24K-Production

PepGen (NASDAQ:PEPG) is an innovative company using exon skipping therapies to address muscular dystrophy conditions. The burdens are high, although the disease is quite rare, but market sizes are not small. However, PEPG is early stage, with still a long ways to go in implementing their new technology to addressing the shortfalls with currently existing exon skipping therapies for these diseases. There is a large outstanding burden, so with financial and operational risks remaining over the development horizon, we feel that despite the small market cap and in light of the burden, the markets may not be large enough to make PEPG attractive at this price.

Product and Innovation

With reference to people in the field, Duchenne muscular dystrophy (DMD) and Myotonic dystrophy type 1 (DM1) are one of the more prevalent rare neuromuscular diseases which have huge impact on the quality of life of the patients which are suffering from it. These genetically inherited diseases have prevalence around 20 and 10 cases per 100.000 in the U.S. respectfully.

DMD is caused by mutation in a gene coding the dystrophin protein, which acts as a “bridge” in a muscle cell membrane, therefore providing stability of the muscle cells during their contractions and movement.

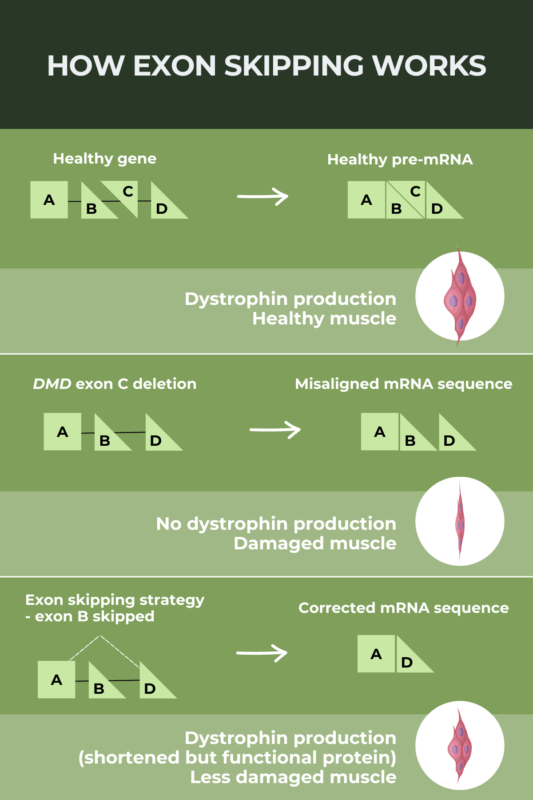

Every gene consists of coding regions called exons, sections that provide instructions for protein production. The main problem in DMD is lack of specific exons in the dystrophin gene, which results in defective and non-functional protein production. That leads to destabilization of the muscle cell which is clinically seen in poor muscle performance, leading to muscle fatigue and overall muscle weakness (including all muscle types: skeletal, cardiac and smooth muscles).

One of the therapeutical options for DMD is exon-skipping therapy of the relevant exons, and this kind of therapy is approved already by the U.S. FDA.

The main point of this therapeutic approach is to make Therapeutic Antisense Oligonucleotides (ASO) which will bind to desired exons, which we want to skip in the translation process, in order to make shorter, but still functional proteins.

Exon Skipping (MuscularDystrophy.com)

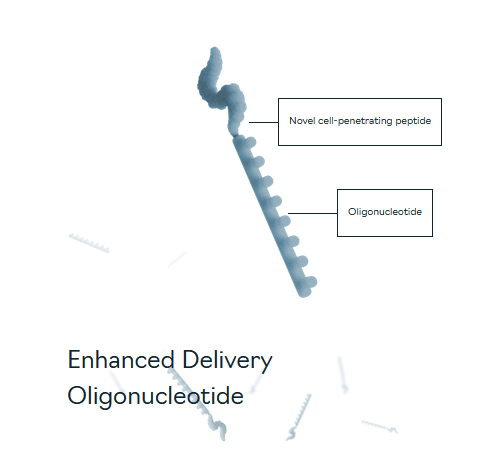

The whole story makes sense so far, but it has shown some limitations. The main problem lies in the insufficient supply of these ASOs in the muscle cells. That’s where PepGen made a step forward by engineering Enhanced Delivery Oligonucleotides (EDO). To be clear, the incumbent exon 51 skip therapies do not make use of EDO.

EDO (Pepgen.com)

They engineered a Novel cell-penetrating peptide which, as they claim, enhances tissue penetration (especially in tissues of interest, such as cardiac, skeletal and smooth muscles) as well as cell delivery, therefore providing a sufficient amount of desired oligonucleotides into the nucleus of the cell, where proteins will be made.

PGN-EDO51 is their main product, which targets a validated genetic target (exon 51) and it is currently completed Phase 1. They are adding a few more validated exon targets to the perspective (which are currently in preclinical examinations), to address eventually more than just 13% of cases.

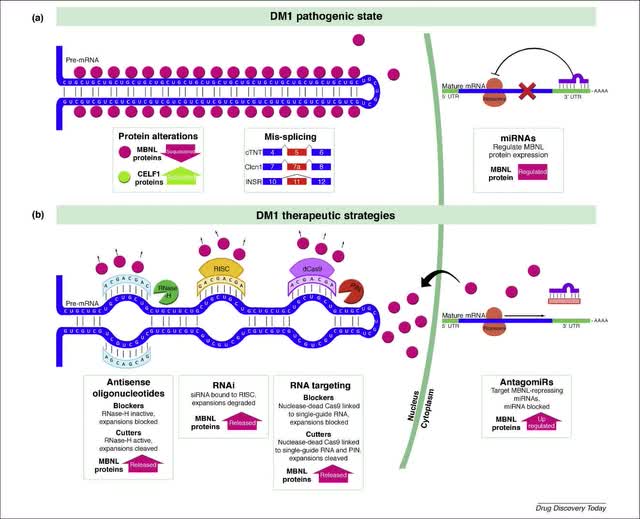

In their pipeline, they also have a product developed for treating DM1 as well, PGN–EDODM1, also in Phase 1. The main problem here is the mutated gene (DMPK gene) consists of over a hundred, in some cases even thousands of trinucleotide repeats in gene structure (normal condition is up to 50 trinucleotide repeats). The mutated gene goes under the translation process, which leads up to forming abnormal and useless structures, “hairpin loops”, resulting in producing defective protein in patients (or even no production at all). That condition causes similar symptoms related to muscle weakness and fatigue seen in DMD.

It seems that PepGen could have a solution for this problem by using the same EDO technology which we already discussed. By using ASO, they are able to attach them to the DMPK gene to produce normal proteins.

Our overall thoughts on this story seems to be positive, considering that this is a modified, better version of the concept that is basically already approved and in use worldwide for treating patients affected by these diseases. We are also not expecting serious side effects from these products, if we compare them to similar products which has exon skipping mechanisms of action.

Financial Comments

Let’s get right onto market sizing. DMD’s burden is around $80-120k per year per patient in the US, and half that in the EU. Based on prevalence figures, across Italy, Germany, UK and US the burden is around $1.8 billion according to NCBI, which gives us a broad market sizing. Exon 51 skips are only able to address a proportion of cases, namely around 13% of cases, so the PGN-EDO51 market size might be $234 million. Doing our own calculation using prevalence figures and multiplying them by around $50k, which is the average direct costs to patients who have DMD in the EU, you get around $10 billion, which is a substantially higher estimate of market size than offered by NCBI, scaled down to $1.3 billion for just exon 51 skipping.

DM1 is a similar burden on society, affecting around 100,000 people in the US and the EU, and the market here could also be billions, which PepGen could address a part. As much as a $3-4.5 billion market size in total, of which PepGen will be able to obtain a part.

At current cash burn rates, PepGen has around 2 years of a runway using current cash, and cash burn rates are likely to grow as trials ramp up. That’s not a lot considering how early stage the clinical trials are. Further financing will be needed and it will dilute equity holders.

Crudely, we can take the equity deficit figure to get an idea of how much they’re in the hole so far from spending, as a pre-revenue company, on developing these therapies. As always, the rule of thumb is $2 billion to develop a drug or therapy. They are early days, having spent around $100 million only. Ostensibly, they’d have around $1.9 billion or so left to spend.

There is a risk that financing conditions deteriorate. This could happen, for example, if inflation persists and Fed policy appears ineffective, or from general economic strife from the current rate increases. But presuming that they raise capital, there is an outstanding financial burden of approximately $1.9 billion to be conservative. And this is assuming total overlap between their two clinical programs, which is generous. Reflexivity is also a major danger. We want the price to decline to a more attractive entry point, but a weaker price also means worse financing conditions, which can death spiral early stage companies. Fragility in financial markets becomes an operational risk, even a going concern risk, if things were to worsen in markets down from recent optimism.

PepGen is worth $162 million in market cap, and adding the outstanding burden gets them to around $2 billion in effective EV. Outside of that, dilution effects from equity compensation plans seem to be pretty limited at around 5-10%, depending on how the reserved rights in the plan grow over the next couple of years.

The obtainable market, assuming it ousts competing exon 51 skip therapies, is around $234 million for DMD according to NCBI, and around $1.3 billion according to our calculation using direct costs to households in Europe, which should be more conservative than using costs in the US, which are twice as high. We assume generously that their therapy will be a lot more effective than incumbents, due to EDO. For DM1, there is additional market to be obtained. However, for a fair value proposition, they still need to capture a lot of the overall burden of DM1, which maxes out at $4.5 billion according to our value capture calculation. There is a $700 million or so that they need to capture of that for a fair value, and we should assume that their therapies will only be appropriate for a proportion of cases, so far unknown.

Bottom Line

It’s not impossible, but for the valuation case to work the more generous figures need to be used, to the point where the costs of the therapy are going to be equal to the current burdens, and we need to assume full penetration into the sick population. While a proper treatment is better than hospital fees and physio costs, it’s still a stretch in terms of market size for both DMD and DM1. Given the financial and operational risks on top of that, we feel there isn’t enough reward.