PeopleImages

If you are a long-term reader of our weekly commentaries and our annual outlooks, you are no doubt familiar with our thoughts about cryptocurrencies. If you are new to our writings, then here is a short summary: at this point in the 16-odd years of this asset class, it exists essentially as speculation for speculation’s sake, with a real-world use case limited to underworld transactions on the dark web. Oh, and as a way for El Salvador’s autocratic president to style himself as the “world’s coolest dictator.” All of which is to say, we do not consider Bitcoin (BTC-USD) and its ilk as suitable additions to the portfolios we construct around the long-term financial goals and attendant risk considerations of our clients.

Plus Ça Change

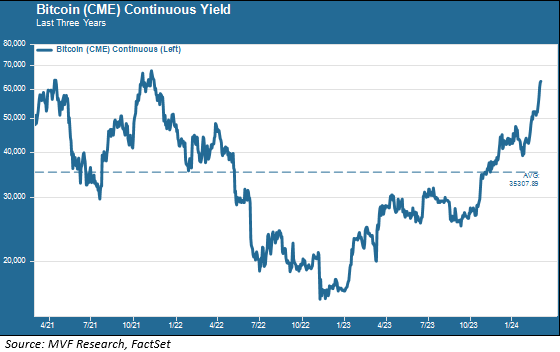

That’s not to say that we don’t get asked about crypto – we do, quite often, especially in times like the present when the speculative spirits are once again running high and bidding up prices to close in on record high levels. Here’s a picture of Bitcoin, the granddaddy of crypto, from the last wave of euphoria in 2021 to the despairing pits of 2022 and back again.

That’s a whole lot of movement, suggesting that some fundamental changes must have happened with the asset – right? Anyone? Bueller? In fact, nothing much in a fundamental sense has changed at all. Other than the people who attend those over-the-top conferences where the high priests of crypto gather to spread their gospels, nobody really has a use for blockchain currencies in their daily lives. Thanks to other digital technologies like contactless payment systems, paying for things has never been easier. Tap, swipe, hover, whatever – but none of that involves cryptocurrencies, which are, in fact, quite clunky when one tries to apply them in a typical transactional setting.

Nor do they have any real function as a store of value because there is no tangible basis for the value. Bitcoin aficionados will prattle on endlessly about its “scarcity value,” deriving from the fact that only a limited amount of that particular currency will ever get produced, but that ignores the existence of literally thousands of other blockchain “currencies” that, in a world where they actually mattered, would be fungible with each other. The difference between Bitcoin and Ethereum (ETH-USD) and Dogecoin (DOGE-USD) and all the rest is hardly the same thing as the difference between gold, silver, platinum, copper and natural gas – commodities that actually have uses in the real world.

Number Go Up

So what explains those seismic shifts, and especially the apparent stampeding of the bulls that is going on now in crypto markets? Last year, author Zeke Faux coined a phrase that became the title of his book, a bestseller among the crop of 2023 business reads: “Number Go Up.” That phrase pretty much explains it: how a bunch of digital ones and zeros with no demonstrable value suddenly turned into trillions of actual dollars. A group of people – not so much large in number as outsize in tech-world influence – simply wanted the number to go up and hyped the living daylight out of things until it did. Remember those Super Bowl ads in 2022 with A-list celebrities pumping up cryptocurrencies and their misbegotten stepchildren of the cultural milieu, non-fungible transactions (NFTs)? But then interest rates went up, and the pumpers did what pumpers normally do and dumped, and the crypto crash was on.

The subtitle of Zeke Faux’s book was “Inside Crypto’s Wild Rise and Staggering Fall.” Now, of course, he will have to update that subtitle to “…and Wild Reincarnation From the Ashes.” Although, as we noted above, nothing fundamental has changed in regard to the properties of blockchain currencies, a recent SEC regulation permitting Bitcoin ETFs has made it easier for the average Dick and Jane to trade them (i.e., take a punt on them). The FOMO-meter, the only thing that truly matters in driving the price for crypto, is back in fifth gear. Now it’s just a question of waiting for whatever comes along that will send the animal spirits into reverse again.

So what do we say when the question comes up about whether we will ever change our views about the appropriateness of cryptocurrencies as an asset class for long-term portfolios? We approach any asset with an open mind, we will say, and if something ever comes along to convince us otherwise, we will be happy to change our tune. There’s no ideological animosity here, just an unbiased accounting of pros and cons. Until that compelling case comes along, though, we will leave Bitcoin and its ilk to those who enjoy speculation for its own sake.

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.