tiero/iStock via Getty Images

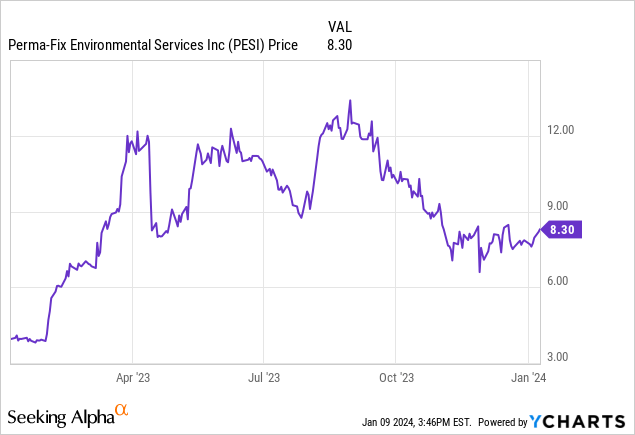

Shares of Perma-Fix (NASDAQ:PESI) started the year off strong in 2023, lifting from a low of under $4.00/share to as high as nearly $12.00/share by the end of 1Q23. The stock quickly gave back some of the gains, dropping as low as $8.00/share in mid-April, only to rally once again to 52-week highs ($13.87/share) by the end of August. The last third of the year was not kind to shareholders, however, as the stock ultimately reverted to where we set now, right around $8.00/share.

The volatility in the stock is not overly surprising. After all, the current core business alone probably does not justify an $8.00/share stock. But the likely future of PESI arguably justifies a higher share price-possibly much, much higher! In a market where traders and investors battle over stock prices, PESI has been caught in the crosshairs. In this article, I want to highlight why I am long-term bullish on shares of PESI and speak to some of the catalysts I believe we will see come to fruition in 2024 and beyond, which could be transformative for the company.

Of course, with PESI, we know the elephant in the room is the Hanford cleanup site. But, material business from Hanford is not likely to be seen until 2025, so let me save the discussion of Hanford until the end of this article. Before that, I want to discuss some nearer-term opportunities that could positively impact PESI’s business and share price. I should note from the outset that I am only highlighting opportunities that I believe are incremental to their current core business, which itself should be stable for years to come.

Does Italy Open the Door to Europe?

Back in early August, PESI reported its 2Q23 earnings and hosted a conference call. On that call, CEO Mark Duff was clearly optimistic the company would be awarded a Joint Research Centre (“JRC”) award in Ispra, Italy. Based on Duff’s guidance, investors anticipated the award to be announced in 3Q23, likely shortly after the Italians returned from their August holiday season. However, 3Q23 came and went without any such announcement. Investors got angsty and many started to exit the stock.

Finally, on November 28, 2023, PESI announced they received a “notice of intent” to be awarded this contract. Still, some investors were skeptical given the fact that this announcement coincided with a disappointing announcement made by the DOE related to the Test Bed Initiative (“TBI”) at Hanford which I will discuss later. Regardless, all doubt was relieved when, on December 21, 2023, PESI was formally awarded the EUR 50M JRC contract.

Joint Research Centre in Ispra, Italy (JRC Website)

In speaking with people familiar with this situation, the delay between the formal award and Duff’s guidance on the 2Q23 call was due to the contract going through an administrative approval process in the EU. Given this was the first time the company went through this process with the EU, it is not surprising it took a little longer than Duff originally anticipated.

For a company the size of PESI, this EUR 50M contract is certainly materially beneficial in its own right. However, what I believe investors might be missing is the fact that this Italy contract is indicative of something much bigger for PESI: opening the doors to Europe. According to people I have spoken with in the industry, Europe is decades behind the US in terms of nuclear waste treatment and disposal. And it is quite clear that PESI is setting itself up to be at the center of Europe moving forward in this respect. That PESI is gearing up for this was made quite obvious when they and Westinghouse announced a collaboration in March 2022 centered around a planned facility in the UK.

Based on my research, I believe the Italy JRC contract is just the first of multiple possible contracts in Europe for PESI. At least one of those, I believe, could be awarded in 2024, likely in the first half. More importantly, there is a whole string of awards that are likely over the next three to five years, with PESI in the driver’s seat given their head start with this JRC award. In speaking with other investors, these European opportunities do not seem to be on their radar, setting up a scenario for PESI to deliver some positive surprises in 2024.

OSMS Delays Continue

For about a year now, PESI has been talking about its opportunity with the Operations and Site Mission Support (“OSMS”) contract with the Department of Energy (“DOE”). The DOE was expected by multiple interested parties to award the OSMS contract as early as August 2023. Unfortunately, however, the DOE continues to delay this award for reasons unknown to anyone with whom I have spoken.

In any case, PESI is a part of one of several bidding conglomerates for this massive award. While there was—and again is (more on that soon)—much excitement about the enormous Hanford Integrated Tank Disposition Contract (“ITDC”), I believe that for PESI, the OSMS contract could be just as material. Based on my research, I believe the revenue and margins for PESI under OSMS would exceed those of the ITDC. Now, clearly, either or both awards would be welcome news for investors, and neither of those seems to be “priced in” the current share price.

OSMS (Paducah) Tests Robot (DOE Website)

Currently, the DOE has allegedly told bidders they expect to announce the award in late January 2024, but that announcement date has been pushed back numerous times recently, so I will believe it when I see it. Ultimately, of course, the DOE will have to award some group the contract, so it really is just a matter of time. If PESI’s group receives the award, I believe it would justify a major rally in the share price. If they do not receive the reward, it is certainly possible the stock will see some selling pressure, although I would view that as a possible buying opportunity given the other opportunities in PESI’s future I am discussing in this article.

Although no one seems to be able to confirm or deny my suspicion, I think the delay with OSMS may be related to the current dispute over the ITDC. After all, there are only so many companies able to do this type of work for the DOE, and the main players involved with ITDC are also involved in OSMS. So, it would seem to make sense that the DOE wants to figure these two major contracts out in tandem. With that in mind, let me now turn to Hanford and the enormous opportunity for PESI there.

Hanford ITDC

While there is reason for PESI shareholders to be cautiously optimistic about the company’s opportunity with the ITDC, I want to reiterate my sentiment that, among the three areas of Hanford where PESI could be involved in the relative near term, the ITDC is the least lucrative for the company, although still clearly materially beneficial. This is not at all an effort to minimize the positive impact of PESI being part of the ITDC, but rather to stress just how lucrative the other two aspects (secondary waste and TBI) of Hanford could be for the company. Further, I want to note that I do not consider PESI winning the ITDC as part of my current valuation of the company. I view it, instead, as a free, but unlikely “call option.”

Now, as it relates to ITDC, back in mid-April the DOE awarded this contract to the bidding conglomerate that did not include PESI (there were only two total bidding conglomerates for this $45B contract). That seems to be a big reason why PESI shares dropped from the late March highs.

However, as you might imagine with a $45B contract at stake, the losing group did not go away quietly. Instead, they filed a lawsuit, bypassing a protest to the Government Accountability Office (“GAO”), the usual way that federal contracts are initially contested. In June 2023, the federal judge hearing the lawsuit blocked the original DOE award, calling it “improper.” As it stands now, the GAO refuses to render a decision on the case, noting that the federal court has competent jurisdiction.

Consequently, an outside chance still exists that PESI’s original bidding conglomerate will be awarded the ITDC. Not receiving this award in the long term should not negatively impact PESI’s current business or share price, given that investors already sold off shares on this news in April. On the other hand, a surprise award to PESI’s group should cause PESI shares to rally, given the clearly material benefit to PESI under such a scenario.

Regardless of who is awarded the ITDC, what is most important for PESI right now is that the Hanford cleanup site’s vitrification plant continues to progress along a timeline to ramp up production in early 2025. That is important because of PESI’s sole-source award to treat the vitrification plant’s secondary waste.

Hanford Secondary Waste

In early December, the DOE reported that crews at Hanford made history by pouring the first test glass at Hanford’s vitrification plant. According to the release:

In August, Hanford crews started making glass after workers poured the first batches of glass beads, called frit, into the melter. By early September, the first molten pool of glass was created in a commissioning process that led to filling the first container with test glass recently at the plant. This is a major step toward future immobilization of low-activity tank waste from Hanford’s underground tanks in a glass form for disposal.”

This progress with the vitrification plant has huge implications for PESI. The reason is that the process of vitrification, which essentially turns the nuclear waste into a safely disposable glass product, itself creates waste that needs to be properly treated before its own disposal. This waste is referred to as “secondary waste” since it is a byproduct of the original waste. Obviously, this secondary waste is only created once the Hanford plant is up and running at the production level. As noted earlier, all systems are currently “go” for this plant to be up and running by early 2025.

PESI’s opportunity with secondary waste cannot be overstated. On January 31, 2023, the DOE released its final report on the treatment of this secondary waste. Investors may sometimes hear this document referred to as the Final WIR. WIR stands for “waste incidental to reprocessing.” PESI also sometimes refers to this decision as the ROD Amendment. ROD stands for “record of decision.” In any case, when you hear about the Final WIR or the ROD amendment, it is almost certainly referring to the DOE’s January 31, 2023, decision on the treatment of secondary waste.

Hanford Cleanup Site (DOE Hanford Website)

In reading that decision, you can see that not only did the DOE state that the secondary waste could be safely transported and treated at a commercial facility, but they further specified that the secondary waste would be sent to and treated at the PESI Northwest Facility (“PFNW”). In terms of what this means in dollars and cents, both the PESI CEO and CFO noted on the 4Q22 call (held in March 2023) their expectation for $65-75M in annual revenue and roughly $3.00/share in EPS as a result of this award for treating secondary waste.

For perspective, this secondary waste treatment estimate would roughly double PESI’s current annual revenue; and, due to the company’s operating leverage, it would multiply even more the company’s earnings. Further, while the DOE specifies a 10-year period of treatment in this decision, there is a high probability that the 10-year window is ultimately expanded—even as far out as 50+ years. I say this because the alternative to PESI treating this secondary waste is for the DOE to spend massive amounts of capital to build its own facility onsite. To give this better context, it should be noted that in addition to the current vitrification plant, the DOE will also need to develop a separate plant to treat the most high-level waste. The probability of the DOE being able to pull all of that off, while also then building a secondary waste treatment facility, seems improbable.

In my opinion, PESI’s core business plus this Hanford secondary waste award alone justifies a much higher share price. In fact, I believe by the time we near the end of 2024 or turn the calendar into 2025, that if Hanford’s vitrification plant is still on the path to being fully productive in 2025, PESI will be a prime acquisition candidate for a larger entity. The company’s neighboring location to the Hanford site combined with this decade or more award for secondary waste likely makes them an attractive acquisition. If a potential acquirer also calculates anywhere near the $3.00/share EPS possibility from secondary waste, you can be sure they will be willing to pay much more than the current $8.00/share price!

Hanford Test Bed Initiative

The Hanford TBI refers to an alternative method of cleaning low-level Hanford waste via grouting instead of via vitrification. It should be noted that TBI is a possible supplemental cleanup method for the main treatment of vitrification. It is not a substitute treatment.

In 2017, PESI completed a successful grouting demonstration, and the DOE recognized their performance as a key component of the overall grouting evaluation. What that means is that PESI could be used by the DOE once TBI starts full production, something that is expected to start soon after the vitrification plant is fully up and running. With this in mind, many investors assumed that PESI would be the sole source supplier on TBI, just as they are on secondary waste.

However, on November 28, the Environmental Protection Agency (“EPA”) released a proposal to grant a treatability variance from the Land Disposal Restrictions (“LDR”) treatment standards for the DOE for approximately 2,000 gallons of mixed low-activity waste from the Hanford site. If the variance is granted, the waste could be stabilized/treated and disposed of at long-term disposal landfills in Texas and Utah. As PESI noted in their November 28 press release linked above (the one related to the notice of intent to be awarded the JRC/Italy contract): “This [proposal] is consistent with past statements by the DOE that it is seeking to fulfill its obligation to define multiple pathways for grouting as a supplemental alternative to vitrification.”

What does this mean in layman’s terms? It means that instead of having PESI conduct a 2,000 gallon test in addition to their much smaller test in 2017, the DOE is seeking to ship untreated TBI waste to Texas and Utah for the waste to be treated and then stored there. It should be noted that even the waste PESI treated and/or might treat in the future from TBI is also planned to be stored/disposed of in the landfills in Texas and Utah. The only question at hand is whether some of that TBI waste will be shipped untreated to Texas/Utah or if the waste must first be treated by PESI before being shipped. In the proposal, the DOE gave until December 28, 2023, for public comment.

Implications for PESI

The implications for PESI are possibly enormous. Before getting into those implications, let me stress that yet again, I do not believe PESI being the sole source of TBI treatment is “baked in” to the current share price. The reason I state that is because, as I outlined in my last PESI article, it seems quite plausible that full-scale TBI production levels with PESI as the sole source could lead to another annual $70M in revenue and up to $3.00/share EPS. With the stock at around $8.00/share currently, full TBI production is obviously not being considered as the most likely scenario.

In any case, as PESI noted, what the DOE is trying to do is consistent with the DOE’s past statements to “define multiple pathways” for grouting. In plain English, the DOE is trying to avoid the situation where a small-cap company like PESI is the sole source supplier of so much Hanford work—both the treatment of secondary waste and TBI grouting. The ultimate question, though, is whether this effort by the DOE will be successful, or whether their hand will be forced to PESI’s benefit. Before getting into the logistics of that, let me say that even if the DOE is able to create “multiple pathways,” it is still highly likely PESI will treat at least some of the TBI waste—it may just be $20-30M/year in revenue instead of the full $70M if the DOE is able to use multiple facilities for TBI treatment.

Hanford Cleanup Site (DOE Hanford Website)

Regardless, the DOE’s proposal to create multiple pathways is anything but a slam dunk. As one contact of mine observed, while it is legally possible for the DOE to transport the untreated waste offsite for treatment, it is currently politically dead on arrival. That is to say, there are no laws prohibiting the DOE from transporting untreated waste to Texas or Utah, but there are influential politicians and political groups who will be standing in the way.

And I think it is quite obvious why. Who wants untreated nuclear liquid waste being transported through their territory? It is one thing to transport treated/solid nuclear waste, which if it “spills,” can be rather easily cleaned. But what happens if liquid nuclear waste spills into the ground? That is quite another matter. I’m sure American investors will remember the toxic train wreck in Ohio in February 2023. Now, imagine such a scenario with liquid nuclear waste seeping into the ground and groundwater from derailed train cars!

My best guess is that someone at the DOE is bent on finding these “multiple pathways” to treat the TBI waste, but that their proposal is divorced from the political reality. Obviously, politics involves compromise and people/politicians can change their minds. But based on my research, I believe the mayor of Spokane, the state of Oregon, and the native tribes in the Hanford area (among others) are all highly opposed to shipping untreated TBI waste through their respective regions. Moreover, it should be noted, that PESI just recently partnered with a local labor union who, I am quite certain, will be advocating to treat the TBI waste locally before shipping to its final destination in Texas/Utah.

One thing that is certain: PESI will not see material revenue/EPS from TBI until mid-to-late 2025 at the earliest. Nevertheless, any positive news between now and then as it relates to PESI’s portion of that business should be a positive catalyst for the share price and should certainly impact an acquirer/investor’s long-term valuation of the company.

Risks

Besides the normal legal risks of working with nuclear waste, I want to highlight two possible risks for PESI shareholders.

First, outside of the core business, which again, is stable, PESI shareholders should recognize possible volatility to the share price as the market reacts to balance near-term and long-term news and potential opportunities for PESI. While I accept a certain amount of volatility for this reason, I maintain a long-term approach whereby I expect that as long as Hanford’s vitrification plant continues to meaningfully progress, the share price of PESI should increasingly price in the secondary waste award that could lead to as much as $3.00/share of annual EPS.

Second, I want to note that, at some point, PESI is likely to need capital to expand its capacity. Given the massive amounts of secondary waste, OSMS-related waste, and European/international waste that will need to be treated—assuming PESI wins all or multiple of these awards—the company will need additional capacity, either domestically, in the UK, or both. While I do not expect enormous dollars to be spent on these capacity upgrades, it is likely that PESI will need to borrow money or offer additional shares to fund the capacity improvements, so investors should be aware of that possibility.

Valuation

As we have seen with the market’s valuation of PESI, so it is with me: I find valuing PESI to be difficult in the short term. As I previously stated, based on its core business, PESI probably deserves a valuation of less than $8.00/share. I would estimate their current core business to be worth around $6.00/share since PESI is currently on a trajectory to be a profitable company before factoring in any of the materially incremental possibilities I have discussed in this article.

At the same time, we are getting closer and closer to the Hanford vitrification plant becoming fully productive. That means we are getting closer and closer not only to PESI earning significantly more revenue/EPS from its secondary waste award but to the distinct possibility that PESI becomes an acquisition target. Moreover, we are closer to OSMS possibly being awarded, as well as some potential additional European business. With that in mind, I have a near-term target of $12.00/share. That said, depending on how the chips fall with respect to ITDC, TBI, and the vitrification plant, there is certainly the possibility that PESI could approach, or even exceed, $20.00/share by EOY24. To be clear, I am not predicting that, and the risks mentioned above should be taken into serious consideration; I am merely outlining multiple possibilities if some of the scenarios highlighted in this article fall PESI’s way.

Conclusion

Although PESI gave back some of its early 2023 stock price gains, it still ended the year at about double the price as it entered the year. Calendar year 2024 could be a pivotal and transformative year for the company. As its core business is now stabilized, the company is on the brink of some possibly lucrative contract wins. While the OSMS contract is a bit of a crapshoot, and the ITDC is still seemingly improbable, I believe the company will almost certainly win additional European business in 2024. I also believe the Hanford vitrification plant progress will lead to investor—and possibly acquirer—excitement about the company as we enter the back half of the calendar year, which I also believe justifies a much higher share price than current levels. With all of these things in mind, I continue to hold shares with the expectation that 2024 will be a rewarding year for PESI.