When it comes to talking about artificial intelligence (AI), Microsoft often dominates the conversation, and rightly so. Early on, the company partnered up with OpenAI, a start-up that’s capturing the imaginations of investors worldwide.

But let’s put Microsoft aside for a moment. Many stocks can benefit from the AI trend, but some are less obvious than others. For one such under-the-radar AI pick, investors should consider buying shares of Booking Holdings (BKNG 1.13%).

Booking stock is at an all-time high as of this writing, but if management’s AI scheme works out, then the stock could continue notching new highs in the future.

How AI can help a travel platform

Before I explain how AI can help, it’s best to start with how the company makes money. Booking is a platform that travelers can use to find flights, hotels, rental cars, and more.

After finding what they need, travelers can pick to book directly with the airline, rental car company, etc. In these cases, Booking simply earns a commission. It’s a good business and has made the company what it is today. However, management has greater aspirations.

Booking’s management would prefer its users book every aspect of their travel on its platform directly — it calls this a “connected trip.” To even make this vision a possibility, the company had to build out its own payments platform.

A travel agent would help people book every aspect of their trip. But employing a human agent would be cost-prohibitive for a company the size of Booking. Therefore, management is hoping it can train its AI to do the work of a travel agent, pushing its vision for connected trips forward.

It’s more than just a vision. If Booking can keep making progress on this, shareholders should reap the benefit.

Why this is the right lever to pull

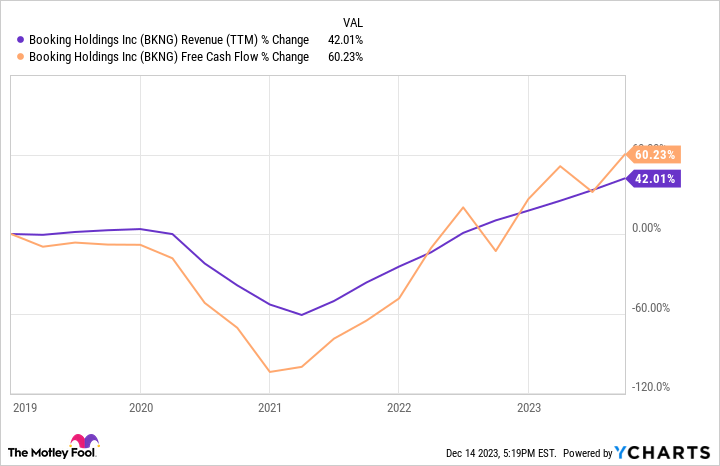

By processing customers’ payments itself, Booking can hold on to travelers’ cash for just a little longer, which is a boost to the company’s cash flow. As the chart below shows, free-cash-flow growth is outpacing revenue growth over the last five years.

Data by YCharts.

What’s exciting is that there’s still plenty of room for the trend to continue playing out.

When Booking processes transactions on its platform, it’s called merchant revenue. And when it earns a commission, it’s called agency revenue. As of 2023, merchant revenue has surpassed agency revenue for the first time ever. However, through the first three quarters of 2023, merchant revenue makes up only 51% of total revenue, meaning it has plenty of room to continue growing into a larger percentage of the whole.

Moreover, it’s possible that many of Booking’s users are making their travel arrangements in various places. If the company’s AI travel agent is effective, it could get users to book many (if not all) aspects of their travel on Booking, which would be a boost to revenue.

Increasingly effective AI can uphold Booking’s top line as users purchase more of their travel arrangements in one place — this is management’s vision of the connected trip. This is only possible if Booking is processing the payments, and when it does the payment processing, it’s a boost to cash flow.

Over the long term, Booking’s cash-flow growth can direct to market-beating returns. That’s why I believe this is a sneaky AI stock to consider buying even now that it’s trading near an all-time high.

Jon Quast has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Booking Holdings and Microsoft. The Motley Fool has a disclosure policy.