Editor’s note: Seeking Alpha is proud to welcome Georgi Dantchev as a new contributor. It’s easy to become a Seeking Alpha contributor and earn money for your best investment ideas. Active contributors also get free access to SA Premium. Click here to find out more »

radub85/iStock Editorial via Getty Images

Introduction

I believe OMV AG stock (OTCPK:OMVJF) (OTCPK:OMVKY) is undervalued and has a promising upside. I base my arguments on the company’s performance and forward outlook, coupled with it carrying almost no debt. Further, I like the 12.5% dividend (5.05 EUR/Share) I get at the current share price (40.39 EUR/share), while I have an overall positive view of a successful outcome of a possible merger of Borealis AG and Borouge.

Company Overview

OMV AG is the biggest company in Austria and a major contributor to the success of Austria as one of the richest nations on the planet. OMV AG has two large minority owners, namely, the Austrian state through ÖBAG with a 31.5% stake, as well as a 24.9% stake owned by the United Arab Emirates, through ADNOC.

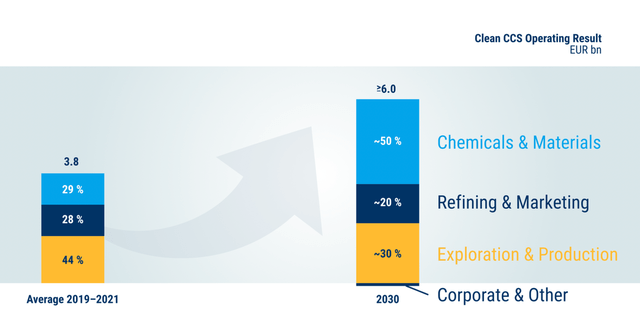

The success of OMV AG is enabled through three distinct business areas that OMV AG operates in: Chemicals and Materials, Fuels and Feedstocks and Energy. As such, the company is an integrated Oil & Gas producer with a major footprint in the base chemicals and polyolefin business through its subsidiary Borealis AG. Moreover, the company has according to its own words “begun its transformation from a traditional oil and gas company into a global gas, oil and chemicals group”. OMV AG is according to the CEO Alfred Stern during the Q1 2023 earnings call “one of the few companies that has a very balanced mix of contribution from the different business segments, about 30% from chemicals, 30% from refining, and 40% from energy”. According to the “Strategy 2030” of OMV AG, by 2030 this mix should be around 50% chemicals, 20% refining and 30 from energy. This does not mean that OMV necessarily will downsize any of its business areas in the future. It means that OMV will wisely focus its growth on the chemicals business.

Before delving into the three business areas, I would like the reader to note how OMV AG lists its Chemicals and Materials business as the first and most important business area and its Energy sector last, although looking at the profit contribution of OMV AG it should be the opposite way round. This is done for two reasons: Firstly, the chemicals business is where the company would like to have the most growth in the future. Secondly, the company is under a lot of public pressure to reduce its oil & gas exposure which from the perspective of an integrated oil & gas company with a major chemicals business is not a good idea, or as Alfred Stern noted in his Q1 2023 earnings call; all segments of the company “have integration value for us that is helping us to have a strong performance through the different cycles” of the economy. Therefore, a low-profile approach such as the one the company has undertaken is merited. In fact, it has been so successful with this approach, that many people believe it is exiting the oil & gas business. This is not the case. I will explain this in the energy section of this article.

Segment Overview

Chemicals and Materials

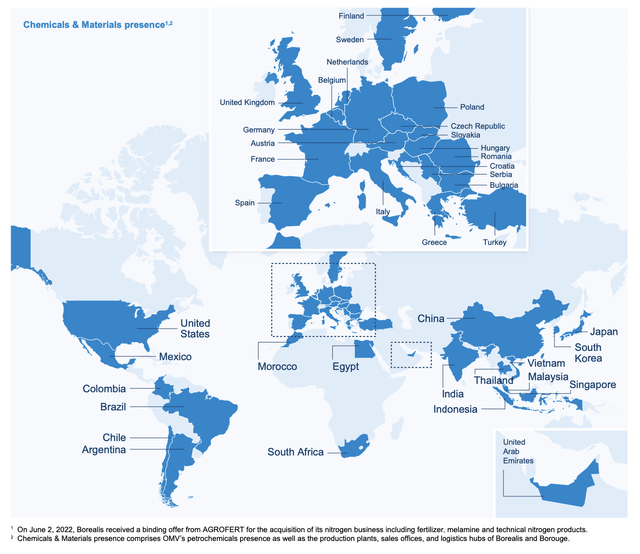

The Chemicals and Materials business of OMV AG is mainly done through its polyolefin subsidiary Borealis AG where it holds a 75% stake while ADNOC holds a 25% stake in the company, while it is important to note the OMV AG separately has a “significant chemical business…focused on base chemicals” according to Q4 2023 earnings. Borealis AG in turn has two important joint ventures. Namely, one with ADNOC in the UAE where it is a major shareholder with a 36% stake in Borouge, one of the world’s largest integrated polyolefin complexes, and one with TotalEnergies in the United States of America where it has a 50% stake in the Baystar joint venture.

This is the business segment where OMV AG will have the highest growth in the coming years, and a lot of developments have been happening this year. In July, Borealis divested its nitrogen business for EUR 810 million, because it was not in line with the core focus (base chemicals and polyolefin production) of the company. In October, new construction of the Baystar site in the United States was completed, which increases the production at the site to over 1 million tons per year by adding an additional 625,000 tons per year. Moreover, the EUR 5.77 billion expansion of Borouge 4 is well underway to begin production in 2025 with an added capacity of 1.4 million tons of polyethylene a year to 6.4 million tons per year.

For 2023, Borealis AG had sales of around 5.69 million tons of polyolefin, and an operating loss of EUR 120 million. This has to do with the problems which the entire chemicals sector has been having this year, for example high feedstock prices coupled with lower demand, although this is expected to normalize in the near future. As Alfred Stern noted in the recent Q4 2023 earnings the current chemicals sectors is in a cycle which will “take about 2 to 3 years. We are now- this started let’s say, in the middle of 2022. So we are pretty significantly through this”. Therefore, it is helpful to note that in 2022 Borealis AG had a yearly profit of around EUR 1.6 billion excluding the nitro business, and for 2021 profit was EUR 1.4 billion excluding the nitro business.

The most important development however comes from the imminent fusion between Borealis AG and Borouge. What is known so far, is that OMV AG and ADNOC value the joint company which will be formed at around EUR 30 billion, and both want to have 47% each in the newly formed company. OMV AG will be expected to pay around EUR 1.7 billion in order to become an equal shareholder in the joint company. The rest of the shares will be floated on the stock exchange (perhaps both in Austria and the UAE), while it is expected that the joint company will be based in Vienna, Austria.

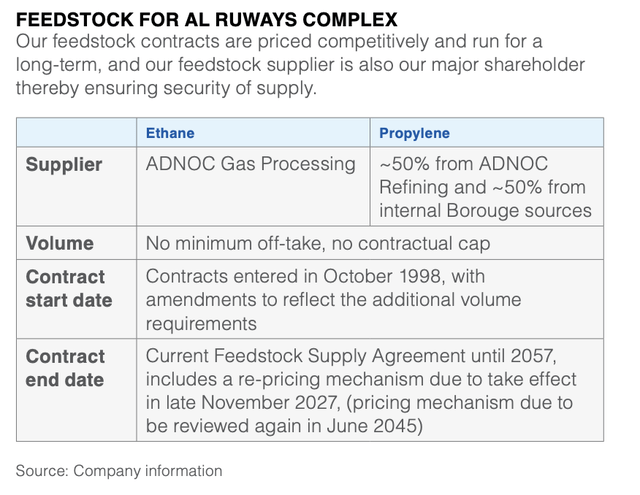

The deal will add a lot of value to both OMV AG as well as ADNOC for several reasons. Firstly, the shareholdings will be simplified. The current shareholding structure where OMV AG owns 75% in Borealis AG which in turn owns 36% of Borouge, and where ADNOC owns 25% of Borealis AG, as well as 54% of Borouge is not ideal. Secondly, both Borealis AG through the Baystar expansion, as well as Borouge through its Borouge 4 expansion are significantly growing. They are currently, according to Alfred Stern during the Q4 2023 earnings, “leading players in their individual regions. Borealis is in Europe #2, Borouge is in the Middle East #2. And globally…a combination will move them up to #5 or 6 in the polyolefin market”. Thirdly, both companies will benefit greatly from one another. Borealis AG has a powerful technological edge in its business which can be seen in its specialty products which have consistent high margins for example in high-voltage cables, while Borouge can offer extremely favorable terms regarding feedstocks, since these are supplied directly by ADNOC. In fact, Borouge just announced a yearly net profit of EUR 930 million with a dividend payout of EUR 1.2 billion for the year of 2023. This will be paid in two tranches of which OMV will receive EUR 432 million divided into the third quarter of 2024 and into the first quarter of 2025.

Lastly, a fusion of both companies will most likely lead to significant cost savings. It is therefore important to note, that should this fusion take place, the value of OMV AG will most likely increase, since alone the 47% share of OMV AG in the newly formed company will be worth EUR 14.1 billion. It is difficult to believe that any European or American polyolefin company, or even a Chinese polyolefin company will be able to compete with a company that has the technological edge, the cost structure, as well as the market penetration that this global champion will have.

Refining and Marketing

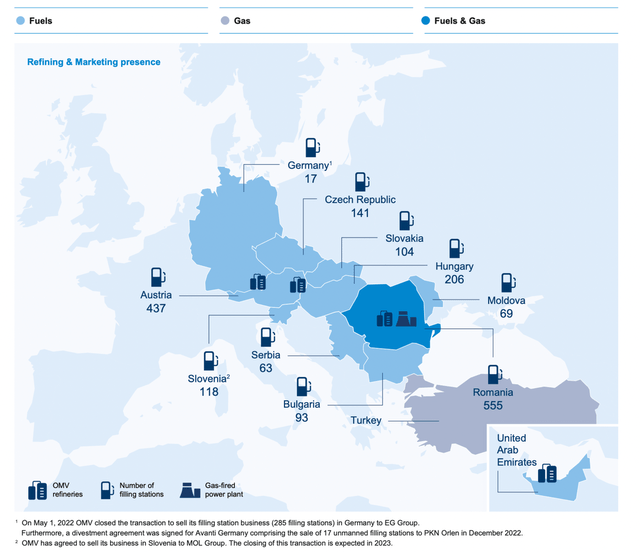

The refining and marketing business consists of three refineries in Europe, a 15% stake in the fourth largest refinery in the world, the Ruwais refinery in the UAE, approximately 1668 filling stations in Europe, as well as the Brazi power plant owned by OMV Petrom (OMV AG owns 51.16% in OMV Petrom) in Romania.

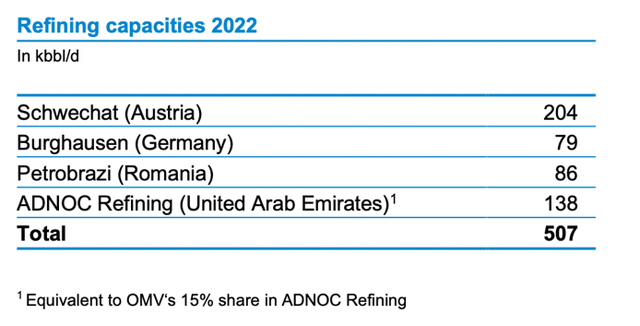

The three refineries that OMV AG directly owns and operates are the refinery at Schwechat near Vienna in Austria, the refinery at Burghausen near Munich, as well as the Petrobrazi refinery in Romania (owned by OMV Petrom). Total production volume is around 507 kbbl/d when including the 15% in Ruwais.

The refineries in Austria and Germany also have strategic roles in the countries where they operate, as the Burghausen refinery has a direct pipeline leading to the Munich airport, just as the refinery in Schwechat supplies the airport of Vienna. Furthermore, it is a common misconception to believe that these refineries have anything to do with Russian oil & gas, since they are directly supplied by the Transalpine Pipeline (TAL) with feedstock coming directly from Triest in Italy. The Petrobrazi refinery in Romania in turn can process the entire crude oil production of OMV Petrom in Romania.

Furthermore, OMV AG is actively working on new technology which allows it to for example refine biogenic feedstocks (i.e. domestic rapeseed oil) in order to reduce its carbon footprint and increase its share of chemicals production in its refineries, as well as electrolysis projects which will help it produce sustainable aviation fuels.

OMV AG runs a multi-brand strategy for its filling stations under the OMV, VIVA (shopping and gastronomy), Avanti (unmanned) and Petrom brands. It is also rapidly increasing its EV infrastructure and charging stations at its sites. This can be seen in the recent deal to purchase Renovatio Asset Management in Romania which owns 400 EV charging station which will be expanded to 650 by 2026. OMV AG has strategically divested its filling stations in Germany (285 filling stations) and Slovenia (118 filling stations). The strategic thinking of OMV AG is clearly to be able to supply all its filling stations with the feedstock from its refineries.

Moreover, it is noteworthy, that the Brazi power plant covers around 9% of the energy needs of Romania.

Lastly it is noteworthy that OMV Petrom is quickly becoming one of the biggest developers of renewable energy in Europe, having signed an agreement to purchase photovoltaic parks with a capacity of 710 MW last year, and just recently having signed an agreement to purchase 50% of Electrocentrale Borzesti which owns projects with capacities of 950 MW wind farm projects and 50 MV photovoltaic projects.

For 2023, the Refining and Marketing business of OMV AG had an operating result of EUR 1.67 billion.

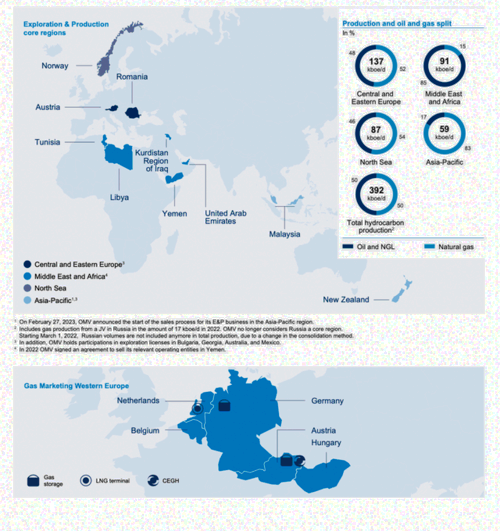

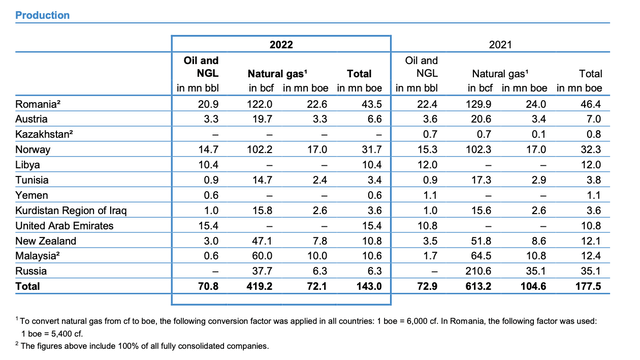

Energy

The energy business of OMV AG consists of a sizeable international portfolio of oil & gas projects. This part of the business has been somewhat misunderstood in the public, ever since the company announced its “Strategy 2030”. OMV AG has stated in its “Strategy 2030” that it “will gradually decrease our oil and gas production by 20% by 2030 and will completely cease oil and gas production for energy use by 2050”. It is also noteworthy that the CEO Alfred Stern noted in the Q4 2022 earnings call that the company will “always have a strong core portfolio of E&P assets. We do not intend to sell the entire E&P of the company”. Furthermore, when asked about the “Strategy 2030” during the Q2 2023 earnings call the CFO Reinhard Florey said that; “If we look at our 2030 target that we have given, it is around 350 000 BOE and if you take our production that we planned for this year, 360 000 BOE, you can see we’re taking out some 70 000 BOE of Malaysia and New Zealand, adding some 70 000 BOE by Neptun, we are around that dimension”. In essence I believe that OMV AG used the fact that its Russian assets had to be written off to claim a victory with regards to its “Strategy 2030”. Without the Russian assets the company has almost reached its 2030 goals. Furthermore, the fact that Russia effectively confiscated the written off Russian assets of OMV AG a few weeks ago will probably just lead to a cash inflow for OMV AG in the near future, as the Russian Federation will pay for this effective confiscation. Moreover, the OMV AG is wisely divesting global assets it doesn’t need (The oil & gas projects in Malaysia and New Zealand) in order to finance strategic assets closer to its core markets, such as the Neptun Deep project in Romania, the Berling gas field in Norway, and the Ghasha gas project in the UAE. Regarding the mix between oil & gas, it is interesting to note that divesting the Asia-Pacific assets will not affect the company’s 50/50 oil & gas production ratio, since these assets (83% gas and 17% oil) are primarily gas producing assets. Thus, the more profitable oil assets will remain. In fact, last week OMV AG announced the sale of its Malaysian assets in SapuraOMV to TotalEnergies for a cash consideration of EUR 840 million. Perhaps, in the near future some smaller projects (apart from the assets in New Zealand) will also be divested such as the smaller assets in less stable African and Middle Eastern countries, but it is safe to assume that OMV AG will continue producing around 360 000 kboe/d for as long as the readers of this article are investing actively. It is important to note that probably no other European oil & gas major has such a beneficial ratio between oil & gas production.

It is also noteworthy, that while OMV AG will not significantly grow its oil & gas production, it is significantly growing its oil & gas trading under the Gas Marketing and Power division. Just like Exxon Mobil announced a return to large scale oil & gas trading last February, OMV AG has been beefing up this business, since war broke out in Russia. To this end, OMV AG has secured regasification capacity at the Gate LNG Terminal in Rotterdam, as well as capacities through Italy, alongside the current gas contracts with Gazprom which send gas from Russia via Ukraine and are projected to stop by the end of 2024. The volatility in the oil & gas market has enabled OMV AG to earn EUR 609 million in 2023 from trading.

The total operating result of the energy segment in 2023 is EUR 3.77 billion.

Risks

There are a number of geopolitical, domestic as well as operational risks in the various segments of OMV AG which can lead to significant impairments in the company’s value.

The first and most important risk is the geopolitical risk exemplified with the complete write-off of the company’s Russia business including the 24,99% stake in the Yuzhno-Russkoye gas field (constituted a loss of EUR 658 million in 2022), as well as the complete write-off of the Nord Stream investment of OMV AG amounting to a loss of approx. EUR 1 billion.

Although these losses were completely written off in 2022, it is important to note that OMV AG works in a number of risky countries where such a scenario could be repeated.

The main geopolitical risks for OMV AG moving forwards with regards to its geopolitical footprint can be found in Yemen, Kurdistan, Tunisia and in Libya. Of these, only the production of Libya can have material consequences for the earnings of OMV AG, as the production from the other countries is fairly small. This risk was exemplified a few weeks ago when Libya had to declare force majeure on Libya’s Sharara Oil Field which is the biggest in the country with a production capacity of 330,000 bpd, due to ongoing protests. OMV AG is a shareholder in this oil field with 30% ownership in block NC 115, and 24% in block NC 186.

Another major risk associated with geopolitics is the Austrian contract between OMV AG and Gazprom which was signed in 2018 and expires in 2040. Since this is a take or pay contract, OMV AG is obliged to buy gas from the Russian Federation via Ukraine, regardless of whether it needs it or not. Ukraine and Russia need to sign an extension of their transit contract for Russian gas at the end of 2024, which means that it is likely that OMV AG will not be getting any more gas by the beginning of 2025. This can be seen as negative, since currently OMV AG is one of the only European companies still supplied with cheap Russian pipeline gas via Ukraine. This has enabled Austria to become a net energy exporter for the first time in twenty years. It is also unclear if there will be a negative contractual impact for OMV AG if no more gas is flowing from Russia via Ukraine by the beginning of next year. My assessment is that force majeure will be declared and OMV AG will have an easy way out of the contract, as long as OMV AG does not cancel the contract single handedly. This was further confirmed during the Q4 2023 earnings call where it was stated that the contract is such “that the supply location is on the Slovakia-Austria border. And in that sense, this Ukrainian transit is not something that is affecting OMV”. Thus, if Russia stops supplying Austria with Russian gas, because they fail to deliver it or sign a new contract with Ukraine, it will be the Russian side that is breaching the contract. OMV AG has also made clear that it will not cancel the contract single handedly, unless the European Union demands this. It has also stated that it can service all of its contractual obligations in Austria via the Gate LNG Terminal in Rotterdam, as well as through Italy, even if the transit via Ukraine is cut off. During the Q4 2023 earnings call, OMV reiterated, that it was able to “fully diversify our supply sources and get all the necessary pipeline capacities, so that also if Russian supply in Austria stops completely, we can supply all our gas customer obligations with non-Russian gas”. This remains to be seen.

The domestic risk that OMV AG faces, arises from the fact that Austria is governed by a coalition government between the centrist ÖVP (Austrian People’s Party) and the left-wing Green Party of Austria. Since the state of Austria owns 31.5% of OMV AG via the state holding ÖBAG, the government has been trying at times to influence the strategic decisions that OMV AG has been making, despite the fact that part of the reason that ÖBAG was created was to depoliticise decision-making wherever the state had shareholdings. The Green Party of Austria is partly to blame for the unwise pressure that has been put on OMV AG to decrease its oil & gas exposure, despite the fact that this is of vital strategic importance to the state of Austria, as OMV AG guarantees the energy security of the Austrian state, and despite the fact that the oil & gas segments of the company supply the Chemical and Materials business of the company making it globally competitive and enabling the green transition of OMV AG.

There are also operational risks associated with the OMV AG. Part of the reason that the value of OMV AG has fallen, is the fact that the margins in the Chemicals and Materials business have fallen to the extent, that OMV AG is making a loss with Borealis AG, which is only mitigated thanks to the Borouge joint venture. Additionally, a few weeks ago the Burghausen refinery experienced technical failure which will decrease the production at that site. Regarding the energy segment, OMV AG faces one serious potential problem with regards to its Norwegian assets, as opposed to its other oil & gas assets (with reserves of around 10 years), as the Norwegian assets currently only have around 3 years of reserves left, whilst producing around one fifth of the entire production of OMV AG. This will require significant investments in order to compensate this potential production loss. Lastly, the pressure on the oil & gas price this year is a serious risk which can adversely affect the results of the refining and oil & gas business segments of OMV AG.

Valuation

I believe that the valuation of OMV AG is primarily derived through its sound balance sheet and business operations which are almost completely reflected in its dividend policy. OMV AG does not buy back any shares. Thus, the only reasonable metric for the valuation of OMV AG is through the dividend yield.

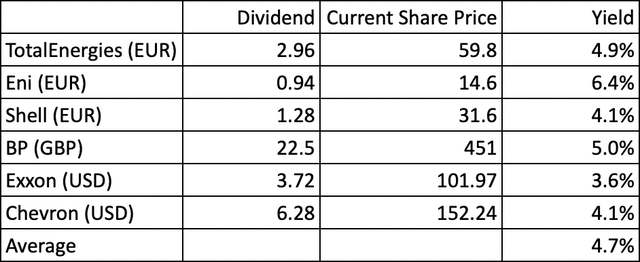

This is confirmed by the new dividend policy which was adopting last year and states that, “if the leverage ratio is below 30%, OMV aims to distribute approximately 20-30% of the OMV Group’s operating cash flow (including net working capital effects) per year to its shareholders through its regular dividend, as a priority, and additionally, if sufficient funds are available, through the new instrument of a special dividend.” Last week the company announced a total dividend of EUR 5.05 per share. At 327.1 million shares outstanding, this results in a dividend of EUR 1.65 billion, which can be juxtaposed to a cash flow from operating activities of EUR 5.7 billion, and a net income attributable to shareholders of EUR 1.48 billion. This results in a yield of 12.5% at current prices of around EUR 40.39 per share. If we consider other European and US oil & gas peers which average dividends somewhere around 4.7%, OMV AG seems undervalued.

www.nasdaq.com and company websites

This calculation does not include share buybacks although these buybacks should be reflected in the current share price of the companies to a large extent. Nevertheless, it is important to note, that the massive share buybacks at many other oil & gas majors explain the lower yields to a certain extent, as their share prices are pushed up faster and are partially greater than their dividend payouts. It also has a limitation, since OMV AG pays dividend once a year (in June) and the other companies pay quarterly dividend. This should indeed mitigate the share buyback impact, since the cash pile held by OMV AG has swelled by money which will be paid out in June, as opposed to money which already has been spent by many other oil & gas majors for buybacks and dividends. Lastly, not all companies have announced their latest dividends for 2024. Nevertheless, simply put, the dividend of OMV AG is between 2 – 3 times that of its peers. At this point it is worth considering that the dividend payout of OMV AG is at the higher range (29% payout) of the company’s stated dividend payout policy, and the announced dividend is indeed higher than the net income attributable to shareholders. According to the Q4 2024 earnings call, this was done to send a “clear signal to the market that we are willing also to use this kind of span and flexibility that we have in order to reflect both the performance, as well as our trust in the stability of this company”, since OMV AG wanted to make clear that “the bandwidth of 20% to 30% is a real bandwidth in which we manoeuvre”. I believe that since this was the second year for the new dividend policy, OMV AG wanted to make a point by declaring this exceptionally high dividend with regards to its net attributable income. In the future, I believe that the company will not pay a dividend which is higher than the net income attributable to shareholders, and that in a normal year the dividend for 2023 would have been declared in the lower range of its dividend policy, i.e., at 20% of operating cash flow which would have resulted in a dividend of at least 8.63% (if we multiply cashflow of EUR 5.7 billion by 20% and divide this number by the current market capitalisation of OMV AG which is EUR 13.21 billion). Even if we take away the obligatory Austrian tax of 27.5%, since foreign retail investors often cannot demand this tax back due to administrative difficulties, this would leave us with a dividend of 6.26%. Taking the net dividend (for foreign retail investors), and assuming that OMV AG should have a similar dividend to its peers, a 4.7% dividend would merit a share price of at least EUR 53.8.

Conclusion

OMV AG is a highly profitable integrated oil & gas producer with a strong presence in the chemicals business through its subsidiary Borealis AG. It is currently worth approximately EUR 13.21 billion at around EUR 40.39 per share.

The Refining and Marketing business is highly profitable and concentrated in its core markets in central and eastern Europe making it highly competitive from the refinery to the filling station.

The Energy business is likewise highly profitable, and with its focus on stable production in its core markets and the growth of its trading arm it will increase its profitability and be able to use proceeds to pay higher dividends or invest in growth. This results in a far higher dividend than its European or US peers of around 12.5% at the current share price of OMV AG at EUR 40.39.

The Chemicals and Materials business of OMV AG will be turbocharged with the fusion of Borealis AG and Borouge, creating a global, highly profitable and cost competitive leader in the polyolefin market with an extremely low level of debt (Borealis AG has virtually no debt, while Borouge has around USD 3.9 billion in low interest debt with a gearing ratio of 0.46). While some people believe that a fusion will be bad for OMV AG, because the company will lose majority control in the newly formed joint company, I believe it will be highly beneficial. The shareholding structure of both companies will be simplified, and there will be massive synergies from fusing the companies together. Lastly, the fusion may depoliticize much that has been going on in the Austrian media and politics, since there will no longer be any need for OMV AG deciding whether it wants to concentrate on oil & gas or on chemicals. It will essentially be able to have its cake and eat it too with a 47% share in a global polyolefin leader worth EUR 14.1 billion (more than the entire OMV AG is worth currently at around EUR 13.21 billion)

Regardless of the fusion of Borealis AG and Borouge, OMV AG has extremely low debt (leverage ratio at 8%) with operating cash flow of around EUR 5.7 billion, a net income attributable to stockholders of the parent of EUR 1.48 billion, and a free cash flow of EUR 2.68 billion for 2023. The company already has considerable upside for 2024, arising from a EUR 432 million dividend from Borouge coming in 2024 and 2025, a divestiture of SapuraOMV for EUR 840 million, a further incoming divestiture of the oil & gas business in New Zealand planned for this year, positive inventory effects still in store from 2022, lower rolled over taxes into 2024 (particularly because of Norway), as well as currently high energy prices for the beginning of this year.

The company has a unique mix between its chemical and materials (30%), refining and marketing (30%) and energy (40%) segments which cannot be found in other integrated oil & gas companies in Europe. This guarantees profitability throughout business cycles.

I rate this company with a strong buy with a share price target of EUR 53.8

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.