Palo Alto Networks

Wow… shares of Palo Alto Networks (PANW) are trading lower by more than 25% this morning as investors were selling the stock hard in the pre-market.

The reason is simple… last night’s earnings report showed that the company beat expectations in the last quarter but lowered their guidance for the 2024.

This market has been operating on forward guidance more than it has actual results, meaning any company – including Nvidia (NVDA) tonight – needs to provide solid guidance for the balance of 2024 or feel the wrath of investors that are now requiring immediate gratification style results from stocks.

Here’s where it hurts: PANW was one of the technology darlings over the last two years. Wall Street analysts’ current recommendations show 80% of analysts were in the strong buy or buy camp. This means that PANW shares will suffer a deluge of downgrades over the next week, forcing the stock lower.

Target a move to $250, which is where the stock’s 200-day moving average sits to provide support.

Walgreens Boots Alliance

The inevitable finally happened. Last night, Dow Jones announced that they would be removing Walgreens Boots Alliance (WBA) from the Dow Jones Industrial Average. The stock will be replaced by Amazon (AMZN) next Monday, February 26.

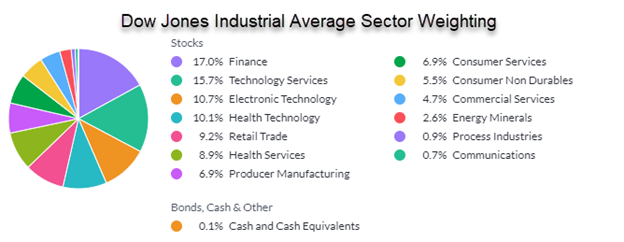

The move will increase the price weighted index’s exposure to the retail sector, which currently stands just over 9%. Finance, technology – which Amazon will add to – and Health Technology are the top weighted sectors for the index.

Losing your spot in an index like the Dow means that index funds and Exchange Traded Funds (ETFs) will start selling shares of WBA and buying AMZN to match the composition of the index. That move will culminate in a crescendo of selling and buying on Friday at the close.

The news is tradable for WBA, which is likely to see selling take shares towards $20. Amazon shares will see buying because of their new index weighting, but the stock will rise less than shares of WBA will drop.

Uber

There’s another shift in one of the Dow Indices. As of Monday, Uber (UBER) will replace JetBlue (JBLU) in the Dow Jones Transportation Index.

Just as with WBA shares, we’ll see some selling of JBLU shares as Friday’s close approaches and buying of UBER to match the new index. Keep in mind that there is far less money allocated to the Transportation Index funds like the iShares U.S. Transportation ETF (IYT).

Uber shares are trading lower this morning, despite the news. As it stands now, there is technical support at $75 for UBER shares with an upside target of $90.

By submitting your email address, you will receive a free subscription to Money Morning and occasional special offers from us and our affiliates. You can unsubscribe at any time and we encourage you to read more about our Privacy Policy.

About the Author

Chris Johnson (“CJ”), a seasoned equity and options analyst with nearly 30 years of experience, is celebrated for his quantitative expertise in quantifying investors’ sentiment to navigate Wall Street with a deeply rooted technical and contrarian trading style.