Ralf Hahn

Did Meta and Amazon Just Save Earnings Season?

Big tech earnings kicked off earnings season last week and not all of the results were so magnificent.

Alphabet (GOOG) (GOOGL) and Microsoft (MSFT) got things started on Tuesday, and while both surpassed top and bottom-line expectations, it wasn’t enough for investors.

Weak advertising revenues for GOOGL resulted in a nearly 6% stock price decline in the wake of the report,[1] and light guidance from Microsoft also didn’t go over well with investors.[2]

Given the momentum tech had into these reports and rich P/E levels, investors were less willing to forgive minor stumbles. The same went for Apple (AAPL) which reported disappointing revenue from China on Thursday, the stock fell over 5% in the hours after the report before climbing back on Friday.[3]

The two standouts for last week were undoubtedly Meta (META) and Amazon (AMZN), both handily beating expectations on the top and bottom line.[4]

Even sweeter for Meta investors was the announcement of the company’s first ever dividend of $0.50 as well as a $50B buyback plan.[5]

CEO Mark Zuckerberg also vowed to “keep things lean,” a strategy that has worked well for the social media company, who successfully pulled off the “year of efficiency” in 2023.[6]

As a result of better-than-expected reports last week, the FactSet blended S&P 500 EPS consensus now stands at 1.6%, an uptick from -1.4% the week prior.[7]

But that’s not all that moved the markets last week, the first Federal Reserve meeting of 2024 ended up being a bust when Chairman Powell indicated they are not ready to begin cutting rates yet.[8]

The CME Group FedWatch tool is now predicting a 60% probability of a rate cut at the May 1st meeting, with the likelihood of a March 20th cut falling to 21%.[9]

While markets initially fell after that news on Wednesday, they perked back up after Thursday’s tech results and Friday’s blockbuster jobs number.

Nonfarm Payrolls came in at 353k for January, and unemployment stayed at 3.7%, marking 24 consecutive months of sub-4% unemployment and the longest stretch since the 1960s.[10]

Industrials, Pharma and Consumer Discretionary Take Center Stage

We get results from a smattering of sectors this week including the restaurant space (McDonald’s (MCD), Chipotle Mexican Grill (CMG)), Industrials (Caterpillar (CAT), Uber (UBER)), pharma (Gilead (GILD), Eli Lilly (LLY)) and always highly anticipated Disney (DIS).

Source: Wall Street Horizon

Outlier Earnings Dates this Week

Academic research shows that when a company confirms a quarterly earnings date that is later than when they have historically reported, it’s typically a sign that the company will share bad news on their upcoming call, while moving a release date earlier suggests the opposite.[11]

This week, we get results from a number of large companies on major indexes that have pushed their Q4 2023 earnings dates outside of their historical norms.

Nine companies within the S&P 500 confirmed outlier earnings dates for this week, all of which are later than usual and therefore have negative DateBreaks Factors*.

Those names are McDonald’s Corporation, IDEX Corporation (IEX), Edwards Lifesciences Corp (EW), Mid-America Apartment Communities (MAA), McKesson Corporation (MCK), The Hershey Company (HSY), ConocoPhillips (COP), T. Rowe Price (TROW) and Catalent Inc. (CTLT).

* Wall Street Horizon DateBreaks Factor: Statistical measurement of how an earnings date (confirmed or revised) compares to the reporting company’s 5-year trend for the same quarter. Negative means the earnings date is confirmed to be later than historical average, while Positive is earlier.

Q4 Earnings Wave

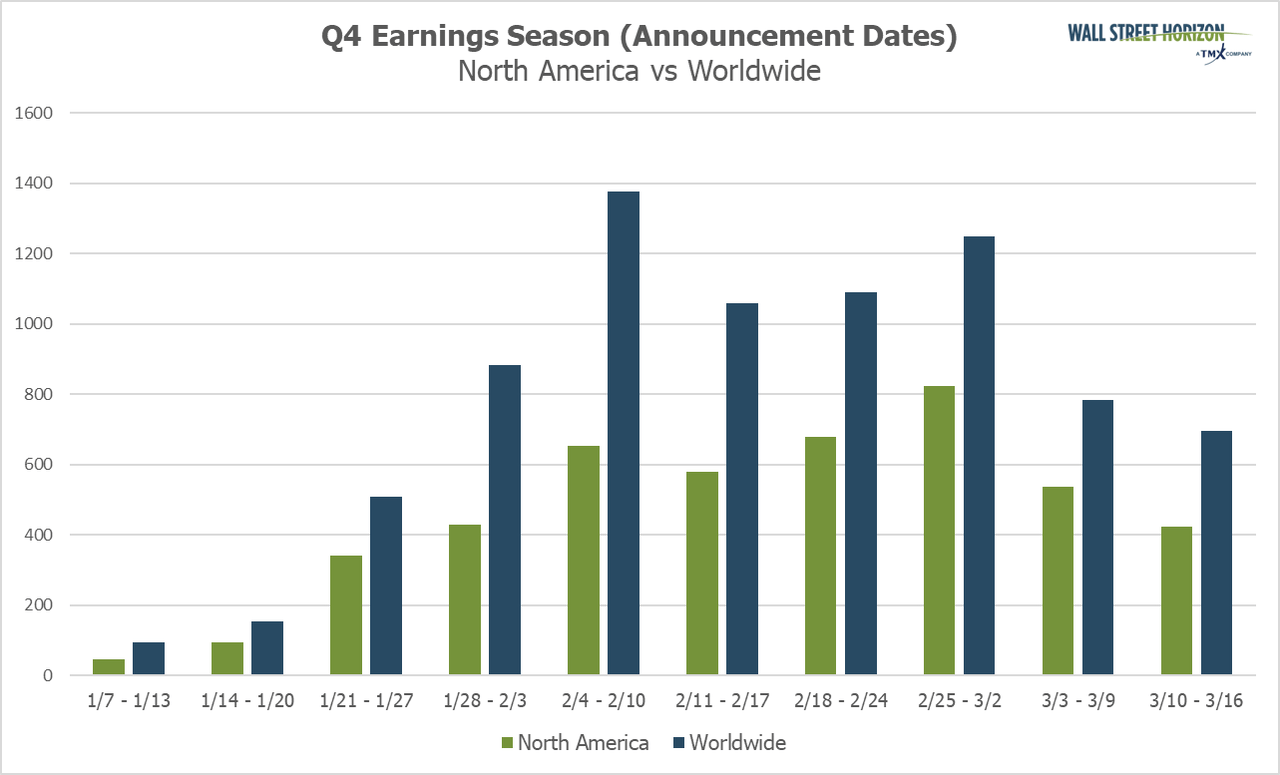

This season, peak weeks will fall between January 29-March 1, with each week expected to see over 1,000 reports. Currently, February 22 is predicted to be the most active day, with 561 companies anticipated to report.

Thus far, 64% of companies have confirmed their earnings date and 18% have reported (out of our universe of 10,000+ global names). Roughly 46% of the S&P 500 has reported.

Source: Wall Street Horizon

1 Alphabet Announces Fourth Quarter and Fiscal Year 2023 Results, January 30, 2024

2 Earnings Release FY24 Q2, Microsoft, January 30, 2024

3 Apple reports first quarter results, February 1, 2024

4 Amazon.com Announces Fourth Quarter Results, February 1, 2024

5 Meta Reports Fourth Quarter and Full Year 2023 Results; Initiates Quarterly Dividend, February 1, 2024

6 Fourth Quarter 2023 Results Conference, Meta, February 1, 2024 Call

7 Earnings Insight, FactSet, John Butters, February 2, 2024

8 Federal Reserve issues FOMC statement, January 31, 2024

9 CME FedWatch Tool, CME Group, February 2, 2024

10 Employment Situation Summary, U.S. Bureau of Labor Statistics, February 2, 2024

11 Time Will Tell: Information in the Timing of Scheduled Earnings News, Journal of Financial and Quantitative Analysis, Eric C. So, Travis L. Johnson, Dec, 2018