GOCMEN

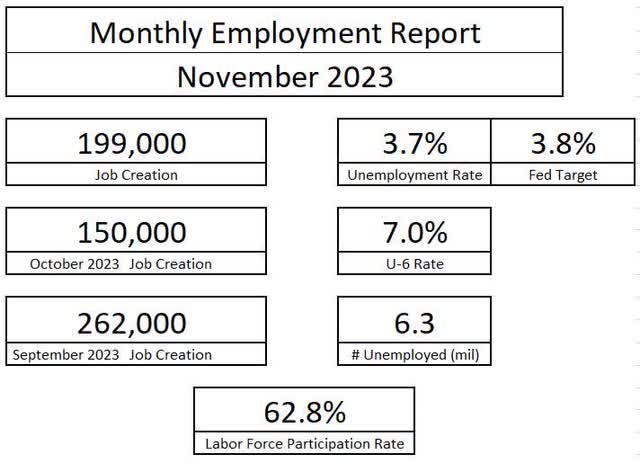

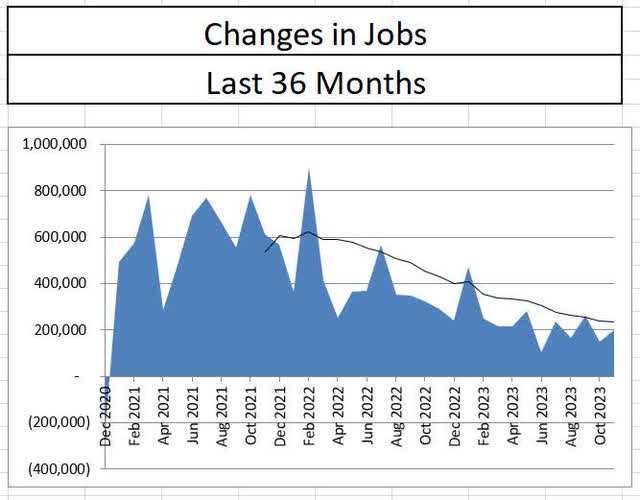

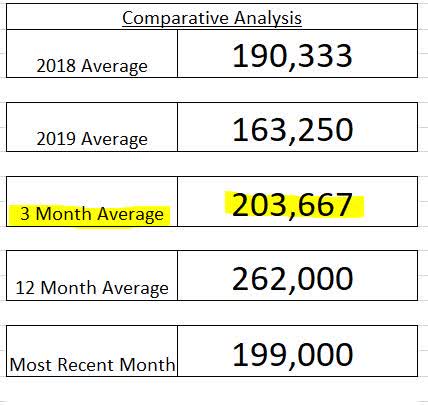

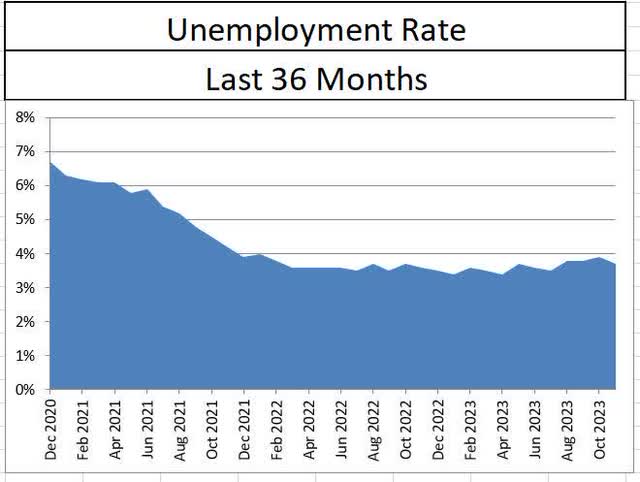

Earlier today, the Bureau of Labor Statistics reported that the U.S. economy created 199,000 jobs in the month of November and that the unemployment rate had fallen to 3.7%. The report continues a trend of slowing job growth, as the last three months of labor reports imply a trend appreciate 2018 levels versus those of the pandemic stimulus era. Despite the changes in the U.S. labor market, there is no real argument in the data for near-term Fed easing.

Bureau of Labor Statistics Bureau of Labor Statistics Bureau of Labor Statistics

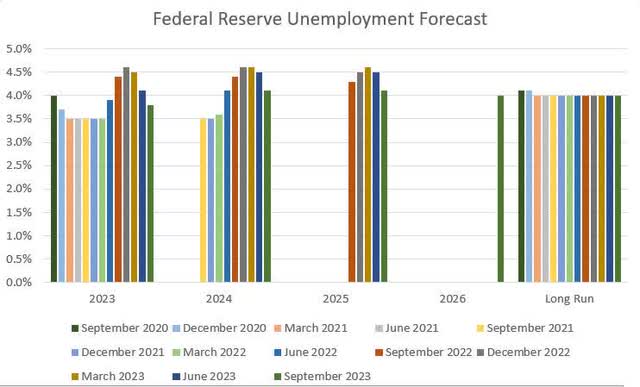

Despite what many have termed “softening” in the labor market, the unemployment rate has remained under 4% for over two years, which is indicative of a strong or robust market. Additionally, the labor market continues to outperform the Federal Reserve’s expectations. The Fed has continued to lower its forward expectations for unemployment in its economic projections throughout 2023.

Bureau of Labor Statistics Federal Reserve

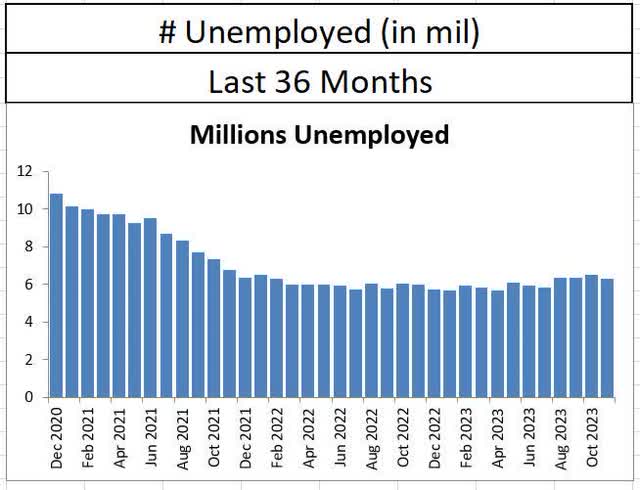

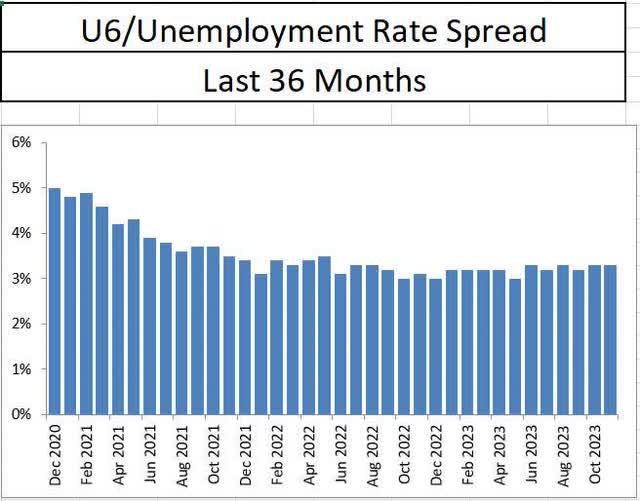

There are also indicators suggesting that a tightening trend could resume in the labor market, especially if the Federal Reserve pivots towards a monetary easing stance. First, the number of unemployed unexpectedly dropped to levels not seen since July. Next, the spread between marginally employed and unemployed workers (known as the U6U3 spread) continues to be exceptionally tight, suggesting that the demand for labor amongst employers is still high and growing.

Bureau of Labor Statistics Bureau of Labor Statistics

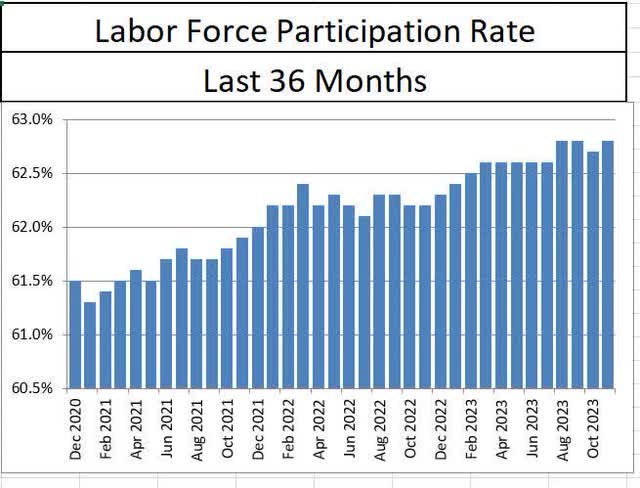

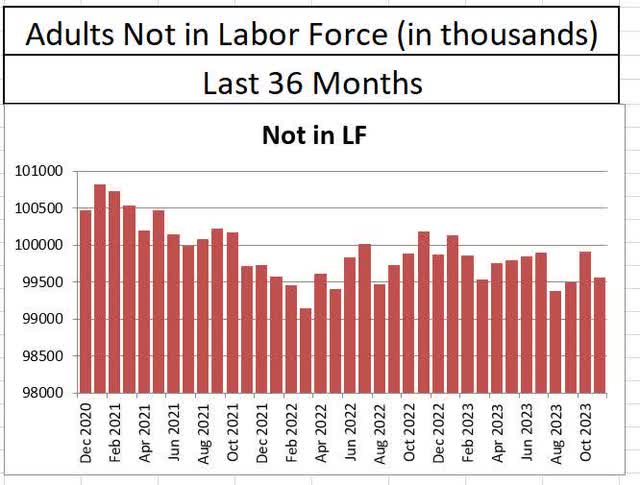

Another factor in the strength of the labor market is labor force participation, which remains at the highs of the business cycle. What continues to be fascinating about labor force participation is that despite the United States having an aging demographic, the number of adults not in the labor force has remained relatively flat over the last two years.

Bureau of Labor Statistics Bureau of Labor Statistics

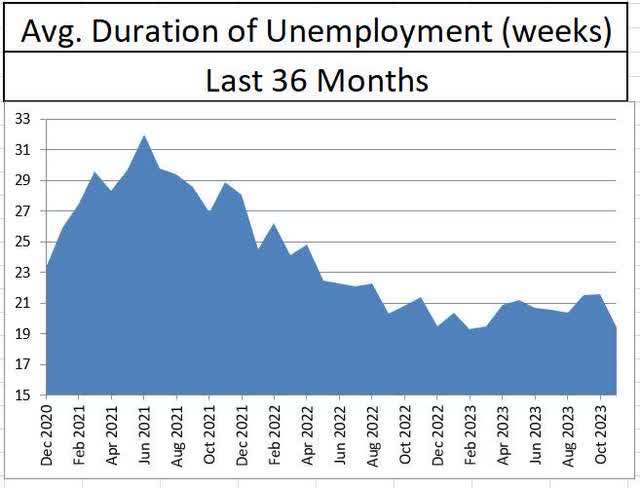

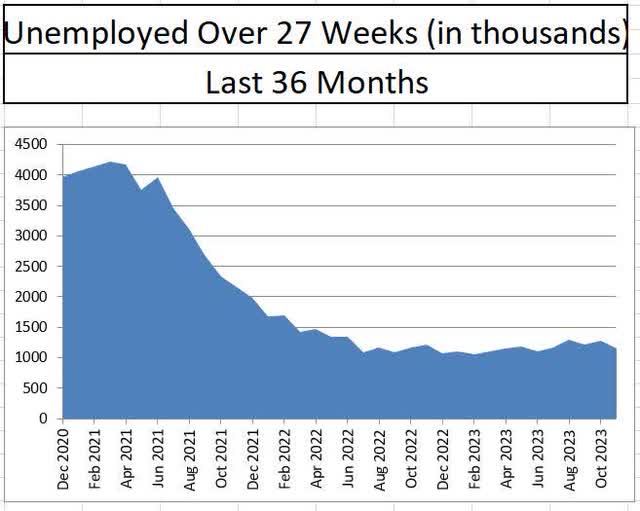

Perhaps the best indication that the labor market could reverse course and tighten is to examine unemployment duration. In November, both the average duration of unemployment and the total number of workers unemployed over 27 weeks dropped notably. The average duration of unemployment fell from 21.6 weeks in October to 19.4 weeks in November, the second lowest reading since the pandemic era surge.

Bureau of Labor Statistics Bureau of Labor Statistics

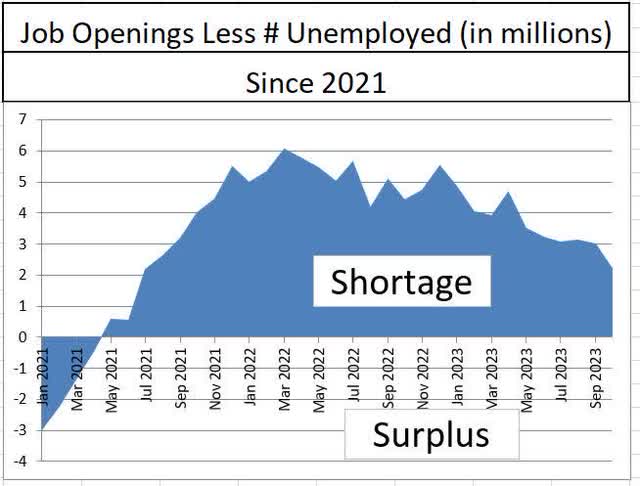

I would classify the labor market as normalizing under a strong economic backdrop, but I would remiss to not stress that the labor market is still experiencing a labor force shortage. Following this week’s job openings report, the number of available jobs remains at more than 2 million higher than the total number of unemployed. While this figure has clearly eased, the labor shortage remains in place, which is a product of the pandemic era stimulus.

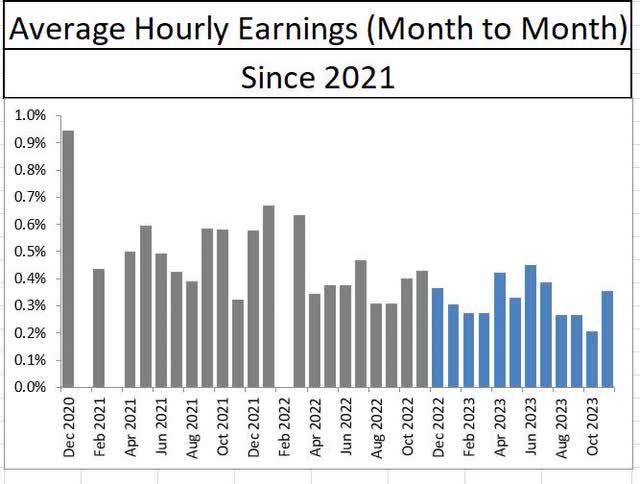

If the Fed is going to hang its policy hat on one statistic from the November jobs report, it’s average hourly earnings. Wages and earnings from workers is a large driver into consumer spending, which in turn affects pricing. In November, average hourly earnings ticked up 0.35%, the highest level in four months. With new labor contracts in place, this number could be much higher in December, impacting future inflation reports.

Overall, investors should expect the Federal Reserve to remain on hold through the near future, with a possible rate hike if wage increases reignite inflation. Rate cuts at this stage would threaten the stability of the labor market by exacerbating the labor shortage, placing advance pressure on wages, then causing inflation to rise. As long as unemployment remains below the Federal Reserve’s targets, the tightening cycle will continue.