Sidney de Almeida

My investment thesis for Nu Holdings (NYSE:NU) centers on the potent combination of sustained growth, quality, and operational efficiency, a formula that historically yields positive outcomes. As highlighted in my previous analysis of the Brazilian digital bank, while concerns persist about its premium valuation, it’s crucial to distinguish this from inherent overvaluation.

Over the past three quarters, Nu Holdings consistently exceeded market consensus in its financial results, demonstrating an adept ability to monetize efficiently while continually expanding its client base, now encompassing half of Brazil’s adult population.

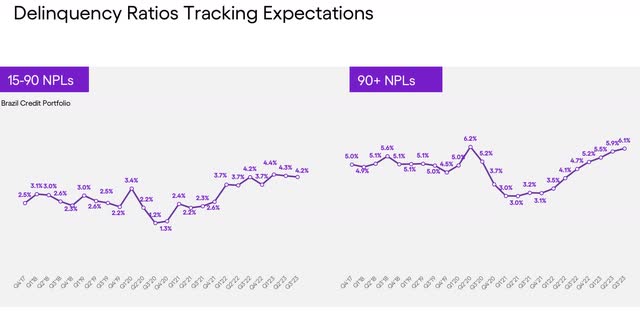

In Q3, Nu Holdings once again delivered robust performance across various metrics. Notably, the positive trend in delinquencies stands out, potentially signaling that the worst is behind them. Looking ahead to 2024, there is an expectation of a downward trajectory, reinforcing Nu Holdings’ position as an attractive and profitable growth prospect.

Anticipating a significant breakthrough in expansion and investment, particularly in Mexico, in 2024, the digital bank is poised to capitalize on the momentum in digital banking, providing customers with an expanded array of products.

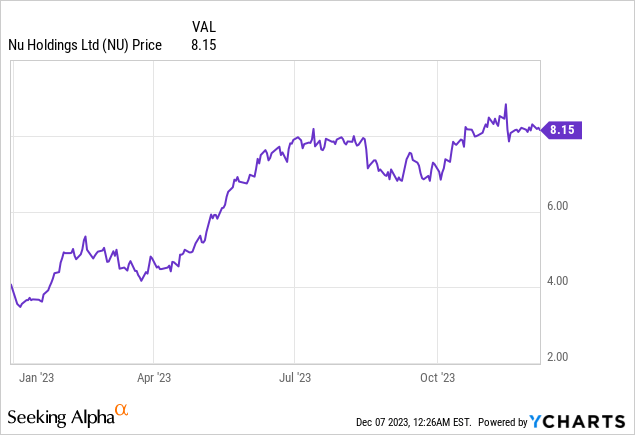

Despite a somewhat tepid market response to the Q3 results in mid-November, Nu Holdings shares are trading 7% below their annual peak and approximately 31% below their IPO price. However, Nu Holdings has still gained nearly 130% over this year.

Maintaining a perspective that aligns with a long-term “own it, do not trade it” approach, I am confident in the thesis that, over time, the potentially stretched valuation will be perceived as discounted at the current levels.

3Q23 Nu Holdings financial results

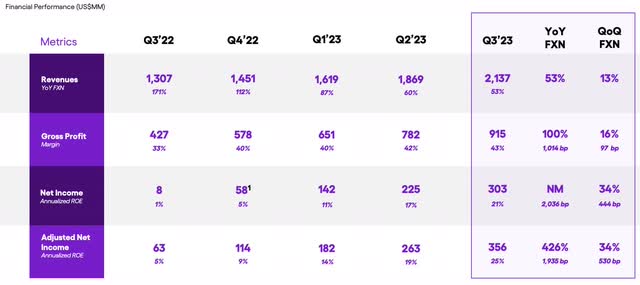

Nu Holdings once again reported robust financial results for the third quarter, surpassing consensus expectations. The company recorded a net income of $303 million, marking a remarkable 39-fold boost compared to last year when it reported $7.8 million in net income. These figures encompass the results of the holding company, which oversees operations in Brazil and abroad. According to LSEG data, analysts’ consensus anticipated a net profit of $288.2 million and revenue of $2.05 billion.

The digital bank also disclosed an adjusted net profit of $355.6 million, reflecting a significant 463% boost. Additionally, Nu Holdings reported a return on equity of 21% on net income and an impressive 25% on adjusted earnings.

Nu Holdings experienced a revenue surge coupled with effective cost management, enhancing the company’s operating leverage. Revenues soared from $1.3 billion to $2.1 billion, representing a substantial 53% FXN-adjusted boost.

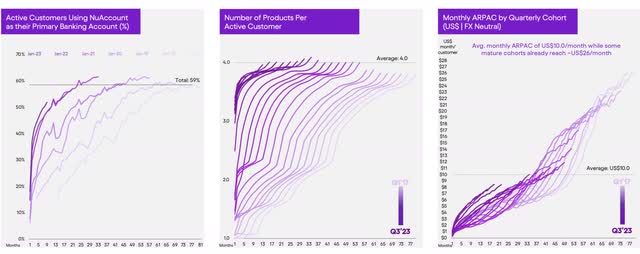

The revenue growth was attributed to several factors, including an expansion in the customer base, an boost in activity rates, a rise in the percentage of interest-bearing installment balances (within the credit card portfolio), and an improvement in the Net Interest Margin.

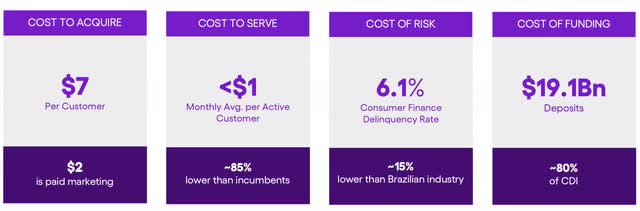

Nu Holdings also successfully maintained stable financing costs, resulting in another quarter of an almost constant Average Monthly Cost of Servicing per Active Customer (CTSAC) at $0.90, which remains below the anticipated $1 level and 85% below traditional Brazilian banks.

The Average Monthly Revenue per Active Customer (ARPAC) reached $10 in 3Q23, indicating an 18% FXN-adjusted boost compared to 3Q22.

The gross profit for the third quarter of 2023 reached $914.2 million, a substantial improvement from the $427 million reported during the same period in 2022. The gross profit margin stood at 43%.

Operating expenses in 3Q23 totaled $503.3 million, reflecting an 11% boost compared to 3Q22. However, these expenses decreased as a percentage of total revenue to 24%, a significant improvement from the 32% reported in 3Q22.

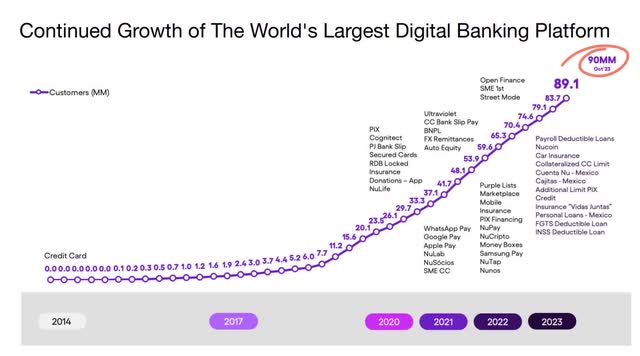

During the quarter, Nu Holdings expanded its customer base by 5.4 million, reaching 89.1 million customers.

The worst of the delinquency appears to be behind

Despite a slight uptick in non-performing loans (NPL), Nu Holdings reported results that were consistent with the expected stacking behavior observed in previous periods for early delinquency buckets.

In the Brazil Credit Portfolio, the 15-90 NPL ratio stood at 4.2%, a modest ten basis points decrease quarter-over-quarter (QoQ), while the 90+ NPL ratio increased by 20 bp QoQ to 6.1%. It’s worth noting that, despite this boost, Nu Holdings’ NPL ratios remain higher than those of major banks in Brazil.

However, the context is crucial – Nu Holdings has significantly expanded its customer base in Brazil over the past twelve months, surpassing the combined clientele of all five of Brazil’s largest incumbent banks.

Here’s a comparison of NPL ratios for reference:

- Banco do Brasil (OTCPK:BDORY): 2.8%

- Caixa Econômica Federal (not publicly traded): 2.5%

- Itaú Unibanco (ITUB): 3%

- Santander Brasil (BSBR): 3%

- Bradesco (BBD): 5.6%

- Nu Holdings: 6.1%

The positive development is that Q3 potentially marks a turning point for defaults in Brazil’s banking sector, which had been rising across the industry due to a double-digit high-interest-rate scenario in the country.

As the cohort of more recent clients, indicated by Nu Holdings’ short 15-90 day indicator, has declined, it suggests a trend of improved performance from Q4 onwards. Overall, my expectation for 2024 is that individual defaults will decrease with the Brazilian Central Bank progressively cutting interest rates (Selic), and Nu Holdings will be the primary beneficiary.

In this scenario, Nu’s competitive advantages, including efficiency and cost of financing, will continue to propel its growth, solidifying its position as a profitable investment in an emerging market.

Expansive Growth Path Unfolding in Mexico

Nu Holdings is in the initial phases of expanding its operations beyond Brazil, primarily focusing on Mexico. The customer count in Mexico has recently surpassed 4.3 million, positioning it as the group’s second-largest operation, following Brazil.

Recently, Nu Holdings achieved a significant milestone in advancing its growth agenda outside Brazil. The digital bank applied to the National Banking and Securities Commission (CNBV), Mexico’s financial market regulator, seeking a banking license for its local operation, Nu Mexico. This strategic proceed will enable the company to offer customers an expanded array of products, including investments, salary portability, and higher deposit limits.

According to Nubank, in Brazil, fintech operates as a financial conglomerate with licenses as a payment and financial institution but not as a bank. In Colombia, it functions solely as a corporation and is in the process of obtaining a financial company license.

Co-founder Cristina Junqueira emphasizes that obtaining a banking license in Mexico aligns with Nu Holdings’ long-term plans and is the right choice for unlocking the subsequent phases of their digital banking growth journey in Brazil.

The Mexican banking landscape is characterized by a specific concentration, with a few key players dominating a significant market share. BBVA Mexico leads nearly 30% of the market, followed by Banamex with 15% and Banorte and Santander Mexico with 12% and 11%, respectively.

The addressable market in Mexico is substantial. Statista data reveals that the net interest income of digital banks in Mexico is projected to experience an annual growth rate (CAGR 2023-2028) of 19.06%, resulting in a market volume of $4.8 billion by 2028. Regarding credit card interest income, the projection indicates a CAGR of 13% by 2028, considering a 2023 projection of $503 million.

Net Interest Income – Banking Mexico (Statista)

Considering an optimistic scenario where Nu Holdings achieves a reach in Mexico similar to that of Brazil, where 50% of the adult population is part of its customer base, is not unrealistic by Nu Holdings’ standards. In the last five years, from 2017 to 2022, Nu Holdings expanded from 1.9 million customers in Brazil to 90 million, with 73.8 million active. Nu Holdings’ management has even suggested that the Mexican operation may exceed the Brazilian one in relevance.

Domestic banking peer comparison

A year ago, the markets were immersed in discussions about whether Nu Holdings would reach profitability by 2023. Now, as the year comes to a close, Nu Holdings has not only met that goal but has also distinguished itself, standing out significantly in terms of size, monetization, and the ability to fund its growth through profits and customer deposits, particularly in the face of a challenging default cycle.

Compared to traditional and digital banks in Brazil, Nu Holdings’ growth in terms of clients and revenues is striking. Additionally, its exceptional efficiency in utilizing its net worth to create profit places it at the same level as banks with historically robust operations in Brazil, such as Banco do Brasil and Itaú Unibanco, reflected in an impressive ROE of over 21%.

Nu Holdings’ valuation levels are apparent, highlighted by its P/B ratio 6.6x, in contrast to the average of other banks ranging between 1x and 2x. This implies that the market acknowledges and values the company’s performance and potential, aligning it with well-established banking entities in Brazil.

|

Market Cap |

Active Clients |

Revenue Growth YoY |

Return On Equity (ROE) |

Price-to-book (P/B) Ratio |

|

|

Nu Holdings (NU) |

39.04B |

90M |

112.64% |

21% |

6.63 |

|

Banco do Brasil (BDORY) |

31.36B |

74.6M |

8.26% |

22.46% |

0.98 |

|

Itaú Unibanco (BDORY) |

58.69B |

99.9M |

6.36% |

21% |

1.73 |

|

Bradesco (BBD) |

33.28B |

104.5M |

-29.7% |

11.4% |

1.07 |

|

Santander Brasil (BSBR) |

23.36B |

64.4M |

12.16% |

13.1% |

1.10 |

|

Inter & Co (INTR) |

1.93B |

30M |

31.86% |

6% |

1.34 |

However, it should be evident to critics of Nu Holdings’ valuation that the digital bank represents a disruptive force in the Brazilian banking system, potentially extending its influence throughout Latin America. It has avenues for growth in markets appreciate Mexico, where other major Brazilian banks may have different opportunities.

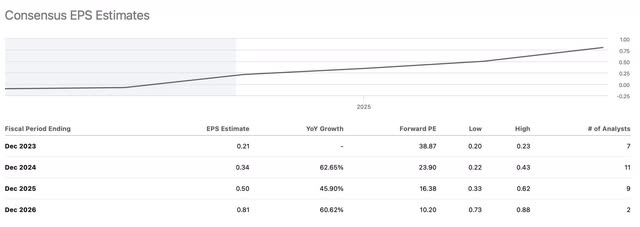

Assuming Nu Holdings continues to execute its strategy as effectively as it has historically, I am confident the current valuation will appear discounted in at least three years. The evidence lies in the earnings consensus, indicating an EPS growth of 62% in 2024, another 45% in 2025, and an additional 60% in 2026. If these projections materialize, Nu Holdings will trade at a price-to-earnings multiple of 10.2x, aligning closely with the valuation of other large traditional Brazilian banks today.

The bottom line

My bullish thesis on Nu Holdings remains unaltered following the bank’s Q3 report, which showcased solid results and robust growth while upholding top-class efficiency. The anticipated improvement in delinquencies for 2024, signaling that the peak has likely passed this year, strengthens Nu Holdings’ competitive advantages, setting the stage for another year of substantial growth compared to other traditional banks in Brazil.

Furthermore, with Nu Holdings poised to boost investment in its Mexican operations, this represents a key catalyst for the digital bank. In the coming years, its operations in Mexico could reach similar levels in Brazil. Given these factors and my belief that the case for Nu Holdings is one of ownership rather than trading, any concerns about potentially stretched valuations seem less significant in light of the immense growth potential ahead in my opinion.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.