mcech

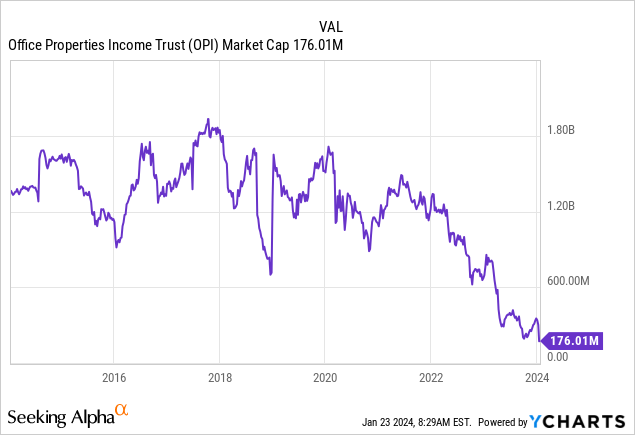

Which, by the way, is twice the current quarterly distribution our protagonist is paying. But let’s backtrack a bit. Office Properties Income Trust (NASDAQ:OPI) is one we have covered several times. Our thesis was that of a slowly melting ice-cube. We got that wrong. It was a rapidly melting ice-cube. We had last updated the company in light of the pending (but contested) nuptials with Diversified Healthcare Trust (DHC). With that one off the table, we look at whether the bull thesis holds water (pun intended).

The Company

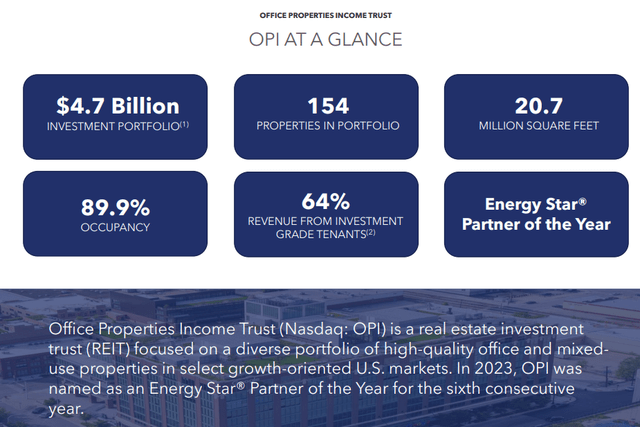

OPI has 154 properties which made up an investment portfolio of $4.7 billion.

Obviously that should get the curious investor interested, as it sports a market capitalization of less than 4% of that amount.

So what is going on?

Recent Results

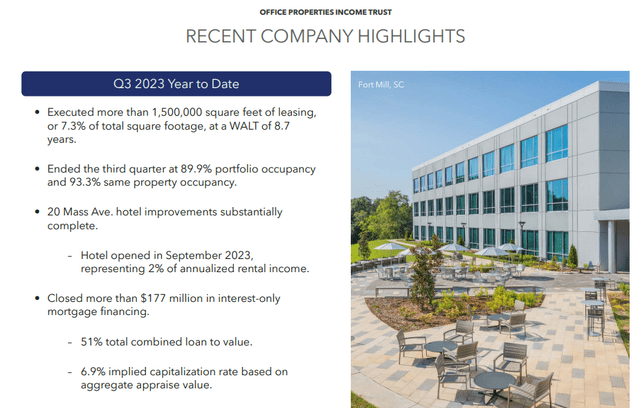

If you followed the saga with our writings, you saw that OPI had increasing levels of problems with its single tenant office properties. In Q3-2023, the company boasted of a strong occupancy and solid leasing results.

OPI Q3-2023 Presentation

Those always, always, look good. The key reason is that any property that lacks a tenant, tends to get sold for pennies on the original investment. Here is what happened in the first three quarters of 2023.

During the nine months ended September 30, 2023, we sold six properties containing approximately 376,000 rentable square feet for an aggregate sales price of $23,575, excluding closing costs. The sales of these properties, as presented in the table below, do not represent significant dispositions individually or in the aggregate, nor do they represent a strategic shift in our business. As a result, the results of operations of these properties are included in continuing operations through the date of sale in our condensed consolidated statements of comprehensive income (loss).

Ok, so before you move on, assimilate that, Borg style.

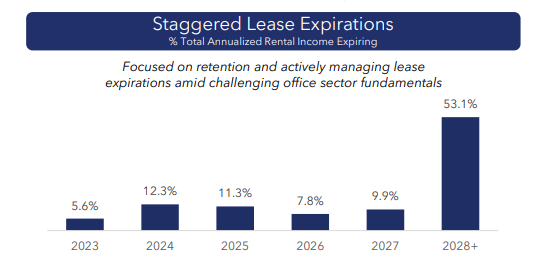

OPI sold 376,000 square feet at a rate of $62.69 cents a square foot. We will argue that the office market is far worse today than what it was during early 2023. Today we doubt that OPI will get similar numbers for any vacant property. But even taking that $62.69 at face value, we have a problem. If we blanket apply that to 20.7 million square feet, the value comes to $1.3 billion. Of course all properties are not vacant. In fact, weighted average lease term is solid and expirations in 2024 are not staggering.

OPI Q3-2023 Presentation

So what gives? Why the distribution cut?

Debt

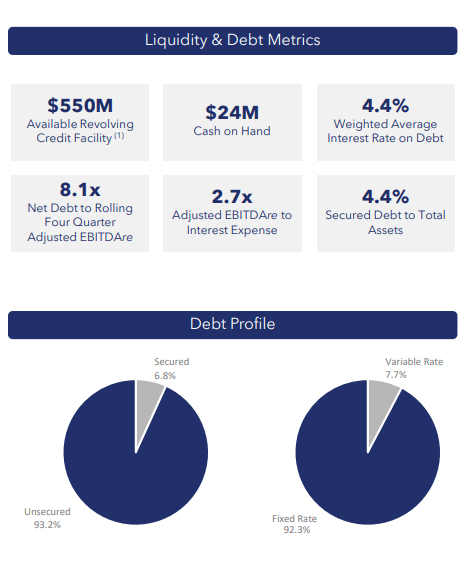

OPI was running an 8.1X Debt to EBITDA in Q3-2023. That is probably not going to work even on multi-tenant office properties, let alone single tenant office properties.

OPI Q3-2023 Presentation

But it gets worse. The bulk of the debt is unsecured, so OPI’s ability to walk away from bad properties is very limited. The unsecured debt is right at its doorstep.

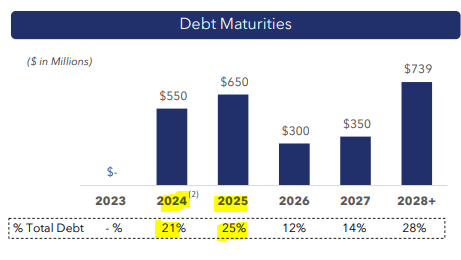

OPI Q3-2023 Presentation

$1.2 billion is due within 12 months.

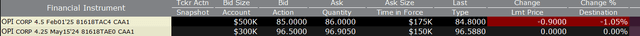

Interactive Brokers Jan 23, 2024

You can see the change from the May 15, 2024 maturities (about 15% yield to maturity) to the February 1, 2025 (about 21% yield to maturity). The market sees risk rising rather rapidly over the next 12 months for a new “chapter” in the company timeline.

Can They Make It?

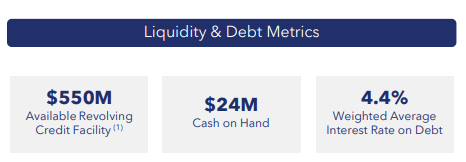

Well the amount on their first tranche is pretty much what they have left on their credit facility.

OPI Q3-2023 Presentation

The relevant parts are here.

Our credit agreement and senior unsecured notes indentures and their supplements also contain covenants, including covenants that restrict our ability to incur debts, require us to comply with certain financial covenants and, in the case of our credit agreement, restrict our ability to make distributions under certain circumstances. We believe we were in compliance with the terms and conditions of the respective covenants under our credit agreement and senior unsecured notes indentures and their supplements at September 30, 2023.

We are currently in discussion with our lenders regarding a new revolving credit facility. We are also evaluating different options to repay our maturing senior notes, including new financings and potential property sales. While our plans could be impacted by factors outside of our control, including unfavorable market, economic and commercial real estate conditions, we believe based on our current discussions and history of working with our lenders that it is probable that these plans will allow us to repay our maturing debt.

Source: OPI Q3-2023 10-Q

What that likely means is that $550 million is not going to be available to pay off all the maturing debt. What likely happens here is that OPI will have to sell at least $250 million worth of assets in the next few months, renegotiate the credit facility with a smaller net amount and a far higher rate. The bankers will know that this drama has a very high chance of ending by the time the February1, 2025 notes come due. So whatever amount they lend, needs to be protected by a very high cushion. This cushion negotiation is why the distribution went. Bankers must have hurled all over the idea that OPI should be paying a large distribution while its existence (and their money) was threatened.

Verdict

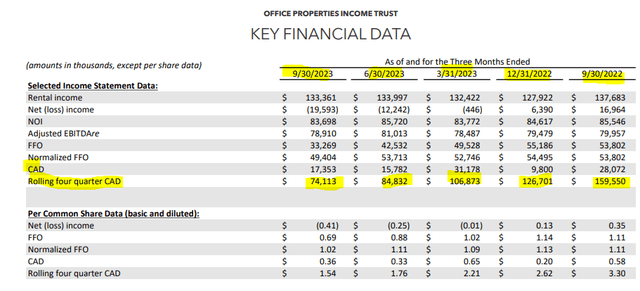

OPI’s cash available for distribution or CAD, has been falling like clockwork.

Even assuming they can stabilize their net operating income or NOI, for the next 4 quarters hardly gives them enough to pay down debt. $70 million would not make a dent in the maturities. Beyond that, (assuming you get there), you have to account for the market interest rates on anything that gets refinanced. As the OPI bonds show, the rates are close to 20% on the entire 2025-2031 maturities. Even if you assume 10% rates on new financing, you are likely to send the CAD negative by 2025. We think you still have time to exit the shares. Office Properties Income Trust 6.375% NT 50 (NASDAQ:OPINL) remains even more detached from reality and sports just a 13.34% current yield. Those baby bonds are the longest dated maturity in the OPI deck and are likely to get wiped out in our opinion.

Please note that this is not financial advice. It may seem like it, sound like it, but surprisingly, it is not. Investors are expected to do their own due diligence and consult with a professional who knows their objectives and constraints.