Astrid Stawiarz

Pernod Ricard (OTCPK:PRNDY, OTCPK:PDRDF) is the second-largest spirits and wines company in the world. They sell well-known brands such as Absolut Vodka and Kahlua. Wines and champagnes make up a small proportion (~5% of sales), the company is mostly focused on spirits such as vodka, whiskey, and gin. These drinks are becoming increasingly popular and Pernod Ricard is expanding internationally.

It is a French family-owned business, where the family still owns about 15% of the company. The current CEO, Alexandre Ricard, is the grandson of the founder, Paul Ricard, who started the company in 1932. Ricard merged with Pernod in 1975 to get its current name. I like family-owned businesses as a value investor because they generally have more stability and a longer-term view on the company. Moreover, its brands provide a strong moat in this category.

The company is facing some short-term headwinds and a normalization of profits after a big run-up following the pandemic. The 20% decline in share price last year might be a good entry point at a fair price. We conclude that Pernod Ricard is an attractive investment for long-term value investors, but the price is not cheap enough for it to be an attractive value investment.

Main Competitor: Diageo PLC From The UK

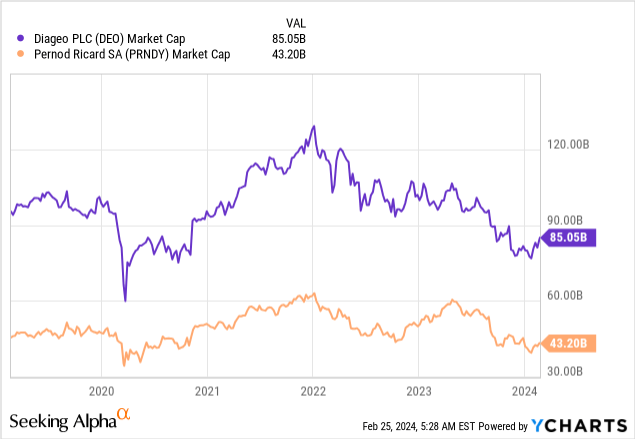

Their main competitor is Diageo (DEO), which is a larger UK-based company that also sells well-known brands, including Johnny Walker Whiskey and the famous Guinness Beer. Diageo is a bit more diversified, and another difference is that Pernod Richard doesn’t sell beer. Moreover, Diageo is more focused on developed markets, while Pernod Ricard invests more in emerging markets.

These companies both had a strong run-up after the pandemic when societies opened up again, but the stock price has come down in recent years after the peak in 2022. Over the past year, Pernod Ricard’s stock price decreased by about 20%. This decreased price might offer a good buying opportunity.

Relevant Long-Term Trends

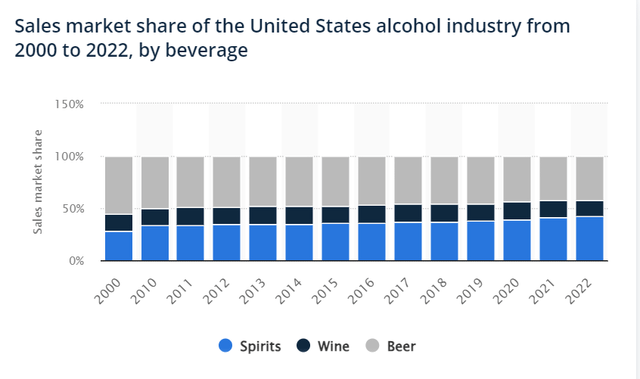

Over the past few years, people are drinking less beer but relatively more wines and spirits, which is a positive long-term tailwind for Pernod Ricard. Especially people in the young generation, Gen Z enjoy drinking cocktails, and other fancy drinks for mixers. That is why I prefer Pernod Ricard over beer-focused companies such as Heineken (OTCQX:HEINY) and AB InBev (BUD).

Market shares (Statista, 2024)

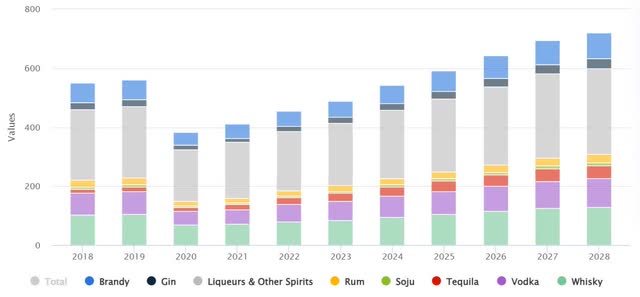

A big potential risk is decreasing alcohol consumption overall due to regulation or societal trends, which could turn out like investing in Tobacco companies. People are more health conscious than ever, and young people are less likely to drink alcohol. Instead of drinking alcohol, people increasingly choose to drink alcohol-free drinks or sodas. Pernod Ricard also makes low-alcohol or alcohol-free spirits, such as Gin without alcohol, to serve these changing consumer needs. These alcohol-free versions are becoming quite popular, and the market for alcohol-free spirits is expected to grow at a 15% CAGR. That being said, a secular decrease in overall alcohol consumption would be a big headwind for Pernod Ricard, but this is luckily not occurring (yet) as the market for regular spirits (with alcohol) is still expected to grow at about a 5% CAGR in the USA.

Expected Sales Growth for Spirits (worldwide) (Statista, 2024)

Finally, Pernod Ricard is investing heavily in emerging markets such as India and China. Emerging markets now make up around 50% of total sales for Pernod Richard. In these emerging economies, people are starting to spend more on discretionary goods and enjoy going out more, which will benefit Pernod Richard. In terms of consumption of (premium) spirits and wines, these emerging economies are forecasted to grow at double-digit rates over the coming years because of improved income and increased premiumization. This is a key difference between Pernod Ricard and Diageo because Diageo is more focused on developed markets such as the USA and Europe. In the long term, I think that the strategic focus on emerging markets benefits Pernod Ricard.

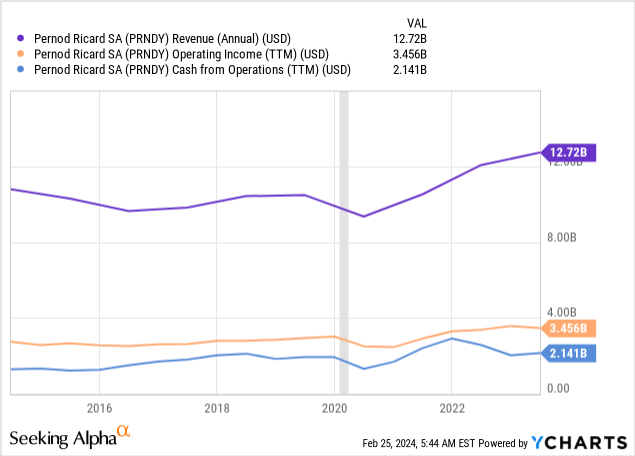

Financial Results

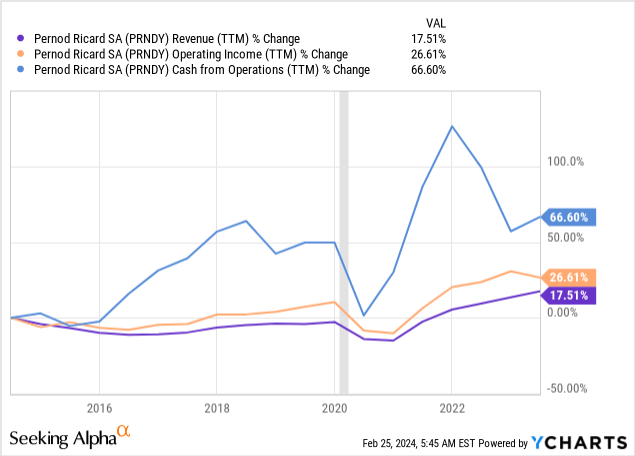

Pernod Ricard is a great company with growth and high profit margins. Over the past decade, its revenue has grown substantially from about $10B in 2014 to almost $13B in 2024, and its net profit margins have been consistently above 10% (excluding the 2020 pandemic). This strong financial performance is shown by its financial results over the past decade, as shown below:

As can be seen below, there was a strong increase in revenue growth after the pandemic has now normalized back to the long-term growth trajectory.

Some of this growth is due to acquisitions of smaller spirits brands such as Código 1935, a Mexican tequila brand, and Cockorico that sells pre-mixed RTD cocktails in a bottle. Financial details of these acquisitions were not disclosed, but we can see the increasing goodwill on their balance sheet, which has increased by about $1B as a result of these acquisitions. Still, their other brands are also growing organically, according to the company.

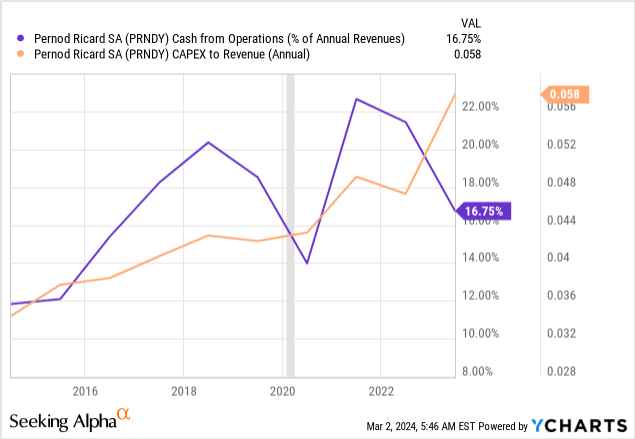

The thing that worries me when investigating these numbers is the relative lack of profit growth. While total revenue has increased by about 60% over the past decade, operating income has only increased by about 20%, so its margins have not improved. Normally, a business should become more profitable with scale. This difference can be explained by the fact that Pernod Ricard is investing heavily into emerging markets, which decreases short-term profitability but will pay off handsomely in the long-run in my opinion. By comparison, the CapEx spend of Diageo is less as a percentage of revenue, allowing them to report higher profits and free cash flow metrics (for now).

In terms of the debt profile, Pernod Ricard has paid down a substantial amount of the debt in previous years, which is good to see. Their costs of debt (interest payments) have therefore decreased over time, as shown below. Their balance sheet is quite strong because they have enough liquid assets to pay off short-term liabilities; i.e., current ratio of 2 while our criterion is higher than 1.

Latest Quarter Financial Results

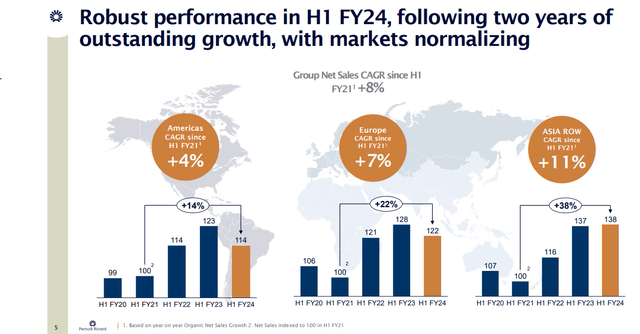

Sales growth (Pernod Ricard, 2024)

“We are in an expected phase of normalization. (…) In three years, for example, the North American market has grown by almost 25%, twice as fast as it should have. After this post-Covid super-cycle, inflation is easing and we’re going to return to a classic pricing policy, the one we had before the crisis, with more targeted increases. In fact, the second half of the year should see a dynamic recovery in sales.” (Alexandre Ricard, CEO Pernod Ricard, 2024)

The most recent earnings report showed a decline in sales volume after a period of strong growth in recent years following the pandemic. Some demand has been “pulled forward” from 2023 into 2022, which the company calls “revenge conviviality”. This pattern is common across peers, where Diageo showed declined earnings, and LVMH reported a 10% decline for its wines and spirits division. So, this sales decline issue is not specific to Pernod Ricard.

These examples comparing current sales to 2020 are a bit cherry-picked by the company to present it better than it is (weak comps). We therefore compared this year’s sales ($13b) to 2019 (before the pandemic), which reveals that sales are indeed higher than in 2019 ($10B). This comparison to 2019 would have been a more transparent and convincing example in my opinion, but still shows substantial growth. This decline in volumes was also due to large price increases across all segments, where consumers can switch to cheaper alternatives. Prices increased by double digits across the world that lead to decreased demand from consumers.

Valuation

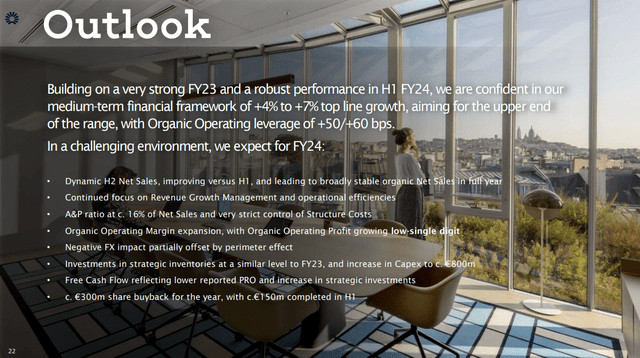

Finally, let’s do a short valuation to see what we should be willing to pay for this company. Looking ahead to the next five years, we model future sales, estimating sales growth across different regions; i.e., developed markets at 5% and emerging market at 10% growth. I base these growth expectations on the outlook provided at 1H FY2024 earnings call provided by the company.

outlook (Pernod Ricard, H1 FY2024)

It currently trades at about an 18 times forward earnings ratio, which is below its historical average that is above 20 times forward earnings. For valuation, our fair P/E should be 20 times earnings, this can easily be higher as shown before, but we should remain conservative in our estimates. However, earnings in FY2024 are temporarily depressed, so this P/E ratio is not very informative.

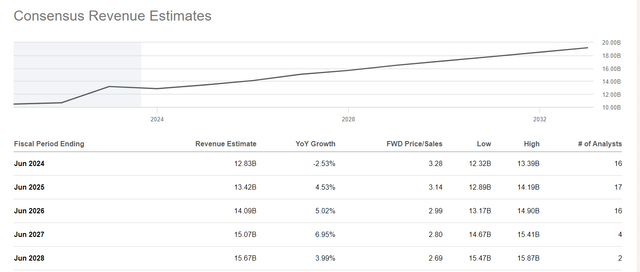

After a small slowdown in 2024 relative to 2023, we project Pernod Ricard to resume its long-term growth trajectory of about 4-7% topline sales growth, which is in line with the consensus estimates from analysts. This 4-7% topline sales growth is the average of 3-5% growth in developed markets, and higher 6-10% growth numbers across emerging markets such as India and China.

consensus estimates (seeking alpha, 2024)

In terms of margins, we expect operating cash flow margins at 15% which is below the long-term average of the past 5 years. They are now investing a lot in emerging markets for FY2024 to establish their presence in the market with marketing campaigns and infrastructure investments. Their capex as a percentage of revenue has doubled since 2016. Importantly, we expect that CapEx will come back down and that these investments pay off in the future.

financials (seeking alpha, 2024)

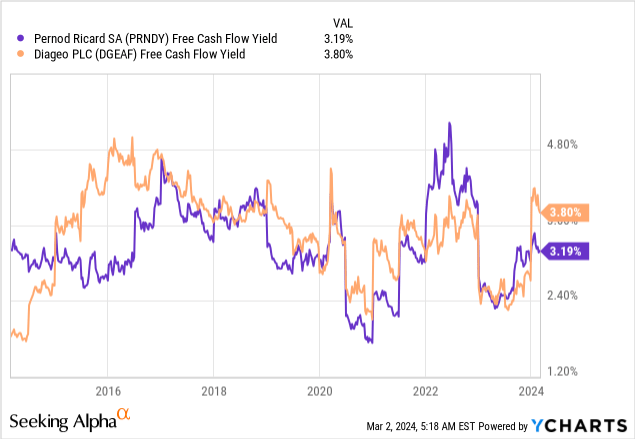

Putting it all together, it seems reasonable to assume that the company will do about $15-16B in total revenue for FY2028, with an operating cash flow margin of about 15%. This would result in about $2-2.5B in operating cash flow in 2028. Reducing capex from its current levels would then logically increase free cash flow. Estimating this level of CapEx to come back down to about 4% of revenue ($0.6B) would results in free cash flow numbers of about $1.4-1.9B. Comparing that to its current market cap ($40B), that is a free cash flow yield of about 3-4% which is reasonable but not spectacular. This FCF yield is also in line with the average of the past 10 years of Diageo and Pernod Ricard. Overall, the company seems to be around fair value instead of being strongly undervalued.

Finally, they are also buying back a substantial amount of stock and they’re paying a 3% dividend. This increases the attractiveness of this investment.

Relative valuations: Compared to Diageo, Pernod Ricard is similar in terms of valuation. They are both trading just below 20 times earnings. However, Diageo is a larger company that does more in free cash flow, so their overall market cap ($80b) is much larger than Pernod Ricard ($40b). Diageo is investing less and optimizing current cash flow numbers. However, in terms of future growth potential, I believe that Pernod Ricard has the edge because they are investing more in emerging markets, so that would actually justify a higher valuation. As a percentage of total revenue, Pernod Ricard is doing more investing capex in order to grow in emerging markets.

Finally, another smaller competitor, the Brown-Forman corporation (BF.B) (owner of Jack Daniel’s) is more expensive; it’s a much smaller business but has a similar market cap ($30b). This company is trading at almost 40 times earnings, while Pernod Ricard and Diageo trade below 20 times earnings.

Conclusions

Our final rating for Pernod Ricard is a “hold” because we believe that its brands provide a strong moat and its investments in emerging markets will drive long-term growth. The company is making the right moves with its marketing and innovative products like alcohol-free spirits and RTD cocktails. The big trend away from beer towards wine and spirits is another tailwind for Pernod Ricard.

However, its valuation is not as cheap as we would like for a deep value investment, but we believe that it is a fair price for a reasonably good company after a 20% drop in share price last year. The current price is not unreasonable for such a strong company, and it has traded at much higher valuations in the past. The coming months might provide an opportunity with a better entry price, as the shares could continue trending lower.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.