PayPal (PYPL 0.33%) has had a tough go of it in recent years. The company thrived during the pandemic and had lofty growth expectations over the next few years. However, the company has faced challenges since then, leading to revised expectations and a stock sell-off; the stock is down 80% from its peak price in 2021.

PayPal is under new leadership that is looking to right the ship, and the stock trades at a cheap valuation relative to its history. Here’s what you should know to help you decide if PayPal is right for your portfolio.

PayPal has seen a dramatic rise and fall over recent years

PayPal experienced massive growth during the pandemic, adding 122 million new accounts and growing revenue by 43% over two years while surpassing $1 trillion in total payment volume.

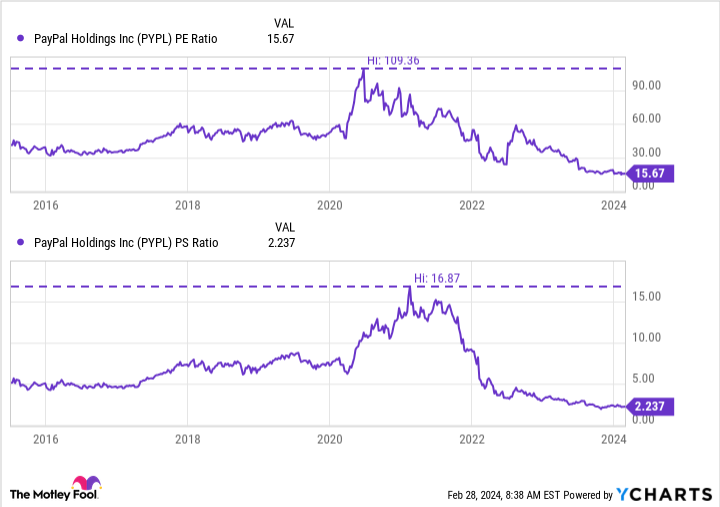

The company was flying high and dreamed of considerable growth in the following years. At the time, the company expected to nearly double its active accounts from 377 million in 2020 to 750 million by 2025. It also expected free cash flow and revenue to double. At its peak, investors valued PayPal stock at 16.9 times sales and 109.3 times earnings.

As it turns out, those expectations were too optimistic, and the company shifted its focus from rapid growth to a more sustainable one. Customer growth slowed, and PayPal focused on getting more activity from its existing customers instead of adding new accounts hand over fist. This shift in focus alarmed investors. On top of that, eBay, which owned PayPal until spinning it off in 2015, shifted away from the company and moved over to Adyen as its preferred payment platform, creating headwinds for further growth.

PayPal stock has never been as cheap as it is today

Investor pessimism regarding PayPal has probably never been higher than it is today, which is evident when looking at the company’s valuation. Today, investors are pricing PayPal stock at 2.2 times sales and 15.7 times earnings, both of which are the lowest valuations ever for the company since being spun off from eBay in 2015.

PYPL PE Ratio data by YCharts

Investors have expressed concerns about PayPal’s margins, which have gradually declined. Its gross margin, or the company’s sales minus its cost of goods sold (transaction costs for PayPal), was around 65% back in 2015. Today, its gross margin is around 46%. One reason for its falling margins is the growing popularity of PayPal’s unbranded checkout option, Braintree, over its branded checkout option.

Braintree is a rapidly growing part of PayPal’s business, which is great for top-line growth but hasn’t been so great for increasing its profits. In the fourth quarter, total payment volume (TPV) was up 15% year over year, and Braintree was vital to this growth. Growth has been especially strong internationally, with TPV up 22% (or 17% on a currency-neutral basis), thanks to strength in Europe and Asia.

Here’s what’s next for PayPal

During the fourth-quarter earnings call, new CEO Alex Chriss said that the company will focus on accelerating growth in branded checkout, which has higher margins. It will do this by redesigning the branded checkout experience to make it more efficient and minimize friction, allowing shoppers to check out twice as quickly.

Another move the company is making is improving its small and medium-sized business offerings with PayPal Complete Payments. The company will look to scale this offering by leveraging its data and artificial intelligence to improve conversion rates for its merchants while helping them better connect with customers. If PayPal can pull this off, it could boost profit margins and provide additional offerings for small and mid-sized businesses, which was Chriss’ specialty at Intuit before becoming PayPal’s CEO.

Image source: Getty Images.

Should you buy PayPal stock?

In an interview with CNBC last month, Chriss said, “2024 will be a transition year for us.” PayPal stock will likely experience further volatility throughout the year as it works to improve its margins and scale up its small and medium-sized business offerings.

Despite its struggles, PayPal continues to generate strong revenue. Last year, the company grew its revenue by 8% and posted its best net income on record, with its $4.25 billion topping 2021’s $4.2 billion. PayPal continues to grow, and I believe it will continue to progress under its new CEO. With so much pessimism priced into the stock, I believe it’s a solid value stock to buy today.

Courtney Carlsen has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Adyen, Intuit, and PayPal. The Motley Fool recommends eBay and recommends the following options: short April 2024 $45 calls on eBay and short March 2024 $67.50 calls on PayPal. The Motley Fool has a disclosure policy.