hapabapa

Paychex overview

Economically speaking, we are living in truly unusual times. On the one hand, you have high inflation and high interest rates that are being used to combat the inflation. Normally, that would have a cooling effect on the economy. And to some extent, that is occurring because inflation is coming down. But on the other hand, you have a labor market that is still very tight. On the side of weakening, with interest rates still elevated at 22-year highs, you’d expect there to be a lot of pain for companies that work in the human resource space. But with a tight labor market, and the economy continuing to grow at a respectable clip, you would expect the exact opposite to be true.

So far, the latter scenario seems to be playing out for companies in this market such as Paychex, Inc. (NASDAQ:PAYX). For those who don’t know, Paychex is a human resource software and services company that provides its clients with payroll functions, human resource activities, benefits activities, insurance services, and more. Because of robust financial performance and the aforementioned economic situation we are dealing with, shares have been rising nicely. Since I last rated the company a “hold” back in March of this year, the stock has generated upside for investors of 18.6%. That’s almost exactly even with the 18.4% enhance seen by the S&P 500 (SP500).

Of course, the picture can always change and investors should not expect shares of a business to rise rapidly in perpetuity. The good news is that if analysts are correct about guidance for the upcoming fiscal second quarter earnings release, expected pre-market on Thursday, December 21st, the end for those who are bullish about the firm might not yet be in sight. Because of how pricey shares are, I still am rating the company a “hold.” But for those who don’t mind paying a hefty price for a quality business, I can comprehend the decision to purchase units.

Paychex financials so far

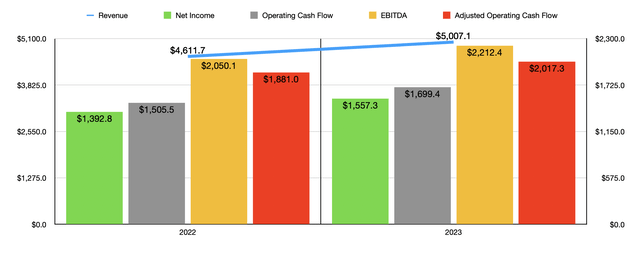

Back when I last wrote about Paychex in March of this year, we only had data covering through part of the 2023 fiscal year. Today, we now have data covering through not only the rest of 2023, but also covering the first quarter of 2024. We should probably begin, however, with a review of how 2023 went for the business. During that year, revenue totaled $5.01 billion. This represents an enhance of 8.6% over the $4.61 billion the company generated one year earlier. The enhance in sales was broad-based across the company, with both the Management Solutions and the PEO and Insurance Solutions Operations reporting sales increases year-over-year.

The greatest upside came from the Management Solutions segment, which saw revenue rise by 8.4% from $3.44 billion to $3.73 billion. Management attributed this to a rise in the number of clients and clients’ employees for various services admire the firm’s HR solutions and for work site employees. The tight labor market allowed the company to enhance pricing on its services, resulting in higher revenue per client. The PEO and Insurance Solutions business, meanwhile, reported a 5.9% enhance in revenue from $1.11 billion to $1.18 billion. That was driven by a growth in the number of average PEO work site employees, as well as higher wages per work site employee.

Again, this is a reflection of the tight labor market. A rise in state unemployment insurance revenue and higher health premiums also contributed, as did a growth in the demand for related services that the company offers. It’s also worth noting that another big driver of the enhance in revenue came from the interest on funds held for clients. In short, Paychex is able to invest the funds that it brings in from clients but does not yet have to distribute out. That generated $99.8 million for the company last year. That’s 73% higher than the $57.7 million generated in 2022.

Although a rise in investment balances contributed to this, the biggest improvement came from a rise in average interest rates that the company was able to capture on this money. In 2022, this was 1.3% per annum. In 2023, it was nearly double at 2.5%.

Naturally, a rise in revenue, particularly when some of it comes from higher pricing and higher interest rates, resulted in a nice improvement in profitability. Net income totaled $1.56 billion in 2023. That’s 11.8% above the $1.39 billion reported for 2022. Operating cash flow for the company surged from $1.51 billion to just under $1.70 billion. If we adjust for changes in working capital, we get an enhance from $1.88 billion to $2.02 billion. And lastly, EBITDA for the company expanded from $2.05 billion to $2.21 billion.

What to expect from Paychex’s Q2 earnings

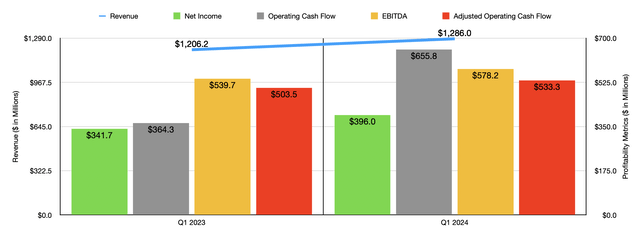

So far, the 2024 fiscal year is proving to be pretty bullish for the company. Due to the same aforementioned factors, revenue in the first quarter came in at $1.29 billion. That compares nicely to the $1.21 billion generated the same time of 2023. Net profits of $396 million beat out the $341.7 million reported one year earlier. Other profitability metrics also improved nicely, as the chart above illustrates. In fact, there wasn’t a single profitability metric that I looked at that showed worsening year over year.

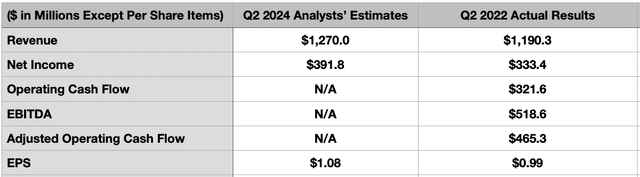

This does not mean that the picture cannot change for the worst. It certainly can. However, the current expectation is for the picture to remain robust. You see, before the market opens on December 21st, the management team at Paychex is expected to announce financial results covering the second quarter of the company’s 2023 fiscal year. At present, analysts are forecasting revenue of $1.27 billion. If that comes to fruition, it would translate to a 6.7% enhance over the $1.19 billion generated in the second quarter of 2023. This actually matches up with current guidance for the year as a whole, with management expecting revenue for 2024 coming in between 6% and 7% above what it was in 2023.

Likewise, profits are also expected to boost. Analysts currently believe that earnings per share will be around $1.08. That would be up from the $0.99 per share reported for the second quarter of last year. This enhance of 9.1% also matches the 9% to 10% enhance that management is forecasting for the year as a whole. For the quarter, this would translate to net profits climbing from $333.4 million to $391.8 million.

Unfortunately, estimates have not been provided when it comes to other profitability metrics. But there is a very high likelihood that the other profitability metrics will have risen year-over-year as well. For context, those can be seen in the table above.

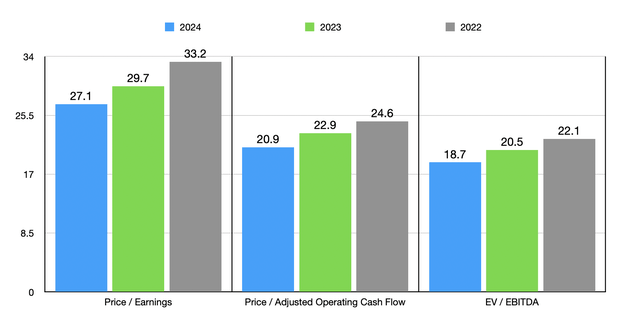

Assuming everything goes according to scheme for this year, investors should expect net profits of $1.71 billion for 2024. If we assume that other profitability metrics will rise at the same rate as net income, that would translate to $2.21 billion for adjusted operating cash flow and $2.42 billion for EBITDA. Using these estimates, we can value the company as shown in the chart above. The chart also values the company using historical results from 2022 and 2023. As part of my analysis, I then compared the firm to five similar firms as shown in the table below. On a price to earnings basis, three of the five firms were cheaper than it. Using the price to operating cash flow approach, this increases to four. But when it comes to the EV to EBITDA approach, we find that our target is the most expensive of the group.

| Company | Price / Earnings | Price / Operating Cash Flow | EV / EBITDA |

| Paychex | 29.7 | 22.9 | 20.5 |

| Global Payments (GPN) | 37.6 | 14.4 | 14.5 |

| Fidelity National Information Services (FIS) | 44.4 | 9.0 | 10.6 |

| Fiserv (FI) | 28.2 | 16.2 | 13.3 |

| PayPal (PYPL) | 18.5 | 18.2 | 10.6 |

| Automatic Data Processing (ADP) | 28.1 | 25.7 | 18.6 |

Takeaway

All things considered, I recognize that Paychex is a high quality company. And that deserves a premium of sorts. However, it’s pricey even relative to similar firms. In the long run, I suspect the company would do just well, as will its shareholders. But because of how expensive Paychex, Inc. stock is, I believe that a “hold” rating still makes the most sense. And honestly, that rating has played out well since my own definition of a “hold” is a stock that will create upside or downside that more or less matches the broader market. And that is precisely what has transpired since I last wrote about it in March.