Montes-Bradley

With hindsight, the trade of the cycle was to short long duration Treasuries on surging interest rates due to the fastest rate hike cycle in history. And certain products, like the Simplify Interest Rate Hedge ETF (NYSEARCA:PFIX), really thrived in terms of not just the timing of their launch, but performance, execution, and assets under management growth. The question now remains as to whether betting against long duration Treasuries still makes sense.

PFIX is a unique financial instrument that offers investors a protective shield against the rise in long-term interest rates. It also gives the benefit of capitalizing on market stress when the volatility in fixed income increases. This ETF is constructed with a significant position in over-the-counter interest rate options, providing a clear and direct convex exposure to significant upward moves in interest rates and interest rate volatility.

PFIX is designed to function similarly to owning a position in long-dated put options on 20-year US Treasury bonds. Because the option position is held for an extended period, the ETF serves as a straightforward and transparent hedge against interest rates.

ETF Holdings: A Closer Look

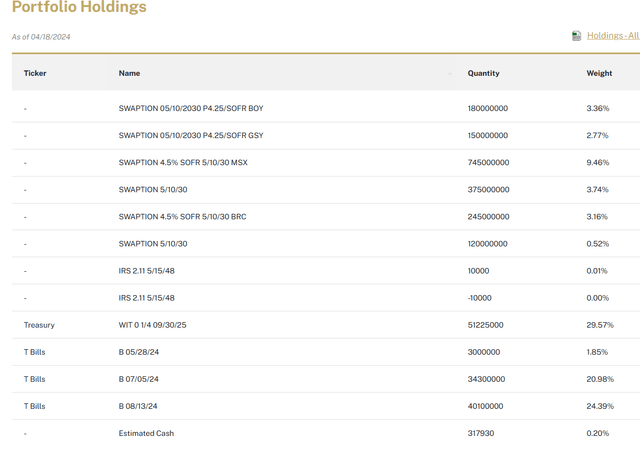

As mentioned, PFIX maintains a substantial position in OTC interest rate options. The ETF’s portfolio consists of swaptions with ranging maturities. A swaption is essentially an option to enter into a swap contract at a future date.

Sector Composition and Weightings

In terms of sector composition and weightings, PFIX’s portfolio is heavily concentrated in the financial sector due to its significant exposure to interest rate derivatives and treasury bills. This sector-specific concentration makes PFIX particularly sensitive to changes in interest rates and the overall health of the financial industry.

Peer Comparison: PFIX vs. Other ETFs

When compared to other similar ETFs, PFIX stands out due to its unique strategy of providing a direct and transparent hedge against rising long-term interest rates. While there are other ETFs that also offer exposure to interest rates, they usually do so indirectly through investments in financial sector stocks or bonds. PFIX, on the other hand, uses OTC interest rate options to achieve its investment objectives, making it a more direct play on interest rates.

The big thing to note is that this has performed much stronger than outright shorting the iShares 20+ Year Treasury Bond ETF (TLT). By a lot, actually. This very much has to do with the speed and volatility of the yield move we went through since 2021. Worth keeping in mind as this really does have some big swings, all things considered.

Investing in PFIX: The Pros and Cons

Investing in PFIX comes with its own set of advantages and potential risks. On the positive side, PFIX provides a direct and transparent hedge against rising long-term interest rates. This makes it an attractive option for investors looking to protect their portfolios against interest rate risk.

On the downside, PFIX’s strategy involves the use of derivative instruments, which can be risky. Derivatives often involve high levels of leverage, which can magnify both gains and losses. Furthermore, the use of OTC derivatives exposes investors to counterparty risk — the risk that the other party to the derivative contract will not fulfill its contractual obligations.

Conclusion: Should You Invest in PFIX?

Investing in PFIX can be a strategic move for those seeking to hedge against rising long-term interest rates. However, like any investment, it is not without risks. The use of derivative instruments and the focus on a single sector (the financial sector) can lead to increased volatility and potential losses. That said, if you understand the risks and believe in the investment strategy, PFIX can serve as a unique tool for hedging against interest rate risk in your portfolio.

The issue I have isn’t with PFIX, but rather whether or not it’s worth allocating to this fund at this point in the cycle. We just went through a historic move in Treasuries, which is unlikely to repeat again in our lifetimes (heaven help the financial system if it does). The duration crash in government debt at some point, I believe, turns into a credit event (and yes – I know my timing has been off there) which would mean you actually don’t want exposure to something that hedges government bond interest rate risk. Still – if you think differently, this is a good way to get some return on higher rates. I just would consider more trading than investing in it.