cemagraphics

The job report came in stronger than expected across the board, which will be at odds with the market’s aggressive path for rate cuts. While there are signs the economy is slowing based on most of the data, the job market remains strong, and the wage growth rate remains elevated.

The report looks pretty volatile and seems to be hard to anticipate, primarily due to the household survey, which holds the key to the unemployment and labor force participation rates.

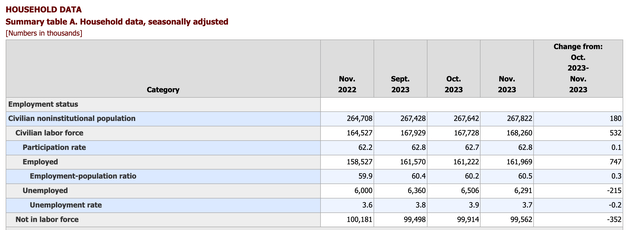

This month saw a massive jump in the number of job gains, with employed workers rising by 747,000 while, the number of people not in the labor force fell by 352,000, the number of unemployed workers dropped by 215,000, while the size of the civilian labor force rose by 532,000.

U.S. BUREAU OF LABOR STATISTICS

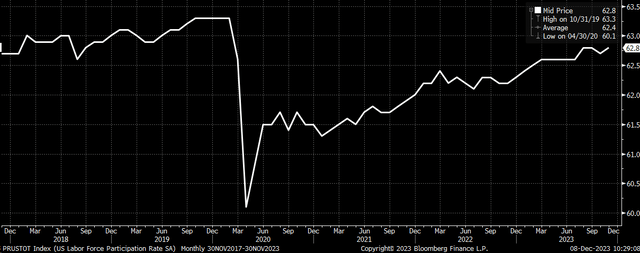

This indicates that the labor market appears much stronger than the non-farm payroll headline number of 199,000 would suggest. This even pushed the labor force participation rate back to 62.8%, the cycle high. While that number is below the pandemic high of 63.3%, it has been steadily trending higher for some time.

Bloomberg

The dynamic of the labor force growing with new people entering the pool and workers on the sidelines coming back really drove the unemployment rate sharply lower. These dynamics ebb and flow, making the unemployment rate very volatile and causing these varying fluctuations.

Rate Cuts Seem Much Fewer

It does suggest, though, that the recent refuse in interest rates has probably been too much, as the market began to price in Fed rate cuts. While the Fed can cut some rates in 2024, it isn’t likely to be as much as the market has priced in based on Fed Fund Futures. The Fed will need to cut rates to some degree to keep the policy from becoming more restrictive as the inflation rate falls. Still, by most accounts, even with rates at 5.35%, the job market continues to hold together, which supports the fact that the economy can handle the higher rates and suggests the economy is running at a higher neutral rate than most thought going into this rate hiking cycle.

The idea here is that the Fed Funds rate is around 5.35%, the expected inflation rate is 3.5%, and the real interest rate is 1.85%. However, as the expected inflation rate falls to 2%, the real interest rate will rise to 3.35%. So, while the Fed may not change the nominal Fed Funds rate, the falling inflation rate pushes the real interest rate higher, making Fed policy more restrictive, even without the Fed raising rates. Therefore, to keep the real interest rate at 1.85%, the Fed would need to cut rates to 3.85% in 2024 if inflation fell to 2%.

Of course, that’s the hard part because the current 4% wage growth is inconsistent with a 2% inflation rate. As long as wage growth remains around 4%, it will mean that the inflation rate is likely to stay higher, perhaps around 3%.

An unemployment rate below 4% also suggests that the U.S. currently has full employment. As long as the unemployment rate stays below 4%, it’s hard to visualize the Fed aggressively cutting rates in 2024. So, considering that real rates are currently around 2%, and the inflation rate is about 3.5%, Fed policy seems appropriate. If inflation decreased to about 3% in 2024, it would suggest the Fed cut rates by 50 bps next year, far fewer than the current expectations for 100 bps in cuts.

The jobs data will likely remain volatile in the coming months, which could create a big gyration across markets as they try to handicap the odds of where monetary policy will be heading.