in this space, with a supposed TAM of $77B by 2030, expanding at an accelerated CAGR of +54.27%.

PFE’s intermediate term prospects are not helped by the deteriorating balance sheet as well, with the closing of $43B all-cash Seagen deal likely to drain its cash/ short-term investments of $44.17B in the latest quarter (-1.3% QoQ/ +22.2% YoY), while leaving behind a bloated $61.04B in long-term debts (-1% QoQ/ +85.2% YoY).

Combined with its mixed FQ3’23 earnings result in October 2023, with revenues of $13.23B (+3.9% QoQ/ -41.5% YoY), adj EPS of -$0.17 (-125.3% QoQ/ -109.5% YoY), and $5.6B worth of inventory COVID write downs, it is unsurprising that the recently announced FY2024 guidance has caused a steep plunge in its stock price.

The impacted profitability suggests that PFE may temporarily utilize its balance sheet and debt to service its annualized dividend obligations of $9.28B (inline QoQ/ +3.5% YoY) by the latest quarter.

The same pessimism has also been suggested by the Seeking Alpha Quant, attributed to its impacted TTM Interest Coverage ratio of 4.28x and TTM Dividend Coverage Ratio of 0.94x, compared to its historical average of 16.02x/ 2.45x and the sector median of 7.84x/ 3.68x, respectively.

PFE Valuations

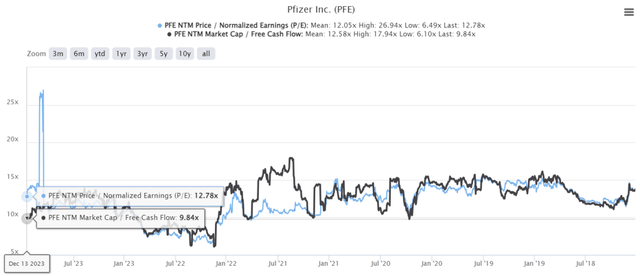

Tikr Terminal

Perhaps this is also why PFE’s FWD P/E valuations of 12.78x and FWD Market Cap/ Free Cash Flow valuations of 9.84x have been somewhat discounted, compared to its pre-pandemic mean of 14.23x/ 14.38x and the sector median of 10.97x/ 12.63x, respectively, though somewhat inline to its 1Y mean of 12.46x/ 10.81x.

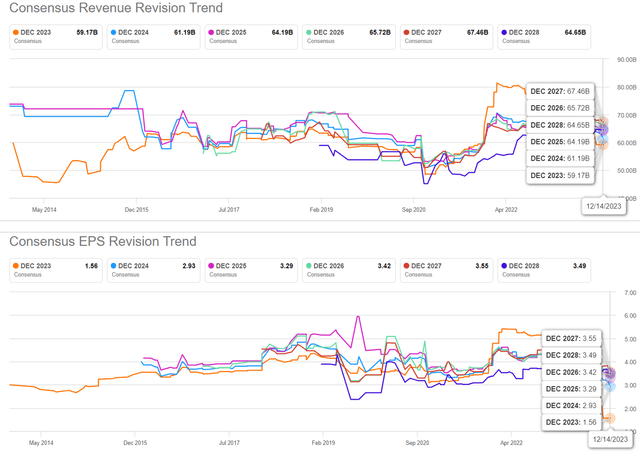

The Consensus Forward Estimates

Tikr Terminal

The subsequent downgrades in PFE’s forward estimates are not surprising as well, with the pharmaceutical company expected to create a minimal top and bottom expansion at a CAGR of +3.9% and +2.8% between FY2019 and FY2025, respectively.

This is compared to the previous estimates of +4.4% and 5.9% over the same time frame, respectively.

The PFE stock appears to be trading above its fair value of $19.80 as well, based on the management’s drastically lowered FY2023 adj EPS guidance of $1.55 (down from the previous guidance of $3.35 and the annualized FQ2’23 adj EPS of $2.68) and its FWD P/E valuation of 12.78x (inline from previous article).

Based on the management’s FY2024 adj EPS guidance of $2.15, it is also evident that the stock has pulled forward part of its upside potential to our NTM price target of $27.47.

Readers must also note that PFE has been negotiating Medicare price revisions for five of its drugs since September 2023, with the new prices to go into effect from 2026 onwards.

We believe that the impact may be muted for now, with the blood thinner Fragmin only comprising $228M of the pharmaceutical company’s overall top-line and Bicillin at $148M in the latest quarter, or the equivalent of 0.8% of its non-COVID portfolio, with the rest not disclosed.

Then again, the combination of underwhelming FY2024 guidance, deteriorating balance sheet, and patent cliff/ Medicare headwinds from 2026 onwards does not bode well to PFE’s intermediate term prospects indeed.

We also believe that its inventory write-downs and goodwill amortization may expedite in the near-term, thanks to the impacted COVID demand and expensive acquisitions, respectively.

So, Is PFE Stock A Buy, Sell, or Hold?

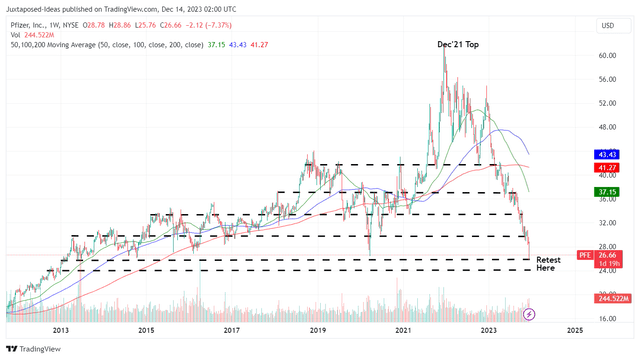

PFE 5Y Stock Price

Trading View

For now, PFE has already plunged drastically to retest its December 2012 levels of $26s, with the sell off closing the gap to its FQ3’23 book value of $17.54 (inline QoQ/ +6.2% YoY).

While we have no intention of recommending a Buy at these levels, it appears that everyone is so bearish until the PFE stock has been overly corrected, in our opinion.

This is why.

The nature of investing in pharmaceutical/ biotech stocks have been speculative all along, since only ~8% of clinical trials have been able to reach the coveted regulatory approval.

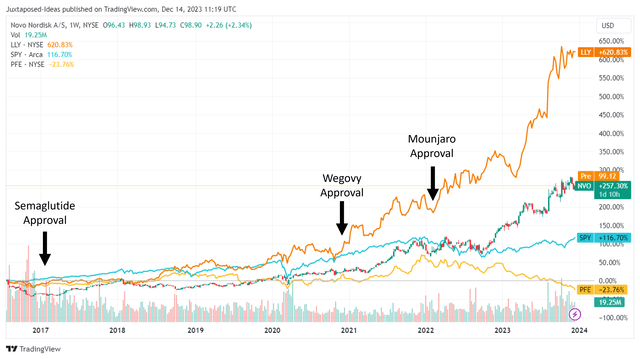

NVO & LLY Stock Prices

Trading View

For example, Semaglutide was first approved in 2017 for type-2 diabetes, with it only gaining in popularity and hype after being approved by the US FDA for weight loss treatment in June 2021.

Otherwise, it is apparent that NVO, LLY, and PFE’s stock movements have been somewhat sluggish between 2016 and 2020, with minimal upside movement then.

Most importantly, valuations matter after all. With PFE already drastically discounted at FWD P/E valuation of 12.78x, we believe these levels offer a highly attractive risk/ reward ratio, as compared to LLY’s astronomical valuations at 88.11x and NVO at 36.63x.

While the latter two’s investment theses may be compelling, we maintain our belief that there is no point in chasing over valued stocks with minimal margins of safety, as similarly highlighted by Peter Lynch:

There’s no shame in losing money on a stock. Everybody does it. What is shameful is to hold on to a stock, or worse, to buy more of it when the fundamentals are deteriorating.

PFE 5D Stock Prices

Trading View

While it remains to be seen how PFE may perform moving forward, the stock appears to have found bullish uphold at $25.83 after the recent freefall, with it already steadily climbing by +3.2% to $26.66 at the time of writing.

While no one can time the market, we believe that the bottom will materialize eventually, especially due to the pharmaceutical company’s expanded pipeline, aggressive R&D efforts, and COVID commercialization from H2’23 onwards.

As a result of the overly steep correction, we believe that Bob Farrell’s regulate likely to run true here:

Markets tend to return to the mean over time. Excesses in one direction will direct to an opposite excess in the other direction.

Thanks to the recently raised dividends, investors may also savor an expanded forward yield of 6.28%, compared to the 4Y average of 3.83% and sector median of 1.66%, especially since the US Treasury Yields are already moderating to between 3.89% and 5.37%.

Despite so, we prefer to cautiously maintain our Hold rating for the PFE stock, while recommending investors to perceive its stock trajectory before buying, once the stock has established a sustainable bottom. Otherwise, investors may have to suffer advance capital losses which may not be covered by its dividend payouts.