tadamichi

By Kristy Akullian, CFA

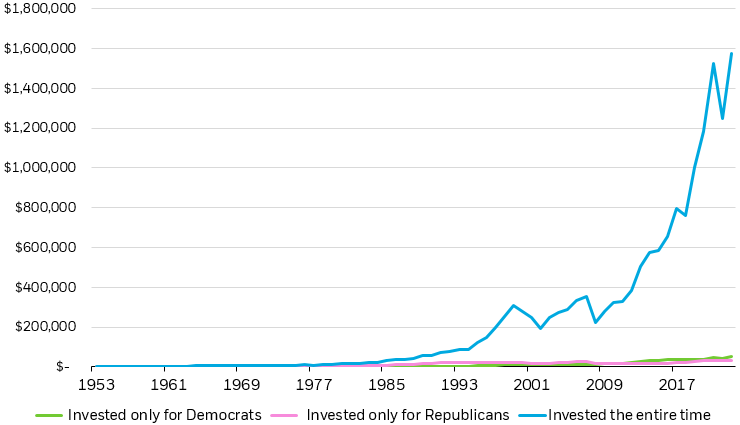

1. It pays to keep your portfolio non-partisan

Markets don’t vote in elections, but they do vote with their feet. And in that regard, they are strictly non-partisan. While party jostling may dominate headlines, historically markets have continued to march higher regardless of who holds power.

Under the hood, party control may influence sector and industry performance, but at the broad index level staying invested has been more important than which party holds the presidency.1

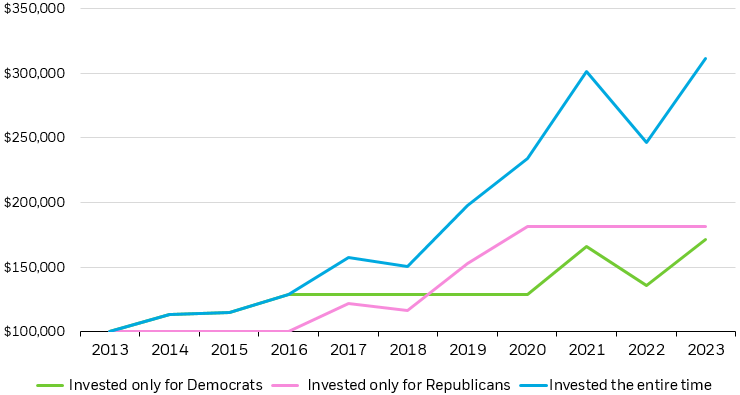

Consider two horizons: Over the last ten years, money invested only under Republican presidents returned slightly more than money invested during Democratic reign.

But by far the winning investment strategy was to stay invested, even as political power changed hands. Investors who held the course as political winds changed earned nearly twice as much in the last decade as those who plumped purely for their party (Figure 1).

Over the very long term, the same is true, but at a much greater magnitude. Over the last 70 years, market performance during Democratic presidencies edged out their Republican counterparts. But bipartisan investors took home the real prize, earnings 31x more than the party faithful (Figure 1).

Index investing can be a good way to diversify company-specific risk, as elections can benefit some and not others, but are notoriously hard to predict.

Rather than selecting funds with exposures tied to the fate of a single party, investors may consider allocating to a diversified basket of high-quality companies that have been shown to stand the test of time – regardless of who’s in power.

Figure 1

Last 70 years, $10,000 invested in 1953, depending on which party held presidency

Source: BlackRock, Morningstar, as of December 31, 2023. Party presidency period determined by party presidency inauguration to next opposing party presidency inauguration. Stock market represented by the S&P 500 Index from 1/1/70 to 12/31/23 and IA SBBI U.S. large cap stocks index from 1/1/54 to 1/1/70. Past performance does not guarantee or indicate future results. Index performance is for illustrative purposes only. You cannot invest directly in an index.

Chart description: Line chart showing the appreciation of $10,000 invested in U.S. large-cap stocks during democratic presidential terms only, republican presidential terms only, and the entire time, since 1953.

Last 10 years, $10,000 invested in 2013, depending on which party held presidency

Source: BlackRock, Morningstar, as of December 31, 2023. Party presidency period determined by party presidency inauguration to next opposing party presidency inauguration. Stock market represented by the S&P 500 Index from 1/1/70 to 12/31/23 and IA SBBI U.S. large cap stocks index from 1/1/54 to 1/1/70. Past performance does not guarantee or indicate future results. Index performance is for illustrative purposes only. You cannot invest directly in an index.

Chart description: Line chart showing the appreciation of $10,000 invested in U.S. large-cap stocks during democratic presidential terms only, republican presidential terms only, and the entire time, since 2013.

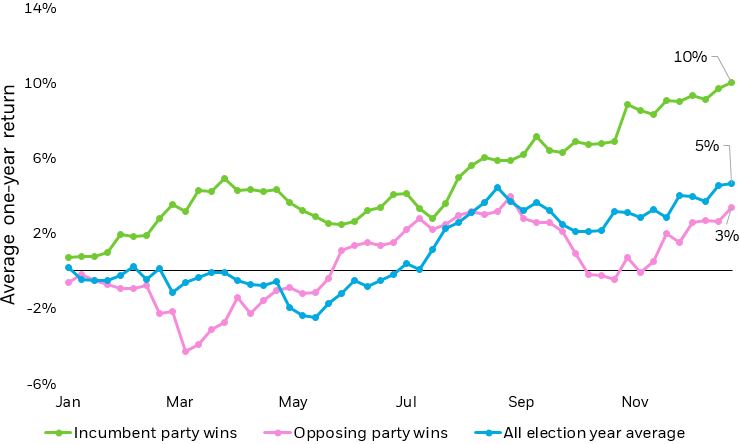

2. Brace for volatility and don’t bet on a blockbuster

More than anything, markets dislike uncertainty, and election years often bring a healthy dose. Looking back at past presidential election years, we find that median index returns are positive, but below the average of non-election years.

More specifically, markets have tended to struggle in the first half of the year, when uncertainty about the outcome is typically highest (Figure 2).

As election day nears, candidates are known, and polls become more reliable, markets have historically delivered positive performance in the third and fourth quarters (Figure 2).

But while historical analogs can be encouraging, they also reveal risks. Election years tend to have a wider range of potential outcomes in either direction, particularly when political power changes hands.

That risk rises even more when one party consolidates power in both chambers of Congress and in the Executive branch, as divided government often stymies sweeping changes, reducing uncertainty.2

While election attention – and the impact on markets – typically begins in earnest in the fall, this election cycle may pull forward focus, as both likely candidates and their policy agendas are largely known in advance.

This could create a bumpy ride through an already busy macro calendar, featuring the Fed potentially set to cut interest rates over the summer.

Investors who want to smooth the ride might consider buffered strategies, where the certainty of downside protection may be welcome in an otherwise uncertain year.

A buffer strategy utilizes options to seek to provide a targeted level of downside protection, should markets experience negative returns.

The tradeoff for this downside protection is that the strategy is limited on its upside potential over each hedge period.

Together, this approach can help investors stay invested by mitigating the pain of major selloffs and ultimately seek clearer financial outcomes.

Figure 2

Stocks have historically struggled in the first half of a presidential election year

Source: BlackRock, Bloomberg. Dr. Ken French, Dartmouth University. U.S. stock returns from 1932 to 1956 are represented by the U.S. stock market daily returns data set compiled by Dr. French. U.S. stock market returns from 1957 to 2020 represented by SPX Index. Index performance is for illustrative purposes only. Index performance does not reflect management fees, transaction costs or expenses. Indexes are unmanaged and one cannot invest directly in an index. Past performance does not guarantee future results.

Chart description: Line chart depicting stock performance during election years categorized by when the incumbent party wins, opposing party wins, and the average of all election years.

3. Find common ground – or at least common investment themes

Even though election years often emphasize the differences between major parties and their candidates, investors may be better served in their portfolio by identifying commonalities: areas of the economy that can benefit from bipartisan support and can flourish regardless of who wins in November. We see two key area for investment where parties can find common ground.

- Thankfully, roads, bridges, and power grids tend not to lean left or right (hopefully they don’t lean at all!). As a result, we believe domestic infrastructure spending is likely to continue in 2025, though the flavor of spending may be colored by party politics. Investing in the theme, rather than specific companies, can give you diversified exposure to companies that should benefit as infrastructure spending continues, which it is set to do thanks to the $1.2 trillion Infrastructure Investment and Jobs Act passed in 2021.

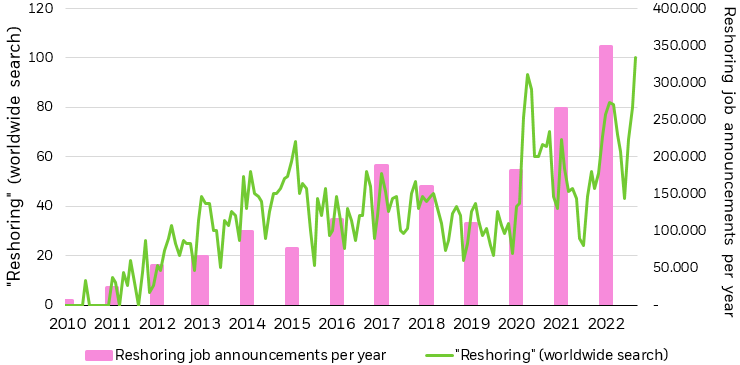

- Geopolitical fragmentation in a world of increasing competition between “the West and the Rest” has led to a rethink of global supply chains. Technology companies, at the forefront of U.S. growth in 2023, are in many cases leading the way. We see opportunity in tech-focused funds that take on an active approach, using geolocation data to tilt into tech companies focused on the U.S. and “friend-shored” tech production and distribution. We believe this unique offering captures an evolving geopolitical reality and believe the focus on this exposure will only continue as election rhetoric picks up, with both sides keen to rebuild domestic manufacturing.

Figure 3

“Reshoring” Google Search Trends and U.S. Company Job Announcements (2010-2022)

Source: Google. Google Trends as of October 31, 2022. Numbers represent search interest relative to the highest point on the chart for the given region and time. A value of 100 is the peak popularity for the term. A value of 50 means that the term is half as popular. A score of 0 means there was not enough data for this term.

Chart description: Bar chart showing reshoring job announcements per year since 2010, overlaid by a line chart showing Google search trends for “reshoring”.

© 2024 BlackRock, Inc. All rights reserved.

1 Source: BlackRock, Bloomberg. Broad index as represented by SPX Index. Historical time in reference from 1/1/1926 to 12/31/2023.

2 Source: Goldman Sachs. “2024: The Year of Elections,” as of February 01, 2024.

Carefully consider the Funds’ investment objectives, risk factors, and charges and expenses before investing. This and other information can be found in the Funds’ prospectuses or, if available, the summary prospectuses, which may be obtained by visiting the iShares Fund and BlackRock Fund prospectus pages. Read the prospectus carefully before investing.

Investing involves risk, including possible loss of principal.

International investing involves risks, including risks related to foreign currency, limited liquidity, less government regulation and the possibility of substantial volatility due to adverse political, economic or other developments. These risks often are heightened for investments in emerging/ developing markets or in concentrations of single countries.

Diversification and asset allocation may not protect against market risk or loss of principal.

Fixed income risks include interest-rate and credit risk. Typically, when interest rates rise, there is a corresponding decline in the value of debt securities. Credit risk refers to the possibility that the debt issuer will not be able to make principal and interest payments.

Buffered ETFs

There can be no guarantee that the Fund will be successful in its strategy to provide downside protection against Underlying ETF losses. The Fund does not provide principal protection or non-principal protection, and, despite the Approximate Buffer (the “Buffer”), an investor may experience significant losses on their investment, including the loss of their entire investment. A blended portfolio of Expiring Options and New Options during a Rebalance Period will impact the Fund’s ability to realize the full benefit of the Buffer or may subject the Fund’s return to an upside limit that is slightly lower or higher than the Approximate Cap (the “Cap”) for the applicable Hedge Period. Accordingly, investors may bear losses against which the Buffer is anticipated to protect and be subject to an upside limit that is lower than the Cap. In the event an investor purchases Fund shares after a Hedge Period begins or sells Fund shares prior to the end of the Hedge Period, the returns realized by the investor will not match those that the Fund seeks to provide. In periods of extreme market volatility, the Fund’s return may be subject to downside protection significantly lower than the Buffer and an upside limit significantly below the Cap. A new cap is established during each Rebalance Period and is dependent upon current market conditions. As such, the Cap is likely to change, sometimes significantly, from one Hedge Period to the next.

The Fund invests in FLEX Options that derive their value from the Underlying ETF. FLEX Options are subject to counterparty risk, which is the risk that the other party in the transaction will not fulfill its contractual obligation, and may be less liquid than other securities. The value of FLEX Options may be affected by interest rate changes, dividends, actual and implied volatility levels of the Underlying ETF’s share price, and the remaining time until the FLEX Options expire. Because of these factors, the Fund’s NAV may not increase or decrease at the same rate as the underlying ETF’s share price.

There can be no assurance that performance will be enhanced or risk will be reduced for funds that seek to provide exposure to certain quantitative investment characteristics (“factors”). Exposure to such investment factors may detract from performance in some market environments, perhaps for extended periods. In such circumstances, a fund may seek to maintain exposure to the targeted investment factors and not adjust to target different factors, which could result in losses.

Funds that concentrate investments in specific industries, sectors, markets or asset classes may underperform or be more volatile than other industries, sectors, markets or asset classes and than the general securities market.

Actively managed funds do not seek to replicate the performance of a specified index. Actively managed funds may have higher portfolio turnover than index funds.

There can be no assurance that an active trading market for shares of an ETF will develop or be maintained.

This material represents an assessment of the market environment as of the date indicated; is subject to change; and is not intended to be a forecast of future events or a guarantee of future results. This information should not be relied upon by the reader as research or investment advice regarding the funds or any issuer or security in particular.

The strategies discussed are strictly for illustrative and educational purposes and are not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. There is no guarantee that any strategies discussed will be effective.

The information presented does not take into consideration commissions, tax implications, or other transactions costs, which may significantly affect the economic consequences of a given strategy or investment decision.

This material contains general information only and does not take into account an individual’s financial circumstances. This information should not be relied upon as a primary basis for an investment decision. Rather, an assessment should be made as to whether the information is appropriate in individual circumstances and consideration should be given to talking to a financial professional before making an investment decision.

The information provided is not intended to be tax advice. Investors should be urged to consult their tax professionals or financial professionals for more information regarding their specific tax situations.

The Funds are distributed by BlackRock Investments, LLC (together with its affiliates, “BlackRock”).

The iShares Funds are not sponsored, endorsed, issued, sold or promoted by Bloomberg, BlackRock Index Services, LLC, Cboe Global Indices, LLC, Cohen & Steers, European Public Real Estate Association (“EPRA® ”), FTSE International Limited (“FTSE”), ICE Data Indices, LLC, NSE Indices Ltd, JPMorgan, JPX Group, London Stock Exchange Group (“LSEG”), MSCI Inc., Markit Indices Limited, Morningstar, Inc., Nasdaq, Inc., National Association of Real Estate Investment Trusts (“NAREIT”), Nikkei, Inc., Russell, S&P Dow Jones Indices LLC or STOXX Ltd. None of these companies make any representation regarding the advisability of investing in the Funds. With the exception of BlackRock Index Services, LLC, who is an affiliate, BlackRock Investments, LLC is not affiliated with the companies listed above.

Neither FTSE, LSEG, nor NAREIT makes any warranty regarding the FTSE Nareit Equity REITS Index, FTSE Nareit All Residential Capped Index or FTSE Nareit All Mortgage Capped Index. Neither FTSE, EPRA, LSEG, nor NAREIT makes any warranty regarding the FTSE EPRA Nareit Developed ex-U.S. Index, FTSE EPRA Nareit Developed Green Target Index or FTSE EPRA Nareit Global REITs Index. “FTSE®” is a trademark of London Stock Exchange Group companies and is used by FTSE under license.

© 2024 BlackRock, Inc or its affiliates. All Rights Reserved. BLACKROCK, iSHARES, iBONDS, LIFEPATH, ALADDIN and the iShares Core Graphic are trademarks of BlackRock, Inc. or its affiliates. All other trademarks are those of their respective owners.

iCRMH0324U/S-3416714

This post originally appeared on the iShares Market Insights.

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.