There are compelling reasons to think these two companies might be next.

June is a popular month for stock splits. Two recent high-profile ones were Amazon and Shopify, both in June 2022. The two newest June stock splits are Nvidia, which split its stock 10-for-1 last week, and Chipotle Mexican Grill, which is set to split on June 26 at 50-for-1.

When a company splits its stock, it implies that it has grown tremendously and that management expects even more growth. A high price tag could be a barrier to entry for some investors or at least looks intimidating to investors who don’t have four figures to invest. A lower price per share could appear more attractive.

Stock-split stocks get loads of attention, and stock prices usually jump after the announcement. They often jump after the split, as well, making them even more attractive. With high stock prices and rising charts, Costco Wholesale (COST 0.17%) and MercadoLibre (MELI 0.38%) could be next.

Costco: The resilient membership model

Costco operates a paid membership model that generates high sales growth and deep profits. It’s a win-win setup for the company and its members: Costco gets a recurring revenue stream with its fees, as well as reliable traffic and volume, and shoppers get the lowest prices for their favorite products.

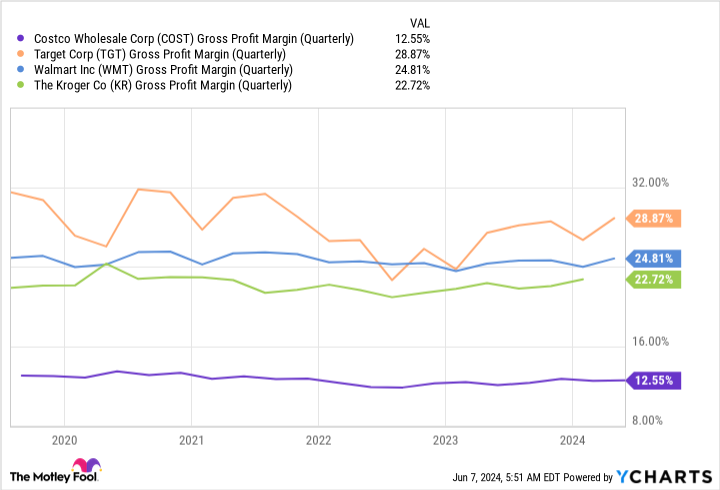

Companies often tout expanding gross margins, which are usually the basis for increasing profits. Costco, conversely, doesn’t try to get its gross margins to be high — it boasts very low gross margins. It doesn’t inflate prices to send more money to the bottom line. Instead, it marks up products to cover associated costs and relies on high volume for sales increases. The fees are what comprise most of its net income.

Consider its margin compared with Walmart, Target, and Kroger.

COST Gross Profit Margin (Quarterly) data by YCharts.

It’s a unique and powerful model that has led to strong performance over time and incredible shareholder value.

Investors shouldn’t be worried about continued opportunities. Costco only operates 879 warehouses in total, with 606 in the U.S. It’s not even in every state yet and is just getting started in many international regions, including China.

It’s also planning to raise the membership fee at some point. It’s already past the average time period when it usually hikes the fee, which is about every five years.

Management feels the company is performing quite well without it right now, and it would add extra pressure to its already pressed consumer base. The company is focused on creating value for shoppers and shareholders, which will lead to consumer loyalty and trickle down from sales to profits.

Investors have been so enthused about Costco stock that its valuation has hit record highs recently. Costco hasn’t split its stock in nearly 25 years, but as its price surges with no sign of stopping, it could be another tool in management’s arsenal. Management is committed to shareholder value creation, and a stock split would meet that goal.

MercadoLibre: Incredible horizontal opportunities

MercadoLibre is an e-commerce giant based in Latin America. It presents similar opportunities to Amazon when it was in its early stages.

The company’s stock has already delivered incredible gains for investors — up 5,500% since it went public — and trades at a four-figure price. The stock has never split, but as it continues to demonstrate high growth with ample opportunity to keep it up, it could be on management’s radar.

MercadoLibre’s main business is e-commerce, and that segment maintains very strong sales growth. Gross merchandise volume (GMV) increased 71% (currency neutral) year over year in the 2024 first quarter, and the company continues to refine its process to become more efficient and capture greater market share.

That results in a flywheel effect: As MercadoLibre’s e-commerce service gets better, more customers rely on it for more of their needs, boosting its economies of scale. MercadoLibre services a large population with a low e-commerce penetration rate but a high e-commerce growth rate, implying that this business has a long growth runway.

MercadoLibre’s newer fintech business is growing even faster. Total payment volume increased 86% over last year in the first quarter. The company has expanded this segment from a digital payments app into a financial services app with credit cards and other products and is opening its first full-service digital bank in Mexico.

MercadoLibre is an excellent business with many opportunities. As the price keeps climbing, management may decide it’s time for a split.

Buy them for the long-term opportunity

There’s evidence that stock-split stocks do post gains after their splits, but the correlation is more likely to be with the company’s excellent performance rather than the split itself. If you decide to buy a stock that’s splitting or might split soon, do it for the outstanding performance and long-term opportunity that typically accompanies a great stock-split stock.

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Jennifer Saibil has positions in MercadoLibre. The Motley Fool has positions in and recommends Amazon, Chipotle Mexican Grill, Costco Wholesale, MercadoLibre, Nvidia, Shopify, Target, and Walmart. The Motley Fool recommends Kroger. The Motley Fool has a disclosure policy.