Michael Vi

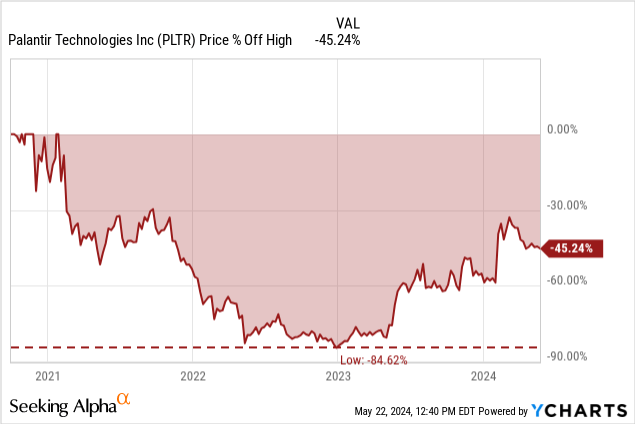

In the last few quarters, I was rather cautious about Palantir Technologies (NYSE:PLTR) and in my last few articles, I rated the stock as a “Hold” and my advice was to be rather cautious. At the end of November 2023, I wrote an article why it is difficult to justify Palantir’s share price. In the meantime, Palantir still increased about 8%, but it underperformed the S&P 500 in the last six months, which increased about 16%.

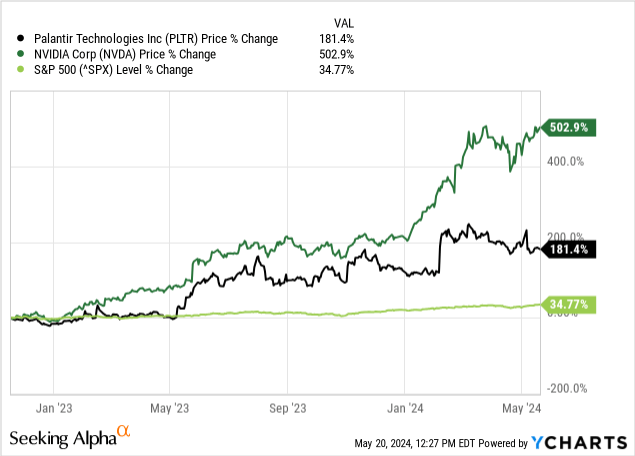

Since the bottom around $7 less than a year ago, the stock has more than tripled in only a few quarters. In the last 18 months, Palantir’s stock price increased 181%. The performance was not enough to outperform high-flyer NVIDIA Corporation (NVDA) which increased 503% in the same timeframe, but Palantir outperformed the S&P 500 (SPY), which is already looking at a solid performance in the last 18 months.

This also raises the question if I have been constantly wrong about Palantir in the last few quarters, or if the stock is just getting more and more overvalued, and we are seeing the typical late stages of a gigantic stock market bubble.

First Quarter Results

When trying to answer this question, we start by looking at the results Palantir reported. And despite any potential criticism (which we will articulate later in this article) we must acknowledge that Palantir is continuing to report great results and not only increasing the top line with a high pace but also continuing its path towards profitability.

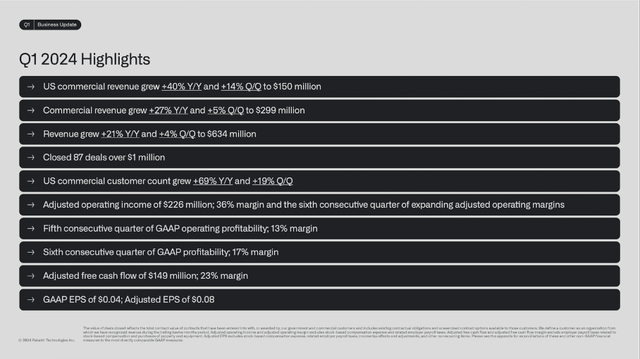

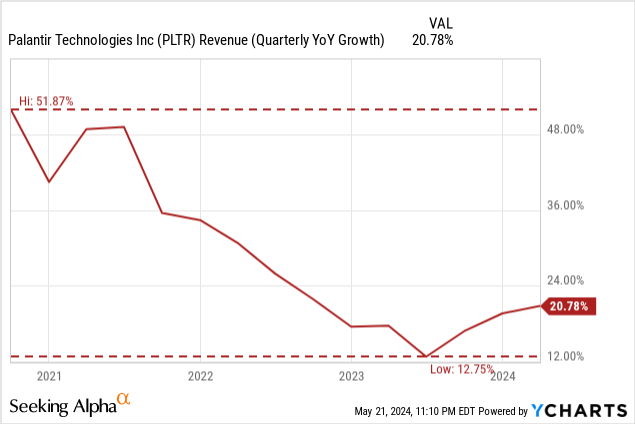

On May 06, 2024, Palantir reported first quarter results and revenue increased from $525.2 million in Q1/23 to $634.3 million in Q1/24 – resulting in 20.7% top-line growth. And on its path to becoming (more) profitable, Palantir saw its income from operations jump from $4.1 million in the same quarter last year to $80.9 million this quarter. Diluted net earnings per share quadrupled from $0.01 in Q1/23 to $0.04 in Q1/24.

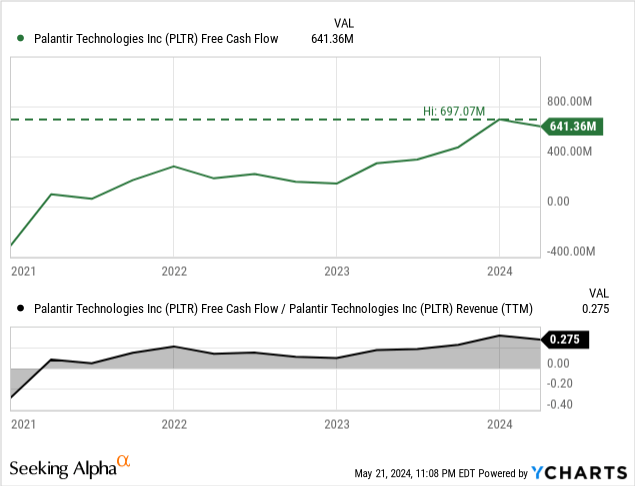

When looking at adjusted earnings per share, the picture is a little different. Adjusted EPS increased 60% from $0.05 in the same quarter last year to $0.08 this quarter. Only adjusted free cash flow declined from $188.9 in Q1/23 to $148.6 million in Q1/24 – resulting in a 21.3% YoY decline.

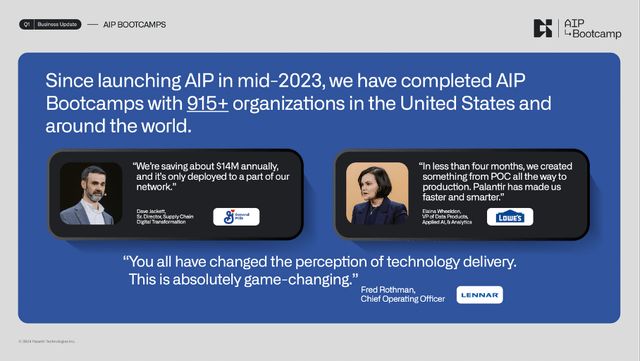

While commercial revenue grew 27% year-over-year from $236 million in Q1/23 to $299 million in Q1/24 and the number of commercial customers increased 53% year-over-year from 280 to 427, government revenue increased only 16% YoY from $289 million in the same quarter last year to $335 million this quarter. And it clearly seems like the bootcamps are working and a good strategy to drive revenue growth. Since launching AIP in mid-2023, Palantir has complete AIP Bootcamps with more than 900 organizations in the United States and around the world.

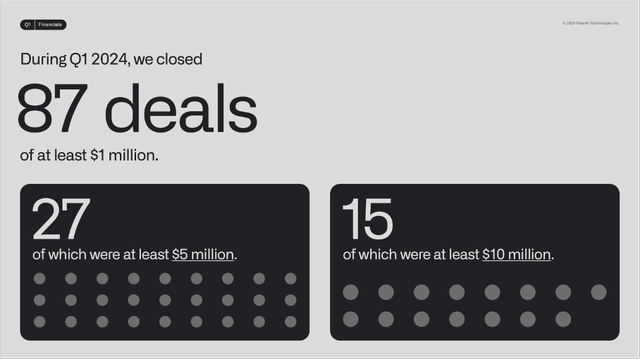

And during the fourth quarter, Palantir closed 87 deals with of volume of at least $1 million with 27 deals of at least $5 million and 15 deals of at least $10 million.

Expectations For Fiscal 2024

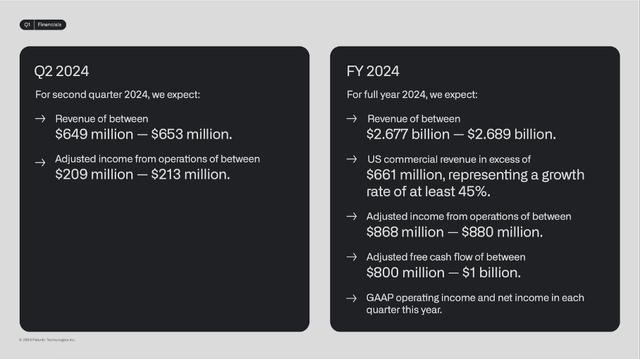

When looking at managements’ expectations for fiscal 2024, revenue is estimated to be in a range between $2,677 million and $2,689 million for the full year. This is resulting in 20% to 21% year-over-year growth compared to revenue in fiscal 2023. Adjusted income from operations is expected to be between $868 million and $880 million. Compared to an adjusted income from operations, this would result in 37% to 39% year-over-year growth.

And finally, adjusted free cash flow is expected to be between $800 million and $1,000 million. Palantir has a very narrow guidance for revenue and operating income, but for free cash flow we see the range getting much broader – reflecting the difficulties for management to make assumptions.

Intrinsic Value Calculation

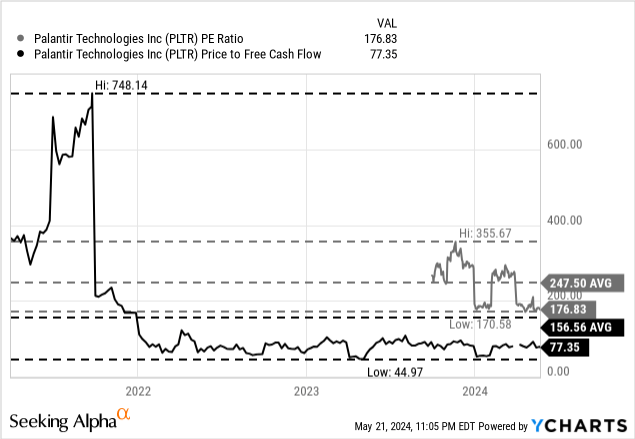

One of the main arguments that can be made against Palantir – at least over the midterm (maybe next 5-10 years) – are the extremely high valuation multiples the stock is trading for. At the time of writing, Palantir is trading for 177 times earnings, and nobody can dispute that such a high valuation multiple is not sustainable. However, we can make the counterargument that Palantir is not only able to grow its top line with a high pace (we will get to growth expectations later) but can also improve its margins and therefore earnings per share will grow with a much higher pace bringing the P/E ratio down quickly.

However, when looking at expected earnings per share for the next fiscal year ($0.33) we get a forward P/E ratio of 64 and that is still a very high valuation multiple. And we can even shift our attention away from the P/E ratio (which is definitely not the best metric here) towards the price-free-cash-flow ratio. At the time of writing, Palantir is trading for 77 times free cash flow, and such a valuation multiple still seems too high to be an acceptable metric.

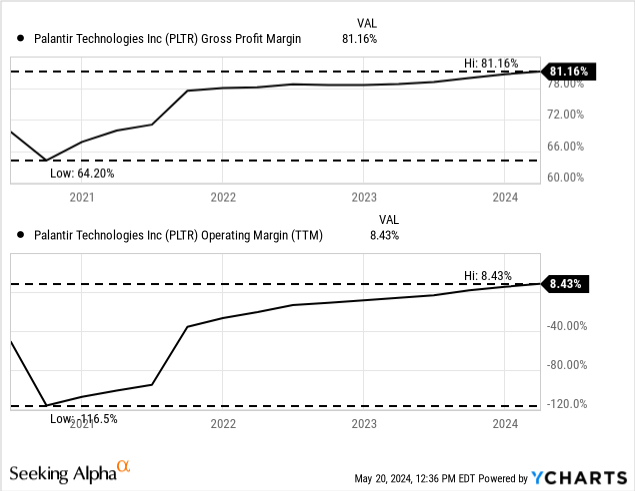

And while we can make the argument for earnings per share that improving margins will contribute to growth in the years to come, this argument is much more difficult to make for free cash flow.

In the last four quarters, Palantir managed that almost one third of its revenue ended up as free cash flow and while an operating margin of 8.4% (TTM numbers) is certainly not impressive and many companies are able to achieve similar or higher operating margins, a free cash flow/revenue ratio of 27.5% is impressive and to be honest doesn’t leave much room for improvement (it was already as high as 31% and in the coming years it is likely that the free cash flow/revenue ratio will decline again – especially in economic challenging times).

And here we must use a discount cash flow calculation again. As the basis for our calculation, we are using the adjusted free cash flow of the last four quarters, which was $691 million, as well as the diluted number of outstanding shares (2,400 million on March 31, 2024). And as always, we take a 10% discount rate and are calculating with 6% growth until perpetuity in 10 years from now. To be fairly valued, Palantir has to grow its free cash flow 22% annually for the next ten years.

As we have pointed out above, that growth must come solely from top-line growth, as it seems extremely unlikely for the free cash flow to sales ratio to being any higher than it is right now. And here it becomes questionable if Palantir can grow at such a high pace. Analysts are expecting revenue to grow with a CAGR of 17.39% for the next ten years (however, these estimates are mostly based on the opinion of one analyst).

When looking at historic growth rates, Palantir grew revenue with a CAGR of 30% in the last five years and 27% in the last three years. This would be enough to make Palantir fairly valued at this point. But we also must see that quarterly revenue growth slowed down in the last few years – only in the last three quarters revenue growth accelerated again (and it remains to be seen if the trend can continue). But in the last few quarters, revenue growth was clearly below the rate which is required for Palantir to be fairly valued. And the last few quarters most likely have not been the worst economic environment a company can be in, and we must raise the question at what rates Palantir can grow if the economic environment is different.

But even if Palantir is able to grow its top line 22% for the next ten years, another major problem remains (one I have pointed out in several articles). Palantir is diluting the number of outstanding shares at a high pace in the last few years and continues to do so. Over the last twelve months, Palantir increased the number of outstanding shares by 8.3% and assuming a similar dilution in the years to come, Palantir must grow its top line 30% annually to be fairly valued. And always remember, this is assuming that Palantir is able to keep free cash flow conversion at close to 30% of revenue (which is a huge challenge in my opinion).

Sentiment

And one final point I made already in my last article about NVIDIA, I like to make here again because it is so important and describes the current sentiment in the stock market. In the article, I wrote at the end of the intrinsic value calculation:

And finally, we are calculating here with a 10% discount rate. For those that don’t already know this (because sometimes we must spell out things that seem otherwise obvious): A 10% discount rate is telling us that investing in Nvidia (under the assumptions made above) would generate a 10% return on investment annually. It means your investment will increase 10% the first year and another 10% the next year. To double your investment, it would take a little more than 7 years. I am just saying this as those people being extremely bullish about Nvidia are probably assuming to double, triple, or quadruple their investment in the next few quarters. A 10% annual return is extremely good, but it doesn’t go hand-in-hand with the dream of becoming rich quickly.

And the same is true for Palantir. Even if we assume that Palantir is fairly valued here, we have an investment return of 10% annually. And when assuming that Palantir is not able to achieve the necessary 23% to 30% top-line growth, the investment return for Palantir will drop into the single digits.

But the fact that investors are not able to see this is characteristic for this final phase before the stock market hits its peak and the bubble will burst. It is also hinting towards another hype and bubble for Palantir as well. Investors (or speculators) are not buying Palantir based on fundamental analysis but due to irrational exuberance and the hope for extraordinary gains in a short time.

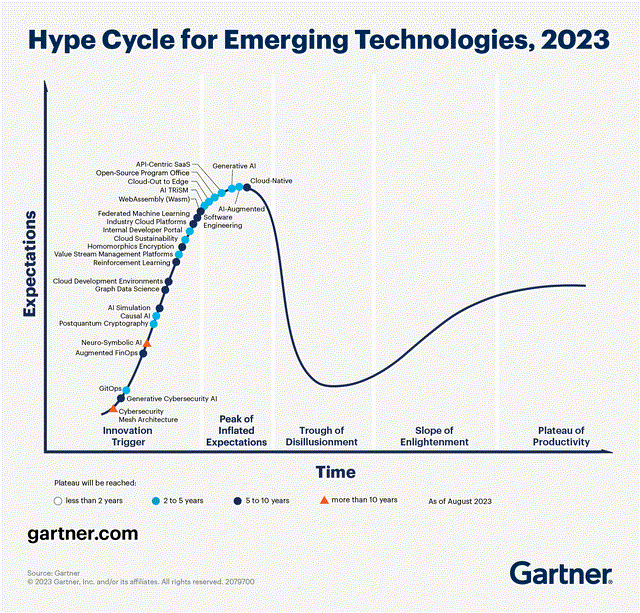

And similar to NVIDIA – despite entirely different business models – both companies are profiting from the hype around artificial intelligence. And while the hype did not really lead to much higher growth rates for Palantir – in sharp contrast to NVIDIA – it led to much higher stock prices for Palantir. When looking at Gartner’s hype cycle for emerging technologies, we see artificial intelligence and generative AI being on the peak of inflated expectations and I would make the argument that Palantir is profiting from that hype and the stock price is reflecting that hype.

Conclusion

In my opinion, the conclusion remains the same as in my last article – Palantir is simply too expensive at this point to be a good investment. Especially, the ongoing high dilution of shares remains a huge problem and is requiring growth rates around 30% for free cash flow for Palantir to be fairly valued. And although Palantir was able to grow at such a high pace in the past, I don’t think it can grow its top line 30% in the years to come – and with the free cash flow/revenue ratio being already close to 30% I don’t see any “margin improvement” that might lead to higher free cash flow.

And the fact that Palantir is still trading 45% below its previous all-time high does not change my assessment. It is only underlining that Palantir was even more overvalued before and certainly not investment-worthy in 2020 and early 2021.