SweetBunFactory

Dear readers/followers,

In this article, I’ll be updating my long-term thesis on Nordic Semiconductor ASA (OTCPK:NDCVF) (OTCPK:NRSDY), a Norwegian niche company without a dividend. The company has strong fundamentals, including sector-beating KPIs and a market-leading position in ultra-low-power wireless communication solutions.

I have in fact, covered this company several times in the past, making this an article update. The last article can be found here.

This is not in any way a bad company. Despite recently declining revenues in 2Q, the company maintains high gross margins and solid EBITDA margins, with potential for future growth. In 3Q, we’ll look at what changes come to the revenue and to the quarterly trends, but I expect no surprises or massive changes here.

The semiconductor space remains an overall risky space to be in – these companies, if you look at other investments, remain at very expensive multiples and at overall high-risk potential, with a very low typical yield.

Often, as in this case, the yield is even zero.

This means that their main upside is always capital appreciation – and in order for you to get this, you need to be clear about investing at the right valuation.

Unlike “timing”, this is about estimating value – which is what I attempt to do in my articles.

So let me try to do the same here.

Nordic Semiconductor ASA – A 3Q23 update

I recently wrote an article on another cyclical and volatile company experiencing a negative market – also from Norway, in this case, Elkem (OTC:ELKEF). The fact is that Nordic Semiconductor experiences some not-dissimilar trends at this time, with significant negative quarterly trends, now at a 1-year low in revenues.

Why?

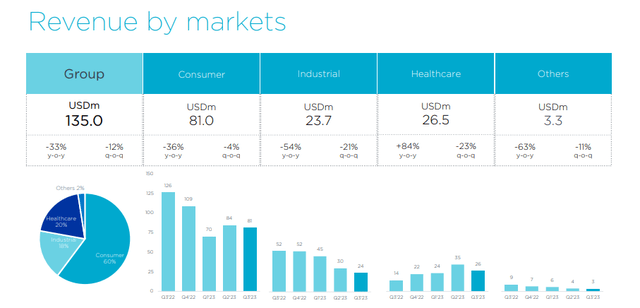

Because of the macro. Bluetooth revenue is down, gross margins and EBITDA margins are in refuse, and the company is now guiding for revenue of $110-$130M for 4Q. To contrast, the company had $200M worth of quarterly revenues in 3Q22. So that’s around half.

The downturn here is “sharp”. Sharp and cyclical, well in excess of what the company had estimated below, when it still managed an annual growth of 39% since 2019, up until the end of -22.

The company, much appreciate businesses in the same segments, is taking steps to lower its cost basis and reallocate resources.

Specifically, the company tries to maintain its leadership in Bluetooth in the Ultra-low-power solutions, while reallocating resources to its long-term projects to projects that focus on generating revenues and profits in the mid and short-term.

Also, the expected reduced use of consultants and higher degrees of economic responsibility should result in less use of capital for this company – expected effect in 2020, with an expected reduced quarter OpEx of $5M, or annualized of $20M.

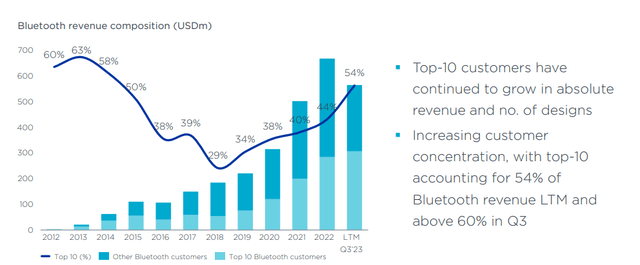

There are positives for this company. Its revenue composition in terms of Bluetooth continues to boost, and the company has really made a name for itself as a market leader in this segment.

Nordic Semiconductor IR (Nordic Semiconductor IR)

Nordic Semiconductor is now, without exaggeration, more than 5x as large as both the number 2 and number 3 individually. The company has, in the last 12 months, managed to bring 445 designs to market, marking 42% of the market share in its segment. Competitors in this market include companies appreciate Qualcomm (QCOM), and Infineon, as well as far smaller ones.

Some examples of customer products include the following, where the company’s products are being used.

Nordic Semiconductor IR (Nordic Semiconductor IR)

appreciate with the remainder of the cellular segment globally, the company is experiencing a downturn here. Because revenues in this segment depend on customer production and purchasing cycles, I do not see a material near-term upside in this part of the company’s business – neither does management, based on the forecasts (Source: 3Q23 Nordic Semiconductor ASA).

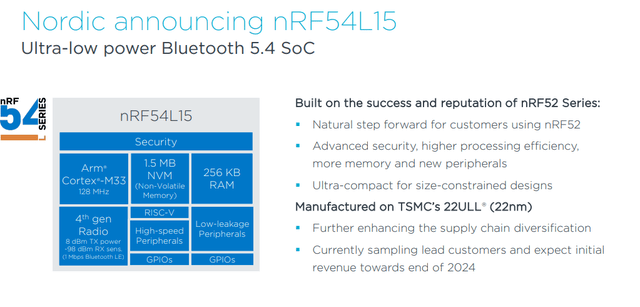

At the same time, it’s focusing on its success stories – moving forward with new products and platforms based on recent successes, appreciate the nRF54L15.

Nordic Semiconductor ASA IR (Nordic Semiconductor ASA IR)

We’re instead in a situation where Nordic Semi is still on the refuse due to a negative outlook for 2023, following a ridiculously strong 2022 and 2021, which saw EPS growth of 79% and 91% respectively.

Going into 2023, that EPS growth is expected to go back down almost to 2020 levels, below 2 NOK per share – or even lower, as of 3Q23.

Fundamentally speaking, this is a great company – and “great” might even be underestimating a bit. I say that because this company has almost no debt, with interest coverage of 175x, less than 0.35x net debt/EBITDA, and less than 0.07x debt/equity.

The company also manages a 52%+ gross margin, and even if the current net margins are impacted and sub-10%, which isn’t all that great, this is weighed up by the fact that the company now costs less than 100 NOK/share.

Fundamentally, the company is a market leader in key segments – and it’s investing in open-source RISC-V, acquiring AI tech IPs in a bolt-on M&A, with initial benefit expectations within 12-18 months from now on.

I see Nordic Semiconductor as a bit of a “sleeping dragon.” This sleeping dragon is going to awaken sooner or later. It has the fundamentals, is focused on ultra-low power solutions is an attractive main vertical. While the current markets are certainly negative, and it seems appreciate there may be no upside to the company, this is the meaning of “darkest before the dawn”.

Nordic Semiconductor ASA IR (Nordic Semiconductor ASA IR)

The company’s current main target, and what you’re looking for going forward, is maintaining a 50%+ gross margin target. If this were to go below 50%, I’d expect to see encourage weakness – though it wouldn’t necessarily mean that I’d go negative on the business.

It’s difficult being a company that’s expanding salaries and employees in an environment of lower revenues and incomes, but that is what the company is doing.

If you’re open to managing the company’s “pain”, then this could be a good investment for you. That’s why my investment in the company, as of yet, is very small. There are many options out there that do not demand me to take this sort of risk.

Let’s look at what upside exists here.

Risks & Upside

So, the risks here are fairly obvious to me – the risks of continued downward pressure. We have no solid indication for when this company is expected to reverse, or when the macro is expected to reverse. Any impact from the company’s cost optimization measures will under the current calculations only have a small impact on the company’s costs. Coupled with the current low visibility in this environment that the company itself has confirmed, this poses the main risk. We could see a continued downward pressure of over 12-20 months, or as little as 5-8.

The upside for the company meanwhile, is if the earnings start to grow again. The current analyst assess for this is 2025E. While I would agree with this assessment, I would also argue that this is extremely low visibility – and confirm this with the company’s 65%+ negative miss ratio even with a 10-20% margin of error. But if this reverts, and even just some of the premium holds, then this could be a several hundred percent upside.

Let me show you what I mean by company valuation.

Valuation

So, Nordic Semiconductor valuation is a very tricky sort of thing. This is because even at this price of 96 NOK, the company is priced at 78x P/E – and this is a discount to the 90x P/E on a normalized basis. Obviously, this makes forecasting rough unless you’re willing to go along with evaluating the company at this level.

The company has no credit rating and no yield. It’s volatility and absolute lack of forecast accuracy means that we have to be conservative here. Don’t invest in this company and expect stable development. But the upside is, that when this company goes up, it goes up.

That’s what I mean when I say several hundred percent. Because this company is a market leader, I believe it actually fair to say that the company may be trading at 50-80x P/E when and if earnings reverse – and if this becomes true, then an upside of at least 100% until 2025-2026E is not “far out there”.

Obviously, such a forecast comes with an asymmetrical amount of risk – which is why my position is low. Aside from historical levels and my own forecasts, you can see what other analysts consider this company to be worth.

Nordic Semiconductor is fairly well covered for a company this niche and this size. 11 analysts now cover the business. Unfortunately, only 3 of them are currently at a “BUY” despite a range starting at 95 NOK and going up to 155 NOK, with an average of around 110 NOK. This needs to be put in context – the company was at an average target of 240 NOK less than a year ago. That’s average. The high-end target was 340 NOK, which would have been around 150x P/E at today’s valuation.

That’s what you need to know about how “nutty” things can get for these companies.

Just as these analysts overreact on the upside, I do believe they overreact on the downside. For the small position in the company I hold, I’m prepared to stick to my long-term PT here, at 130 NOK/share, and I continue to give this company a “spec buy”. The company has not been materially in the negative since my last article, and I see a potential upside within 12-24 months.

I may buy more here, but this, dear readers, is a very speculative play.

Approach it with care.

Thesis

- To say that Nordic Semiconductor is a potentially undervalued business would, as I see it, be a very accurate statement. While the company may be in an earnings slump for 2023, the earnings reverse during the periods of 2024 and 2025E are likely to bring about significant growth, compared to the years of 2021 and 2022.

- What’s more, I don’t believe that these developments are likely to stop or go back down, but back on increased digitization and development on the digital side of things, are likely to enlarge and grow.

- Based on this, I consider this company as having a potential upside even to a very conservative growth assess. While 60-70x P/E where the company has been before is sort of a “dream scenario”, the company as upside starting as low as 20x P/E. This upside expands – and if we consider the EPS growth of 31.7% annually likely, this would imply a 30x P/E normalized based non 70%+ EPS growth in both 2024 and 2025, which then is at an upside of 22% per year, and a PT of 172 NOK.

- To be conservative, I give the company a 130 NOK PT, and a “BUY” rating though with a speculative note – and I maintain this for my December article.

recollect, I’m all about:

1. Buying undervalued – even if that undervaluation is slight, and not mind-numbingly massive – companies at a discount, allowing them to regularize over time and harvesting capital gains and dividends in the meantime.

2. If the company goes well beyond normalization and goes into overvaluation, I harvest gains and rotate my position into other undervalued stocks, repeating #1.

3. If the company doesn’t go into overvaluation, but hovers within a fair value, or goes back down to undervaluation, I buy more as time allows.

4. I reinvest proceeds from dividends, savings from work, or other cash inflows as specified in #1.

Here are my criteria and how the company fulfills them (italicized).

- This company is overall qualitative.

- This company is fundamentally safe/conservative & well-run.

- This company pays a well-covered dividend.

- This company is currently cheap.

- This company has a realistic upside based on earnings growth or multiple expansion/reversion.

This means that the company fulfills almost every single one of my criteria, making it relatively clear why I view it as a “BUY” here – though a speculative one.

Thank you for reading.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.