The Chancellor has ‘missed a massive opportunity’ to boost ailing electric car sales in the Spring Budget today, experts and manufacturers say.

Jeremy Hunt’s refusal to respond to industry calls for more incentives to private EV buyers in the form of ‘fair taxes for a fair transition’ will make it increasingly hard for car makers to hit strict targets set out in the Government’s Zero EV (ZEV) Mandate.

For drivers, the 2035 ban on new petrol and diesel car sales might seem far away, but for manufacturers, the heat is on.

Since January, new laws require car manufacturers to sell an increasing number of electric vehicles (EVs) each year until the 2035 deadline. By 2035, it must be 100 per cent.

The Government’s Spring Budget has ignored industry calls for ‘fair tax for a fair transition’ to EVs, with no incentives offered to private buyers such as VAT cuts on new sales

In response to the lack of EV incentives in the Spring Budget, Fiat UK said: ‘ We are sleepwalking into an electric vehicle crisis’

Failure to meet these targets will see car makers fined £15,000 per model below the threshold.

While this stick method is effective in getting manufacturers to switch to producing EVs, the Government is under fire for forgetting the carrot part of the equation.

The Budget’s only mention of zero emissions vehicles was a £270million investment to be shared between ‘innovative automotive and aerospace’ sectors – nothing to directly target EV purchasing.

The most recent new car registration figures show EV sales are growing among fleets and businesses, but sales to private buyers have plateaued.

The Society of Motor Manufacturers and Traders (SMMT) wants the Government to abolish VED rates combined with lower VAT on new EV sales and reduced VAT on the public charging network to make EVs more appealing to new buyers.

Without these tax incentives, manufacturers are going to find it hard to meet the ZEV targets set.

Mike Hawes, SMMT Chief Executive, said: ‘Reducing VAT on new EVs, revising vehicle taxation to promote rather than punish going electric, and an end to the VAT ‘pavement penalty’ on public charging would have energised the market.

‘With both Government and industry having statutory requirements to deliver net zero, more still needs to be done to help consumers make the switch.’

Car manufacturers independently made statements regarding their disappointment in the lack of EV policies.

Reacting to the today’s budget, Fiat UK said: ‘It’s hugely disappointing that the Chancellor has failed to reinstate financial incentives for electric vehicle buyers in today’s budget.

‘The demand for electric vehicles is waning and we are sleepwalking into an electric vehicle crisis. The Government is also potentially putting its Net Zero target at risk.

‘Without any government financial incentive there’s no reason for the consumer to make the switch.’

Vauxhall UK’s managing director, James Taylor, said Hunt’s Spring Budget had hung electric car makers out to dry, saying the lack of EV sales-boosting policies will continue to see Britain’s transition to electric vehicles ‘stall’.

He added: ‘If we are to meet the rightly ambitious targets laid out in the Government’s Zero Emission Vehicle mandate (80 per cent of all cars sold to be electric by 2030) then there needs to be incentives for private car buyers to make the switch to electric as there are in the majority of European nations.

‘Vauxhall will already offer its entire car and van line-up as electric by the end of this year and has a number of highly competitive offers available but we cannot drive demand alone.

‘Whilst there are strong incentives for company car drivers to make the switch to electric – including for those choosing luxury vehicles – the private buyer who wants a more attainable small or family car receives nothing.’

He went on: ‘We would call on the Chancellor to urgently set up purchase incentives to stimulate the electric vehicle market and review the unfair taxation on public charging so that the UK isn’t left behind in the race to more sustainable motoring.’

Electric future: The ZEV mandate will force car makers to sell an increasing volume of EVs between now and 2035

Three incentives car makers called for in the Budget

1. VAT halved on new EV sales

Private electric car uptake has been in decline since 2022, with buyers now accounting for one in four new EV registrations compared to one in three previously.

SMMT research has shown that a VAT cut on EVs would be the single most effective measure to encourage drivers to go electric sooner.

More than a quarter (26 per cent) of drivers not even interested in switching said a VAT cut would be most likely to change their mind, and four in 10 drivers wanting to go electric said it would accelerate their switch.

EVs are one of the only CO2-saving technologies that don’t benefit from VAT incentives unlike heat pumps, with adopters paying the full 20 per cent VAT.

And with EVs typically costing more upfront – the majority of new models are over £40,000 – cutting VAT would save the average buyer around £4,000 off upfront purchase price.

While running costs over time are found to save an EV driver £700 a year over a petrol car, the big initial purchase price is a large deterrent for many people.

This is set to change as EVs as manufacturers scale-up production of EVs, pushing down costs, but for now there’s still significant EV premium on most mass-market electric cars.

For instance, a small city runaround like the VW ID.3 costs £35,700 for the entry level model, whereas the petrol VW Golf is only £26,945 comparatively. Both cars are almost exactly the same size, offer similar boot space and tech offerings.

The new Hyundai Kona petrol (left) is priced from £25,725 where as the new all-electric Hyundai Kona (right) is priced from £34,995 – a hefty EV premium for new car buyers

The Hyundai Kona – a very popular family SUV – has both electric and combustion versions. The all-new electric Kona starts at £34,995 for the entry level Advance trim, but the same Advance trim petrol Kona only costs £25,725.

The Peugeot 208 – one of the nation’s most popular learner cars – is an affordable £20,400 for the entry petrol, but over £10k more for the electric version – £31,600.

The SMMT predicts that removing VAT would deliver an additional 270,000 EVs to the road over the next three years, and increase supply to the in-demand used EV market where uptake rose 90.9 per cent in 2023.

And it would cost the Treasury less than the now scrapped Plug-in Car Grant.

2. Abolish premium VED rates for EVs

Vehicle Excise Duty (VED) or car tax as many people refer to it, is a yearly tax paid by vehicle owners in the UK.

One of the many benefits of EVs has been their exception from VED but that’s set to change in April 2025. From then on around seven in 10 EVs currently sold will be subject to an ‘expensive car’ VED supplement from next year.

While this might help add an estimated extra £9.4 billion by 2027/28 to the Treasury’s coffers, it will be a massive deterrent to prospective EV buyers. Owners of all new motors £40k will be forced to pay an extra £355 per year in car tax for the first five years at the standard rate.

Motorists will counterintuitively be penalised £1,950 for choosing to buy an electric car – something the Government’s ZEV mandate is supposed to encourage.

And with most new EVs over this price point, especially when considering higher spec and trim levels, the majority of prospective new EV drivers will be stung by it.

But there are some new EVs that come in under the £40k ‘premium tax’ benchmark including the very popular MG5 EV family estate for £30,995, the long-range Kia Niro EV award-winning SUV for £36,795 and the Cupra Born sporty hatchback for £36,475.

The announcement that the Dacia Spring will go on sale in Britain this month is a big step in the direction of actually affordable new electric cars. Set to be the most budget-friendly EV to date in the UK, prices are yet to be confirmed but it’s likely it could start from £15,500 and will almost certainly cost less than £18,000.

3. Slash VAT on public charging to 5%

Slashing VAT on public charging to 5 per cent would bring public charging costs in line with home charging energy rates and make it fairer for EV owners without access to wallbox home chargers

The other major call across the industry – and something that’s been gathering momentum for the last few years – is the end to the unfairness of taxation on public charging.

The demand for VAT reduction from 20 to 5 per cent would bring public charging in line with home charging.

RAC head of policy Simon Williams says: ‘Anyone without a driveway is penalised by having to pay four times the rate of VAT when they charge their cars at a public charger’

The current charging system favours people fortunate enough to be able to have a wallbox home charger.

Drivers without access to a home charger are discouraged to move to an EV because charging at a public charger costs four times more tax than homeowners with driveways.

RAC head of policy Simon Williams said: ‘The Chancellor has once again missed a massive opportunity to correct a bizarre tax anomaly and level the playing field when it comes to making running electric vehicles more affordable.

‘As things stand, anyone without a driveway is penalised by having to pay four times the rate of VAT when they charge their cars at a public charger, compared to anyone who is fortunate enough to charge up at home.

‘There is a huge strength of feeling about this issue, with charging networks having committed to passing the savings on in full to drivers – so it’s enormously frustrating that the Chancellor has chosen to look the other way on this important issue.

‘As campaign group FairCharge points out, the current tax rules date from 1994 and were written long before there were any electric cars on the road.’

Ken McMeikan, CEO at motorway services operator Moto Hospitality added: ‘Freezing fuel duty is good news for drivers, however it’s disappointing that the Chancellor did not go further and introduce a VAT reduction on public charging for electric cars, something we, and many others, have been repeatedly calling for.

‘This is a missed opportunity to make significant strides with EV adoption as it would incentivise more people to make the switch to electric cars. Exempting public charging from VAT ensures that transitioning to EVs is more financially accessible to everyone.

‘Encouraging motorists to switch to electric cars will be key if we are to achieve our goals as a nation of decarbonising over the coming decade and the Government has a major role to play in making this possible.’

Slashing VAT public charging rates would bring an end to the unfairness of taxation on public charging. Comparing charging a Nissan Leaf at home and using public charging infrastructure sees home charging owners save around £18 * based on 30p/kWh home energy prices and 45p/kWh public charging energy prices

With the average home energy price 30p/kWh but public charging priced at 45p/kWh, it’s easily apparent how EV drivers coughing up for more expensive public charging quickly lose out.

Charging a 2019 Nissan Leaf with a 62kWh battery costs around £11 to fully charge but it will cost £29 to charge at a 50kW public charging station.

The longer ranger, more expensive Mercedes EQE with a 100kWh battery, costs £16.02 to home charge and £41 at a 50kW fast charger.

There are ways to reduce public charging costs including getting a subscription or charging for longer at a slower charger rather than opting for a rapid charge, but none of these come close to bringing EV charging taxes in line with home charging rates like the slash on VAT would.

How do the UK EV incentives fair compared to Europe?

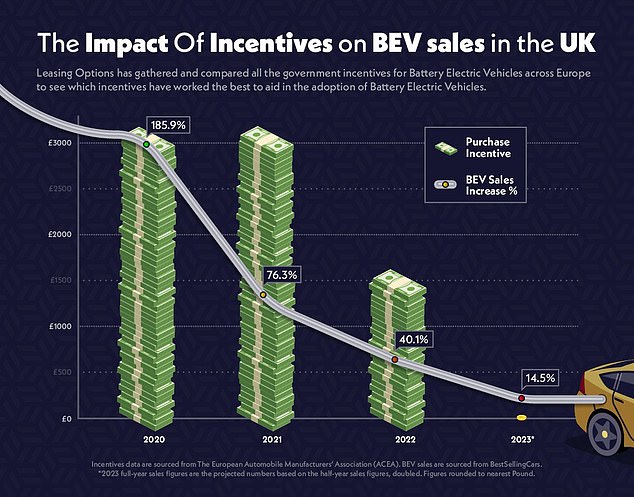

The average purchase incentive offered for electric vehicles in the UK was just £1,875 over the last three years, new analysis from automotive experts Leasing Options has found.

This puts the UK 23rd out of the 30 European countries for monetary EV switching incentives, according to the report.

This comes after the Government was told it needs to seriously accelerate its transition to EVs by a House of Lords inquiry earlier this year.

Comparatively Romania comes out on top as the number one country for providing the highest average BEV purchase incentives over the last four years: Their Government offers a massive grant of €11,500 (up from €11,250) to purchase a new BEV and scrap their old car.

Across the Channel, France has offered an average €9,750 (3rd place) to its citizens to switch to electric over the last three years, while Germany’s doled out €8,438 per EV buyer, ranking 5th.

The findings reveal how linked BEV sales are with incentives: Increasing incentives boosts BEV sales by 117.9 per cent.

Findings from Leasing Options shows the impact of incentives on BEV sales in the UK – with sales increases dwindling as the UK government removes incentives for new EV buyers, prompting calls from the industry to step up the level of monetary benefits to switching to EVs

Cyprus (in 2nd place) went from zero incentives until 2022, where they granted drivers up to a massive €20,000 to buy a BEV (€80,000 or under) and to scrap their old car in the process. This resulted in an equally impressive 379.8 per cent increase in sales.

Similarly Malta’s government offered no incentives until 2023 when it implemented a €12,000 incentive for purchasing a BEV and scrapping their old vehicle. The decision saw Malta’s BEV sales increase dramatically, according to half-year statistics, resulting in a projected full-year increase of 120.4 per cent in BEV sales.

And vice versa. Once purchase incentives have been lowered from the previous year, the average BEV sales across Europe drop by 84 per cent compared to when it is increased.

Slovakia’s incentive of €8,000 was in place in 2020, and BEV sales increased by 456.4 per cent. In 2021 the purchase incentive was removed and BEV sales grew by only 20.4 per cent – a reduction of 436 per cent.

The same happened with Germany. In 2023, their purchase incentive dropped for the first time in four years, from €9,000 to €6,750. The result is projected to cause sales to decrease for the first time as well, at -6.6 per cent.

Britain had a Plug-In Grant (PiCG) that launched in 2011 offered up to £5,000 off the price of a new EV or plug-in hybrid. This dropped to £3,000 in 2020 and again to £2,500 in March 2021 and included further eligibility restrictions based on the electric range of models and their retails price.

It was slashed to just £1,500 in December 2021 and made only available to EVs under £32,000 (of which there were only a handful) before being phased out prematurely in June 2022.

James Court, chief executive of the electric vehicles member association, EVA England, said: ‘This year’s Spring Budget is a missed opportunity by the Government to support an EV sector that is on the cusp of mass uptake.

‘Without targeted schemes to make EVs more affordable for the average consumer, all of our immense progress so far risks failing to hit the mark of our rightly ambitious net zero targets.

‘Highly successful social leasing and targeted grant schemes are being implemented elsewhere, incentivising yet more drivers to make the switch, and this Government has failed to keep up with this momentum,’

Some links in this article may be affiliate links. If you click on them we may earn a small commission. That helps us fund This Is Money, and keep it free to use. We do not write articles to promote products. We do not allow any commercial relationship to affect our editorial independence.