Wagner Meier/Getty Images News

Over the past year, I’ve maintained a skeptical stance on Petróleo Brasileiro S.A. aka Petrobras (NYSE:PBR), primarily due to concerns regarding the company’s outlook under CEO Jean-Paul Prates’ new management and potential state interference from the newly elected Workers’ Party (“PT”) government in Brazil. These perceived risks have led me to adopt a cautious position on Petrobras throughout my stock coverage.

However, the outcomes did not align with my expectations. Instead, the company’s share price surged, accumulating gains of up to 50% over the last twelve months.

Analyst’s Rating History on PBR (Seeking Alpha)

Despite my predictions, Petrobras posted robust profits and dividends in 2022. Ending the first year of President Luiz Inácio Lula da Silva’s administration back at the helm, the state-owned company reported a positive result of R$124.6 billion for 2023. While this figure represents a 33.8% drop compared to the previous period, it is the second-highest in the company’s history.

During the last year of Bolsonaro’s administration, Petrobras recorded a profit of R$188.3 billion, marking a 76.6% increase from 2021. Additionally, in 2022, the company announced a dividend payment of R$215.7 billion to shareholders.

Under the new governance structure, Petrobras has implemented several measures that I previously judged as potentially detrimental to shareholder value. These measures seem to have already begun to manifest.

“Key uncertainties in the thesis include the risk associated with the discount concerning international parity prices in the short and medium term, investments in new refineries (despite past controversies in developing its last refineries), increased pressure on the company to support national content policies, and rumors of using the company to repurchase previously sold assets.”

In 2023, dividend payments to shareholders significantly declined, indicating the company’s intention to allocate more funds towards investments rather than dividends. Dividend volume fell by 66.4% last year, though still substantial at R$72.4 billion. As in the previous year, the decision not to pay extra dividends disappointed investors, resulting in an approximate 11% drop in shares following the Q4 earnings announcement.

Despite reporting solid results for the quarter and the year, I view these factors as significant enough to counterbalance a more optimistic investment thesis for the company, even though it is trading at valuation multiples well below the industry average.

Breakdown of Petrobras Q4 2023 Earnings Results

Petrobras released its fourth-quarter 2023 results on March 7th. It exceeded EPS estimates of $0.83 by delivering $0.85 and revenue estimates of $25.27 billion, approximately $15.53 million above consensus.

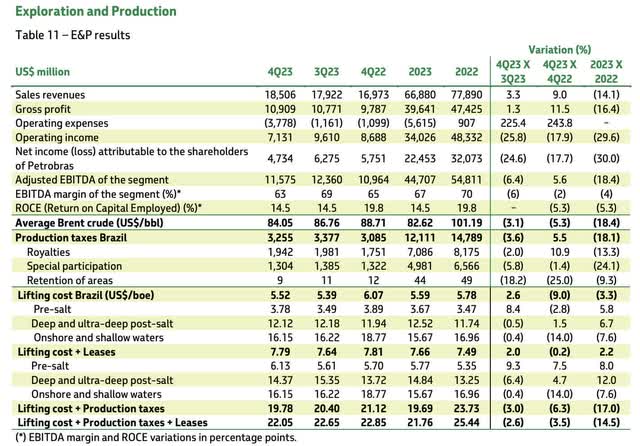

In the exploration and production (“E&P”) segment, the realized Brent oil price stood at US$84 per barrel, reasonably aligned with the company’s practice throughout the year. Revenues in the E&P segment reached $18.56 billion, marking a 3.3% surge compared to 3Q23. Production hit 2.9 million barrels of oil equivalent per day (Mboed), a 1.4% increase from the previous quarter. Pre-salt production achieved a record high, reaching 1.9 Mboed.

Lifting costs in 2023, without government take and leasing, were $5.59/boe, 3.3% lower than in 2022. According to the company, this reduction resulted from active portfolio management, including divestments and the production start-up of new platforms in 2022 and 2023.

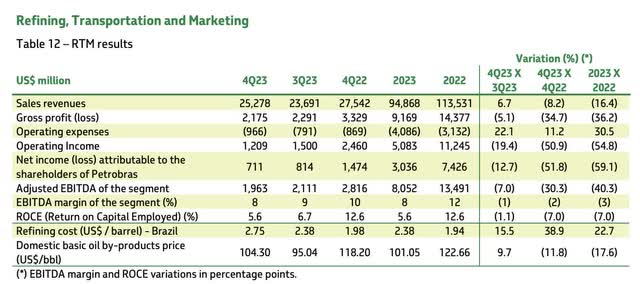

In the refining, transportation, and marketing (“RTM”) segment, revenues reached $25.27 billion, up 6.7% versus 3Q23. With higher volumes processed, the price of basic oil products for the domestic market rose to $104.3 per barrel, a surge of 9.7% compared to 3Q23, reflecting better price parity maintenance throughout the quarter. As noted in other documents, the company is directing a higher percentage of production to the domestic market and increasing segment utilization rates.

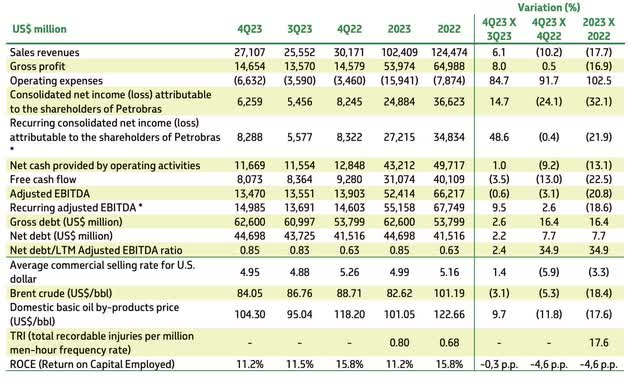

Petrobras reported recurring consolidated EBITDA of $13.4 billion, with a recurring free cash flow of R$8.07 billion. Operating expenses totaled $6.63 billion (versus $3.59 billion in Q3 ’23), mainly due to the non-recurring impact of $2.4 billion in impairments in oil and gas fields. However, it’s worth mentioning that the administrative expenses line would have been higher due to new hires and third-party services.

Investments amounted to $3.6 billion (versus $2.9 billion in Q4 ’22), with 80% focused on the Exploration & Production segment, aligning with the company’s current business plan unveiled in Q3.

Finally, net debt reached R$203 billion ($44.7 billion) in Q4 ’23, closing the quarter with a net debt/EBITDA of 0.85x vs. 0.63x in Q4 ’22 – still distressed but worth monitoring due to the dividend policy considering leverage. Consequently, the company reported a net profit of $6.25 billion in Q4 ’23 (versus R$5.45 billion in Q4 ’22).

A Setback to the Dividend Thesis

Despite Petrobras’s consistent results in Q4, there was significant market anticipation regarding whether the company would announce the payment of extraordinary dividends in the quarter.

Petrobras revealed that its board of directors had authorized the submission of a proposal to distribute dividends equivalent to R$14.2 billion, as stated in a material fact—this amount, determined by the remuneration policy and devoid of extraordinary payments, greatly disappointed investors.

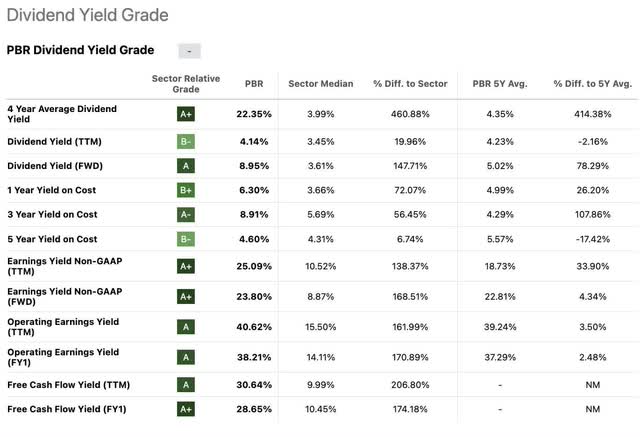

The proposed dividend equates to R$1.0989 per share, to be disbursed in two installments of R$0.5494 per share in May and June. This translates to a dividend yield of 2.7% in Q4 ’23 and 10.8% on an annualized basis—still appealing but insufficient to justify a more aggressive position in the stock for many investors who had anticipated yields well into double digits, as the company had previously announced in recent years.

Considering the operating cash flow (R$57.6 billion) minus investments (R$17.6 billion) multiplied by 45%, the proceeds earmarked for distribution would total R$18.0 billion. Of this amount, R$2.7 billion was allocated to share buybacks, with an additional R$1.1 billion related to the Brazilian interest rates (Selic) adjustment of interest and interest on shareholder’s capital (“JCP”).

Consequently, shares plummeted a further 11.8% after hours following the release of the earnings results.

It’s worth noting that a recent change in Petrobras’ Shareholder Remuneration Policy in July 2023, reducing the distribution of free cash flow from 60% to 45% and including share buybacks alongside dividends, raised further concerns. This adjustment aimed to implement elements of the new Strategic Plan 2024-28, emphasizing increased investment in low-carbon projects and refineries for self-sufficiency in derivatives and oil.

Therefore, this dividend distribution setback wasn’t entirely unexpected either.

Petrobras’ management adhered to its commitment, allocating the remaining profit for the 2023 financial year, amounting to R$43.4 billion, to these other initiatives. This sum will be entirely given to the capital remuneration reserve to ensure resources for dividends, interest on equity, and buybacks. If distributed, this amount would represent an additional R$3.3 per share to the proceeds paid by the company in 2023, adding around 8.3% more dividends for Petrobras shareholders at current price levels.

Additionally, the evolution of gross debt, which reached US$62.6 billion in Q4 ’23 (vs. US$60.9 billion in 3Q23 and US$53.8 billion in Q4 ’22), didn’t support the investment thesis. Another crucial detail is that the current dividend payment formula is only valid if gross debt does not exceed US$65 billion. Hence, the progression of gross debt is another critical point to monitor moving forward.

Are the Yellow Flags Resurging, or Were They Ever Gone?

Despite the company’s robust performance in 2023 and some anticipated risks that haven’t materialized thus far, I still perceive significant uncertainties surrounding the Petrobras thesis.

While Petrobras demonstrated resilience in 2023, lingering concerns warrant attention.

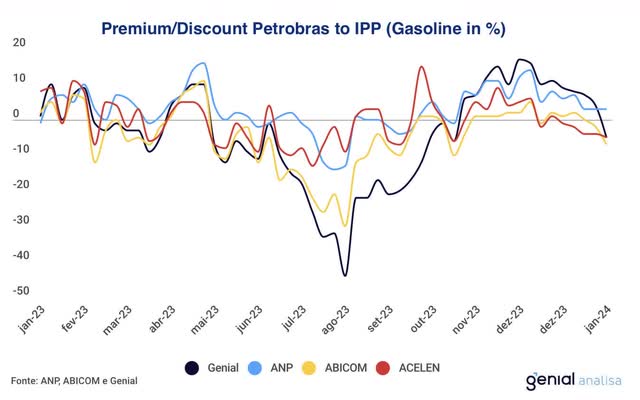

Discrepancies Between Prices Charged and Oil Parity Prices

In my assessment, the primary concern persists with the disparity between domestic and international oil parity prices.

In May 2023, the International Price Parity (IPP) policy was discontinued, with management stating that price readjustments would continue based on the international scenario. However, discrepancies between domestic and international prices raised concerns about the effectiveness of this strategy, reaching 23% in mid-August last year.

Despite this, throughout 2023, fuel price increases mitigated these effects, which was a welcomed development for the thesis. However, it remains a significant risk for the thesis in 2024, given the potential need for fuel price readjustments and the challenge of balancing Petrobras’ financial health with the policies of the Lula government, which align with the preferences of the Brazilian population.

Investments in Refineries and Renewable Assets

The second significant risk to the thesis revolves around investments in new refineries. Petrobras has a controversial history in this area, particularly during past administrations of the same party as the current President, Lula. I perceive a political risk of using the company to support national content policies, which could pressure its investment strategies.

Towards the end of last year, Petrobras announced plans to construct new diesel production units at five refineries. This strategy aims to boost fuel processing capacity at its facilities by 229,000 barrels per day by 2029.

In its unveiling of the 2024-2028 Strategic Plan, the state-owned company highlighted that this objective could be achieved with the introduction of new major projects at the refineries, such as the construction of Train 2 at Rnset (Abreu e Lima Refinery), along with revitalization efforts at other facilities.

Moreover, Petrobras may not continue to receive proceeds from divestments in the coming years, and there’s no indication of a resumption of this practice. The company anticipates halting divestment activities outside the Exploration and Production segment and initiating new investments in renewable assets and those aligned with the energy transition, which is in line with its Strategic Plan.

This stance by the company in favor of more aggressive investments in refining and other renewable energies, at the very least, undermines the dividend thesis for Petrobras’ shareholders.

Potential Repurchase of Previously Sold Assets

As Petrobras finds itself flush with cash and under pressure from the Brazilian government to reengage in aggressive investments, there’s considerable speculation regarding the repurchase of assets previously sold off to bolster its robust balance sheet.

Jean-Paul Prates, CEO of Petrobras, who has been at the helm for almost a year, took one of his first decisions to halt the asset sale program, initially adopted in 2016 under the Michel Temer government, to refocus on exploration and production activities.

Petrobras has stated that it evaluates opportunities such as acquiring a stake in the Mataripe Refinery and a project for an integrated biorefinery. There are also ongoing discussions with Mubadala Capital regarding downstream partnerships in Brazil.

However, rumors abound that the company may be eyeing a return to the fuel distribution sector. In response to a query from the Brazilian Securities and Exchange Commission (CVM), Petrobras stated that it is not currently considering the acquisition of a stake in Vibra (OTCPK:PETRY), its fuel distributor in Brazil.

Final Thoughts on PBR’s Earnings

Petrobras reported robust Q4 results, with solid cash generation and a healthy bottom line. However, it’s important to note that the quarterly result was somewhat dampened by a non-recurring, non-cash event of significant value: R$7.4 billion. Excluding this event, EBITDA in 4Q23 would have been R$74.3 billion.

Yet, Q4 earnings marked a pivotal moment in the company’s dividend investment thesis, as the distribution fell below expectations, given Petrobras’ strong cash generation of R$39.8 billion in Q4 ’23. This implies a cash flow yield of just over 7% for the quarter.

The primary concern remains the allocation of these resources towards accelerating the energy transition in projects that may not be as beneficial for generating shareholder value, especially when compared to the high returns from the Exploration & Production (E&P) segment, particularly in the pre-salt and equatorial margin areas.

Despite appreciating over 48% in the last twelve months (up to the Q4 earnings day), Petrobras still appears significantly undervalued based on valuation metrics.

The company trades at a forward P/E of 4.2x, which is 60% below the industry average and its private peers. Considering the company’s debt, its forward EV/EBITDA of 2.86x is substantially lower than the industry average of 5.56x. These factors present a compelling case for a quality asset like Petrobras trading at discounted levels. However, significant uncertainties persist, particularly following recent governance changes and heightened political risks, which are challenging to quantify and may potentially lead Petrobras into becoming a value trap.

While Petrobras may still offer an attractive valuation and potentially distribute a dividend yield of 10% in 2024, the persistent state risk once again casts doubt on the investment thesis for this company with solid fundamentals. Consequently, I maintain a neutral stance on Petrobras, anticipating a trend of less substantial dividends in the future.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.