miroslav_1/iStock via Getty Images

Summary

In our initial report on Northview Residential REIT (TSX:NRR.UN:CA) back in October 2023, we outlined our bull thesis for the REIT. The recapitalization transaction had deleveraged the balance sheet, reduced the distribution rate to a sustainable level, internalized asset management, and converted the REIT from an externally managed, closed-end structure to a traditional listed REIT structure. Due to the significant financial underperformance of the REIT and non-traditional structure, Northview was trading at an enormous discount to intrinsic and relative value. We believed that increased coverage of the REIT from sellside analysts was an essential catalyst in a unit price recovery.

On December 19, 2023, CIBC initiated coverage of Northview, leading to a ~40% rally over the following weeks. We were delighted to see a core part of our thesis play out this well, and this quickly.

In this report, we provide an update for Q4 earnings, which include the full impact of the acquisitions from the recapitalization, and outline why we still believe the REIT is undervalued.

Earnings Update

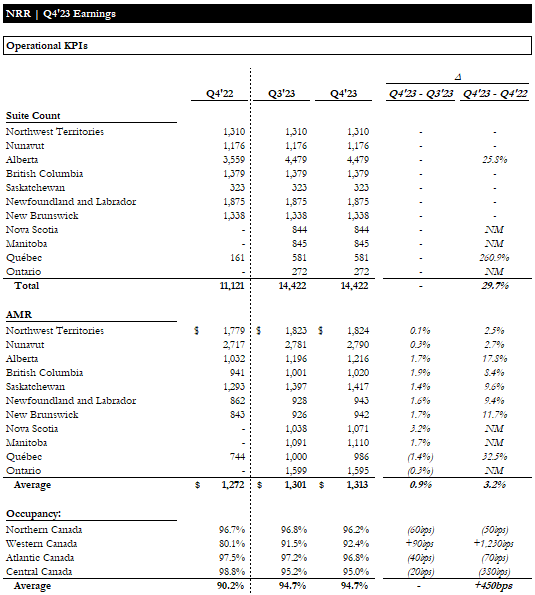

Operationally, Q4 brought no surprises. The suite count was unchanged from Q3 following the recapitalization. Occupancy remained stable at +95% across Northern, Atlantic, and Central Canada. Western Canada saw further improvements in occupancy, with a 90bps pickup QoQ. Rent growth was fairly robust across all provinces except for Quebec and Ontario. Note that the QoQ comparison is not perfect, as the prior quarter’s average rents did not fully reflect the full impact of the recapitalization acquisitions. Another point to note is that rents in Northern Canada are predominantly generated from long-term contracts with government/public sector counterparties, so rent growth appears lower than one would expect. We anticipate a material step-up in rents in Northern Canada when these contracts expire.

Earnings Update – Operations (Empyrean; NRR)

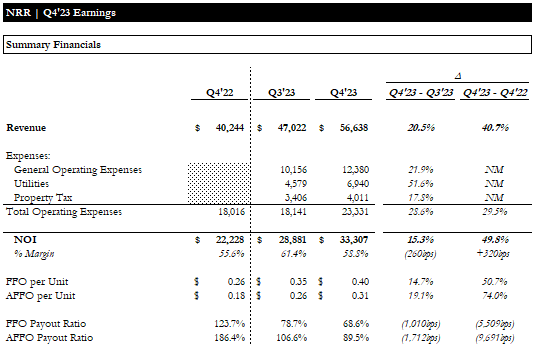

Turning to the financials, the comparison QoQ is not very material as Q3 did not include a full 3 months of contribution from the acquired properties. Thankfully, there are a few metrics which we can draw meaningful comparisons from. The NOI margin was down sequentially, as Q4 is typically a lower margin quarter than Q3, but it was +320bps better than the comparable quarter in ’22.

FFO and AFFO per unit improved significantly QoQ and YoY, as we had expected, due to the full quarter’s contribution from the acquisitions and net debt paydown. This decreased the payout ratio to ~69% on FFO and <90% on AFFO. While the AFFO payout is still too high, it is moving in the right direction and is now technically sustainable.

Earnings Update – Financials (Empyrean; NRR)

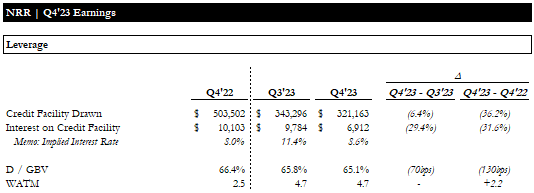

A major factor in improving FFO/AFFO metrics has been the ongoing paydown of the credit facility, which is the most expensive component of the debt stack. Northview made net repayments of ~$22MM over Q4 (n.b., ~6% of the outstanding balance), and the interest paid on the facilities dropped ~$3MM. The D / GBV ratio improved by ~70bps to ~65% – still too high but moving in the right direction. Importantly, the recapitalization extended the WATM on Northview’s debt to ~4.7 years.

Earnings Update – Leverage (Empyrean; NRR)

While there is still much work ahead of Northview to reduce leverage and win back the market’s confidence in the distribution, we are seeing it do all the right things.

Valuation

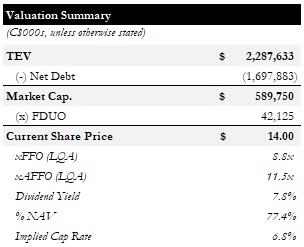

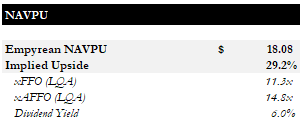

Since the CIBC report, Northview has consistently traded around $14/unit, representing 8.8x and 11.5x LQA FFO and AFFO, respectively. This is ~23% below our NAVPU estimate and represents a ~6.8% implied cap rate. Its ~8% yield is the highest within the Canadian residential universe and probably the US residential names.

Valuation Summary (Empyrean; NRR)

Our revised NAV estimate of ~$18/unit implies a ~29% upside and a ~11x and ~15x FFO and AFFO multiple, significantly below comparable residential REITs.

NAV (Empyrean)

Our NAV estimate is based on a ~6.4% blended cap rate and NOI of ~162MM (n.b., ~3% higher than LQA NOI).

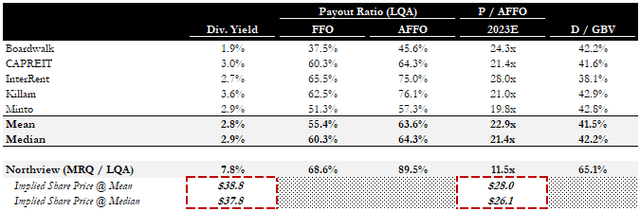

In addition to being undervalued relative to its underlying portfolio value, Northview is also deeply discounted relative to its close Canadian multifamily peers. Given its significant exposure to properties in remote and rural areas and elevated leverage, Northview should trade at a discount to peers (n.b., remote properties are more capital intensive and trade at wider cap rates). At even a modest discount to its peers’ multiples/yields, Northview could trade significantly higher than our NAVPU estimate.

Canadian Multifamily Comps (Empyrean; Various)

Risks

Low Trading Liquidity

With only a ~20% public float, major institutions are unlikely to be able to accumulate significant positions in Northview’s units. It is essential to maintain trading discipline when establishing positions in less liquid securities and to size them according to your risk tolerance.

Northview also has a significant amount of redeemable LP units (n.b., ~10% of fully diluted units outstanding) that were issued in the recapitalization. These units are in equal instalments on the 12th, 15th, 18th, and 21st month anniversaries of the transaction. While these units are redeemable in cash or Class A units, at the Company’s option, we expect these to be redeemed in units given the Company’s liquidity and leverage position (i.e., cash would be preferentially used to repay debt). Thus, should the holders of these units subsequently sell their newly converted (and now listed) units, the float would increase, which may help mitigate this risk.

Leverage

While the recapitalization and recent pay downs of the credit facility have significantly reduced Northview’s overall leverage and exposure to variable rates, it is still highly leveraged compared to peers (n.b., ~65% D/GBV vs peers’ median at ~42%). While this is unlikely to be an existential risk, especially given the strong operating performance and the high probability that we are approaching peak rates, it is likely to weigh on trading multiples and be a headwind to FFO/AFFO growth. Conversely, Northview will likely provide the most leverage to any future rate cuts (n.b., a 25bps reduction in base rates would increase AFFO per unit by ~2%).

Conclusion

Since our initial report on Northview, we have had two core elements of our thesis play out. First, CIBC initiated coverage of the REIT in mid-December, leading to a ~40% rally. Second, the Company published Q4 results showing the full impact of the recapitalization transaction and subsequent deleveraging. So far, the market has yet to react to the results as we anticipated, with the unit price seemingly stuck at $14. Nevertheless, we believe Northview is undervalued and maintain our Buy rating with a ~$18/unit target price. We see the potential for the units to trade higher if the market can re-rate them closer to its Canadian multifamily peers. Even at a sizeable discount to peers, which we believe is warranted given elevated leverage and payout ratios, the units could trade well above ~$20.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.