kotangens/iStock via Getty Images

Investment thesis

Our current investment thesis is:

- NCLH is a capital-intensive business that needs to invest heavily to accomplish consistent growth, owing to capacity constraints across its fleet. The business is close to fully ramped up, with occupancy exceeding 100% and price-driven revenue soaring. This should contribute to a strong trajectory, although we are concerned that its future returns will not preserve holding the stock. We ascribe this to its mediocre share price performance historically.

- Although NCLH appears slightly undervalued, we do not see sufficient upside to imply a buy rating.

Company description

Norwegian Cruise Line Holdings Ltd. (NYSE:NCLH) is a global cruise company that operates cruise lines under the Norwegian Cruise Line, Oceania Cruises, and Regent Seven Seas Cruises brands. Headquartered in Miami, Florida, NCLH offers a variety of cruise experiences, including contemporary, premium, and luxury cruises, sailing to numerous destinations worldwide.

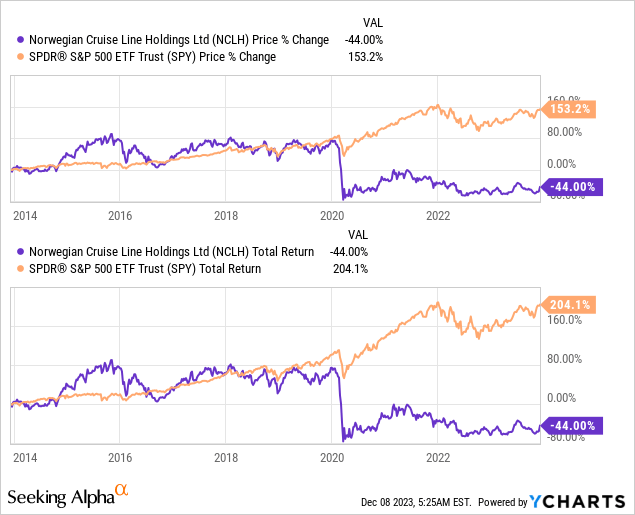

Share price

NCLH’s share price performance has been disappointing, primarily due to the impact of the pandemic. Prior to this, its returns were underwhelming due to an unattractive financial profile.

Financial analysis

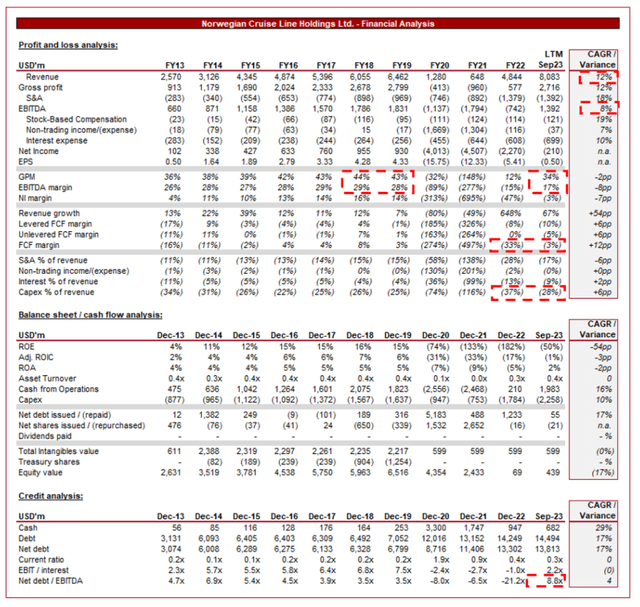

NCLH’s financials (Capital IQ)

Presented above are NCLH’s financial results.

Revenue & Commercial Factors

NCLH’s revenue growth has been impressive despite the issues it faced during the pandemic, with a CAGR of +12%. Profitability has lagged behind this, with EBITDA growing at an +8% rate.

Business Model

NCLH operates multiple cruise brands, including Norwegian Cruise Line, Oceania Cruises, and Regent Seven Seas Cruises. This multi-brand strategy allows the company to cater to different market segments, geographies, and consumers, from mainstream cruising to luxury experiences.

A key element of NCLH’s business model is “Freestyle Cruising,” which emphasizes flexibility and choice for passengers. This includes open dining options, diverse onboard activities, and a relaxed dress code, providing a more customized and informal cruise experience.

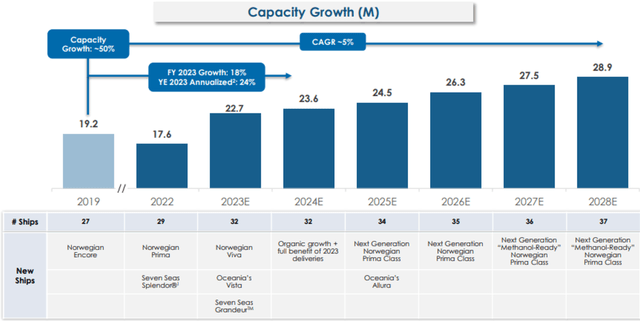

NCLH is investing heavily in fleet modernization and expansion, introducing new ships with innovative features and technologies. This not only attracts new customers through marketing its new features, but also encourages repeat business from existing customers who seek novel cruise experiences. As the following illustrates, Management is expected to boost capacity at a CAGR of ~5% into FY28F.

NCLH’s Latitudes Rewards Program incentivizes repeat business and ongoing relationships with customers. Rewards, benefits, and exclusive offers inspire passengers to select NCLH for their subsequent cruises, a strategy that is highly successful in the airline and hotel industry.

NCLH maximizes onboard revenue through various channels, including specialty dining, entertainment, shore excursions, and retail. The improvement and enhancement of these venues is a core component of its fleet expansion. This diversified revenue stream contributes significantly to the overall profitability of each cruise.

The cruise industry is positioned to grow well long term, owing to an aging population in the West, alongside a growing middle class in developing nations. This is an underrated tailwind as its target demographic is generally more wealthy and thus positions NCLH well for a steady long-term trajectory.

NCLH competes with the following leading cruise providers:

- Carnival Corporation & plc (CCL): The largest cruise company globally, operating multiple cruise brands.

- Royal Caribbean Group (RCL): A major competitor known for innovation and diverse offerings.

- MSC Cruises: Growing presence in the cruise industry, particularly in the European market.

Although competition is high, each business has done well to carve out their own niche, attracting a subset of customers. As an example, RCL is known for its enormous, feature-filed ships (seek “the Wonder of the Seas” for an example) while Regent Seven Seas Cruises is known for its extravagances and luxury.

Margins

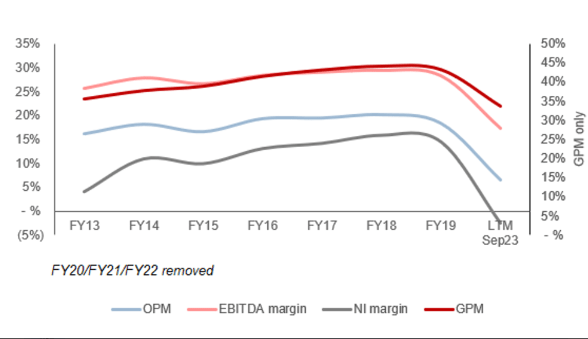

Margins (Capital IQ)

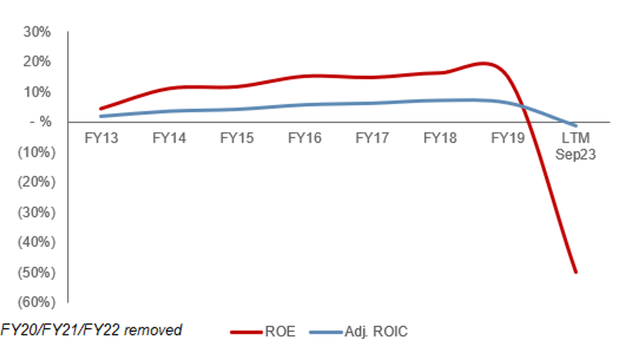

NCLH’s margins had trended positively prior to the pandemic, primarily driven by unit economics as the company expanded its fleet and capabilities. Between FY13 and FY19, GPM increased by +7ppts while S&A spending as a % of revenue offset this (+4ppts).

Subsequent to the pandemic, NCLH has benefited from inflationary price increases, allowing for margin improvement without a corresponding uplift in margins, with revenue already exceeding their pre-pandemic level despite margins falling short.

We believe there is reasonable scope for NCLH to push toward its historical level again, although appears unlikely given the limited improvement thus far. Occupancy already exceeds 90% and so the runway for advance ramp-up is limited.

Quarterly results

NCLH is currently in the second phase of its ramp-up from the pandemic period, with an acceleration that comes with highly utilized experiences provided consistently to customers. Its top-line revenue growth was +211.7%, +249.1%, +85.8%, and +57.0% in its last four quarters.

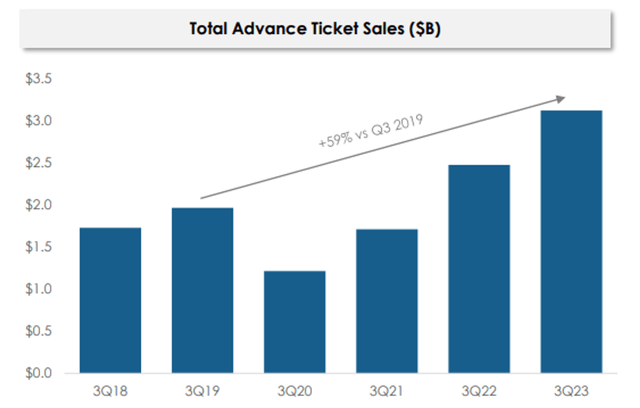

This has been driven by a combination of factors. Advance ticket sales began accelerating in late 2022 and continues to compound currently, materially accelerated by inflationary price increases that consumers have shown a willingness to adopt. advance, there is clear demand in the market for cruise experiences, with the pandemic contributing to pent-up demand among a cohort of individuals that are financially positioned to ride any downturn.

Looking ahead, we are slightly concerned that macroeconomic factors could negatively impact its broader upward trajectory. Positively for NCLH, its clientele are higher earners / wealthy individuals, allowing for a degree of inelasticity. Nevertheless, however, a negative impact will be experienced.

Key takeaways from its most recent quarter are:

- NCLH met or exceeded all key guidance metrics in the quarter, continuing its strong outperformance track record.

- Revenue per customer is +16% ahead of 2019, while occupancy has reached 106%.

- Management is initiating cost reduction projects as a means of improving margins. This is slightly disappointing to see given it indicates Management is not confident that scale will be sufficient to drive margin appreciation.

- Advance sales balance sits at $3.1b, 59% higher than 2019.

Balance sheet & Cash Flows

NCLH’s balance sheet is bloated following successive debt raises to shore up the company’s finances during the pandemic. At a ND/EBITDA ratio of 8.8x and interest comprising 9% of revenue, the company is burning through cash as it seeks to invest in growth.

This leads us to the biggest issue currently, and the reason for its poor historical performance, NCLH is cash-hungry. During the last decade, its FCF margin has been negative in 6 of the years. The company’s capex commitments are substantial, offsetting any of the attractiveness in its EBITDA-M.

Given this has not fallen below 22% of revenue once, it is likely NCLH will remain at 24-28% in the near-term, limiting its attractiveness. NCLH may need to raise cash through debt (or potentially equity) in the coming 12 months.

Outlook

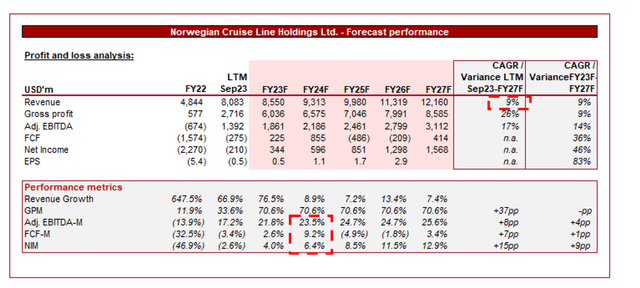

Presented above is Wall Street’s consensus view on the coming years.

Analysts are forecasting reasonable growth in the coming years, with a CAGR of 9% into FY27F. In conjunction with this, margins are expected to better, although will remain below its pre-pandemic levels.

These forecasts appear appropriate in our view. The company is expanding its fleet positively, while already close to max capacity. This implies underlying demand is strong and so should proceed positively with capacity. advance, limited margin improvement implies a return to its historical levels is unlikely.

Industry analysis

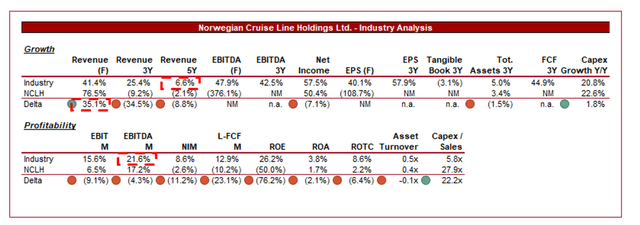

Hotels, Resorts and Cruise Lines Stocks (Seeking Alpha)

Presented above is a comparison of NCLH’s growth and profitability to the average of its industry, as defined by Seeking Alpha (25 companies).

NCLH’s industry has been materially disrupted by Covid-19, contributing to messy growth rates as businesses ramp up at different times. The 5Y metric is a useful indicator in our view, as many businesses have seen an offsetting benefit from inflation on revenue, contributing to a reasonable reference rate. In this case, NCLH’s forecast growth of 9% exceeds the industry average.

NCLH’s margin performance is disappointing. The company is significantly less profitable than its peers, while burning through cash at a rapid rate. Investors must ask themselves whether future returns will be sufficient to subsidies this company during an extended growth phase through capex investment. Exposure to discretionary industries can come with superior unit economics and less cyclicality with Hotels, for example.

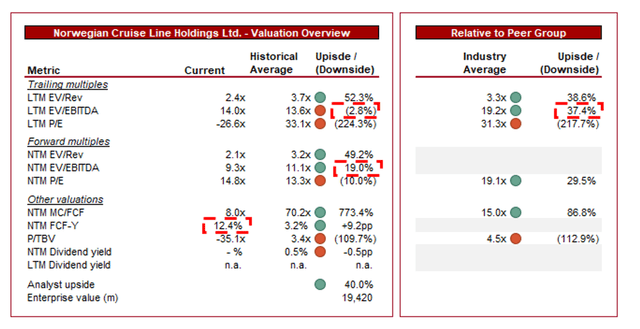

Valuation

NCLH is currently trading at 14x LTM EBITDA and 9x NTM EBITDA. This is a discount to its historical average on a NTM basis.

A discount to its historical average is warranted in our view, owing to the company’s margin erosion and continued heavy capex commitments, both limiting the scope for shareholder returns through cash distributions. Our view is that a discount beyond the current level is warranted,

advance, NCLH is trading at a discount to its peers on an LTM EBITDA basis (~37.4%) and on a NTM P/E basis (~29.5%). A discount is warranted in our view, owing to the long-term scope for shareholder returns on a relative basis and the asset-heavy nature compared to franchising hotels.

Overall, NCLH is likely marginally undervalued, although we do not believe its overall position is highly attractive. We struggle to see the long-term value creation potential relative to its peers, so long as cash investment remains high.

Key risks with our thesis

The risks to our current thesis are:

- [Upside] Strong demand recovery.

- [Upside] Effective cost management contributing to margin improvement.

- [Downside] Lingering pandemic-related challenges or economic downturn.

- [Downside] Adverse geopolitical events.

Final thoughts

NCLH is a solid business with a reasonable runway for good growth, owing to industry tailwinds and a solid business model. It owns market-leading brands and has the expertise to deliver on a scale globally that is only rivaled by a handful of firms.

The issue we have is that its financial profile is not very attractive, particularly relative to others in the wider industry. Its capex commitments will drive healthy growth but it is diverting cash from shareholders.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.