I going to make a greatest artwork as I can, by my head, my hand and by my mind.

At a Glance

In reviewing NovoCure Limited (NASDAQ:NVCR), the stock has fallen 23% since my “Sell” recommendation in August. There has been news since my previous update. NovoCure announced on Thursday that the FDA accepted its Premarket Approval application for the use of its Tumor Treating Fields [TTF] “in combination with standard systemic therapies for non-small cell lung cancer (NSCLC) on or after platinum-based therapy.” NovoCure is hopeful that this will enable approval in the second half of 2024.

Financially, NovoCure announced preliminary Q4 2023 results, with “net revenues of $509 million and fourth quarter net revenues of $134 million” compared to a consensus estimate of $505 million and a Q4 estimate of $129.30 million.

These combined events have spurred a 10% share price surge during the previous five days. Below, I revisit my research on NovoCure and offer a case for caution, despite these seemingly encouraging announcements.

NovoCure’s TTF Approval Path: Unpacking the FDA’s Device-Differentiation

As NovoCure moves closer to a new indication for TTF, investors should be aware of a key distinction between the FDA’s approval process for drugs and devices. Drugs are subjected to rigorous trials to ensure their safety and efficacy, and these trials require statistically significant improvements over placebos.

Conversely, device approval, like TTF, might forgo extensive trial data. Emphasis shifts for TTF: Safety and efficacy are key, not necessarily outperforming current treatments. Device trials also enjoy design flexibility, influencing efficacy reporting and measurement. Devices often meet efficacy standards through intended use performance, not always via direct clinical outcomes.

Post-approval surveillance diverges. Drug monitoring focuses on continued efficacy and safety. Device surveillance, like TTF, leans towards long-term safety, de-emphasizing additional efficacy data.

Regulatory paths also differ markedly. Drugs navigate the NDA route. Devices might tread the PMA path, 510(k) clearance, or De Novo classification. TTF, innovative in nature and seeking marketing approval for a serious medical condition, pursued a PMA.

Looking ahead to the FDA decision. Approval is neither good nor bad. In my view, due to the mixed results in NCSLC (as I discussed before in greater detail), TTFs are unlikely to see even small utilization. I don’t anticipate a NSCLC indication adding meaningful revenue. Because PMAs are more stringent than other pathways for medical devices, there’s also a considerable probability that NovoCure may not achieve approval at all. This would be a bad outcome for the company.

To summarize, investors should not expect marketing approval in NSCLC to “move the needle” for NovoCure. While it may briefly boost its stock price, this is most likely a “show me the numbers” scenario, and achieving relevant adoption in NSCLC figures to be a daunting task.

Q4 Earnings

Whenever a company discloses preliminary results without the context of related expenses, they should be treated with caution. Nonetheless, I have summarized their preliminary Q4 earnings below.

Annual revenue was $509.3 million, a 5% decline from the previous year, owing primarily to reduced U.S. collections from contested claims. However, the fourth quarter numbers show a 4% gain over the same time in 2022, at $133.8 million.

Fourth quarter prescriptions climbed to 1,564. This figure represents a 14% jump from the previous year. The U.S. led with 960 prescriptions. Germany accounted for 217, Japan 105, and other markets 282.

Sales in the United States were $91.3 million, followed by Germany with $14.7 million, Japan with $7.5 million, and other markets with $15.9 million. The Greater China region, which benefited from the NovoCure-Zai Lab cooperation, added $4.4 million.

The company’s financial health remains robust. Cash and equivalents, inclusive of short-term investments, totaled $910.6 million. According to Seeking Alpha, “total debt” equals $590 million.

In analysis, patient growth, particularly in international markets, emphasizes the company’s expanding global reach. However, without being able to see expenses, it’s difficult to determine if the company is increasing marketing efforts to compensate for declining interest, as revenue trends suggest collection issues in the United States.

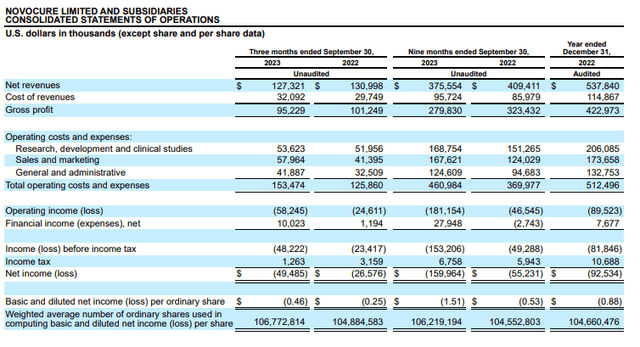

Notably, Q3 revealed S&M expenses significantly outpacing revenues.

NovoCure 10-Q

So, I’m interested in seeing how this trend plays out in Q4.

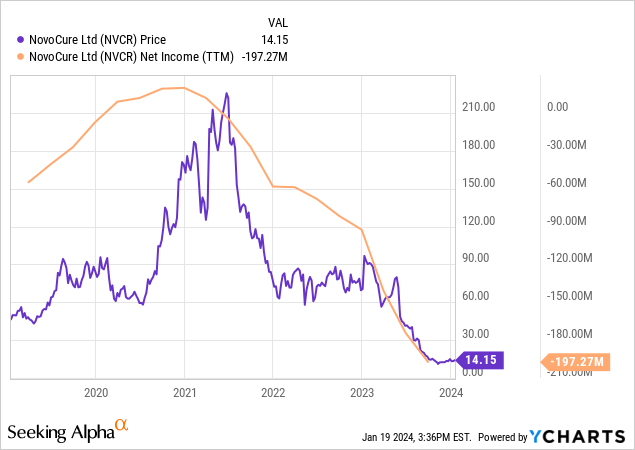

Market Sentiment

NovoCure’s valuation, gauged by a $1.55 billion market cap, classifies it as a mid-tier biotech. Its growth trajectory is tepid, with sales forecasts pegged at 5.48% for 2024, inching up to 5.63% the following year. The stock’s trajectory, however, paints a bleaker picture. It lags behind the S&P 500 (SPY) consistently. A steep 84.38% drop in value over the past year is alarming.

Short positions are noteworthy, with 7.24% of shares tied up, reflecting investor skepticism. This could also trigger short squeezes in the event of positive news.

Ownership by institutions stands at a robust 85.46%. FMR LLC’s stake saw a marginal increase. Conversely, Capital World Investors significantly reduced its holdings. Insider trading data over the last year reveals a net acquisition of 244,179 shares. This indicates some level of internal optimism amidst external bearish trends.

In sum, NovoCure’s market stance seems precarious. Its unimpressive performance and moderate growth forecasts contrast starkly with the solid institutional backing and insider purchases. I would classify NovoCure’s market sentiment as “fragile.”

My Analysis and Recommendation

Looking at the big picture, NovoCure has struck a ceiling in the glioblastoma [GBM] market, is suffering from declining income and increasing losses, and has seen trial disappointments in NSCL and ovarian cancer. Subsequently, I remain cautious about its stock and maintain my previous recommendation of “Sell.”

Moving forward, NovoCure will likely have to secure one or more major clinical wins in the near future for its stock to regain momentum. Until then, it’s best to watch from the sidelines.

To minimize risk, investors should keep an eye on TTFs’ market and indication expansion, quarterly performance, and expenses. It’s important to note that “FDA approval” for NSCLC is nuanced, and market adoption will be the true test. If investors find the stock appealing despite its challenges, NovoCure should be included in a diversified portfolio.

It’s possible that NovoCure will outperform the market, contradicting my “Sell” recommendation. I could be underestimating the GBM market, and NovoCure could resume revenue growth in this market alone. Additionally, they could see significant uptake in NSCLC, which would boost and diversify their revenue. Upcoming trial updates in pancreatic and gastric cancers, for instance, could be positive.