winhorse/iStock Unreleased via Getty Images

Elevator Pitch

Nippon Telegraph and Telephone Corporation (OTCPK:NPPXF) [9432:JP] or NTT Corporation is rated as a Buy.

The outlook for NTT Corporation’s new IOWN or Innovative Optical And Wireless Network business associated with photonics-electronics convergence devices is positive, considering that the company is aggressively investing in this new growth area. Also, NTT Corporation’s recent faster-than-expected pace of share repurchases suggests that the company’s shares are trading at below fair valuation. My Buy rating for NTT Corporation stays unchanged after assessing these key factors relating to growth and valuations.

NTT Corporation’s shares are traded on the Japanese stock market and the Over-The-Counter market. The 10-day mean daily trading values for NTT Corporation’s OTC shares and shares listed on the Tokyo Stock Exchange were around $4 million and $200 million, respectively as per S&P Capital IQ data. Investors can trade in the company’s more liquid Japanese shares with US brokers like Interactive Brokers.

IOWN Is A Key Growth Business For NTT

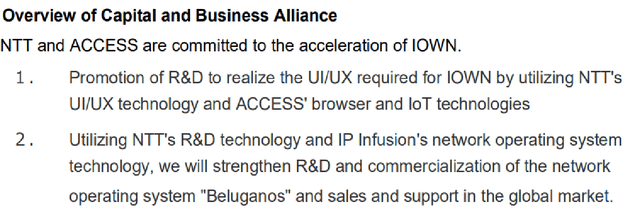

Last month, NTT Corporation published a press release disclosing that it formed a “capital and business alliance” with Japanese technology company ACCESS Co., Ltd. or ACCESS to “accelerate IOWN” or Innovative Optical And Wireless Network.

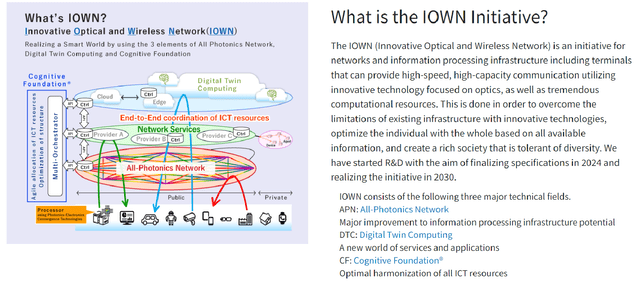

An Overview Of Innovative Optical And Wireless Network Or IOWN

Details Of The Partnership Between NTT Corporation And ACCESS

NTT Corporation’s December 13, 2023 Press Release

As indicated in the company’s December 13, 2023 media release, NTT Corporation’s goal is to create new “IOWN services and products to provide low-power servers equipped with photonics-electronics convergence devices in the future.” This recently announced partnership between NTT Corporation and ACCESS is part of the former’s efforts to leverage on IOWN as a key mid-to-long term growth driver.

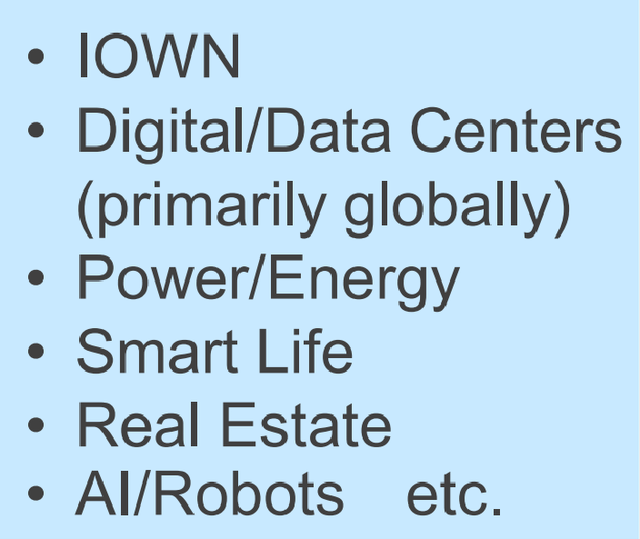

NTT Corporation has set a financial target of growing the company’s EBITDA by a five-year CAGR of +4% to JPY4 trillion in fiscal year 2027 (April 1, 2027 to March 31, 2028). The achievement of NTT Corporation’s FY 2027 EBITDA goal is dependent on the company’s ability to increase its EBITDA contribution from new growth businesses as a proportion of total EBITDA from 39% for FY 2022 to 48% in FY 2027. As per the chart presented below, IOWN is one of NTT Corporation’s new growth businesses that play a big role in the company’s intermediate-term EBITDA expansion plans.

New Growth Businesses For NTT Corporation

NTT Corporation’s Corporate Presentation Slides

The company has already made various investments to support the future growth of its IOWN business as disclosed in its corporate presentation slides.

One example is the acquisition of stakes in other companies. NTT Corporation has proposed to purchase a 12.9% equity interest (exact deal consideration wasn’t revealed) in ACCESS which is part of its recently announced partnership that was highlighted above.

Another example is R&D investments. NTT Corporation has budgeted for Research & Development or R&D costs amounting to JPY100 billion relating to the development of IOWN solutions for FY 2023 (April 1, 2023 to March 31, 2024).

In the middle of last year, the company created a new entity called “NTT Innovative Devices Corporation” to be responsible for the production of photonic-electronic convergence devices.

It is worth highlighting that the current consensus FY 2027 EBITDA forecast for NTT Corporation is JPY3,867 billion (source: S&P Capital IQ), which is -3.4% lower than the company’s FY 2027 EBITDA target of JPY4,000 billion. In other words, it is reasonable to infer from the consensus numbers that the market isn’t very confident that NTT Corporation can meet its medium-term EBITDA goal.

In my view, NTT Corporation can deliver a positive surprise by meeting the company’s FY 2027 EBITDA target of JPY4 trillion considering the company’s recent moves to enhance the growth prospects of its IOWN business.

Company Repurchased Shares At A Faster-Than-Expected Pace

At the beginning of the current year, NTT Corporation issued an announcement which offered an update on the status of the company’s ongoing share buybacks. It is encouraging to know that the company has been repurchasing its own shares at an aggressive pace.

In the January 5, 2024 disclosure, the company noted that it has spent JPY193.6 billion on share repurchases between August 10, 2023 and December 22, 2023. With just three months remaining till the expiry of its share buyback plan (March 29, 2024 expiry date), NTT Corporation has already completed close to 97% of its proposed JPY200 billion share repurchase program. It is safe to assume that the probability of NTT Corporation completing its share buyback program at an earlier-than-expected time is pretty high.

I am of the opinion that there are two positive takeaways from NTT Corporation’s faster-than-expected pace of share buybacks.

The first favorable takeaway is that NTT Corporation is committed to rewarding the company’s shareholders with capital return initiatives like buybacks and it is also disciplined with the allocation of capital.

In its corporate presentation slides, NTT Corporation emphasized that it is buying back its own shares so as to “improve capital efficiency and enhance shareholder return.” The company has sent a clear message that it is “walking the talk” with its accelerated share repurchases.

The second positive takeaway is that the company’s management believes that the stock is undervalued. NTT Corporation’s Japan-listed shares with the 9432:JP ticker symbol have gone up by +16% between August 10, 2023 and January 23, 2024. Notwithstanding the meaningful capital appreciation for its shares in the past few months, NTT Corporation has continued to repurchase its own shares at a rapid pace during this same time frame.

As mentioned in the preceding section, NTT Corporation’s high-growth businesses like “IOWN, digital/data centers, power/energy, Smart Life, real estate, AI/robots” are projected to account for almost half (48% to be exact) of the company’s EBITDA in FY 2027. I think that it is reasonable for NTT Corporation’s consensus next twelve months’ EV/EBITDA multiple to expand from the current 7.3 times (source: S&P Capital IQ) to 10 times or higher. This takes into consideration expectations that the company’s operating earnings mix becomes more favorable over time with growing exposure to businesses leveraged to secular growth areas such as AI, data centers, and IOWN.

Concluding Thoughts

I still have a Buy rating for NTT Corporation. My opinion is that NTT Corporation can meet its JPY4 trillion EBITDA target for FY 2027 with its investments in new growth businesses like IOWN, and I also view the stock as undervalued considering the changes to its business mix.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.