binabina/E+ via Getty Images

Dear readers/followers,

In this article, I’ll be providing you with an update on Old Republic International (NYSE:ORI). I’ve been covering this company and its prospects a few times in the past. This is an updated article for my previous thesis on the company to the piece published a few months back in September of 2023. The company is a conservative and well-run insurance company with strong fundamentals and a well-covered dividend – but my view at the time was that the company was overvalued and did not offer enough upside potential, making it a “HOLD” rather than a “BUY” – at least at that time.

In this update, I’m going to show you the 3Q23 specifics and see what we can expect from a forecast basis here. Since selling my position in Old Republic, I’ve been conservative on the business.

With 3Q23 out, we have a good basis for providing an update and expectations for the company.

Old Republic – An update going into 4Q23.

With 3Q23 behind us, it’s time to look at what this company may offer us. ORI is a P&C insurance company with a very long and storied history. P&C in this case refers to property & casualty insurance, as opposed to Life & Health (L&H).

ORI has the holding structure that if you look at these sorts of companies, may be used to. The main company does the underwriting activities, while the insured itself is done through a multitude of subsidiaries in three attractive segments. In a structure admire this, we’re seeing income from both underwritings but also from insurance premiums. From a split perspective, the company is 65% general insurance and 35% title insurance, from which it manages to get an 8% income margin on $8-$9B worth of annual revenues.

This is what makes the company technically attractive as an investment here because when compared to other insurance businesses, ORI is better than the average here – and it’s also one of the companies that grow and is the most profitable on a 10-year basis. (Source: Gurufocus)

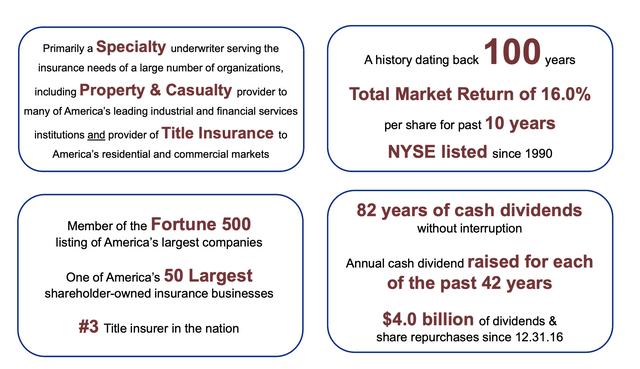

ORI IR (ORI IR)

As you can see above, the company has a very attractive operation based on over 80 years of uninterrupted cash dividends and a very solid TSR overtime. Also, adding to the company’s attractiveness here is the fact that ORI remains one of the most attractively-rated insurance businesses out there with an S&P Global A+ rating.

3Q23 saw the company produce attractive operating EPS of $0.72/share, which marks a 6% YoY enhance, which was driven by a solid upward trend in operating income growth in general insurance, not fully able to weigh up the negative trends in title insurance that we saw during the quarter. As I’ve alluded to in previous pieces, the typical trend here is seeing one segment fall, while the other segment rises.

This impacted company’s net premiums and fees, which saw a 9% decrease to around $1.75B and an overall company-wide combined ratio of 91.9%. When it comes to an insurance company’s combined ratio, lower is better – so a 50 bps enhance here is not positive. General insurance is better at 89%, Title insurance went up above 96.5%, which is something to at least be aware of. If this ratio goes above 100%, it means the company is no longer making money on its insurance operations.

Company book value at this time has gone up to $21.37, adding back dividends we see a 4.9% enhance from the year-end of 2022.

Overall, the company saw favorable development in all segments, but macro pressures weighed down the company. Still, ORI increased its dividend 6.5% this year and completed over $120M of share repurchases in this quarter alone, coming to nearly half a billion dollars of share repurchases on a YTD basis.

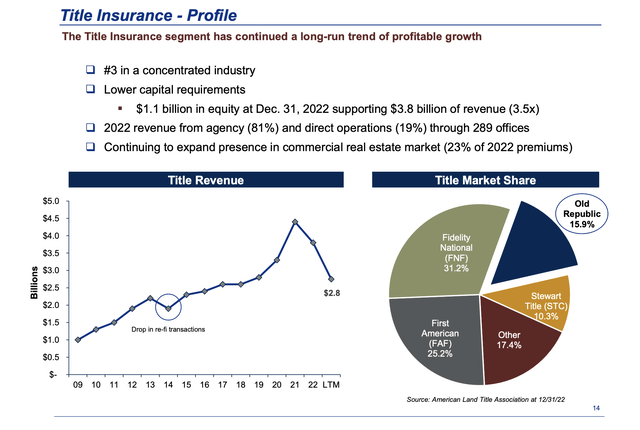

The company is moving, which by the way is a positive, more into general insurance as the specifics here are better. However, General insurance is also far more capital-heavy than Title insurance. The two are essentially almost opposites of one another in terms of trends. While General insurance is high loss – low expense, Title insurance is low loss-high expense, and in the latter, ORI also happens to be the 3rd-largest in the market. ORI is not leaving title insurance, nor should it – but improving trends here would be welcome.

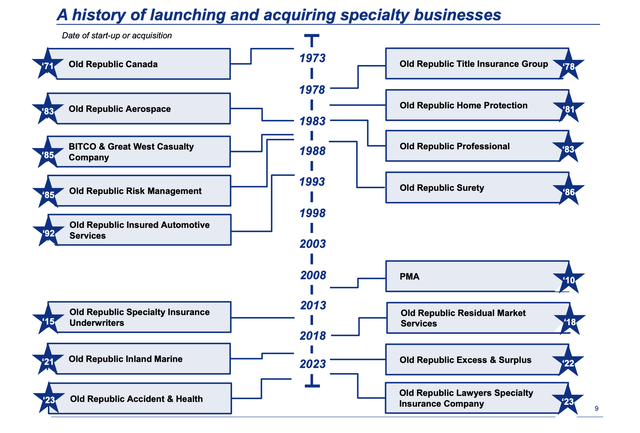

Still, it’s important not to understate this company’s ability to start up and run profitable and successful businesses – or acquire them.

ORI IR (ORI IR)

Also, the general insurance segment has, since 2017 seen consecutive years of impressive growth, especially in the latter years. Title insurance is looking less impressive at this time, taking a bit of a nose-dive since 2021.

ORI IR (ORI IR)

The best thing that can be said for the operation in its current state is that it maintains a very low ratio of loss, with most of the headwinds being made up by the expense ratio.

Fundamentals is where ORI shines and where it seeks to convince you to purchase shares. The company maintains its 42-year record of annual dividend increases and 82 years of consecutive payments. Within 8 years, it’s becoming a dividend king. At this time, the company offers a dividend yield of 3.35%, which is sub-par to the insurance industry as a whole, where 6-9% from BBB+ or even above isn’t unheard of in this market – and those numbers and trends are based on solid operations as well.

Also, the company is expected during this year to see advocate reject. 2022A was a near-double-digit reject in adjusted EPS, and 2023E is expected to see another 5% reject down to around $2.65/share. The company’s dividend is very conservative in this context, coming in at less than 50% of this adjusted EPS, making for a very risk-adjusted payment.

Instead, what we need to focus on is not if the company is safe or attractive – because it is – but what we’re paying for that attractiveness, because that’s where the thesis falls apart.

Risk & Upside

The risk to ORI is not operational – it’s valuation. I believe that the company is a solid enough business to warrant a “BUY” at the right price, and I also believe the company is likely to outperform if bought at a historically attractive valuation. The problem is that the TSR and the buy-in here are intimately linked, and as things currently stand, I do not see it as a possibility to get a good upside, unless you give the company some sort of premium. The risk that I view as most material here is that you pay too much for a great company, which could impact, or even turn negative your long-term returns.

The upside to the company is continued premiumization. While theoretically possible, I’m always wary of premiumizations in industries that do not typically “get” them, and where there is no solid argument for why we should expect much better performance from the business.

Valuation

I did, in retrospect, go neutral on this company too early. The proof of this is that ORI has continued to climb even beyond its historical average. We’re now at a valuation for the company of 11x normalized, compared to around 10x normalized. This might not sound admire much of a premium, but the problem is that there are so many attractive insurance businesses out there at this time.

Let’s say that you were to invest in ORI. You’d get a 3.35% yield with an upside of 5.62% (dividends included) annually until 2025E, based on the company’s well-established discount of 10x until 2025E., implying a share price of $30/share based on EPS reject in 2023, slight growth in 2024 and back to better growth in 2025 (Source: FAST Graphs).

Even if you went for 11-12x P/E, that’s 15-17% annually at the high end of that forecast range.

Now contrast this to investing in say Legal & General (OTCPK:LGGNY), where you’d get almost 8.5% yield at a 10x normalized P/E (closer to 8x on a normalized longer-term P/E), and even if you assume underperformance, you’re getting 13% annually at a 9x forward P/E (Source: FactSet/FAST Graphs)

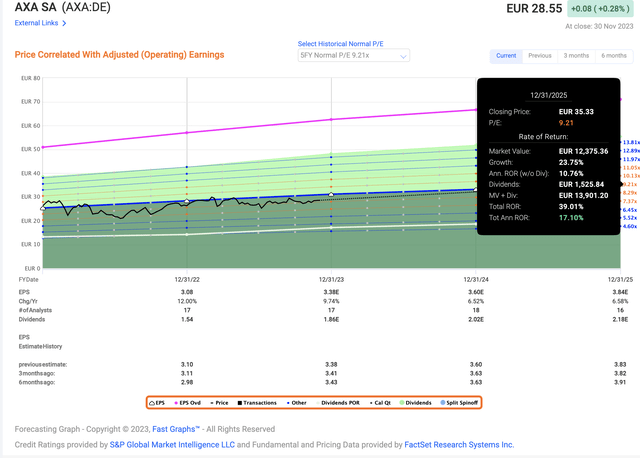

Or, if you’re open to other European areas, look at AXA (OTCQX:AXAHY).

AXA Upside (FAST Graphs)

That 17% annualized is with a near 6% yield with an even more conservative payout from a larger, better-rated business that’s trading at 8.5x P/E.

My point here that I am making is that investments need to defend themselves to you not only in the relation or context of themselves but to the entire overall market. And I do not believe it a stretch to say that Old Republic International, at this valuation, has quite a bit of trouble doing this. I inspire my readers, regardless of status or position, to be open to looking at the world market as a possibility for investment. There are so many attractive businesses and potentials out there that I view it unnecessary to limit oneself to specific or single markets – that includes the US.

I’ve had great success in diversification in many of my investments here – and I believe those results to be repeatable as long as there is a laser-sharp focus on valuation and fundamentals where such focus is warranted – which I believe to be “everywhere”.

ORI’s current share price trends are a result of good quarterly trends and significant amounts of share buybacks coupled with being a very conservative operator. There is nothing wrong with this – but as investors, we should be looking for upside. ORI does not supply us with enough upside, even if the company were to perform better than expected. And just as a small point, the company does miss estimates negatively 1/4 of the time.

Now, ORI is a pretty underfollowed business by the market as a whole. I’d still be happy to buy it closer to $20/share, which is where I bought it last time around, but I only had a very small overall exposure that’s almost not worth mentioning.

My last share price target for the company was a conservative $24.5/share. I see no reason to change this target here. The company now trades close to $30/share. Many analysts have bumped their price targets (Source: S&P Global). I am not one of them.

If you hold ORI, I believe this to be a good time to look at what else is available on the market instead of this holding. I am not going to argue that there is upside here, nor will I stamp a “SELL” on the stock – I use the “SELL” stamp when I believe there are truly disadvantageous trends in the near term or long term, almost as a shorting indicator (even though I do not practice shorting).

But I am sticking to “HOLD” here.

Thesis

- Old Republic International is an overvalued business with excellent fundamentals. It has a well-covered yield and low debt, and the results are promising.

- The company’s 20-year history shows a bit of volatility for extended periods of time – but the company has righted and adjusted since, and overall I view the company as “safe.”

- The company is, thanks to recent trends in trading, now overvalued. I stick to my PT of $24.5/share, which makes it a “HOLD” here. I have rotated my position in the stock.

recall, I’m all about:

- Buying undervalued – even if that undervaluation is slight and not mind-numbingly massive – companies at a discount, allowing them to standardize over time and harvesting capital gains and dividends in the meantime.

- If the company goes well beyond normalization and goes into overvaluation, I harvest gains and rotate my position into other undervalued stocks, repeating #1.

- If the company doesn’t go into overvaluation but hovers within a fair value, or goes back down to undervaluation, I buy more as time allows.

- I reinvest proceeds from dividends, savings from work, or other cash inflows as specified in #1.

Here are my criteria and how the company fulfills them:

- This company is overall qualitative.

- This company is fundamentally safe/conservative & well-run.

- This company pays a well-covered dividend.

- This company is currently cheap.

- This company has a realistic conservative upside based on earnings growth or multiple expansion/reversion.

It’s no longer cheap, and it’s no longer at a high enough conservative upside. I say “No” here.