Svetlana Repnitskaya/Moment via Getty Images

Investment Thesis

Northern Oil and Gas (NYSE:NOG) deals in the upstream energy business. The firm has reported solid financial results in the last three years and started paying high dividends to its shareholders. I will be examining the financials of the company and the demand and prices of the company’s products. It has significantly increased its production levels and expanded its footprint through acquisitions which can help it to capture existing solid demand and sustain growth.

About NOG

NOG is an energy firm based in the United States that carries out the acquisition, development, exploration, and production of oil and natural gas properties mainly in the Permian, Appalachian, and Williston Basins. Later it expanded its presence in the Permian region and also accelerated its diversification through large acquisitions in the basins of Appalachian. The company deals in oil and natural gas production and exploration by engaging on a proportionate basis along with third-party interests in wells that are drilled and completed in spacing units that comprise its acreage. The company had approximately 272 thousand net acres and about 9800 gross wells at the end of the third quarter. It increased an additional 18,800 acres to its Permian footprints since the beginning of the fiscal year.

Financials

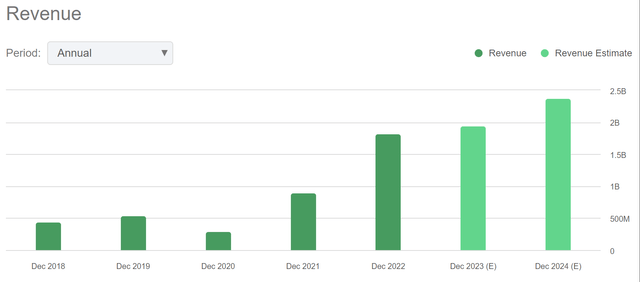

Revenue Trends of NOG (Seeking Alpha)

NOG has achieved huge growth in the last three years. The company’s oil & gas revenue was $975.1 million in FY2021 which is a humongous rise of 200.9% YoY from $324.1 million in FY2020. In the succeeding year, the company’s oil & gas revenue grew to $1.99 billion which is an increase of 103.65% YoY. The increased production and prices of oil & natural gas have helped the company to achieve this solid growth in the last three years.

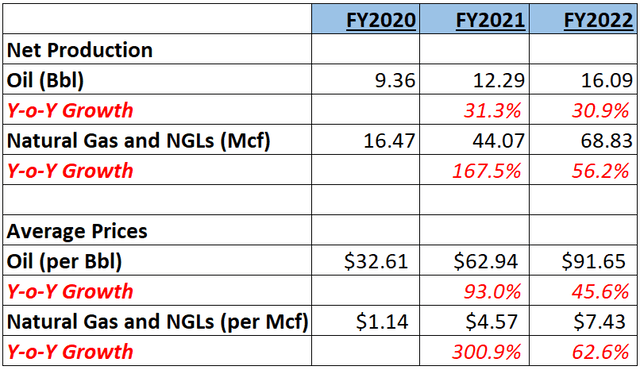

Production and Selling Price History of NOG (Value Quest)

The oil & gas industry is highly volatile and exposed to the risk of market fluctuations. It has been impacted in the past three years due to elevated interest rates, rising material costs, and geopolitical conflicts. The geopolitical conflicts have resulted in disrupted supply and demand and high prices of oil & natural gas. The elevated revenue has resulted in significant growth of the net income.

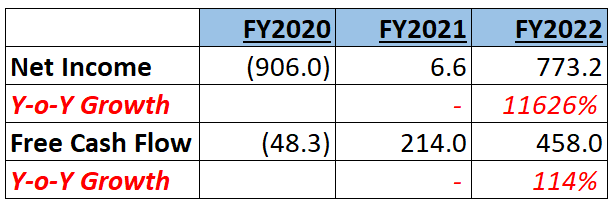

Net Income and FCF History (Value Quest)

In FY2021, the company’s net income was $6.6 million which is equivalent to 0.68% of oil & gas revenue and huge growth compared to net loss of $906 million in FY2020. Its net income skyrocketed in FY2022. The company reported net income of $773.2 million in FY2022 which is 38.85% of oil & gas revenue. The primary driver of this growth is favorable product prices and revenue growth outpacing the operating expenses growth.

Even in 2023, the industry has shown positive signs. The global demand has surged by 2.2 mbpd and has also gone beyond the 100 mbpd point for the first time in history. This growth is mainly fueled due solid demand from China. Recently, it was noted that the U.S. is one of the leading exporters and is known for exporting large quantities which are almost close to the total production of Russia or Saudi Arabia.

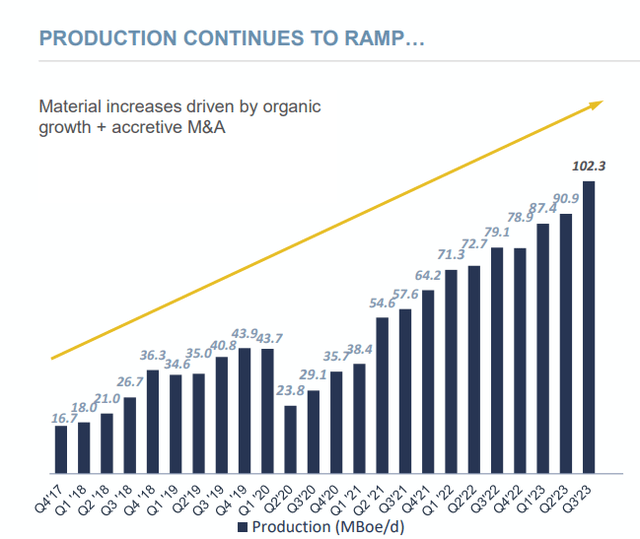

Production of NOG (Investor Presentation: Slide No: 10)

The company has reported its quarterly results. It reported a revenue of $313.97 million, down 60.33% compared to $791.64 million in Q322. This decline was mainly fueled by loss on commodity derivatives and a reduction in average sales price. Net income declined by 95.50% YoY from $580.85 million to $26.11 million. It reported a diluted EPS of $0.28. This mainly resulted from an increase in production expenses and noncash expenditures. Oil and Gas represented about 62% and 38% respectively of the company’s production portfolio. NOG reported $879 million in liquidity and adjusted EBITDA stood at $385.50 million. The company has increased its production in Q3 by 13% QoQ to 102,327 Boe per day compared to the second quarter. This upside was achieved due to a 42% rise in the production levels in the Permian Basin on a sequential basis.

The company performed well in the third quarter even though the macroeconomic tensions were overpowering and I believe it can expand its profit margins in the future as it has significantly accelerated its production levels compared to the previous year which can help it to address the market demand and increase its customer base. The management also has a positive outlook to achieve growth in the upcoming quarters.

Nick O’Grady, NOG’s Chief Executive Officer, commented that NOG had experienced a highly successful third quarter characterized by ongoing operational strength, record organic growth, and achievement in acquisition. He noted that the company had shifted into harvest mode, resulting in increased free cash flow, while still actively pursuing accretive acquisitions. He highlighted the robust state of the balance sheet and the expanding scale of NOG, positioning it well to further enhance growth prospects for 2024 and beyond as they navigate through various investment opportunities.

NOG has recently announced Bolt-on acquisitions which will include core non-operated working interest properties in the Appalachian Basins and North Delaware for 107,657 shares of common stock and an initial combined purchase price of $170 million. It acquired about 0.8 net producing wells and 1.7 net wells-in-process in Jefferson, Belmont, Ohio, and Monroe Counties. It has also expanded its presence in the Northern Delaware Basin by acquiring non-operated interests in Lea and Eddy Counties and New Mexico across 3000 net acres with around 1.0 net wells in process and 13.0 net producing wells. The combined average production for 2024 is expected to be 6500 Boe per day. After the closing of the transaction, the company will have 40,000 net acres of Permian land and can become its largest basin in terms of production as well as activity. On the Appalachian front, the firm will have its presence in the core of Utica which also has a high potential for expansion in the longer term. In addition, it is expecting a capital expenditure of $33 to $38 million. The cash flow from operations for the acquisitions is predicted between $57.5 to $62.5 million, indicating a purchase price multiple of 2.8- 3.0x. I believe these acquisitions highly align with the company’s trajectory of production growth and can benefit the firm in accelerating its production levels on a notable level.

The macroeconomic variables such as rising interest rates might continue to affect industry in FY2024 as inflation is still significantly high. According to IEA, the global demand for oil can decrease approximately to 180,000 bpd in 2024 due to EV penetration and complete recovery after the pandemic. I think the oil prices might decrease significantly in FY2024 as IEA expects that the global oil supply growth can outpace the demand growth. Even if the supply growth surpasses the demand growth the prices might still be higher than prices in FY2022 as 2024 is just the starting of higher supply growth. The company’s increased production can help the company to capture the existing demand in the market. That is why, I believe it is reasonable to assume that the company can surpass EPS of FY2022 in FY2024. I am assuming a growth rate of 2.2% in FY2024 from an EPS estimate of $6.75 in FY2023 (3.4% growth compared to EPS of FY2022) as the global production and price might decrease in FY2024 compared to FY2023. Therefore, I am predicting the company’s EPS for FY2024 to be $6.90.

Dividend Yield

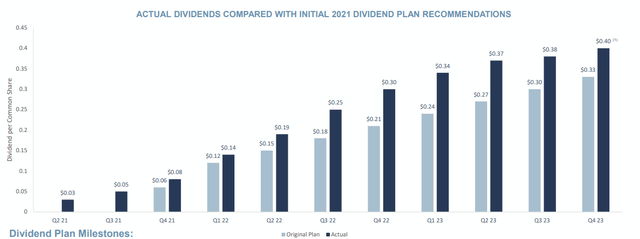

The company has started paying dividend since FY2021. It has managed to maintain excellent cash positions which was mainly fueled due to its increased operations. In FY2023, NOG distributed dividends of $0.34, $0.37, $0.38, and $0.40 in Q1, Q2, Q3, and Q4, respectively, which makes the annual dividend $1.49. The FY2023’s annual dividend represents a dividend yield of 4.43% compared to the current share price of $33.56. The company’s dividend yield is 13.29% higher than the sector median dividend yield of 3.91%. NOG’s FCF payout ratio in FY2021 was 9% and in FY2022 it was 17%. The management is projecting a record free cash flow generation in Q4FY2023. Therefore, I am assuming that the company might increase the dividend distribution in FY2024 and can pay $0.42 quarterly dividend which is an annual dividend of $1.68. If we compare the annual dividend of $1.68 with current share price, we will get a dividend yield of 5.01%. The business is expanding its production levels and acquiring new businesses which support dividend payment increases. This appealing dividend yield makes the company an attractive stock, especially for risk-averse and retired investors.

Actual vs Initial Dividend Plan of NOG (Investor Presentation: Slide No: 10)

What is the Main Risk Faced by NOG?

The company highly depends on third parties to market its oil and natural gas. These operations rely on various factors: proximity and capacity of pipeline systems, processing facilities, rail transportation assets, and oil trucking fleets owned by third parties. If these services by external sources get disrupted due to reasons such as physical damage or other legal challenges, it can negatively impact the company’s operations and can further reduce its profitability by reducing its sales levels.

Valuation

The oil & gas industry is growing rapidly which is reflected in its positive demand dynamics. I think the firm is positioned well to cater to the growing demand as it has expanded its production levels which can help it to increase its market share and profitability by selling additional volumes from its elevated production levels. After considering all these factors, I am estimating an EPS of $6.90 for FY2024 which gives the forward P/E ratio of 4.86x. The comparison of forward P/E ratio of 4.86x with the sector median of 9.76x indicates that the company is undervalued. I think the firm can potentially grow in the next year as a result of solid existing demand in the industry and NOG’s increasing production levels which can help it to trade above its current P/E ratio. I estimate that the company might trade at a P/E ratio of 6.5x in FY2024, giving the target price of $44.85, which is a 33.64% upside compared to the current share price of $33.56.

Conclusion

The company has reported its financial results and experienced resistance in the growth levels however it performed well despite the macroeconomic pressures. I believe that the firm can expand its profit margins in the future quarters as it has recently increased its production levels and also implemented various acquisition plans to grow its productions which can help it to respond to the solid existing industry demand. However, the global oil demand is slowing down. The global supply growth can surpass the demand growth in the coming period. In FY2024, the product prices might continue to remain higher as the demand is still significantly higher than the supply. It also pays an attractive dividend which I believe can increase in the future as the cash flow increases due to its expanded operations. The stock is currently undervalued and I think it can grow by 33% from the current price levels as a result of its expansion activities and improving demand in the market. After analyzing all the above scenarios, I assign a buy rating to NOG.