wellesenterprises

Investment Thesis

Paycom Software, Inc. (NYSE:PAYC) tweaked its business model and consequently has meaningfully changed its revenue growth rates. The business is no longer a fast-growing business. Rather, it’s now expected to grow in the mid-teens.

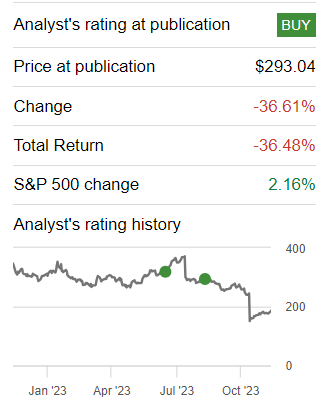

Here I describe the implications for investors going forward and why I cannot continue recommending this stock as a BUY.

Rapid Recap

Back in August, in a bullish article, I wrote,

If I were to point to just one aspect that dragged down this stock’s ascent, it would be that investors didn’t take it too kindly that Paycom’s revenue growth rates appear to be slowing.

Altogether, I believe that investors have overreacted to its potential slowdown, leaving new investors considering this name with a positive risk-reward opportunity.

Michael Wiggins De Oliveira on PAYC

In hindsight, I made a bad call, as you can see from the stock’s performance. I was attracted towards Paycom as a steadily performing company, that was cheaply valued.

And although the stock today is still clearly cheaply valued (we’ll converse this soon), I no longer propose this stock as a buy. Here’s why.

Paycom’s Mixed Near-Term Prospects

While Paycom has reported solid results in the third quarter with strong profitability, it faces challenges associated with the ongoing transition to its innovative payroll solution, Beti. Chad Richison, the CEO and President, emphasizes the significance of the do-it-yourself payroll for employees with Beti, which he describes as a “paradigm shift for our industry.” However, challenges arise as the company navigates this transition, impacting certain financial metrics.

The challenges are intricately linked to the implementation of Beti, where the focus is on helping clients shift to the new way of payroll processing. Richison points out that nearly two-thirds of Paycom’s clients have made the shift to Beti, but the transition is not without hurdles.

The adoption of Beti, while delivering value to clients, has led to considerable cannibalization. Craig Boelte, the CFO noted the impact includes lower-than-expected service revenues and unscheduled payroll runs. The challenges also manifest in changes to the revenue model, with Boelte stating, “it has eliminated certain billable items, which is cannibalizing a portion of our services and unscheduled revenues.”

Looking ahead, Paycom is making strategic decisions to ensure clients achieve the full value of the innovative Beti system. Richison alludes to the company’s commitment to long-term relationships with clients, stating, “Our mission is to ensure and achieve client value, and that is our focus.”

However, these strategic decisions are expected to impact the revenue growth outlook for 2024, with Boelte indicating a prudent setting of expectations for a year-over-year growth of “between 10% and 12%.”

Given this background, let’s delve into Paycom’s financials.

Revenue Growth Rates Took Me By Surprise

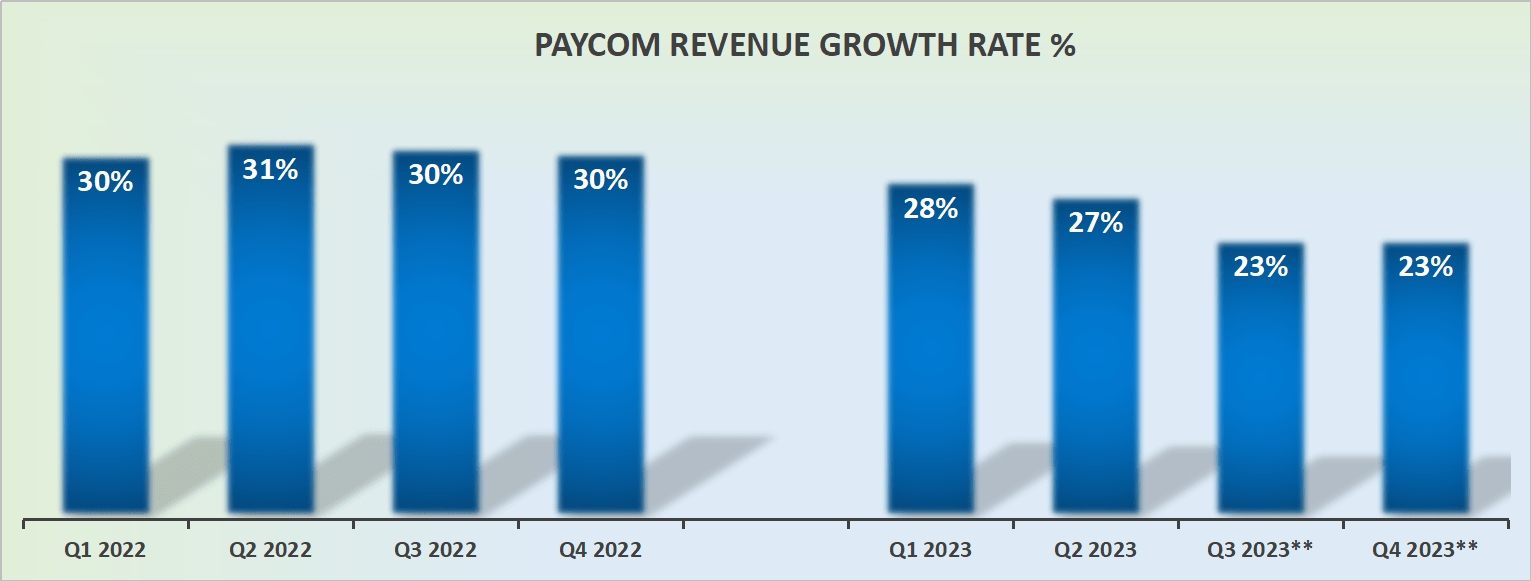

On the back of Paycom’s Q2 results, this is what investors were expecting its guidance to be heading in Q4.

PAYC revenue growth rates, back in Q2

You can see above, that on the back of its Q2 2023 results, investors were expecting to see around mid-20s% CAGR from Paycom. A deceleration from the prior year, but nothing to get overly concerned about.

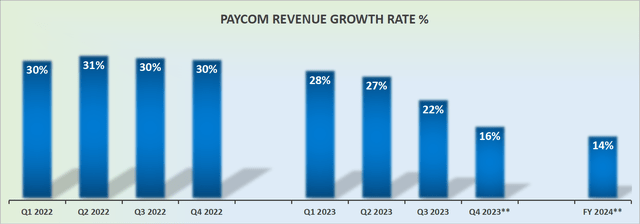

And now, below is Paycom’s updated guidance.

PAYC revenue growth rates, updated

Not only was there a slight miss in its Q2 revenue growth rates, relative to expectations, but the big negative surprise is the outlook into Q4 2023 is now demonstrably less than 20% CAGR.

In fact, I’ve not only assumed that Paycom will deliver the high end of its guidance, but that Paycom will also beat the high end of its guidance. This means, that all in, including the best-case scenario, the business is growing at around the mid-teens CAGR.

Why is this important? Firstly, because it forces a lot of uncomfortable questions. Allow us to momentarily advance beyond the default, ”buy the dip” mentality.

Public companies have a few responsibilities. Beyond ethical elements, they endeavor to not furnish their investors with negative surprises. Why? Because negative surprises affect the multiple that investors are willing to put on their stock.

As Charlie Munger would say, ”recollect that reputation and integrity are your most valuable assets – and can be lost in a heartbeat.”

If a management team loses its reputation as good stewards of capital investors will not reward the stock. There’s no need to overcomplicate what is straightforward.

Secondly, the underlying expected organic growth rate a business can deliver impacts its valuation. A business that is expected to grow in the mid-20s% gets a higher multiple than one that’s growing in the mid-10s%. Some elements can change the face value of these statements, such as if interest rates were to drop again, but for the most part, if one expects interest rates to remain stable, a fast-growing business gets a higher multiple of its stock.

With that context in mind, let’s converse Paycom’s valuation.

PAYC Stock Valuation — 13x Forward EBITDA

As it stands right now, Paycom’s EBITDA is annualizing around $700 million. That being said, when it comes to investing, it’s always about attempting to price the future.

If we assume that in 2024, Paycom’s EBITDA grows by 20% compared with 2023, this would put the business on a run-rate of $840 million.

That being said, my projected EBITDA already factors in a substantial enhance in underlying profitability.

One way or another, it appears that Paycom is priced at 13x forward EBITDA. That’s meaningfully cheaper than its peer, Workday, Inc. (WDAY), a stock that’s priced at 37x forward free cash flow.

So, while I grasp the impulse to root for the underdog and buy the dip and all our other biases, in my encounter, those sorts of investments work too infrequently.

Simply put, you need a favorable market to have success with that sort of investing. And you can’t rely on a favorable market as part of your investing strategy. At some point, the business has to stand up on its own two feet and deliver against investors’ expectations.

The Bottom Line

Upon revisiting Paycom Software, Inc.’s outlook, the notable shift in its growth trajectory is apparent, moving from a once fast-growing business to a mid-teens growth expectation.

The introduction of the Beti payroll solution has triggered a slowdown, prompting a reevaluation of the company’s valuation and investment appeal.

The unexpected deceleration, particularly in Q4 results and the outlook for 2024, challenges the default “buy the dip” mentality, raising concerns about the impact of strategic decisions on investor sentiment.

As the growth rates refuse, questions arise about Paycom’s intrinsic value and the multiple investors are willing to assign to its stock.

In my assessment, Paycom’s ability to stand on its own and face investor expectations requires a closer examination amidst this shifting landscape. Hence, I’m now neutral on Paycom Software, Inc. stock.