Md Saiful Islam Khan/iStock via Getty Images

Topline Summary

PDS Biotech (NASDAQ:PDSB) is a clinical-stage company focused on the development of immunotherapy-based approaches for cancer, primarily at this time virus-driven tumors. In 2023 they shared exciting data in a subset of patients with head and neck cancer, propelling them toward opening a pivotal trial. While their cash position is a serious concern, I feel that this company warrants a potential buy based on their current valuation ($150 million market cap) and favorable clinical data.

Pipeline Overview

PDS0101

The main pipeline project being developed by PDSB at this time is PDS0101, an immunotherapy built on the Versamune platform. Versamune at its core is a lipid nanoparticle designed to promote uptake to dendritic cells, which in turn leads to presentation of some antigen of interest, which should promote an immune response against cells harboring that antigen.

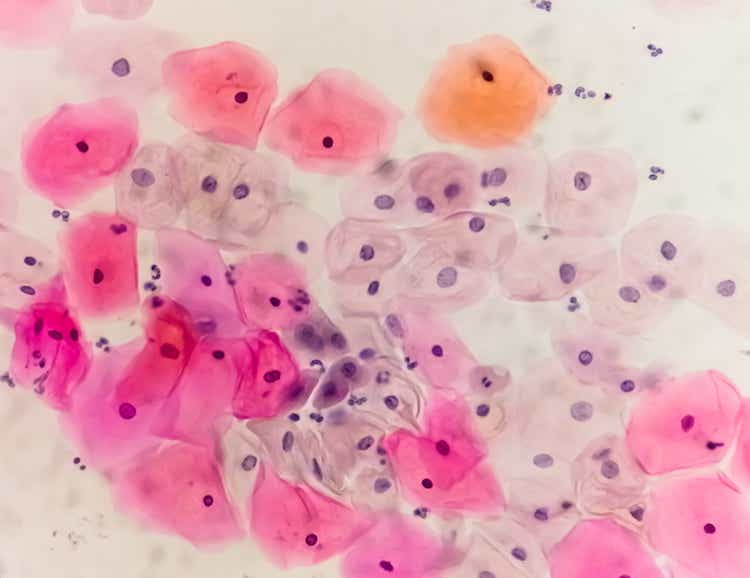

Theoretically, this antigen could be just about anything, and PDS0101 has as its target the p16 protein, which is made by cells that have been infected by HPV16, one of the most common “high-risk” strains of human papilloma virus well known to increase the risk of certain cancers like head and neck squamous cell carcinoma. These tumors have particularly poor outcomes, even among patients who are candidates for anti-PD1 immunotherapy, and this gets worse as the patient progresses on therapy.

And head and neck cancers are the main areas of focus at this time for clinical development. The phase 2 VERSATILE-002 study is assessing the efficacy and safety of PDS0101 plus pembrolizumab in patients with recurrent/metastatic, HPV16-positive head and neck cancer, both in the frontline setting as well as in checkpoint inhibitor-refractory disease.

Back in October, PDSB presented findings from VERSATILE-002 as part of a key opinion leader roundtable discussion. The combination yielded a median overall survival [OS] that was not estimable, with 74% of patients remaining alive after 2 years.

Bearing in mind the problems associated with cross-trial comparisons, this 74% 2-year OS compares favorably with the benchmark set by the KEYNOTE-048 study, which showed 2-year OS rates of 29% and 31% for pembrolizumab alone and pembrolizumab-chemotherapy, respectively. This provides a pretty clear signal of additive benefit of PDS0101 for patients. Response rates were similar to those observed in KEYNOTE-048.

As for tolerability, 13% of patients had a grade 3 adverse event related to treatment. This tracks well with the 17% observed with pembrolizumab alone in KEYNOTE-048.

The findings from VERSATILE-002 provide a springboard to a large, randomized phase 3 trial. VERSATILE-003 will randomly assign patients with recurrent or metastatic, HPV16-positive head and neck squamous cell carcinoma to receive pembrolizumab or PDS0101 plus pembrolizumab, with a primary endpoint of overall survival. Patients also have to have a PD-L1 CPS of 1 or higher, which is the setting where pembrolizumab alone is approved. The company anticipates that this study will begin in Q1 2024.

Another track of interest for PDS0101 is cervical cancer, which is another HPV-associated cancer. The phase 2 IMMUNOCERV trial is assessing the potential benefit of adding PDS0101 to standard of care for patients with locally advanced disease (tumors that have either grown large or that have spread to the nearby lymph nodes). The company presented findings from IMMUNOCERV at the 2023 ASTRO meeting highlighting favorable rates of clearance of tumor cell DNA in the blood with PDS0101 compared with standard therapy alone.

PDS01ADC

The other phase 2 entity PDSB is working on is PDS01ADC, an antibody conjugated to interleukin-12, a cytokine that can ramp up the immune system. In an NCI-led phase 2 trial, patients with recurrent or metastatic HPV16-positive cancers are receiving the triplet combination of PDS0101, PDS01ADC, and an immune checkpoint inhibitor, with a 3-year overall survival rate of 75% among patients with no prior immune checkpoint inhibitor. In patients who were resistant to immune checkpoint inhibitors, 72% remained alive after 12 months.

Financial Overview

As of their most recent quarterly filing, PDSB held $57.2 million in total assets, with $54.3 million in cash and equivalents. Meanwhile, their total operating expenses reached $10.5 million, and after interest income and expenses, the net loss for the quarter reached $10.8 million.

Given these losses, the company has approximately 5 quarters of cash on hand left to fund operations, but that does not take into account the likely upward tick in costs associated with opening and running the VERSATILE-003 study.

Strengths and Risks

One strength I failed to highlight since I was trying to be concise is the breadth of PDSB’s pipeline, which includes other targets of interest like prostate cancer, as well as influenza. They are quickly running toward a point where a different part of the pipeline could take over if PDS0101 does not pan out.

It’s rare to see a company generate the kind of phase 2 data that PDSB has shared. It’s worth noting that the VERSATILE-002 results were not presented in some kind of peer-reviewed format, but the use of KOLs as part of the presentation definitely lends some level of rigor to the proceedings.

That 74% 2-year OS looks pretty spectacular when you look at what pembrolizumab was able to achieve on its own in KEYNOTE-048. It is important to keep in mind that KEYNOTE-048 included mostly patients who were not HPV16 positive. According to even long-term followup and subgroup analysis, pembrolizumab seemed to do about the same regardless of positive and negative.

But the differences in enrollment leave the door open to having the VERSATILE-002 study does not end up being reproduced by VERSATILE-003, which does present a risk. We see trials whose design seems to line up perfectly with promising phase 2 studies fail to meet expectations all the time, and the impact on the market valuation of PDSB would be basically catastrophic. So you can’t consider this risk lightly.

At this moment, cash is the chief problem for PDSB. They will reach a serious issue before the end of 2024, and you can expect that they’ll need to raise funds somehow before the year is through. As always, this raises the likelihood that they’re going to be needing to undergo some kind of substantial dilutive equity raise, which certainly presents a key risk for somebody considering a buy in January 2024.

The company implied in their most recent guidance that they intend to pursue partnerships as a first priority for addressing cash concerns, but they did not take additional debt and equity raises off the table. At a market cap of $150 million as I write this, it would appear as though they do not have a lot of valuation-based leverage to make a cash raise from a position of strength, despite the exciting data they were able to announce late last year.

Bottom-Line Summary

PDSB has definitely generated some substantial positive phase 2 data. It’s about as strong an efficacy signal as you can hope for, even if the target population is only a subset of all head and neck patients. There’s always a good chance that the late-stage trial fails to meet expectations, and I have serious concerns about their cash position, but if this company’s data do not justify a big pharma partnership, whose does? I never like to count on that kind of bailout to justify an investment thesis, but PDSB definitely has the makings of a company that will find a way to get the job done.

For these reasons, PDSB represents a tentative “buy” for me. Well worth considering a small position, and at this market cap, while there is significant risk (particularly of unfavorable equity or debt raises), there is also a lot of upside that has not been realized yet.