Miguel Alvarez/iStock via Getty Images

Introduction

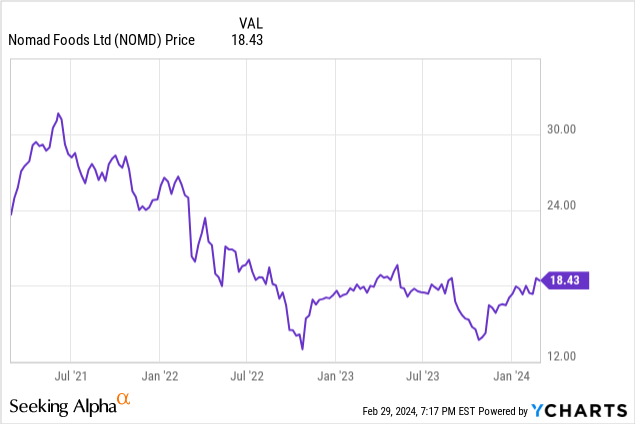

When the interest rates on the financial markets are low a “buy and build” strategy based on M&A makes a lot of sense. That’s exactly how Nomad Foods (NYSE:NOMD), a leader in frozen meals and frozen food, operated. Of course the increasing interest rates in the past few years have impacted the company as well and the aggressive expansion plans have come to a screeching halt. That’s fine, as it allows the company to further consolidate its efforts and focus on the current product ranges while focusing on generating strong free cash flow results which ultimately result in a lower gross and net debt and lower interest expenses.

This article is meant as an update to my previous coverage of Nomad Foods, and you can find all 11 related articles here. I’d encourage you to read some of the older articles to get a better understanding of the company’s business model.

2023 was not as bad as feared

I was actually pleasantly surprised when I saw the company’s Q4 and full-year 2023 results. Looking at the final quarter of the year, Nomad Foods reported a 1.4% revenue increase which jumped to 761M EUR while the EBITDA increased by 3.2%. Meanwhile, the full-year results included a 3.6% revenue increase to 3B EUR while the organic revenue increase was approximately 4.9%. Meanwhile, the adjusted EBITDA increased by 2%.

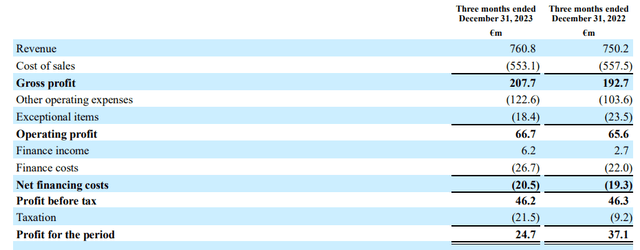

Looking at the Q4 results below, you indeed see a revenue of 761M EUR which resulted in a gross profit of almost 208M EUR. After deducting the other operating expenses as well as the exceptional items, the operating profit was just under 67M EUR, which is a 1.5% increase compared to the fourth quarter of 2022.

Nomad Foods Investor Relations

And while the finance costs increased, the net finance costs remained relatively unchanged as the higher finance expenses were compensated by a higher finance income. This ultimately resulted in a pre-tax profit of 46.2M EUR and a net income of 24.7M EUR. Based on the weighted average share count of almost 164 million shares, this represented an EPS of 0.15 EUR. That’s lower than the 0.21 EUR per share in Q4 2022 but the average tax rate was abnormally high in Q4 2023 while it was abnormally low in the fourth quarter of 2022.

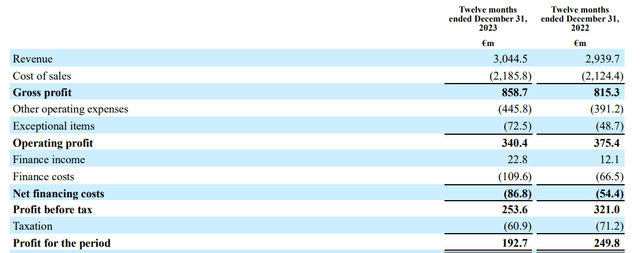

Looking at the full-year results (shown below), the total revenue of just over 3.04B EUR resulted in a gross profit of 859M EUR and an operating profit of 340M EUR. Unfortunately the total net finance expenses came in substantially higher than in 2022 (hardly a surprise) resulting in a net income of almost 193M EUR.

Nomad Foods Investor Relations

The reported EPS was 1.13 EUR, which is based on the average share count of just over 170M shares. If I would use the current share count, the EPS would come in closer to 1.2 EUR per share (or almost $1.30 per share).

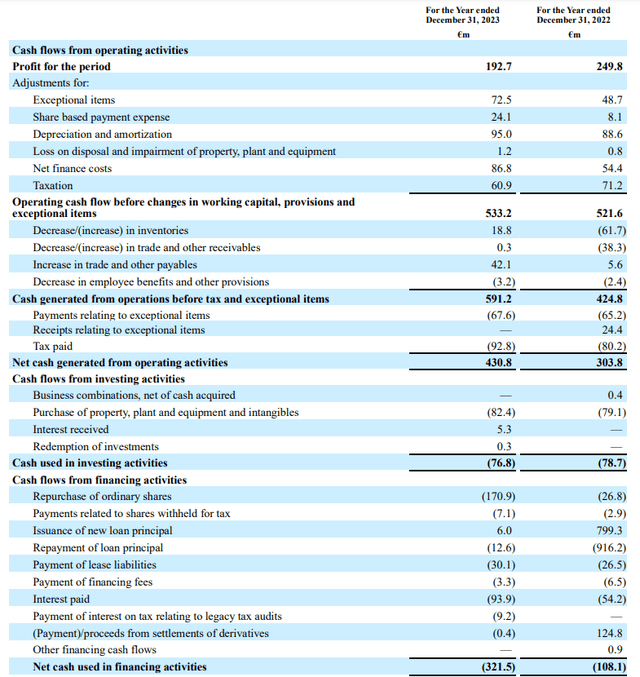

The company has always had a very strong focus on cash flow as its sustaining capex has traditionally been lower than the reported depreciation and amortization expenses. Additionally, the income statement contains share-based compensation which is a non-cash compensation as well.

Looking at the cash flow statement (below), the operating cash flow was 431M EUR but this included a 58M EUR contribution from working capital changes. It also included almost 68M EUR of exceptional items. On the other hand, it excluded the 30M EUR in lease payments, 94M EUR in interest payments and the 5.3M EUR in interest income. On an adjusted basis, the operating cash flow was 254M EUR.

Nomad Foods Investor Relations

The total capex was 82M EUR, resulting in a net free cash flow result of 172M EUR including the exceptional items and approximately 240M EUR excluding the exceptional items. Using the 172M EUR, the net free cash flow pr share was approximately 1.05 EUR using the Q4 weighted average share count which is approximately $1.13. Excluding the exceptional items, the free cash flow would have come in $0.44 per share higher.

At the end of 2023, Nomad Foods had 413M EUR in cash while its total debt came in at 2.14B EUR (including lease liabilities) for a net debt of 1.73B EUR (including lease liabilities). That’s less than 3.5 times the adjusted EBITDA so Nomad Foods is well on its way to continue to reduce the leverage on its balance sheet.

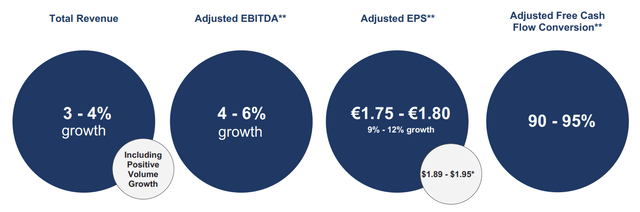

The outlook for 2024 is pretty decent

Nomad Foods also provided an initial outlook for 2024. The company expects its revenue to increase by 3%-4% while adjusted EBITDA should increase by 4-6%. When it comes to the earnings per share, Nomad is guiding for an EPS of 1.75-1.85 EUR per share. While that appears to be a substantial jump from the 2023 reported EPS, keep in mind the adjusted EPS in 2023 was 1.61 EUR per share after excluding the exceptional items. So an increase to 1.75-1.80 EUR per share is a very reasonable expectation.

Nomad Foods Investor Relations

Based on the current exchange rate, this means Nomad foods is trading at less than 10 times the expected earnings. As we know the sustaining capex is lower than the depreciation expenses, the sustaining free cash flow should be higher than the EPS and adjusted EPS. I think aiming for a sustaining free cash flow result of close to $2/share in 2024 is pretty realistic given the historical delta between sustaining capex and the depreciation.

Meanwhile, the strong underlying cash flows will help the company to reduce the gross debt and net debt level. Considering we can expect approximately 320M EUR in sustaining free cash flow and given the company’s current dividend policy to pay a quarterly dividend of $0.15 per share, there will be approximately 230M EUR in available free cash flow for debt reduction, share buybacks and potentially more M&A. I’m not convinced we will see a lot of M&A anytime soon though (unless there are some small bolt-on acquisitions) and I think the focus will be on debt reduction. Excluding lease liabilities, the net debt should decrease to 1.5B EUR which would reduce the debt ratio to 2.75 times the EBITDA (assuming a 5% adjusted EBITDA growth this year, which is the midpoint of the full-year guidance).

Nomad Foods usually has pretty decent visibility on its future earnings and production volumes so I don’t expect any negative surprises. The main risk associated with an investment in Nomad Foods is a general decrease in the demand for frozen meals and food supplies. That being said, a contracting economy may make frozen meals actually more desirable to a larger portion of the population.

Investment thesis

I haven’t had a long position in Nomad Foods for a while now, but the recent set of results and the outlook for 2024 make the company pretty appealing again. I like the company’s focus on generating a positive free cash flow result, as that’s the best way to rapidly reduce its net debt to the lower end of its preferred range of 2.5-3.5 times EBITDA.

I currently have no position but I’m for sure keeping an eye on Nomad’s performance in the near future.