Editor’s note: Seeking Alpha is proud to welcome Markets & Equity Learner as a new contributor. It’s easy to become a Seeking Alpha contributor and earn money for your best investment ideas. Active contributors also get free access to SA Premium. Click here to find out more »

da-kuk

Investment Thesis

Albeit Opera’s (NASDAQ:OPRA) smaller scale, it has proved its viability in the browser market. The company has provided sufficient confidence to continue to scale profitably, through its relatively low value currently, its improving advertising and its ability to leverage on artificial intelligence to push out services exclusive to certain users. Hence, this operating leverage boost and sustainable long-term network effect moat compels me to recommend a buy rating for Opera.

Market Overview

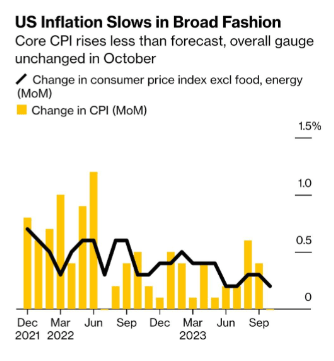

After the US Economy was rocked by the US Federal Reserve steadily raising interest rates in an attempt to quell inflation up till October, it seems like investors are beginning to regain confidence in US stocks. Some notable index funds include the S&P 500 (^GSPC) advancing 2.49% for the third week of December to close at 4,719.19 points, posting gains in four out of five sessions in 2023, and The Dow closing out November with an 8.9% gain, breaking its three-month losing streak. This is likely due to the Fed seeing inflation slowly broaden, leading to consumers finally feeling greater economic certainty in the US. Even better news is that the Federal Reserve has held its key interest rate steady in its last meeting of 2023, and set the table for multiple cuts to come beyond 2024, exceeding consumer expectations.

Banks such as Citibank believe that 2024 will begin with slow, followed by steadier growth, while others like Standard Chartered forecast that the first half of 2024 would have healthy growths, especially in US and Japanese equities, but the risk of recession in the second half is high. Whilst many variables are in play in the global economy that make it seemingly volatile, one thing is for certain: Technology, especially (AI), will lead the way in the years to come. This can be seen by the Magnificent 7 ((Amazon.com (AMZN), Apple (AAPL), Alphabet (GOOGL), Meta Platforms (META), Microsoft (MSFT), Nvidia (NVDA) and Tesla (TSLA))) leading global equities in returns.

Core CPI (Bureau of Labor Statistics)

Amidst this strong demand for generative AI in the last several months as a form of technology with immense potential for applications across various fields, experts like Adam Gold advocate for buying companies with strong fundamentals in a promising industry such as Nvidia in times of volatility. As such, I believe that Opera Limited is greatly capitalising on current trends in a “browser-first world”, which coupled with potential consumer sentiment could greatly boost its performance.

More about OPRA

OPRA is a web browser company developed by OPRA Software. With the Original Opera’s inception in April 1995, it remains one of the oldest web browsers still actively developing. Yet, it is certainly trying to keep things fresh by boasting its unique features to stand tall amidst its much larger competitors. This includes Speed Dial, direct page customisation, built in Ad-Blocking, virtual private networks (VPN) and most eye-catchingly, the utilisation of generative AI software to personalise user feeds in both its original and gamer-targeted browsers. These browsers are Opera One, Opera GX, Opera Mini, respectively.

According to Morningstar’s classifications of super sectors, OPRA falls under the “Sensitive” super sector. OPRA has several competitors that offer web browser services, almost all of which are large corporations like GOOGL, MSFT and AAPL. However, smaller, independent companies also exist in the market, such as public & private firms such as Yandex (YNDX), Brave Software, Inc., DuckDuckGo, Baidu, Inc. (BIDU) etc.

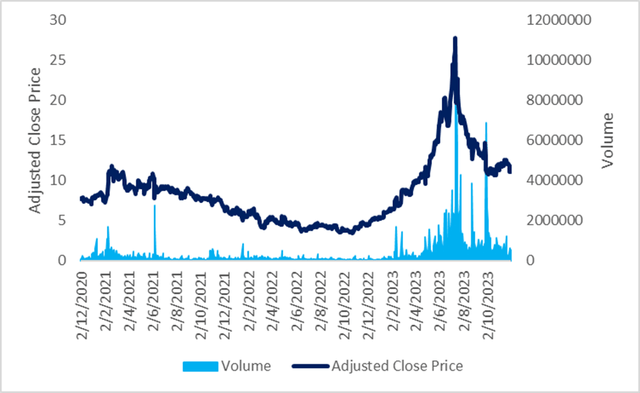

Adjusted Close Price of OPRA stock from 2020 to 2023 (Yahoo Finance)

Looking at the last 12 months (LTM) of adjusted close prices, OPRA’s prices peaked at $27.83 on June 13, and has currently dipped to a share price of $10.76 at the time of writing this (December 12th). However, in recent weeks, it has regained momentum and gained an upside of 11.7% to a price of $12.02 as of January 7th.

OPRA’s Q3 performance

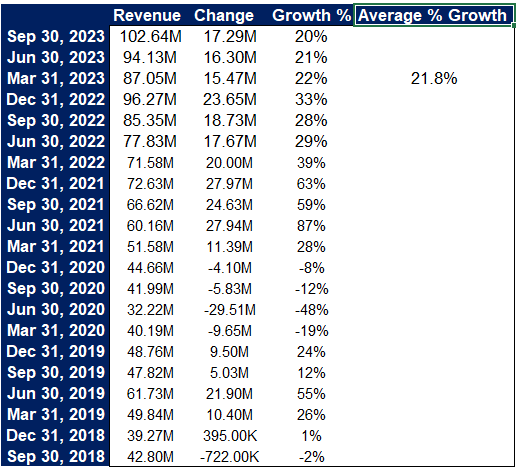

Quarterly Revenue Growth of Opera (Excel)

OPRA’s total revenue has been healthily growing at an average of 21.8% per quarter from FQ3 ’18 to FQ3 ’23. This is coupled with its improving earnings per share since the stock’s price fall in July 2023, from 0.15 in FQ2 ’23 to an estimated 0.18 in FQ4 ’23, suggesting solid future growth potential.

OPRA’s advertising revenue increased 24% year-on-year (YoY) to $60.8 million, and ARPU also increased by 24% to $1.31. Such revenue gains despite the number of monthly active users (MAU) falling by 3% from FQ3’22 makes sense as the fall in users are primarily attributed to lower ARPU users in emerging markets, whilst user numbers in developed regions with higher ARPU grew.

This is a lucrative way to generate returns by targeting more profitable users, however gross margins have decreased, which explains why operating expenses increased at a greater rate than revenue growth at 25% to $86.6 million. As Opera Ads was the fastest growing contributor to advertising revenue, OPRA could focus on getting more third party advertising clients and optimising their ad space. One minimally explored area are Western Market Users, since in FQ3’23 it still only comprised 16% of all users but also constitute as developed market users (Developed Market Users: North America, Europe and Oceania). Fortunately, this is a direction that OPRA is heading towards, and its offerings are paying off as shown by the above data.

Porter’s Five Forces:

I observe that albeit macroeconomic headwinds, the ever-growing demand for generative AI is one that OPRA can capitalise on with its unique characteristics, considering that it is still a relatively small independent browser company with room for multiple expansion.

Competition Within Industry – High

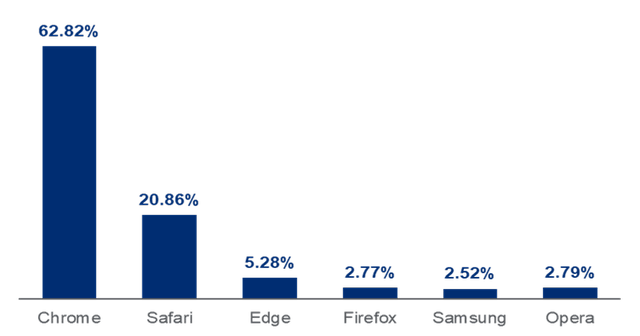

Market Share of Web Browsers (Source: Statista)

As stated in OPRA’s 2022 20-F report, they face intense competition, Primarily from global browser developers like GOOGL, AAPL and MSFT who run Google, Safari and Edge respectively. However, they also need to compete with smaller browser companies that dominate smaller regions as mentioned previously. Still, with a 3 firm concentration ratio of 88.96%, the big 3 dominate the market of Internet Browsing. These firms have the advantages of greater global recognition, ability to make acquisitions of similar services and also imposing restrictions on existing software which OPRA depends on. Whether OPRA can keep up with these competitors and gain market share in various regions would depend on its innovativeness.

Bargaining Power Of Suppliers – Low

Most of the services OPRA provides are fundamentally powered in-house, such as their Opera Ads, Opera Corner and Opera Gaming features that use proprietary artificial intelligence technology to optimise user experiences based on algorithmic features. Hence, while some risks include scaling these technologies appropriately as the service expands, these are all based on internal investments and innovation.

Bargaining Power Of Customers – Moderate

Because of the many competitors within the industry, customers would have a range of browsers to choose from, and hence also choices of other add-on services such as (VPN) networks, pay services and more. Notwithstanding the fact that Google Chrome has highly integrated apps like Google Drive linked to it, OPRA is unique in its integration of other technologies such as its built-in ad blocker, (VPN), crypto wallet and even direct access third-party apps like Twitch, Telegram, WhatsApp and ChatGPT, appealing to a younger demographic who frequent the Internet more than any other group.

Threat Of Substitutes – Low

Web browsers are the gateways to the internet. It is a universal platform that allows easy access to information, websites, web-based applications, entertainment services and many more. Such a fundamental type of technology can hardly be replicated by other alternative technologies. In addition, considering that users have already been accustomed to the customised interfaces of web browsers, this form of standardisation over the years would make it infeasible not just for personal usage, but also corporate users to switch to alternatives.

Threat Of New Entry – Moderate

Due to the low barriers to entry, the market is relatively saturated with many independent browsers as mentioned prior. Yet, this can only be said for entering; to continuously innovate and stand out, new entrants would need to keep investing in businesses, products, services and technologies to boost their browser capabilities, thus making it challenging to stay in the industry.

OPRA’s Healthy Cash Flows

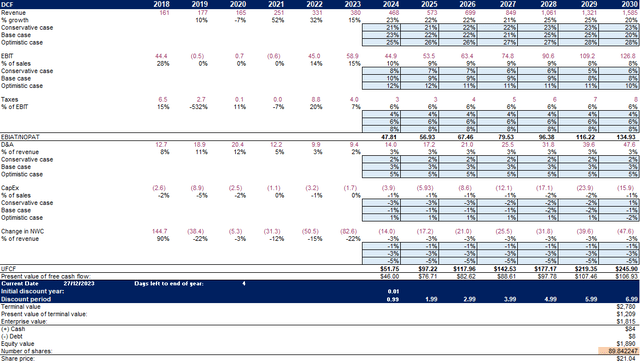

Discounted Cash Flow Valuation (Author)

The main reason why I chose this stock is because I felt that OPRA is currently undervalued, with Goldman Sachs initiating a resounding buy at a price target of $20.91. This is an upside of more than 50% from its current price range of $13 and $14. As such, I decided to create simple discounted cash flow (DCF) and comparable company analysis (CCA) models to see if it aligns with market consensus.

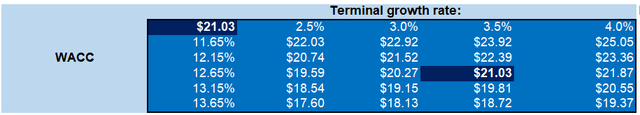

Since OPRA is dividend-paying, I assume the Gordon Growth Model of calculating terminal value. Referring to OPRA’s 20-F report, their management assumed no growth in the labour force as well as no improvement in labour productivity, which resulted in zero real GDP growth. Moreover, IMF’s inflation estimates for 2027 were used to estimate long term inflation, where a nominal growth rate of 3.0% was concluded. Since there is increased attention towards US technology equities, with 2024 outlook reports such as those from Standard Chartered to buy such stocks, I assume the terminal growth rate (TGR) to be slightly higher at 4.0%.

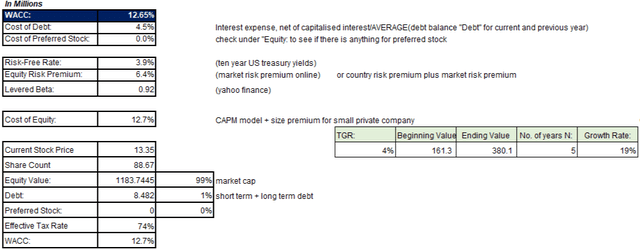

The weighted average cost of capital (WACC) was extracted from OPRA’s most recent 20-F report, which may have some minor inaccuracies as it is dated to several months ago. Nonetheless, it considers country risk premium as well as size premiums for the scale of their company.

Calculation of WACC and TGR (Author)

Based on OPRA’s 2023 20-F report, it offers 89,842,247 American Depositary Shares (ADS), which includes restricted stock units (RSU) and stock options for a fully diluted share count.

For this slightly simplified model, I mainly took averages of growth percentages for revenue, EBIT and taxes, along with simplified but reasonable estimates of future values of D&A, capex and net change in working capital.

My DCF model gives a base estimated share price of about $21.03, where the assumptions will be explained further. This proves to be a tight valuation close to the analyst consensus average of $19.50 (No. of Est.=6), with a very strong buy rating and a standard deviation of 2.23. This valuation along with my (CCA) and analyst consensus all point towards OPRA being an opportunistic stock to buy moving forward in 2024 H1.

OPRA’s Underwhelming Comparable Metrics?

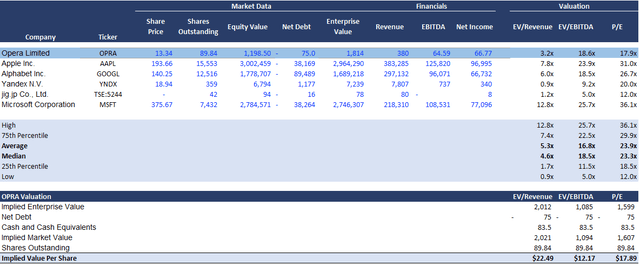

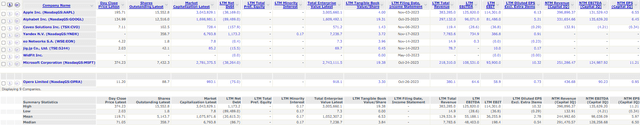

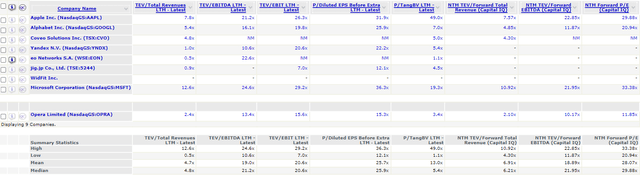

OPRA Company Comparables Analysis (Capital IQ)

OPRA Trading multiples Analysis (Capital IQ)

OPRA has a TEV/Forward Total Revenue and TEV/Forward EBITDA of 2.10x and 10.17x respectively, below average compared to its comparables. Its Next 12 Months (NTM) Forward P/E is 11.85x, the lowest amongst its peers and also much lower than the 28.07x mean of its comparables. These are based on Capital IQ estimates.

Amongst its competitors, it has a median gross margin of 56.1%, and a higher than average (LTM) EBITDA growth of 52.91%. This suggests that their focused efforts into advertising have been effective to some extent.

However, considering that these companies offer many other services and products, as compared to OPRA which primarily focuses on its web browser capabilities, these multiples may not accurately compare the direct performances of each companies’ browsers. Still, its profitability and top-line do not stand out based on these metrics.

Instead, specific industry-related metrics such as Revenue/no. of users, Gross Margin/Advertising costs, Advertising revenue/Total browser revenue could be used to assess the performance of these browsers, regardless of whether they are conglomerates that generate earnings from their other services. Because such data is relatively tedious to compile, the ideal metric to use is ARPU; it accounts for how much these browsers earn in relation to their number of users, and considers advertising as a significant source of their total revenue, which is true across the board.

For context, Opera’s ARPU has risen consistently from $0.75 in Q3 2021 to $1.31 in Q3 2023. Since the reversal of stock price occurred in Q2 2023 with an ARPU of $1.17, if this reported metric starts to decrease steadily and goes below $1.17 for at least 2 quarters, this could suggest that their earning efficiency has greatly worsened, and its ability to reap profits from its economic moat is reduced.

OPRA is working on improving its margins through the OPERA Ads platform to efficiently link advertising partners to users of OPRA’s different browsers.

OPRA has a relatively small market capitalization as compared to its more dominant competitors, largely due to the fact that they are conglomerates offering a vast array of other technological services. The vast size of these competitors should be taken into consideration for the accuracy of this CCA.

Mean price per share/CFPS is $24.20, an upside of 224% from the current $10.77 price as of Dec 12, 2023. My CCA model gives estimated prices between $12.16 and $22.48 based on the main multiples used for valuation. This gives a healthy range of future prices, aided by the bullish outlook on “magnificent” technology related equities for H1 2024.

OPRA’s Solvency And Liquidity

Capital IQ gives OPRA a top rating for both metrics. However, it has a S&P Issuer Credit Model Score of bbb-. Whilst not an ideal credit score, their debt is relatively low at $8.48 million, which is only 2.23% of revenue. Its debt to equity ratio is 0.01 as of September 2023 as well. Coupled with a current and quick ratio of 4.69 and 2.40 respectively, I do not believe OPRA would face any liquidity or solvency concerns anytime soon, and in the broader horizon.

OPRA’s Novelty: Web Browsing As Personalised As Can Be

What caught my eye about OPRA is the wide variety of features it is trying to implement in its browser along with its continuous marketing towards certain audiences. One defining feature of OPRA is its direct affiliation with OpenAI’s ChatGPT 3.5/4.0 software &its integrated AI assistant Aria. OPRA One, a new version of its browser that provides bundled AI services. since its introduction in November 2022 has caused its usage to skyrocket.

Furthermore, Opera GX is designed specifically for gamers with its built-in (RAM CPU) & Network Limiters, built-in (VPN), Twitch & discord integration, release calendars for games and more which gamers would find highly convenient. Thus, I believe its ability to innovate and harness artificial intelligence to cater to various audiences will have great appeal in the near future.

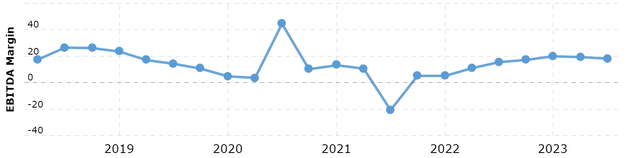

OPRA’s EBITDA MARGINS (www.macrotrends.net)

Also, in OPRA’s Investor Deck, they boast healthy EBITDA margins of 21% (YoY) in 2022 and an adjusted margin guidance in 2023 of 21%. Such margins, albeit not as high as its dominating peers, still allow them to “invest in scaling our business to elevate our profitability trajectory”. This gives me hope that they can continue to keep their services, be it in gaming, content or premium browsing, fresh and accessible to many demographics and across different devices.

Potential Risks Opera May Face

The allure of Opera lies in its groundbreaking AI-driven services. However, there’s a risk that the company may struggle to secure exclusive rights to specific technology, trademarks, or designs before competitors. Instances of denied patents or weak trademark protection might incentivize rivals to swiftly develop similar or enhanced technologies, capitalizing on gaps in Opera’s intellectual property framework.

A noteworthy case involved Oracle (ORCL) and GOOGL, where ORCL accused Google of copyright infringement related to Java Application Programming Interfaces in the Android operating system. This emphasizes the intricate nature of intellectual property rights in software development. Competitors could draw inspiration from source code, creating improved versions, as was the case with ORCL.

In this fiercely competitive industry, where AI-powered innovations can be game-changers, the delineation of rights for pioneering web browser concepts is ambiguous. OPRA faces potential threats from larger competitors with more extensive resources, capable of accelerating software development.

If news surfaces about other browsers replicating OPRA’s open-source codes or infringement threats, it could result in legal battles for OPRA and expose their technology advantages to public use. For example, if other browsers mimic OPRA’s GXs algorithms, diminishing the gap in customizability, OPRA might lose its competitive edge, impacting user preference and usage frequency. Such developments could signal a downturn in OPRA’s stock value, prompting a bearish stance.

Additionally, a primary revenue stream for OPRA stems from user-initiated searches within its browsers. However, the reliance on users utilizing search partners like DuckDuckGo, GOOGL, or AMZN raises vulnerability. A decline in traffic directed through OPRA’s search boxes could dissuade search partners from collaborating, significantly impacting OPRA’s revenue if users opt to directly access these partners’ search engines. Any indications of diminishing search activity directed through OPRA’s platform would forewarn a substantial impact on the company’s revenue.

Conclusion

I believe that OPRA ticks the boxes of low debt, steady margins and revenue generation while following consumer demand trends as a sustainable industry to look into in the years to come. Whilst my valuations are relatively simplified, the numbers, especially ratios like debt/equity, gross margins and fundamentally revenue, don’t lie. OPRA stock is currently safely within the $10-$20 range, and from a technical standpoint, there is no better time than the present for investors to consider reaping the benefits of its $0.40 dividend per share and improving profit margins.

Competition within this industry is strong, however OPRA seems to have found its groove in monetising its different browsers (exemplified by its ARPU) by optimising advertising and premium technological services it offers. Instead, I believe that OPRA can focus more on ways to bring in more users to their browsers, perhaps focusing on other demographics that may not have been considered previously, including corporate users who would appreciate streamlined platforms that optimise their workflows, similar to Microsoft Office and Google Suite.

As mentioned, US equities should be returning to a positive market outlook after the initial drop in many stocks at the start of 2024. Hence, as long as OPRA continues to upgrade and market its highly customisable interfaces that integrates key applications that users require, along with innovating a plethora of browser services in one package, it should be able to stand out amongst its competitors with fresh concepts, and demographics such as students & gamers will continuously be drawn to them.