franckreporter

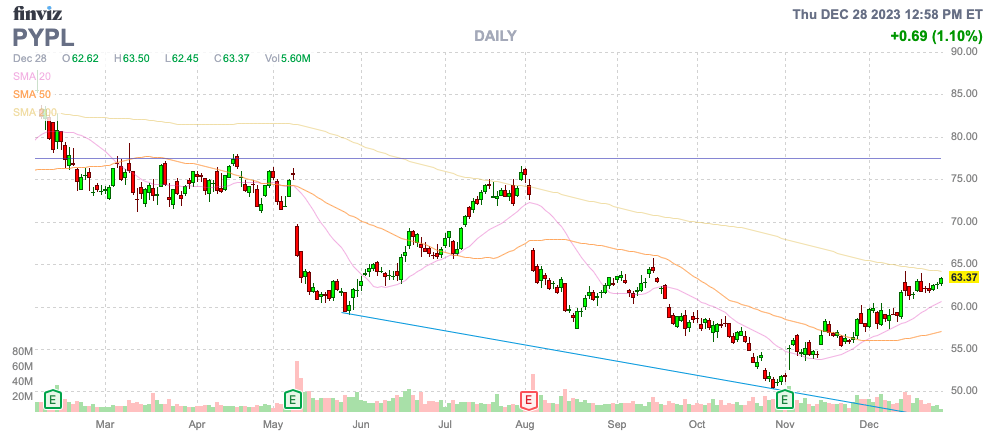

PayPal Holdings, Inc. (NASDAQ:PYPL) appears to have finally hit bottom at a perplexingly low valuation. The digital payments company was priced for disaster while maintaining strong cash flows to reward investors with cheap share buybacks. My investment thesis remains ultra Bullish, with the stock still trading below pre-Covid levels despite massive growth during this period.

Source: Finviz

Growth Rates Bottoming

PayPal just reported quarterly revenue growth of only 8% in Q3’23 while forecasting Q4 growth of only 6% to 7%. The digital payments platform has seen growth struggle below 10% over the last couple of years, as the company absorbs some of the excessive growth of the Covid period and faces new competitor pressure.

A big part of the future investment gains in this stock will be based on whether new management is able to re-accelerate growth. CEO Alex Chriss has only been in place several months, while the new CFO just started in early November.

While sales growth rates have slowed, PayPal still maintains solid growth metrics. Active accounts are down, but the transactions per account are up 13% to 56.6.

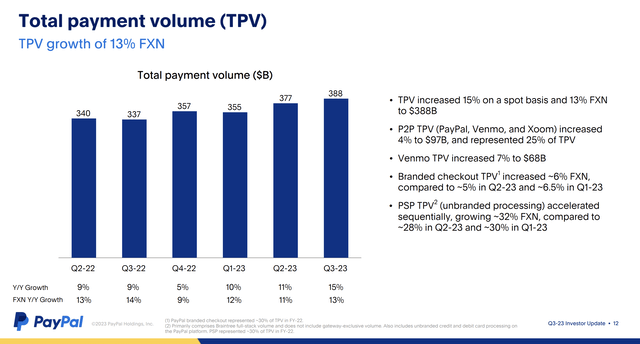

At the same time, TPV was up 15% on the year to $388 billion in Q3’23. This growth metric was actually the highest rate in the last couple of years.

Source: PayPal Q3’23 presentation

The growth story still appears underappreciated by the market. The new CEO has jumped on the innovation opportunity and before new products have really hit the market, PayPal has already gone from TPV growth dipping down to a reported 5% back in Q4’22 to re-accelerating to 15% in the last quarter.

With normal sequential growth in Q4, PayPal would further boost the annual growth rate in payments volumes growth.

Priced For Disaster

Amazingly, PayPal has now rallied over $13 off the bottom for a nearly 26% gain, yet the stock still trades at a very cheap valuation. Some Magnificent 7 stocks offer limited growth and trade at double the 12x forward P/E multiple of this company, and the digital payments company has a strong history of innovative growth.

Even more amazing, PayPal is in the process of unleashing their own year of efficiency to follow the same path of Meta Platforms (META) in 2023. Meta saw the stock bounce off a low of $90 and soared to over $355 now on the backs of reduced costs along with growing revenues in the process.

On the Q3’23 earnings call, new CEO Alex Chriss made similar efficiency goals to where a higher cost structure actually is slowing down the growth at PayPal as follows:

In order to maximize this opportunity, it will require technology consolidation and automation across the company. Simply put, our cost base remains too high, it is actually slowing us down. As such, I am in the process of evaluating our most profitable growth priorities and aligning our resources to those priorities. We will become leaner, more efficient and more effective, driving greater velocity, innovation and impact for customers.

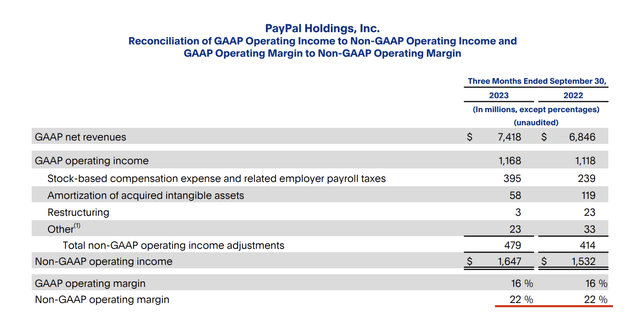

PayPal currently has a 22% non-GAAP gross margin, and the plan is to hike this number to 25% and even 30% over time. Considering the high level of stock-based compensation, the digital payments company should indeed produce higher profit levels.

Source: PayPal Q3’23 earnings release

While management is busy working on improving the products at PayPal and boosting leverage via cost optimization, the company has been busy repurchasing cheap shares this year. On a trailing twelve-month basis, PayPal repurchased approximately 75 million shares of common stock, returning $5.4 billion to shareholders.

The company forecasts a massive 21% EPS growth rate in 2023 due in large part to cutting the outstanding shares. PayPal forecast a 2023 EPS of nearly $5, an amazingly large number for a stock that just traded down to only $50.

The Q3 diluted share count was down to 1.1 billion shares, down 57 million YoY. PayPal didn’t even see the full benefit of the share repurchase in the quarter due to accounting regulations requiring the use of average share counts during the period, instead of the 1.08 billion shares outstanding on October 26.

The consensus analyst estimates target a 2024 EPS of $5.60 for 12.5% growth. The stock only trades at a P/E multiple of 11x in a market where such growth would usually warrant a 20x multiple, or more.

With a digital payments market with strong long-term growth dynamics. PayPal appears poised to participate in those growth dynamics.

If the company just maintains current growth rates in the 7% range and boost EPS growth, the stock should generate solid gains. If PayPal is able to accelerate growth back into the double-digits range, the stock could offer substantial gains with growth combined with multiple expansion.

Takeaway

The key investor takeaway is that PayPal Holdings, Inc. stock remains priced for disaster despite the company producing strong EPS growth on solid sales growth. The digital payments company could definitely do better to fend off fears of competition taking market share, but the stock is just too cheap to ignore here. In reality, the stock market appears too focused on the recent negative account numbers and not focused enough on the payments usage levels of the active accounts that are far more supportive of the strong business model of PayPal.

Investors should continue using this stock price to load up on a cheap stock.