We’re taught from a young age not to accept sweets from a stranger, but that strand of common sense seemingly goes out the window when we are offered £100 from a financial company.

Banks, investment platforms and pension companies all use cash bonuses to lure new customers into signing deals – and with good reason, because it works a treat.

Savers are 20 per cent more likely to switch pension providers if they have been promised a cash reward – even if it leaves them thousands of pounds worse off in the long run, a new study has found.

An experiment with 5,500 people run for the People’s Pension by the Behavioural Insights Team (BIT) consultancy, shared with The Mail on Sunday, found that the allure of a cash incentive is so powerful that savers are more likely to be blinded to the negative consequences of a deal.

One in three people who were shown an advert that promised £100 to those who switched pension providers agreed to do so, despite it making them £1,111 poorer over the next five years. With the shiny prospect of ‘free’ cash, savers are less likely to probe and ask questions to inform themselves before making a decision, the BIT found.

Banks, investment platforms and pension companies all use cash bonuses to lure new customers into signing deals – and with good reason, because it works a treat

In some cases savers may benefit from the incentives if they encourage them to take out products that offer good value. However, this sneaky advertising tactic is also used by pension providers to entice new savers into taking out deals that could charge higher fees, warns the People’s Pension – one of Britain’s largest pensions.

In many cases, these companies take advantage of the complex nature of pension charges, which can be difficult for the average saver to weigh up.

But hidden charges in pension transfers can wreak havoc on retirement savings. A seemingly small difference in fees can cost tens of thousands of pounds over decades. For example, transferring a £50,000 pension pot from a provider charging 0.4 per cent to one charging 0.75 per cent could result in a shortfall of more than £70,000 over a 30-year career.

In the BIT experiment, all those taking part were told their current, hypothetical pension provider charged 0.5 per cent, and grew by 5 per cent a year by investing in a basket of global company shares.

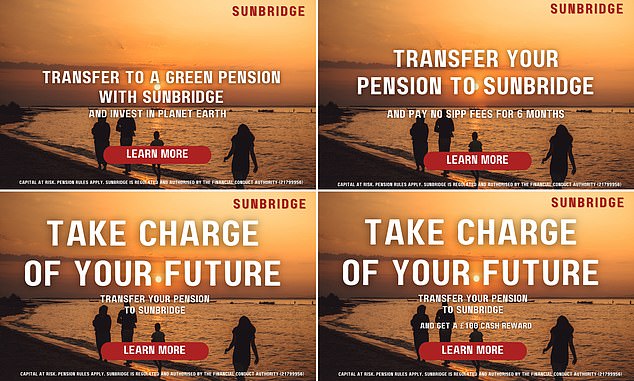

They were then shown one of four adverts at random: one offered £100 to those who switched pension provider, another promised six months fee free, one said the transfer would help the planet, and a final advert said switching your pension would make it easier for you to manage your money.

Anyone taking part could click for more information about the new pension, where they would be told that the pension provider would charge 0.925 per cent in fees to those who took the cashback offer and 0.875 per cent to those who responded to non-cash incentive adverts. Both pensions returned 5 per cent a year in investment growth.

This meant that anyone who took up the advert would be left worse off in the long run, as they would be charged more than their current 0.5 per cent rate.

Of the four adverts, the £100 cash incentive overwhelmingly received the best response, with one in three saying they would take up the offer.

But taking the carrot came at the biggest cost – with additional charges of £1,111 after five years. Those who made the transfer on the offer of six months fee free, would still be down £1,069 compared with if they left their pension where it was.

Patrick Heath-Lay, chief executive at the People’s Partnership –the provider of the People’s Pension – says the research shows just how harmful cash incentives can be in the pensions transfer process. He says: ‘They act as a barrier against people considering what is on offer and whether it is value for money.

‘People are also less likely to read and understand basic details about their new pension, even when these are prominent and they stand to lose money.’ He says consumers are vulnerable to these underhand sales tactics and the industry is not doing enough to make the transfer process transparent and comparable.

Mr Heath-Lay warns: ‘The transfer market is too stacked in favour of pension providers, rather than in the interests of the consumer. This urgently needs to change.’

Ruth Persian, head of the financial behaviour team at BIT UK, says: ‘Pensions are complex and often confusing.

‘Our experiment shows that ads promoting incentives such as free cash offers for transferring pensions can lead pension savers to ignore costs and other important information and choose poor-value products.’

It is vital that you take a close look at the fees charged by pension providers before making any big decisions about where to put your money. Default pension funds that your employer signs you up to cannot charge more than 0.75 per cent, but others may charge more. It is equally important to take a close look at charging structures when you are retiring.

The growth difference between the cheapest and most expensive ‘drawdown’ plans – where you take money from your pension pot as and when you need it – for a £260,000 pot was nearly £18,000 over a 20-year retirement, according to consumer group Which?

Some older pension policies charge 1 per cent in fees, while you tend to pay between 0.4 and 0.7 per cent on newer pensions.

This also goes for regular savings accounts and Individual Savings Accounts (Isas), where there may be hidden catches behind attractive transfer bonuses.

Some links in this article may be affiliate links. If you click on them we may earn a small commission. That helps us fund This Is Money, and keep it free to use. We do not write articles to promote products. We do not allow any commercial relationship to affect our editorial independence.