During my days of purchasing homes with mortgages, I had a fondness for adjustable-rate mortgages (ARMs). The appeal lay in securing a lower interest rate compared to a 30-year fixed-rate mortgage. Further, it’s better to align the fixed-rate duration with my planned homeownership tenure.

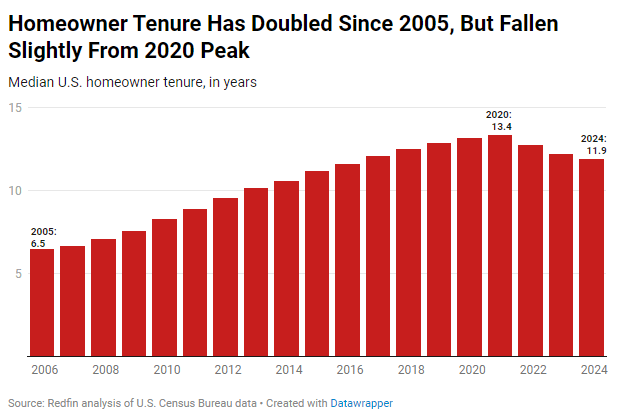

With the average duration of homeownership being approximately 12 years, opting for a 30-year mortgage term with a higher interest rate is suboptimal. Getting a 30-year fixed rate mortgage is like buying a bus for a family of four.

Despite my rationale, adjustable-rate mortgages often face strong opposition. Indeed, between 90% to 95% of new or refinanced mortgages fall under the 30-year fixed-rate category. It is logical to be against something you don’t understand or have.

Despite experiencing the largest and swiftest Federal Reserve rate hike cycle in history, there’s no rush to pay off your adjustable-rate mortgage before it resets. Allow me to illustrate using my own ARM as a case study. I’ve taken out or refinanced a dozen ARMs in the past.

No Hurry To Pay Off Your Adjustable Rate Mortgage

Most ARM holders will turn out fine once their introductory rate period is over. Here are the five reasons why:

1) You will pay down mortgage principal during your ARM’s fixed-rate period

Back in 2014, I purchased a fixer-upper in Golden Gate Heights for $1,240,000, putting down 20%. I opted for a 5/1 ARM with a 2.5% rate, resulting in a $992,000 mortgage. Though I could have secured a 30-year fixed-rate mortgage at 3.375%, I chose not to pay a higher interest rate unnecessarily.

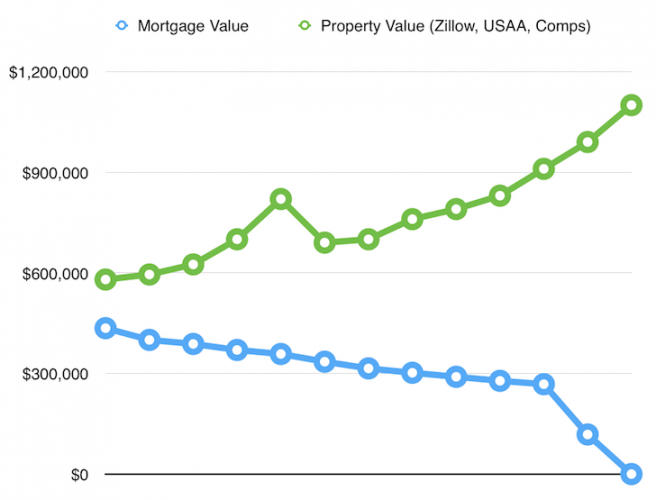

Then, on October 4, 2019, I refinanced the remaining $700,711 mortgage to a new 7/1 ARM at a rate of 2.625%. Once again, I had the option to refinance to a 30-year fixed-rate mortgage at 3.5%, but I stuck with the lower rate. Additionally, while I could have selected a shorter ARM duration for a reduced rate, I found that seven years struck a balance. This was a “no-cost refinance,” which is what I prefer.

Throughout the years, I made regular mortgage payments and occasionally applied extra funds towards the principal when I had surplus cash. Through this method, I managed to reduce the principal by $291,289 over 5 years, amounting to a 29.3% decrease from the original mortgage balance.

This process of paying down the mortgage didn’t impose any liquidity constraints or cause stress. I simply adhered to my FS-DAIR framework. It determines how much cash flow to allocate towards investments or debt repayment as interest rates changed.

2) Your mortgage pay down momentum will continue

Since refinancing $700,711 on October 4, 2019, I’ve managed to reduce the principal loan balance by an additional $284,711, bringing the current mortgage balance down to $416,000 today. Throughout this nearly five-year period, I continued to experience zero liquidity constraints or stress while paying down the principal.

There are several factors contributing to this steady reduction in the mortgage balance.

Firstly, a lower mortgage rate increases the proportion of the monthly payment allocated to paying down the loan, resulting in more principal being paid off over time. Secondly, despite the drop in my monthly mortgage payment following the refinance, I maintained it at the same level to pay down extra principal. Finally, whenever I had extra cash available, I continued to make additional payments towards the principal.

However, the frequency and amounts of these extra principal payments decreased in 2020 when COVID struck and interest rates plummeted. It was more prudent to retain cash during the uncertainty and then invest in the stock market after prices fell. As inflation surged, I found myself with a significantly negative real interest rate mortgage.

3) Elevated inflation rates will likely recede by the time your ARM resets

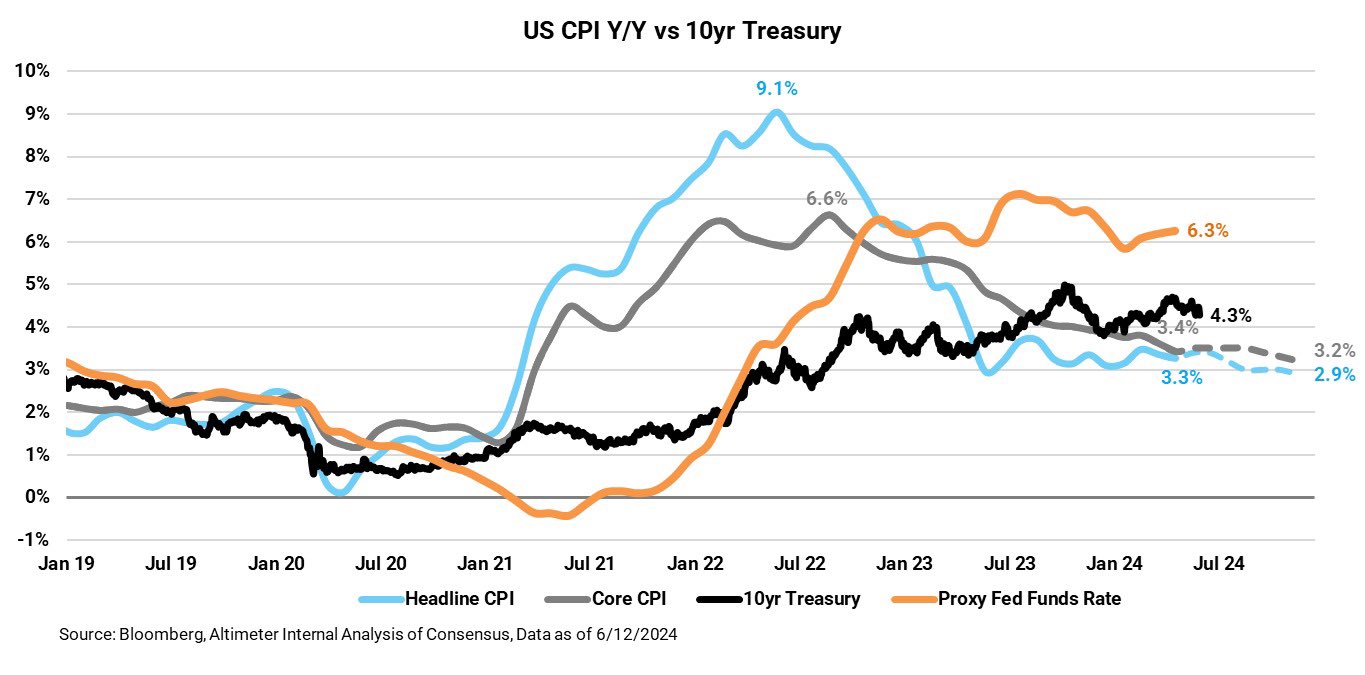

Inflation and mortgage rates experienced a sharp rise in 2020 and 2021, reaching a peak in 2022 before gradually declining. The Consumer Price Index (CPI) peaked at 9.1% in mid-2022 and now stands at around 3.3% in mid-2024. Elevated inflation has thus far proved to be transitory. It would be surprising if CPI were still above 3.5% by mid-2025.

Recent economic indicators suggest a slowdown in inflation, with May jobless claims exceeding expectations and May Producer Price Index (PPI) coming in lower than expected. Rate cuts are an inevitability.

Many ARMs have durations of five or seven years. For instance, if you secured a 5/1 ARM in March 2020 when the 10-year Treasury bond hit about 0.61%, your 5/1 ARM rate would be closer to 1.75%. With such a low payment, you would have been able to save even more cash flow during this period.

As your 5/1 ARM resets in March 2025, there’s no need to be apprehensive. Not only did you save money with a lower rate, but you also paid off a significant amount of principal. Furthermore, by March 2025, mortgage rates are likely to be lower than they are currently.

My 7/1 ARM so happens to reset in December 2026. As a result, I still have plenty of time to refinance or enjoy lower payments.

4) There’s a mortgage rate reset cap and lifetime cap

I reached out to my mortgage officer for a refresher on my ARM’s interest rate caps, both after the first year after the introductory rate resets and over my ARM’s lifetime. The maximum increase allowed per annual rate adjustment for the first year is 2%.

So, in the worst-case scenario, my initial rate adjustment would take me from 2.625% to 4.625%. However, even at 4.625%, my rate would still be 2.125% lower than today’s average 30-year fixed-rate mortgage.

Looking ahead to the next rate adjustment, with another 2% cap, if I neither refinance nor pay down the mortgage, the maximum my rate could reach during the 9th year would be from 4.625% to 6.625%. Again, 6.625% remains lower than today’s average 30-year fixed-rate mortgage.

Lastly, the lifetime cap on my 7/1 ARM is 5% above my initial 2.625%, or 7.625%. While 7.625% is high, the mortgage will be paid off or refinanced by its 10th year. In other words, 6.25% will likely be the highest rate I will ever pay. If the mortgage is not paid off by then, it’s because interest rates will have fallen, making the urgency to pay it down less.

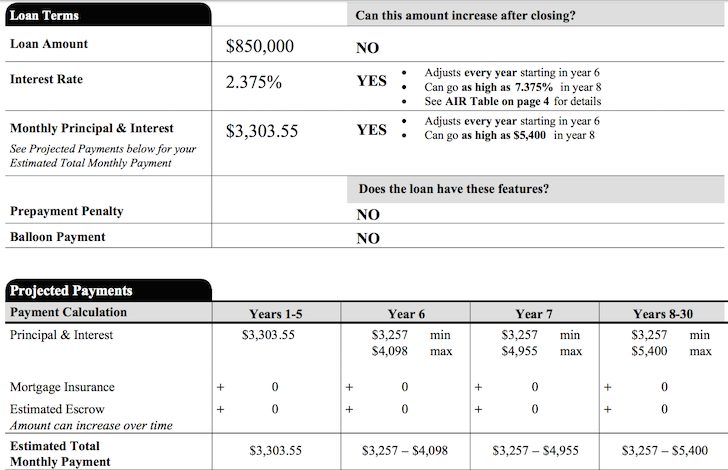

Below are the terms of a 5/1 ARM refinance for 2.375% I was offered. The ARM has a maximum interest rate cap at 7.375%, or 5% higher than the initial 2.375% rate.

5) Your property likely appreciated in value

Another factor mitigating the urgency to pay off your adjustable-rate mortgage is the likelihood of property appreciation during the introductory fixed-rate period. As your property’s value increases, the impact of facing a higher mortgage rate after the reset becomes less significant.

Real estate is my favorite asset class to build wealth for the average person. A mortgage keeps you disciplined by forcing you to save each month. Meanwhile, inflation acts as a tailwind to boost your properties value.

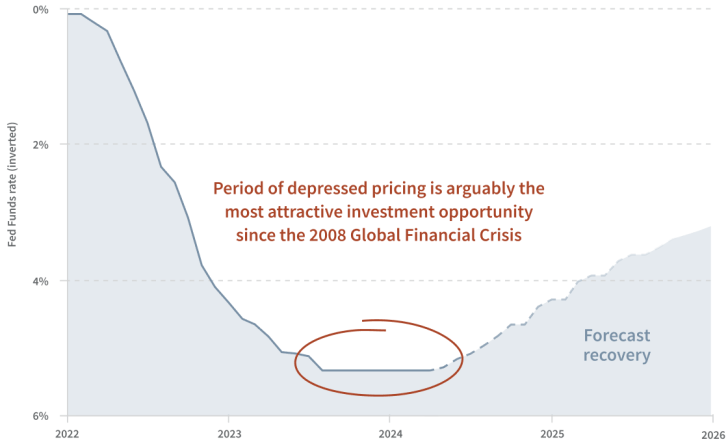

I continue to dollar-cost average into private real estate funds, especially with the prospects of declining mortgage rates. I see upside in commercial real estate in the residential multi-family and industrial spaces.

Of course, there are no guarantees that your property will appreciate in value by the time your ARM resets. For instance, if you had purchased property in 2007, its value declined for approximately five years before rebounding to pre-crisis levels in 2011-2012.

However, the global financial crisis represented a true worst-case scenario. And for commercial real estate today, you are able to buy similar bargains, but in a much stronger economic environment.

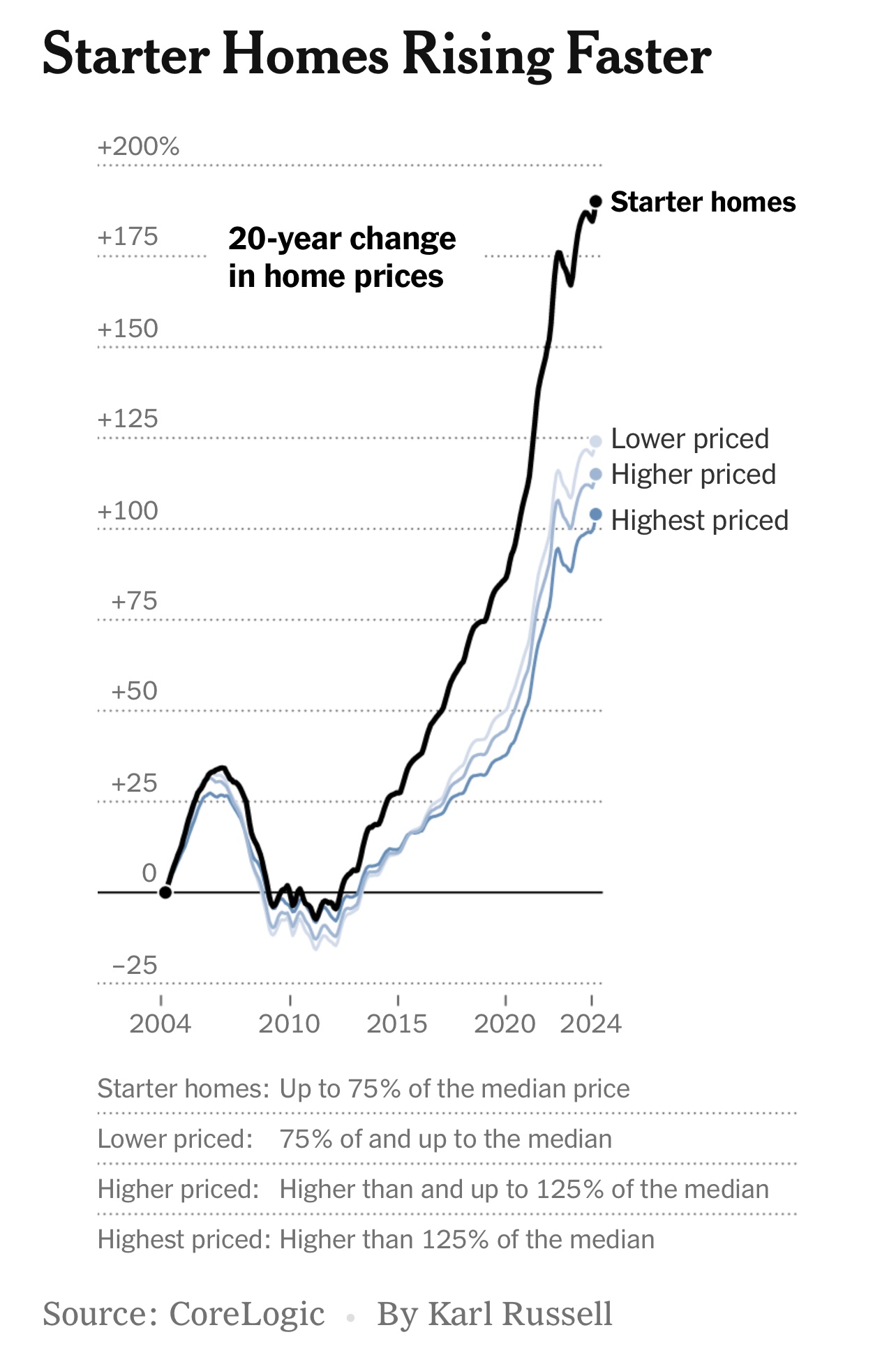

A Strong 20-Year Change In Home Prices

Since obtaining my 7/1 ARM in 2019, my property’s value has appreciated by ~20%. While this is not as substantial as gains seen in the S&P 500, when considering leverage, it’s certainly better than a poke in the eye. A 20% increase in property value easily offsets a 2% mortgage rate hike after the first reset.

With bidding wars back, the price appreciation could very well be even greater based on recent comps I’ve seen. This particular home hovers closer to the median price in my city. As a result, its appreciation could be higher.

6) Your payment might be lower once the ARM resets

The final reason there’s no rush to pay down your adjustable-rate mortgage is that your ARM reset payment could be the same or lower.

At the time my mortgage officer emailed me, I had 18 months left until my ARM resets. By just paying my monthly mortgage payments, I will have paid an additional ~$35,000 towards the principal. This means my principal loan balance will fall to ~$381,000 when my ARM resets, 45% lower than my refinanced balance of $700,711 in October 2019.

My payment will decrease by $569 to $2,245 a month despite a 2% increase in the mortgage rate to 4.25%. This is assuming my interest rate rises by the full 2% cap after the first reset in year starting in year eight. The mortgage is amortized over 23 years, not 30 years, hence why the payment is even lower.

If my mortgage rate rises another maximum 2% to 6.25% in year nine, my monthly mortgage payment will only rise to about $2,300, or $514 lower than before the ARM reset. Finally, in a worse-case scenario of 7.625% in year 12, my mortgage payment will still be at least $400 a month lower than it was in 2019.

Don’t Worry About Paying Off Your ARM Before The Reset Period

So there you have it, folks. If you are among the minority who took out an adjustable-rate mortgage before aggressive mortgage rate increases, congrats! Just like those who took out 30-year fixed-rate mortgages, you were also able to take advantage of cheap money to buy an asset that likely appreciated.

There’s no need to worry about paying off your ARM before the reset period begins. Chances are good that you’ll end up paying a similar mortgage amount or less once the reset starts.

When the ARM resets, compare your new mortgage rate to the existing inflation rate. If your new mortgage rate is 1% or higher than the CPI, then it’s wise to pay down extra loan principal when you have extra cash. Your money market funds and Treasury bills will likely pay an interest rate at least 1% below your mortgage rate.

Conversely, if inflation is equal to or higher than your new adjustable mortgage rate, I wouldn’t pay down extra principal. Just let inflation reduce the real cost of your mortgage debt for you.

I like borrowing cheap money to buy a nice home to enjoy and profit from. As I get older, I equally enjoy paying down mortgage debt in a sensible fashion. I’ve always felt great paying off a mortgage, and I’m sure this home I purchased in 2014 will be no different.

Reader Questions on Adjustable-Rate Mortgages

Why do you think so many people continue to dislike adjustable-rate mortgages? Is it simply because people don’t like things they do not understand or commonly encounter? Why wouldn’t people want to save money on mortgage interest expenses, improve their cash flow, and invest the difference? Why lock in a fixed-rate duration at a higher price for much longer than you plan to own your home?

To invest in real estate without a mortgage, check out Fundrise. Fundrise operates diversified funds that mainly invest in the Sunbelt region, where valuations are lower and yields are higher. The company manages over $3.5 billion for over 500,000 investors taking advantage of the long-term demographic shift to lower-cost areas of the country.

Financial Samurai is a six-figure investor in Fundrise funds, and Fundrise is a long-time sponsor of Financial Samurai. Our outlook on real estate is quite similar. For most investors, investing in a fund is the optimal way to go.

No Rush To Pay Off Your Adjustable-Rate Mortgage Before It Resets is a Financial Samurai original post. Since 2009, everything on Financial Samurai is written based off firsthand experience.