Daniel Balakov/E+ via Getty Images

Investment Rundown

If there is one company that has had a fantastic last 12 months it surely is NGL Energy Partners LP (NYSE:NGL). The stock price has risen by over 380% with a big move in the last few months. The company now trades at pretty high earnings multiple in comparison to the sector, sitting at 23 right now. The market cap of the company is not that high either, just over $700 million right now. I think a key factor for the large share price increase has been the low previous valuation the company has been trading at.

We get some more clarification when we look at the estimated earnings for the company. In 2026 it’s expected to recover to an EPS of $1.6 for the year, putting it at an FWD p/e of 3.4 right now. Back in 2019, the company had strong earnings of $360 million and it seems it is returning to that rather quickly, which seems to have enticed the markets and been a key reason for the large runup this last year.

Company Segments

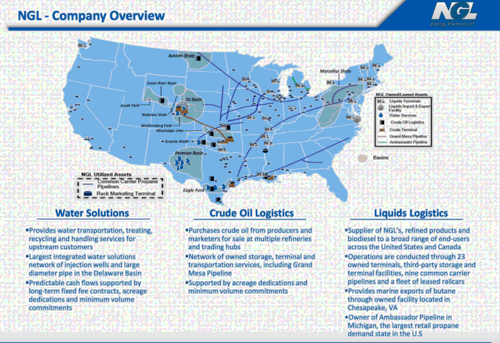

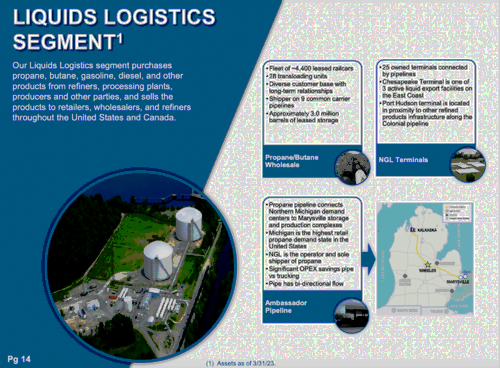

NGL is actively involved in the comprehensive management of energy-related resources, spanning the transportation, storage, blending, and marketing of a diverse range of products. Operating across three key segments – Water Solutions, Crude Oil Logistics, and Liquids Logistics – the company plays a crucial role in various aspects of the energy industry.

Company Overview (Investor Presentation)

In the Water Solutions segment, NGL specializes in the transportation, treatment, recycling, and disposal of produced and flowback water generated during the extraction of oil and natural gas. Additionally, the segment involves the aggregation and sale of recovered crude oil and the responsible disposal of solids, including tank bottoms, drilling fluids, and muds. This reflects the company’s commitment to environmentally conscious practices and efficient management of by-products in the oil and gas production process.

In terms of the growth of the water treatment market in which NGL operates it’s not that high really. Between now and 2030 it seems to be an annual growth rate of 3.4% that investors can expect. That is not very high and perhaps the lack of growth is why NGL is trading at such a low FWD p/e in 2026 and beyond.

Earnings Highlights

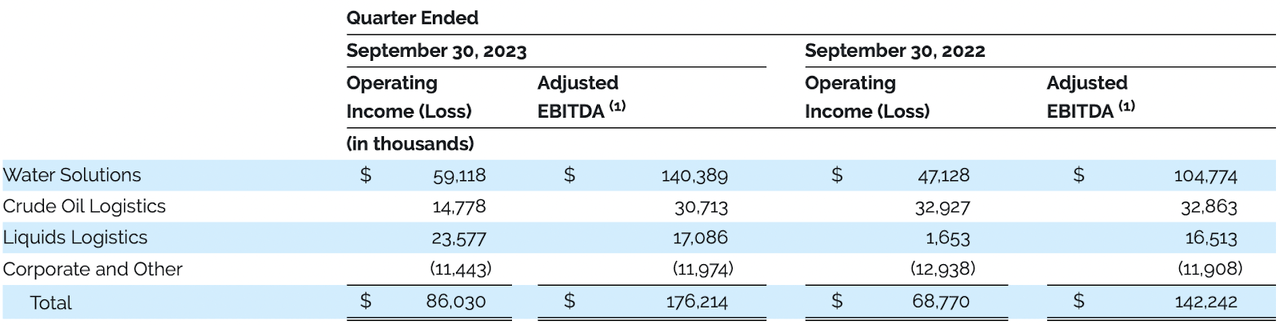

Income Statement (Earnings Report)

In the last report from the company, they managed to achieve decent margin growth. The operating income grows from $68 million in Q3 FY2022 to $86 million as of Q3 FY2023. That represents a YoY growth rate of 26%. Should that momentum continue then the higher multiple the company trades at could potentially be valid I think. My issue is still with the high amount of debt it has and how that could cripple upcoming growth ventures. The largest segment in the company is still Water Solutions, but the liquids logistics is not far behind either at $23 million operating income last quarter.

Segment Overview (Investor Presentation)

In the liquids logistics segment the company focuses mostly on the purchase of various materials and commodities and then selling that to retailers and refineries throughout North America. Some of the commodities it focuses on are propane and diesel for example, two markets that are expected to grow quite well over the next few years. The propane market for example is expected to grow around 12.5% CAGR until 2030 and the diesels market at 4.02% until 2032. In the last quarter, one of the biggest improvements was seen in this part of the business. The segment grew its operating income from $1.6 million last year to $23 million this year. In the upcoming reports, I think a key area to focus on for investors should be here. NGL can leverage this momentum into higher earnings for the entire business then we will likely see the share price reach even higher levels.

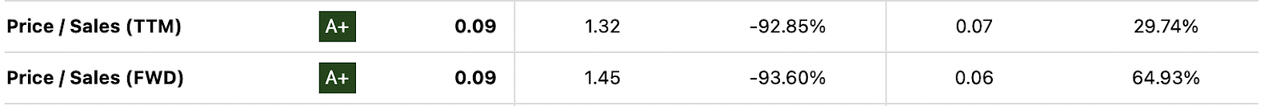

Looking at the valuation of the company on a p/s scale it’s very low, under 0.1. This is an over 90% discount to the rest of the sector. With a market cap of $725 million, NGL has in TTM generated $7.6 billion in revenues. It is a massive ebusiness but is lacking the capability to turn that into higher earnings which is why it’s trading at these low valuations. I think it will keep doing this as well until the company can expand its margins. With net margins at under 1%, which might be an improvement from the 5-year average of negative 3.06% there isn’t much to buy into here I’m afraid, resulting in the hold rating.

Risks

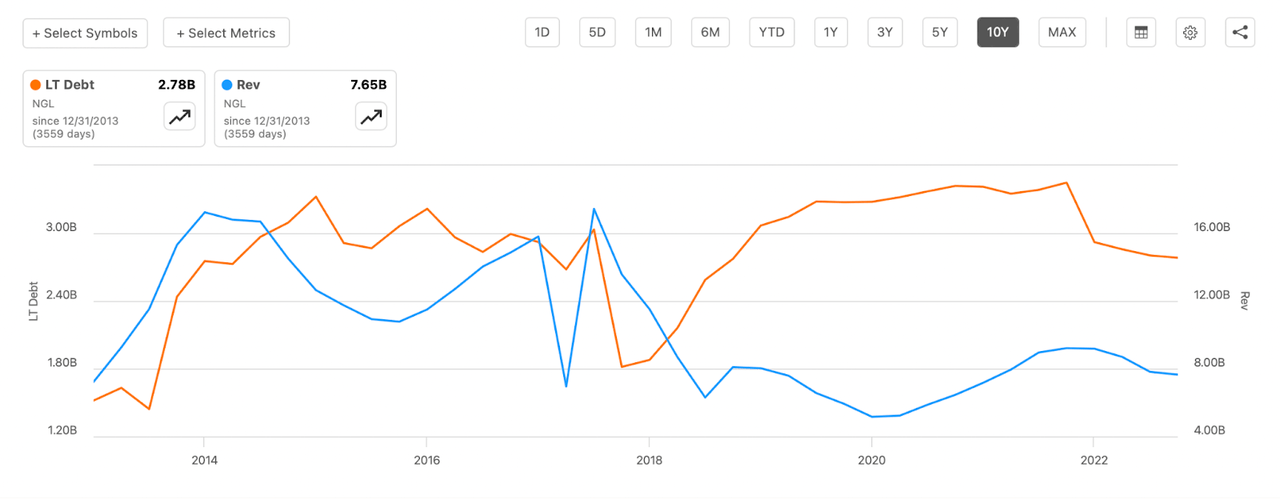

Investors need to closely consider a significant factor impacting NGL Energy Partners, which is the substantial amount of debt the company has accumulated in recent years, currently reaching $2.7 billion. The limited liquidity, with less than $3 million in cash, raises concerns about the company’s ability to cover upcoming expenses efficiently. This financial structure necessitates a careful assessment of NGL’s financial health and its capacity to manage debt obligations while sustaining operational growth.

While NGL Energy Partners has demonstrated resilience through steady shareholder dilution over the past years, the relatively modest annual growth in shareholder equity, growing at low single digits, poses potential risks for long-term investors. The reliance on consistent business growth becomes crucial in preventing adverse impacts on share prices. I think that if NGL doesn’t get a good hold of its bottom line and expands it along with higher sales, then once debt matures, which seems to be mostly in 2026 with $2 billion. NGL does not generate nearly those numbers in net income and I think that is something investors will have to consider in the coming years. Over the long-term, the assets and infrastructure that NGL has is important to the region and I think they could get government support should the worst come to worst or even be bought out. This is why I think NGL is a hold for now, but should the earnings be consistently below profitability next year then I could consider lowering my rating further.

Final Words

NGL has seen its share price run up massively over the last 12 months but I don’t think it’s entirely that appealing to buy into. The company trades at a low FWD p/e in 2026 as estimates are for a decent recovery. But I think there is little to buy into still and seeing the margins reach higher is a crucial point. With high amounts of debt and share dilution being a consistent fact over the last several years I think investors are better off with a more conservative hold here. If the margins don’t improve this year I think a sell might be in order, depending on the severity of the margin loss.