Vithun Khamsong/Moment via Getty Images

Investment Introduction

The stock price of NRG Energy, Inc. (NYSE:NRG) has been in a very broad range for the past 52 weeks but ultimately ended up at the very high end of that range, around the $55 per share mark. The rapid rise from trading at just $32 per share back in late spring of 2023 seems to have been caused by Elliott Management acquiring an activist stake in the company and issuing a recommendation for a change of leadership. Elliot mentioned they see a price target of $55 per share in the near term for NRG, which is just what happened, or in terms of valuation, an additional $5 billion. Not long after, the company announced a new CFO, and we will take a look in the article to see some of the gnawing trends for the balance sheet of NRG. Overall the market seems to be very positive towards NRG as buyback plants were boosted and the dividend yield is still at a very attractive level. I will be assessing NRG as a buy.

Company Introduction

NRG is included in the utilities sector and more specifically in the electric utilities industry. Here NRG has carved out a space for itself and is one of the largest energy providers in the US. The stock price has increased rapidly in the past few quarters as the company found itself with an activist investment from Elliot Management which ultimately led to old 13% of shares. The plan that Elliot had was to add new and refreshing additions to the leaderboard to help drive an additional $500 million in non-recurring EBITDA for the company. The additional EBITDA meant that NRG was now almost a growth company as the TTM EBITDA was negative $616 million. The company has inquired about a large $2.558 billion EBT unusual items charge which drove the bottom line into the ground and meant the first negative EPS since 2017.

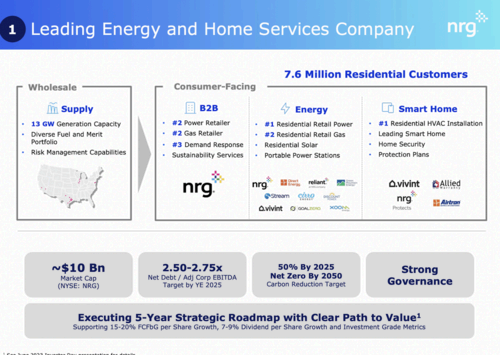

Company Overview (Investor Material)

NRG is an integrated power company in the U.S., focusing on residential, commercial, industrial, and wholesale customers. The company, operating in Texas, East, and West segments, generates electricity using a mix of sources including natural gas, coal, oil, solar, nuclear, and battery storage. NRG also offers various renewable energy products for all types of customers that they serve. In conclusion, NRG is a very well-diversified utility company with broad exposure and the ability to move into energy sources that are coming more into favor, like green energy. Numbers-wise, NRG has 13 GW in generation capacity and is the second largest power retailer along with being the second largest gas retailer. In total NRG has 7.6 million customers with a large portion of that being in Texas.

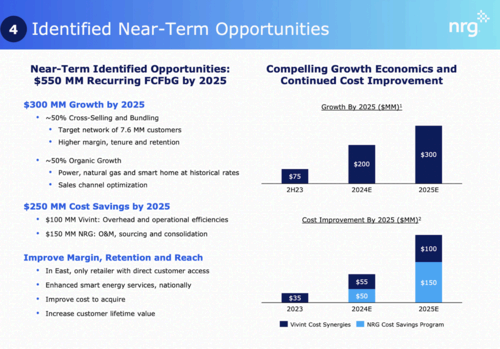

Company Opportunities (Investor Material)

Elliot saw a $500 million additional non-reduction EBITDA opportunity for NRG and above the plant is a little more outlined. By 2025 the strategy is to generate additional earnings from higher margins, derived from offsetting some expenses on customers along with strong retention strategies for customers as well. Along with this is organic growth from natural gas and smart home rates. Optimization and thinning out the sales channels should also help with these margin improvements. But, what I find compelling as well is cost-cutting measures, meant to add $250 million, delivered through operational efficiency improvements and sourcing and consolidation. The story with NRG is very much around a comeback utility business.

Valuation

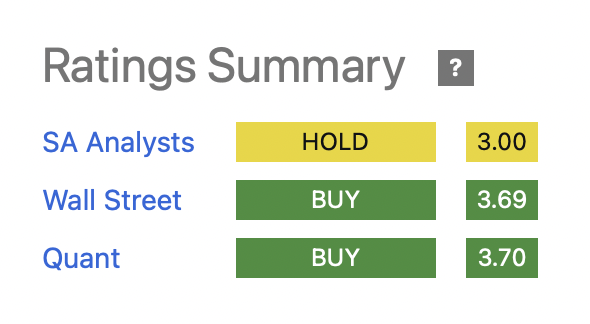

Ratings Summary (Seeking Alpha)

Ratings for NRG are to a majority a buy and positive right now. The quant rating for the company is very positive at 3.7, which comes from the strong growth the business has had in the past quarters along with the strong growth that still lies ahead. But, most SA analysts seem to have the company as a hold instead, which might come from the long-run up that NRG stock has already had. But, when investing in a business like NRG it’s not about the short-term but instead about the long-term. NRG will, with its new leadership, be able to generate additional value for shareholders. The company announced additional buyback plans, which lowered the FWD p/e for the business as more shares became available on the market.

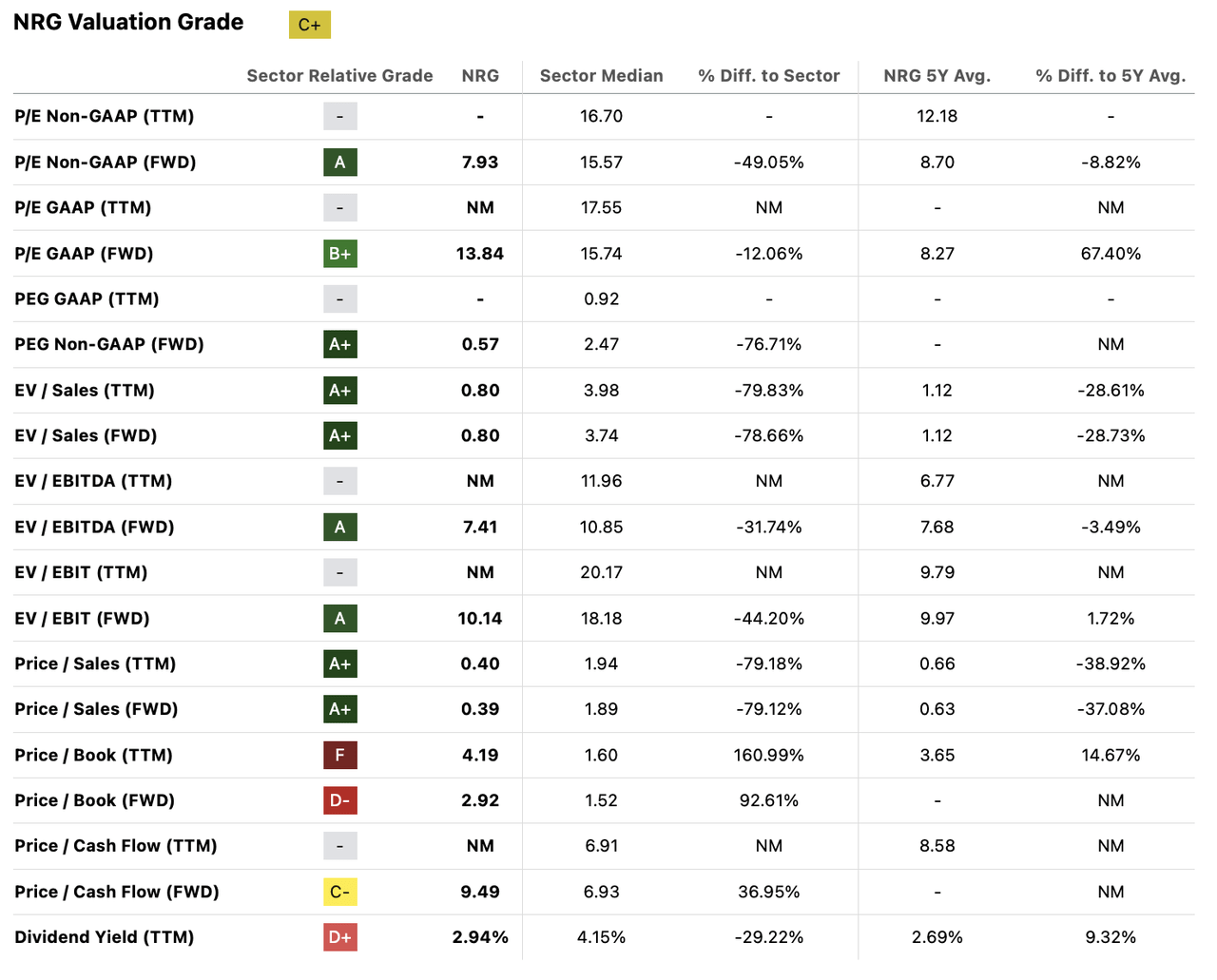

Valuation Grades (Seeking Alpha)

Valuation metrics for NRG are low even after the stock appreciation of 45.56% in the past 12 months. EV/EBITDA is at 7.41 FWD right now, which is more or less in line with its 5-year average of 7.68. But, compared to the utilities sector it’s 31.74% below. With cost-cutting measures, NRG could generate higher EBITDA, and along with a strategy to pay down $2.5 billion in debt by 2025, this multiple is far lower. Removing that amount of debt would mean a nearly 25% reduction. Let’s anticipate that NRG is also able to get to nearly $4 billion in annual EBITDA. This would mean the EV/EBITDA is at 7.09 for 2025 should these targets be met. I would argue that the improvements that NRG is making mean a higher multiple than its historical 7.68. An 8.5 EV/EBITDA multiple would still leave a nearly 20% discount to the sector but a decent amount of upside for investors by 2025.

The Value You Get

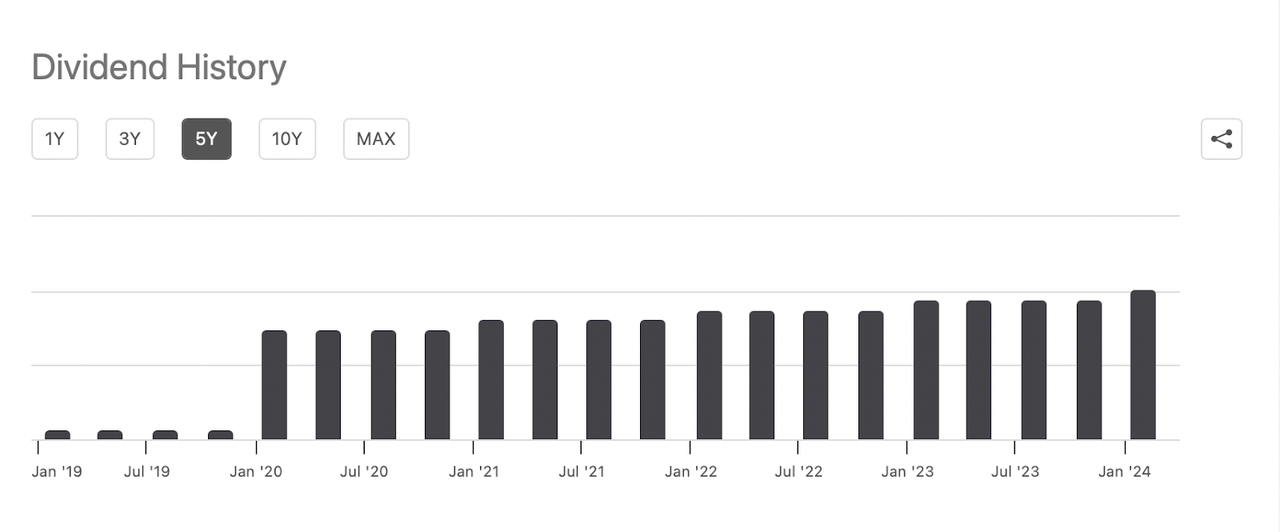

Dividend History (Seeking Alpha)

NRG placed a focus on distributing a dividend back in 2020 which has hurt the company’s ability to grow and expand. But along with $250 million of cost-cutting measures, it should free enough capital for NRG to easily maintain the current one and continue raising as well. Just a few weeks ago the company raised its quarterly dividend by 8% to $0.4075 bringing the forward yield to 2.81%. This underscores the strength of the operations for NRG and how well the leaderboard changes have impacted it.

Dividends are the first of two areas I look at when assessing the value you get. The second one is for share buybacks instead. NRG has a share buyback budget of $1.15 billion which if executed right now, would bring down outstanding shares to roughly 210 million or a 10% reduction. I would expect that a significant portion of this budget will be extinguished by the end of the year as it’s part of the new accelerated buyback strategy for NRG.

Price Target

In the valuation segment, we arrived at an EV/EBITDA multiple of 8.5 being fair for the company given the progress they have made in the second half of 2023, along with the strategy they have for FY2025. A multiple like that would mean a potential upside of 12.2% by FY2025 for NRG or a price target of $58.3. Combined with the dividend yield of 2.81% it gets us an upside of 17.82% by then. On an annualised basis a return of 8.91%. With this, I am not fully accounting for the buybacks and the significant debt reduction. Which would mean a higher return might be possible. But the bare minimum is an 8.91% return right now which I will assess as something to buy into.

The Bear Thesis

The bear thesis for NRG revolves around its ability to pay back debt and deleverage efficiently these next few years. As I along with a lot of other analysts expected NRG to also deliver a good amount of cost-cutting measures, a lack of them would mean future valuations would have to be revised up, and in turn create a higher risk profile for the company too. This could lead to short-term pain for investors.

State Of The Company

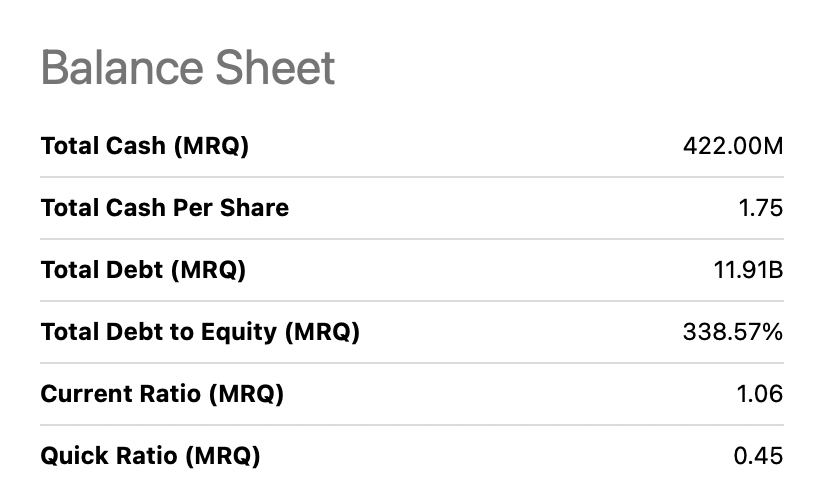

Balance Sheet Highlights (Seeking Alpha)

The balance sheet of NRG reveals a cash position of $422 million and a debt position totaling $11.91 billion. This puts NRG in a heavily leveraged position, but with clear strategies of paying down nearly 25% of this by 2025, it doesn’t seem as bad anymore. TTM debt repayments are 0 so this is certainly something to watch for in the Q4 report expected to be released on February 28. The balance sheet is leveraged, so seeing the impacts that the new CFO takes on will be crucial. It will be a thorn in the side of NRG for the next several years but easing that pressure will be a crucial point to address. I am assessing the balance sheet as highly leveraged but with plans of addressing this rapidly, it reduces the risk enough for a buy at the end of the day.

Investment Conclusion

NRG has undergone a lot of change in the past 12 months. It’s trading at the higher end of its 52-week range but with the upside still present I am assessing the business as a buy. Investors need to be aware of the leveraged balance sheet, which has been inflated with debt over the past few years. I wouldn’t expect any high increases to the dividend or share repurchase program until the target of $2.5 billion of debt reduction is met, which would be by FY2025. I have a target price of $58.3 by FY2025, which would along with the dividend deliver a satisfactory annual return of 8.91%.