In the early 1970s, Nike (NKE -2.03%) was founded and its “swoosh” logo was unveiled. Then in the 1980s, the company signed basketball legend Michael Jordan to a marketing deal and the rest is history. Nike has grown so big and has been so successful that it’s one of the most recognizable brands in the world.

Likely because of its consumer mind-share, Nike is more than just a popular shoe brand — it’s also a popular stock. But this is a little surprising to me right now. The company most recently reported financial results for its fiscal second quarter of 2024. And through the first two quarters of this fiscal year, revenue was only up 1% from the comparable period of its fiscal 2023.

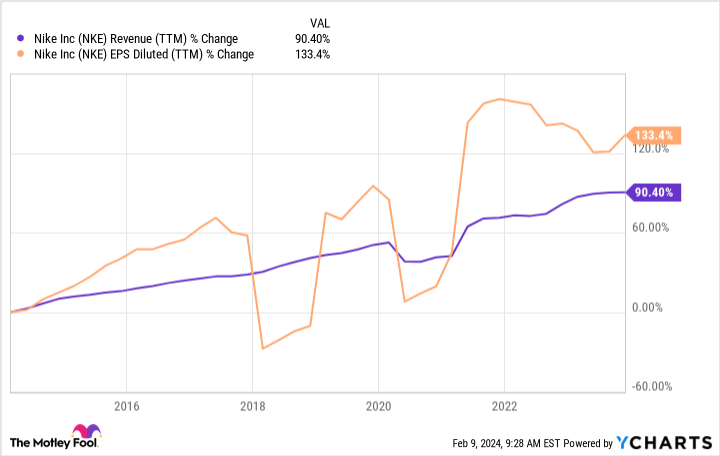

Far be it from me to criticize Nike. It’s been one of the greatest stocks to own over the last 30 years. It’s a reliable, global brand, and it earns good profits. Moreover, its earnings per share (EPS) have grown faster than revenue over the last 10 years, which is what investors want to see.

NKE Revenue (TTM) data by YCharts

That said, to be a market-beating investment today, I think that Nike would need better growth. Management doesn’t expect that to happen in the back half of its fiscal 2024. But it could come eventually — investors will want to watch and see.

In the meantime, there are other good shoe stocks out there. Specifically, On Holding (ONON -0.30%), Crocs (CROX -2.85%), and Deckers Outdoor (DECK -0.95%) are three shoe companies with better growth than Nike right now. More than that, these companies also have better profit margins, which is why I believe all three could be better stocks to buy today.

1. On Holding

When it comes to top-line growth, Switzerland’s On Holding is the best among the companies here. Through the first three quarters of 2023, net sales are up 57% compared to the same period of 2022. The company’s guidance for the fourth quarter implies just 21% growth. But even that is still faster than the growth from any of the other shoe companies we’re discussing.

On is only 13 years old. However, it’s encouragingly already gaining a lot of awareness from consumers. This is manifested in its direct-to-consumer (DTC) revenue. In its third quarter, DTC sales were up 55% year over year, outpacing overall sales growth of 47%. This suggests that consumers aren’t just stumbling upon On’s shoes in stores — they’re seeking out the brand.

Over the last four quarters, On’s operating margin of 9% hasn’t been quite as good as Nike’s margin of nearly 12%. But perhaps this “shortcoming” can be overlooked given its far superior growth rate. Moreover, On’s gross margin of 59% is better than Nike’s margin of 44%, suggesting On may eventually command a higher operating margin as it gains scale.

My only concern with On stock is its pricey valuation — it trades at more than 6 times sales, which is unusual for a shoe stock. In short, the market expects this company to become a powerhouse in the shoe space. Perhaps it will and the investment will pay off. Investors should just be aware that it has the priciest valuation of the bunch.

2. Crocs

While On trades at 6 times its sales, Crocs stock trades at just 6 times its forward operating earnings — that’s quite cheap. In 2024, the company expects its revenue to exceed $4 billion and for its adjusted operating margin to be 25%. That would give it $1 billion in adjusted operating income compared to a market cap of less than $6.5 billion.

Of course, there’s a trade-off here for investors. Crocs is a cheaper stock but its growth is much slower as well. On Feb. 15, the company expects to report full-year revenue of $3.95 billion, which would represent 11% growth. And for 2024, it’s already guiding for just 3% to 5% growth.

However, that growth is still better than Nike’s. Moreover, Crocs can make up for its slowing growth with high profits and shareholder friendly moves. Two things the company is doing right now are paying down debt ($277 million in the fourth quarter alone) and repurchasing shares. To this latter point, it still has almost $900 million in repurchase authorization left, which is almost 14% of outstanding shares.

Moves like these can help move the needle for Crocs’ shareholders. And it’s why I believe this is a better buy than Nike today as well.

3. Deckers

Finally, we come to Deckers Outdoor — the best-performing stock on this list. Over the past 10 years, it’s up 942% compared to 603% and 188% for Crocs and Nike, respectively. On Holding only went public in 2021. But since it went public, Deckers stock is outperforming On stock as well.

Deckers owns the shoe brands Hoka and Ugg, and the company is enjoying better growth than Nike right now. Its fiscal 2024 ends on March 31. And for fiscal 2024, it expects net sales of $4.15 billion, which represents 14% year-over-year growth.

Like On, Deckers is enjoying a great increase in brand awareness, as manifested by its DTC growth. DTC sales were up almost 23% in its fiscal third quarter of 2024, better than its 16% overall growth.

I like Deckers stock better than Nike stock today — I’ve already mentioned its superior growth. But I like it for other reasons too. It expects its full-year operating margin to be 20%, which is among the best in the business. Moreover, this company is debt-free and has almost $1.7 billion in cash and equivalents, giving it financial fortitude as well.

That said, of these three shoe stocks, I like Crocs stock the best — I believe its valuation is the safest and it has a path to market-beating upside by smartly using its profits. After that, I like On stock in spite of its valuation, because it’s a promising growth story with good economics.