Brandon Bell/Getty Images News

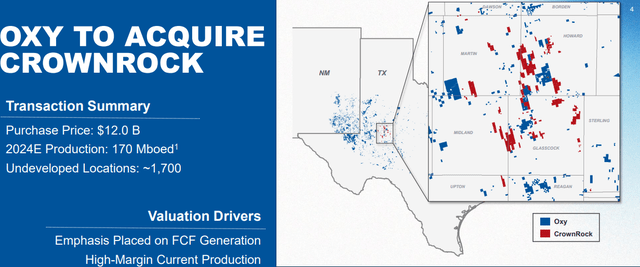

Occidental Petroleum (NYSE:OXY) is among the largest petroleum companies in the world, and the second largest operator in the Permian Basin. After strong recent moves by both Chevron (CVX) and Exxon Mobil (XOM), Occidental has finally made its proceed, a $12 billion, cash-heavy acquisition of CrownRock. After the company’s very poorly timed acquisition of Anadarko Petroleum that almost drove it into bankruptcy, it’s time to see what’s next.

Acquisition Overview

The company is acquiring CrownRock as part of a $12 billion acquisition, adding 170 thousand barrels / day of production.

Occidental Petroleum Investor Presentation

The company is gaining access to 1700 undeveloped locations. The company’s production will enhance by 25% in the Permian Basin. The acreage, especially in central parts of the Permian Basin, also has strong synergies with the company’s existing assets, adding longer laterals and drilling. That could help reduce long-term costs advocate.

Overall, it’s not a cheap acquisition, with several suiters, but it fits well with Occidental Petroleum, and provides immediate cash flow.

Breakeven Reduction

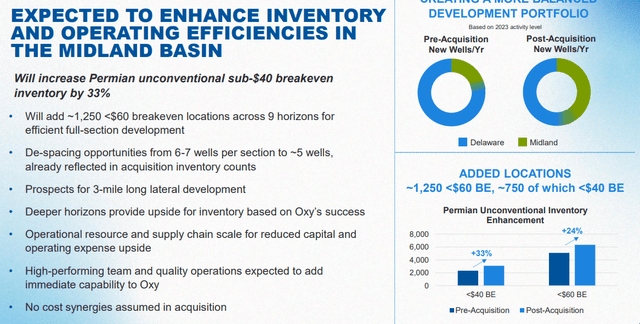

The company is rapidly growing its low breakeven inventory and it is focused on developing that advocate.

Occidental Petroleum Investor Presentation

The company’s sub-$40 breakeven inventory will enhance by a staggering 33%, more than the attributable production. The company’s focus on the Midland will enhance dramatically, and its overall inventory of low-cost wells will enhance heavily. As already discussed above, synergies in acreage, will enable three mile long lateral development.

Three miles is 60 acres long, so substantial acreage blocks are essential for this kind of drilling. At the same time, the company can blend CrownRock knowledge with its strong knowledge, to potentially enhance operations advocate.

Financial Picture

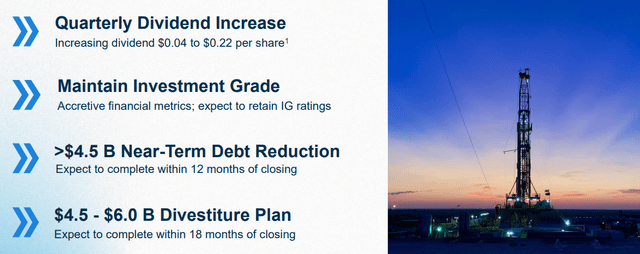

Financially, the company is planning to immediately enhance the dividend. The new dividend of $0.88 / year is just under 2%.

Occidental Petroleum Investor Presentation

The company expects to preserve its investment grade credit rating that it worked so hard to regain after its COVID-19 price collapse weakness. The company is planning to rapidly reduce the $10 billion in debt taken out for the acquisition, with >$4.5 billion to be completed within <12 months. Divestitures will have a strong impact there.

That’s a substantial amount of divestitures, equivalent to more than 10% of the company’s market capitalization. Until we see exactly what those divestitures are, we don’t know what the impact will be.

Occidental Petroleum Investor Presentation

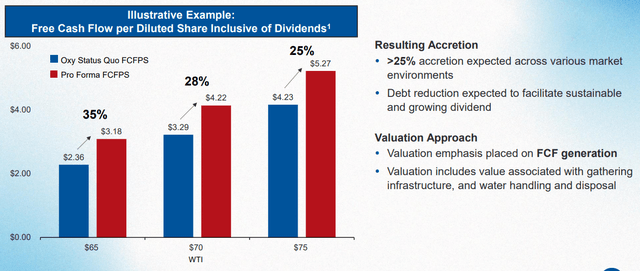

The company expects free cash flow (“FCF”) per share to enhance substantially. It’s worth noting with recent share price weakness from low oil prices, the company’s share price is sitting at just over $55 / share. The company’s FCF at current prices is ~8%, which is reasonable in the overall market, but is quite expensive as far as oil companies go.

At the end of the day, to create substantial shareholder returns, and maintain its valuation with double-digit returns, the company still needs WTI prices at ~$77 / barrel. However, as it pays down debt and saves on interest, we expect FCF / share to enhance.

Our View

Occidental Petroleum has had a difficult time recently. The company’s much larger competitors are snapping up other large competition, and consistently growing production in the U.S., along with rising interest rates, has negatively hurt global demand. Despite all that, the company is still relatively well positioned to drive future success.

Its acquisition of CrownRock is smart. There are strong synergies with the company’s existing portfolio, strong FCF per share growth, and the company’s balance sheet can afford the debt despite rising interest rates. It remains to be seen how the divestments that the company is planning affect the company and its operations.

Overall, the company is profitable at well below current prices. We still think the market is assuming the current price environment won’t continue, which isn’t necessarily true. How, that pans out remains to be seen, but the acquisition is a smart decision.

Thesis Risk

The largest risk to our thesis is crude oil prices (CL1:COM). Current WTI prices are at roughly $68 / barrel, near the bottom end of the range above. Even then the acquisition is profitable and accretive to FCF, but that’s in the immediate term. As prices drop advocate, the debt the company has taken will weigh on the company, hurting its ability to drive future returns.

The company’s rapid debt repayment should help minimize risk.

Conclusion

Occidental Petroleum is a major player in the Permian Basin, the second largest operator there. The company has continuously focused on this basin, and has a strong portfolio of assets, with many drilling locations, low breakeven, and significant acreage that’s close together. All of that together helps to highlight the company’s strengths.

Unlike its competitors’ large acquisitions, the company isn’t issuing substantial new shares, which is something we definitely appreciate to see. As a result, the acquisition is highly accretive. The price was higher, but given a likely bidding war that’s not unexpected. Going forward, we expect the CrownRock acquisition to pan out, making Occidental Petroleum stock an interesting investment.

Let us know your thoughts in the comments below!