simonkr/E+ via Getty Images

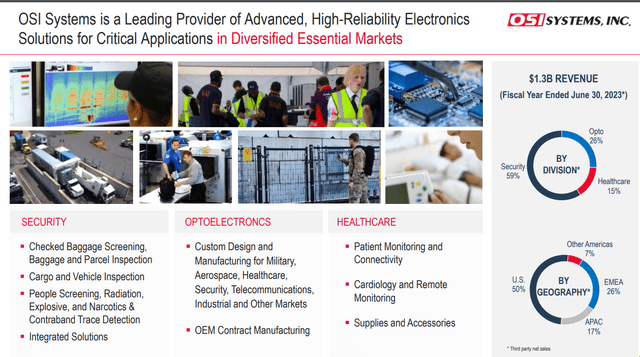

OSI Systems, Inc. (NASDAQ:OSIS) doesn’t capture many headlines, although anyone who has traveled through an airport will likely recognize their market-leading security screening systems including X-ray machines, and explosive detectors.

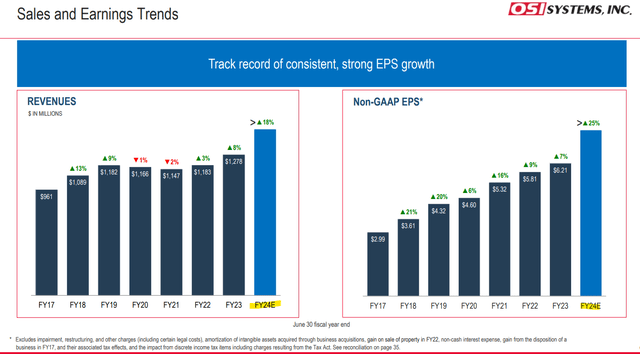

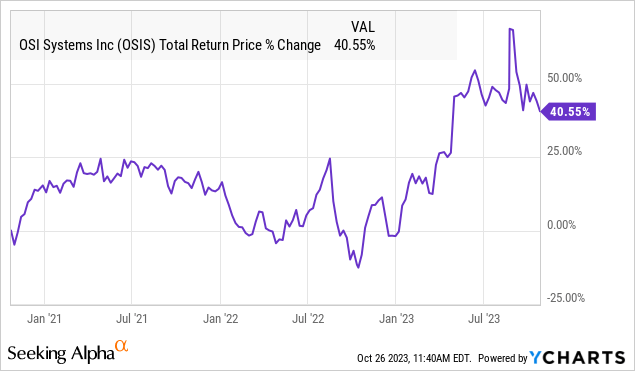

Indeed, OSI Systems has benefited from the ongoing travel boom with the stock outperforming and up more than 40% in 2023 despite some recent volatility. The company just reported its latest quarterly results highlighted by a revision higher to its full-year earnings targets.

There’s a lot to like about OSIS as a high-quality small-cap with overall solid fundamentals. Beyond the security segment, the product portfolio is diversified into applications across healthcare equipment and even defense industry solutions. Ultimately we believe shares are well positioned to rebound higher and have more upside into 2024.

OSIS Q1 Earnings Recap

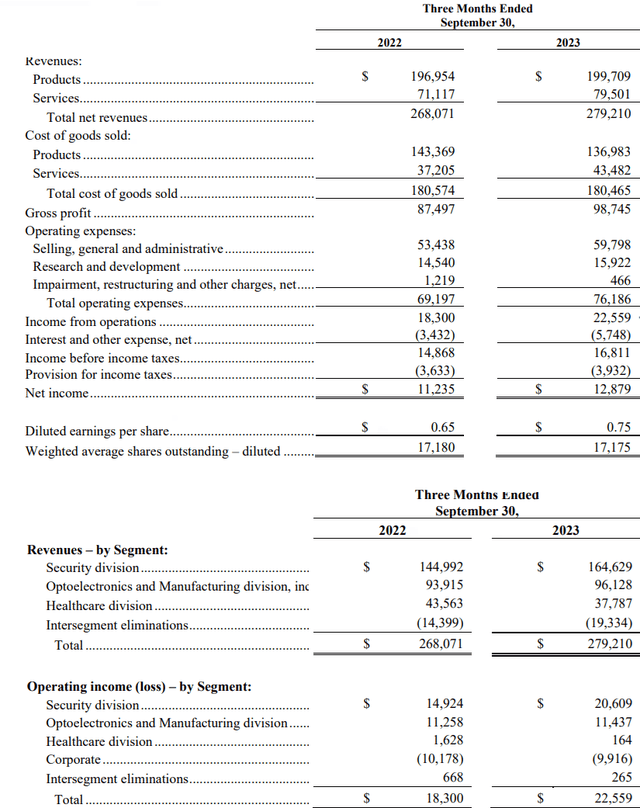

OSIS fiscal 2024 Q1 non-GAAP EPS of $0.91, came in $0.05 ahead of the consensus, and up 5% from the period last year. Revenue of $279 million climbed by 4.1% y/y but missed the estimate by a modest $1.7 million.

The setup here has been a continuation of the strong trends from last year defined by a climbing order backlog that reached $1.8 billion, up from $1.5 billion at the end of Q1 fiscal 2023. At the same time, the record growth in the comparison period last year left a high benchmark explaining the slight sales growth miss this quarter alongside the timing of some deals.

A major theme for the company has been climbing profitability with the gross profit margin reaching 35.4% this quarter compared to 32.6% last year. Osis has benefited from both easing manufacturing input cost inflation and lower supply chain shortages while the business continues to shift towards more value-added solutions. The result is that the operating income was up 23% y/y with an expectation for continued margin expansion going forward.

Operationally, the strength here has been driven by the Security division with revenues climbing by 14% y/y and currently representing nearly 60% of the total business. In this case, the segment operating income has been even stronger, up 38% y/y.

The security division momentum has balanced softer trends in the Optoelectronics division where growth was just 2% higher and operating income flat. The smaller Healthcare division has been a weak point with sales down by -13% y/y in Q1 with management citing industry-specific conditions.

Overall, the results were good enough that management reaffirmed its full-year revenue growth guidance “above 18% y/y” while also hiking its expected fiscal 2024 EPS estimate to climb by “greater than 27% y/y” compared to a prior target suggesting growth above 25%.

A large part of that increase considers the announcements of some major new contract awards. The sense is that demand remains strong in security, particularly in areas related to passenger bag screening, advanced cargo, and vehicle inspection solutions.

What’s Next For OSIS?

The attraction of OSI Systems for us is the company’s established market position and extensive relationships among a who’s-who of high-profile customers. With the security products portfolio, beyond what are recognized as generic x-ray machines, the growth driver here is the broader ecosystem of software and interconnected devices for a more comprehensive approach.

The need for turnkey solutions in more and more types of public settings represents a competitive moat for the company with its technology already certified across a global installed user base. Simply put, customers already familiar with the “security as a service” and software platform are more likely to continue expansion deployment given the high costs of switching and familiarity at the employee level.

Naturally, airport screening is a highly visible use case for the solutions, but the opportunities are more extensive covering everything from intelligence agencies, sporting venues, border authorities, and customs offices internationally. Ongoing investments to modernize many legacy infrastructures should continue to drive sales for OSIS as a long-term tailwind.

We can also cite the attraction of the optoelectronics and manufacturing division with applications in everything from semiconductors, consumer electronics, medical devices, and defense industry suppliers.

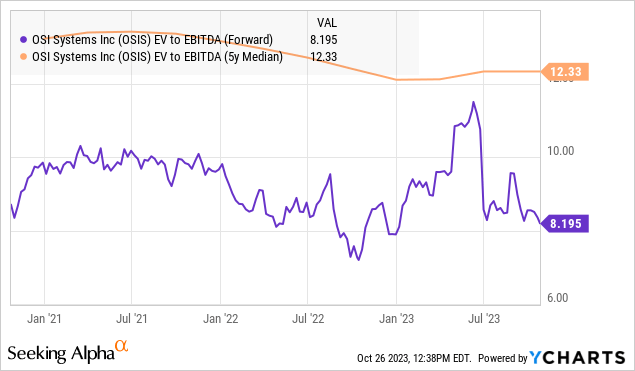

In terms of valuation, we believe shares once again look attractive, particularly following the recent selloff with OSIS currently about 20% from its recent all-time high near $140.00. Considering the strong earnings guidance from management, OSIS is trading at an 8.2x EV to forward EBITDA multiple. This is well below the company’s 5-year average for the metric closer to 12x.

By this measure, we believe the stock is simply undervalued, likely pressured by the broader macro headwinds. The risk and ongoing concern in the market is that economic conditions deteriorate leading to a sharp demand slowdown forcing the company to miss expectations.

We’ll take the over on that scenario with a sense that resilient economic conditions should continue to support a positive operating and financial outlook for the company.

Final Thoughts

Overall the takeaway here is that Osi Systems stands out as a unique industrial name that checks off several boxes of what we believe makes a good investment between steady growth, recurring profitability, and a solid balance sheet. The bullish case for the stock is that the company continues to deliver positive results while we see some room for recovery in the smaller healthcare division as opening the door to outperform expectations.

Monitoring points here include the evolution of the order backlog which is an important gauge in the underlying operating environment. Over the next few quarters, we’ll also be tracking the operating margin and cash flow trends.