hapabapa

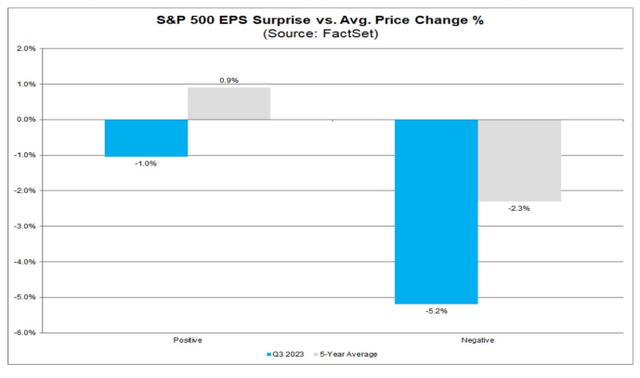

Earnings season has been dramatic. The S&P 500’s blended EPS growth rate for the quarter is solid at 2.7% – above what strategists had predicted heading into the Q3 reporting period. Despite the generally decent results, earnings revisions have been cautious and stock price reactions have been downright spooky.

FactSet notes that companies beating and missing bottom-line expectations have seen their share prices fall. It takes an absolute home run of a report to impress investors given the ongoing market correction.

I have a hold rating on Palo Alto Networks (NASDAQ:PANW). The valuation appears fair to me while the chart has some yellow flags. PANW has a very bullish EPS beat rate history and long-term earnings growth is strong, so it’s a candidate to buck the broader earnings-reaction trend.

Strong Earnings? Not Good Enough.

According to Bank of America Global Research, Palo Alto Networks develops and sells network security solutions, ranging from solutions in appliance form factors to software and cloud-based solutions.

The California-based $74 billion market cap Systems Software industry company within the Information Technology sector trades at a high 187 trailing 12-month GAAP price-to-earnings ratio and does not pay a dividend.

Ahead of earnings next month, shares trade with a somewhat high implied volatility percentage of 47%, and short interest is material at 6.7% as of October 27, 2023. Importantly, the company has topped EPS expectations in each of the previous 12 instances and shares have traded higher post-earnings in the last 10 earnings events. Quarterly EPS growth is expected to verify close to +40% for the periods just ended.

Back in August, PANW reported a mixed quarter. Per-share earnings verified above analysts’ estimates ($1.44 vs $1.29) while revenue of $1.95 billion, a 26% YoY climb, was about in line with expectations. The company’s Next-Generation Security (NGS) ARR grew by 56.1% YoY, also beating expectations, as the firm continues to transition from legacy hardware to software-based solutions. Fourth quarter billings rose 18% from year-ago levels while FY 2023 billings came in at +23% from the previous year, helping to grow the firm’s EPS from $2.49 to $4.27.

As the industry leader in network firewalls, the management team sees ‘24 billings near $11 billion, continuing the near-20% growth trajectory. Margins are also strong, with its free cash flow margin seen in the 37-38% range this year (FY 2024). Shares traded higher post-reporting but have since stagnated for the most part despite the very strong guidance. Keep your eye on PANW’s gross margin and FCF margin in the upcoming report. Also monitor how Palo Alto’s XSIAM (extended security intelligence and automation management) product over the next several quarters – Goldman sees that product cycle as having the potential to drive significant upside to revenue and margins in FY 2024.

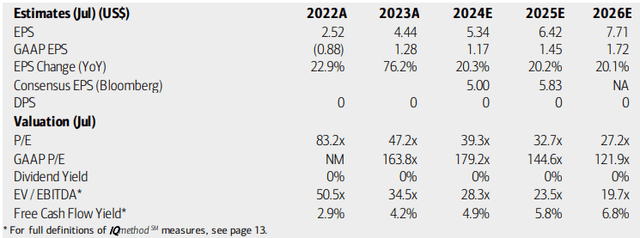

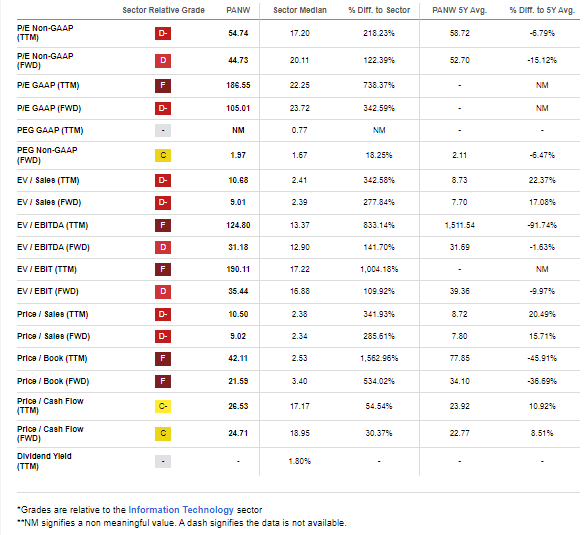

On valuation, analysts at BofA see earnings rising at a steady 20% clip over the next few years. With its 2023 already in the books, operating per-share profits are seen as topping $7 by 2026 and the latest consensus estimate, per Seeking Alpha, is closing in on $8 of EPS by FY ‘26 – with a very bullish 36:1 positive:negative sell-side analyst EPS revision ratio in the last several weeks. No dividends are expected to be paid on this fast-growing I.T. cybersecurity stock, but PANW is free cash flow positive while its EV/EBITDA ratio is indicative of a premium valuation investors are paying for the stock.

Palo Alto Networks: Earnings, Valuation, Free Cash Flow Forecasts

With steady 20-25% EPS growth over the coming quarters, we can use the forward PEG ratio as a guide on valuation. The price-to-earnings multiples are obviously very high (as they always have been with this long-term winner). If we assume a 22% long-term EPS growth rate and assume next-12-month EPS of $5.50, then PANW’s current 44 forward P/E makes for a PEG near 2.0 – right near its long-term average. The stock is also possibly a bit to the pricey side on an EV/sales basis and price-to-sales basis. Thus, I have a hold on valuation.

PANW: A Premium Valuation Warranted

Seeking Alpha

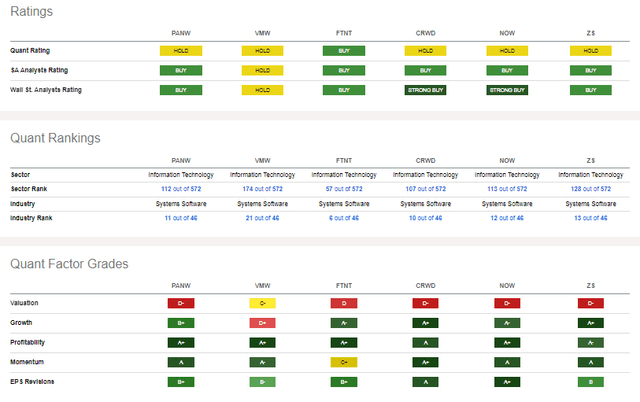

Compared to its peers, PANW’s premium valuation is commonplace, while its stellar growth rate is about in line with competitors, too. Share price momentum has been strong over the past year, but I will note some bearish movements over the last few weeks later in this analysis. Still, there is no debate that PANW is both highly profitable and a solid free cash flow machine. I expect another strong quarter to be reported in November, so there’s upside risk assuming the trend of better-than-expected EPS verifies.

Competitor Analysis

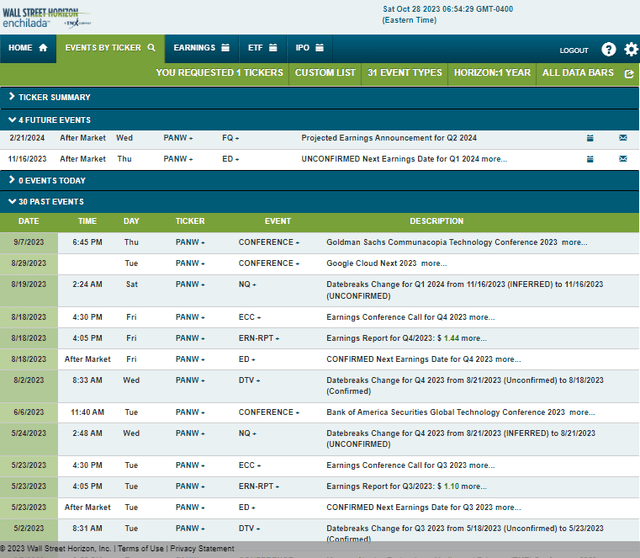

Looking ahead, corporate event data provided by Wall Street Horizon show an unconfirmed Q1 2024 earnings date of Thursday, November 16 AMC. No other volatility catalysts are seen on the calendar.

Corporate Event Risk Calendar

The Technical Take

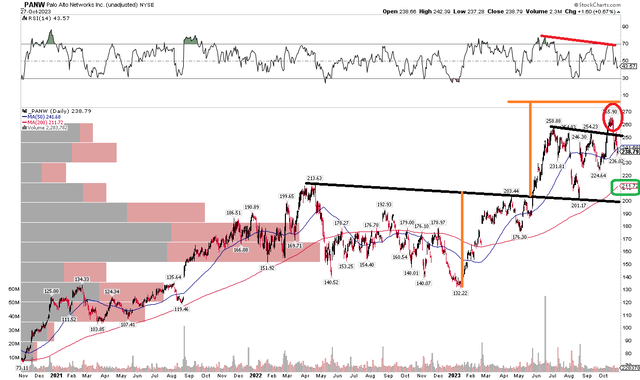

With shares near fair value on this earnings-grower, the chart shows some signs of exhaustion. Notice in the graph below that PANW reached a fresh all-time high earlier this month, breaking out above the $254 to $259 range. The new peak came alongside a small bearish divergence on the RSI momentum indicator at the top of the chart, so there is the risk of a bearish false breakout today.

The long-term rising 200-day moving average illustrates that the bulls are in control, and that’s also where the April 2022 high comes into play, so we could see a retest of that area if this correction persists. Still, there’s ample volume by price from $150 to $195 that should offer cushion on a more sustained move lower. We can also calculate a measured move price objective based on an upside breakout from a year-long consolidation pattern from 2022 – $277 was the target, which PANW did not quite get to. That price objective may not be invalidated given the false breakout.

Overall, the uptrend remains intact, but there are cracks in the near-term view, so I am cautious but would be a buyer on a test of the 200-day moving average which has been important for much of the chart’s history.

PANW: Negative RSI Divergence, Possible False Breakout

The Bottom Line

I have a hold rating on PANW. The valuation appears fair to me while the earnings backdrop is very solid given the strong EPS beats and 20% growth rate. The technical situation is mixed, and buying on a further pullback is a better risk/reward than purchasing today near $240.