chameleonseye

Intro & Thesis

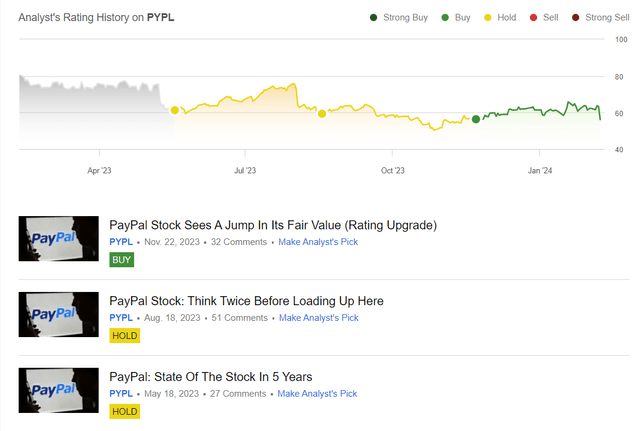

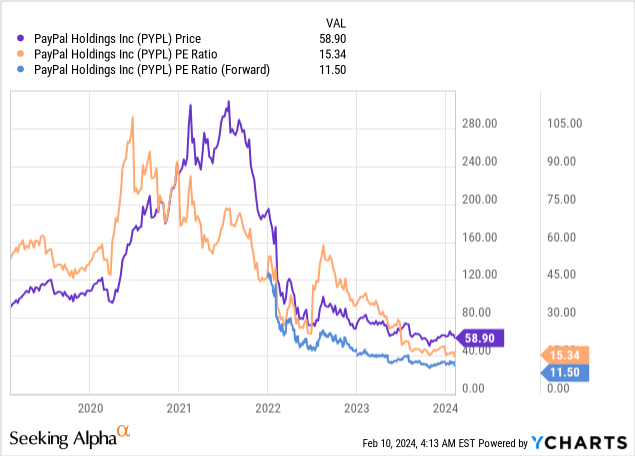

I initiated coverage of PayPal Holdings, Inc. (NASDAQ:PYPL) stock in May 2023, initially giving them a “Hold” rating, citing slowing business growth rates and still expensive valuation at the time. However, in late November 2023, I upgraded the stock to “Buy” seeing a jump in PayPal’s fair value. Since then, PayPal has seen a 17% surge before experiencing an 11% decline after the latest report for Q4 FY2023.

Author’s coverage of PYPL stock

Despite the negative reaction following the company’s report and the accompanying comments from management, I am inclined to believe that this was an overreaction and that the market does not fully understand what the company’s transformation efforts could lead to in the medium term.

Why Do I Think So?

First off, let’s quickly review the actual results for the past quarter.

In Q4 FY2023, PayPal reported a 5% YoY increase in branded checkout growth, slightly down from the previous period but still in line with expectations. PayPal reported a 9% revenue growth driven by a $410 billion total payment volume (+5.7% YoY). The company maintained strong expense discipline, reducing non-transaction-related expenses by 9% YoY. This led to a 19% YoY increase in non-GAAP EPS, beating the consensus estimate and reflecting solid financial results amidst significant organizational changes.

Despite a slight decrease in growth compared to the prior quarter, PayPal maintained robust performance in unbranded checkout, primarily driven by a 29% YoY increase in Payment Service Provider (PSP) volumes, fueled by growth in Braintree. The company anticipates further benefits from initiatives such as Fast Lane, aimed at streamlining checkout processes, and plans to explore opportunities for higher-margin transactions in international and small business sectors.

Speaking about the Small and Medium-sized Business (SMB) merchants, PayPal’s continued momentum was evident through the expansion of PayPal Complete Payments (PPCP), marked by record customer adoption, reduced merchant churn rates, and increased transaction volume for migrating merchants. PayPal aims to capitalize further on this segment, targeting the vast $750 billion TAM of SMB processing volumes.

During the earnings call, PYPL’s management outlined strategic priorities aimed at accelerating growth, improving profitability, leveraging data for value creation, and enhancing operational efficiency. Initiatives include accelerating growth in branded checkout, driving profitable growth in PSP services, and focusing on small business solutions like PPCP.

If we look at the state of the “Buy Now, Pay Later” (BNPL) industry, where PayPal is trying to actively develop, we see that it’s experiencing significant growth, though it still represents a small portion of the overall consumer credit space, according to the latest Morgan Stanley’s report (proprietary source). Usage of BNPL options has surged in recent years, especially during holiday seasons and promotional events. This rise in popularity is partly driven by tightening lending standards and higher inflation rates, making BNPL more attractive, particularly for younger and lower-credit-quality households.

Looking forward, PayPal guided for Q1 FY2024, expecting revenue to increase approximately 6.5% at spot and 7% on a currency-neutral basis, with non-GAAP EPS projected to grow at a mid-single-digit percentage. For the full year, PayPal anticipates non-GAAP EPS to be roughly in line with the prior year, with minimal impact from recent innovations. The management said it intends to reinvest cost savings into strategic product initiatives, prioritizing sustainable and profitable growth in 2024. I believe that the reason why investors were disappointed and sold heavily on February 8 after the report and commentary was due to the discrepancy between forecasting flat EPS momentum despite the expected cost savings and profit growth promised for this year.

What the market has missed in my opinion, however, is PayPal’s opportunity to qualitatively expand its ecosystem.

PYPL is the largest BNPL industry player in the world with a massive 68.1% market share. In my view, PayPal’s market dominance could fuel growth acceleration in the medium term, thanks to its new strategy emphasizing disciplined go-to-market strategies and renewals. This strategy places a specific emphasis on innovative checkout solutions, enhancements to consumer apps, and the consolidation of its technological infrastructure onto a single platform to maximize data synergies.

In other words, PayPal is trying to create a data-driven ‘super-app’ – a unified digital wallet – enabling users to manage various financial services seamlessly. Users can transfer funds across multiple channels and to various recipients using preferred funding sources like card products, PayPal or Venmo balances, cryptocurrencies, and BNPL options. This effort is likely to drive the company’s TPV volumes further thanks to digital payment adoption, international expansion, and improved checkout conversion rates.

Also, PayPal’s guidance for at least $5 billion of share buybacks exceeded FactSet’s expectations (Goldman Sachs data, proprietary source), indicating additional support for the stock in the foreseeable future. Additionally, while non-transaction operating expenses are anticipated to grow slightly in FY2024 due to increased investment in new product initiatives, PayPal remains committed to delivering value to shareholders while pursuing strategic growth opportunities.

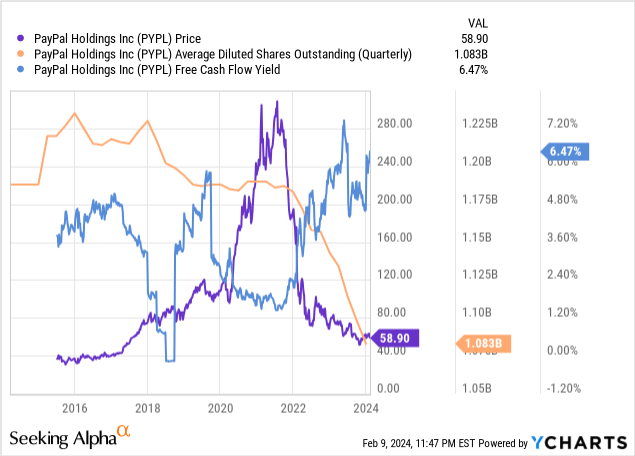

PayPal is systematically reducing the number of its shares outstanding, and even a relatively high SBC of ~4.8% (Q4 FY2023, YCharts data) cannot stop this strong downward trend. At the same time, the forwarding FCF yield of 7.9% (based on my calculations and PYPL’s guidance) seems attractive today if we assume growth acceleration beyond 2024.

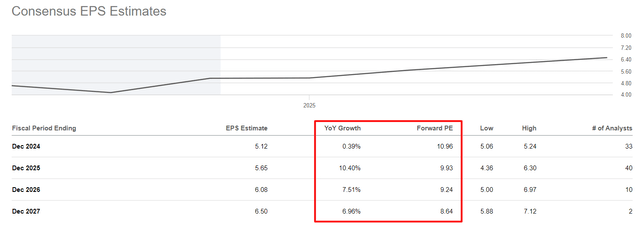

In my opinion, the market is wrong about PYPL’s stock price today because it assumes no growth for 2024 and ignores the growth prospects for 2025-2027. We see this in the consensus forecasts (Seeking Alpha Premium data): PYPL’s lack of EPS growth in FY2024 gives way to growth recovery as early as 2025, resulting in a longer-term EPS CAGR of +6.15% and an implied P/E ratio falling to 8.64x in FY2027:

Seeking Alpha Premium, PYPL, author’s notes

The forecasted standardized profit and loss report from analysts at Goldman Sachs illuminates a crucial prerequisite for the anticipated upswing in PYPL’s financials rating post FY2024:

Goldman Sachs [proprietary source], author’s notes![Goldman Sachs [proprietary source], author's notes](https://topnews.media/wp-content/uploads/2024/02/49513514-170754112264777.png)

Goldman’s FY2025 EPS forecast of $5.65 is in line with consensus. Let’s assume PYPL’s P/E approaches 13x by the end of FY2025 as the business transforms and growth accelerates. In the historical context, this seems to be a very conservative assumption considering where PYPL’s multiples were 2-3 years ago.

With this input data, I get a price objective of $73.45, which is 24.7% above today’s price. This means that if an investor is willing to buy the PYPL stock now, assuming that the company’s strategic efforts will be at least partially realized, then he/she can potentially achieve an above-market return in the medium term with a very conservative exit valuation multiple. I therefore maintain my ‘Buy’ rating, despite the sharp fall in the stock price that we saw after PayPal’s quarterly figures.

Risks To My Thesis

Investing in PayPal carries inherent risks, notably regulatory uncertainties and fierce competition in the fintech sector. Established players like ApplePay and Visa’s Checkout pose formidable challenges to PayPal’s market share and profit margins. Moreover, cybersecurity threats and economic fluctuations further compound these risks, potentially eroding consumer trust and transaction volumes.

Additionally, PayPal faces execution risks in sustaining user growth amidst evolving market dynamics. The company must navigate transaction margin pressures while adapting to changing consumer preferences, especially in mobile payment services. Furthermore, macroeconomic factors and currency exchange rate fluctuations add complexity to its risk profile. Effectively managing these risks is essential for PayPal to maintain its market position and capitalize on growth opportunities.

So make sure you do your own due diligence before you buy PYPL stock: Seeking Alpha Premium’s many offerings, as well as research from other authors, may help you with this.

The Verdict

Despite the abundance of negativity following the publication of the Q4 FY2023 results, PayPal’s prospects look interesting in the medium term as the strategic plan is implemented. In the long term, competition will be a strong headwind, but name me a fintech company that doesn’t have serious competition today. PayPal’s revenue origination looks very stable today, and the focus on quality growth going forward with the expansion of business margins next year (which I hope for) should provide even more opportunities for FCF generation in my opinion. And as we’ve seen in recent quarters, PayPal’s approach to using its FCF for buybacks is already positioning the company as a solid value-like play in the industry. Based on all of the factors discussed, I’m reiterating my previous “Buy” rating today with a medium-term price objective of $73.45/share. Please let me know in the comments below if you agree with me here.

Thanks for reading!