Hiraman/E+ via Getty Images

Co-authored by Treading Softly.

I know a number of people who try to live their lives with the concept of having “no regrets.” Ironically, it’s usually people who have that push in their life who carry some of the biggest regrets in their past that they falter to address effectively. There’s a truth about the human condition: you’re going to screw up from time to time. There’s no way to avoid it. There’s nothing you can do to ensure that you’ll never make a mistake, but what you can always do is learn from your mistakes and the mistakes of others.

Often, we treat Time appreciate it’s the enemy. We don’t appreciate how long things take. We don’t appreciate how little we have left. We seem to always be battling this invisible force that continually pushes us forward. When it comes to the market, many investors see Time as their enemy. They view things through the lens of opportunity cost. Every second that ticks by is another lost opportunity.

As an income investor, Time is my ally. The longer I hold something, the more dividends it pays me, and the greater the realized return on an investment grows and grows. That’s realized returns, in my pocket, that can never be taken away from me. I will never claim to be a master of market timing. I don’t try to trade in and out of the market. I don’t try to game it. I simply engage in it. I’m a strong believer that the reward from time in the market will vastly outweigh timing the market.

I grasp that in order to have a powerful income stream to fund my retirement, I have to make judgment calls. Inevitably, some of them will be wrong. The stocks I pick to invest in might not have the best returns over a day, month, quarter, or year compared to the thousands of other options I had to pick from. In fact, over any given time period, only one stock is going to have the highest returns. Out of thousands of stocks, picking that one is pure luck.

I also grasp that I don’t need to have the best-performing stock over any random period. Time is my ally. I invest in companies that are paying me a healthy income right now. As I collect that income, my realized return climbs with each payment – regardless of whether the market is currently overvaluing or undervaluing the company. Rather than getting caught up in the rat race of the market, trying to gamble on which stocks will see price increases next week, I can put my portfolio to work generating income.

Today, I want to look at an opportunity that I expect to hold for a long time to come, not only because its dividends are very tax-efficient for me but also because they continue to grow. This company at one point was likely overpriced, now it’s oversold, and today, as I’m buying more shares, I’m getting massive double-digit highly covered yields.

Let’s dive in!

Mispriced, Oversold, Now I’m Doubling Down

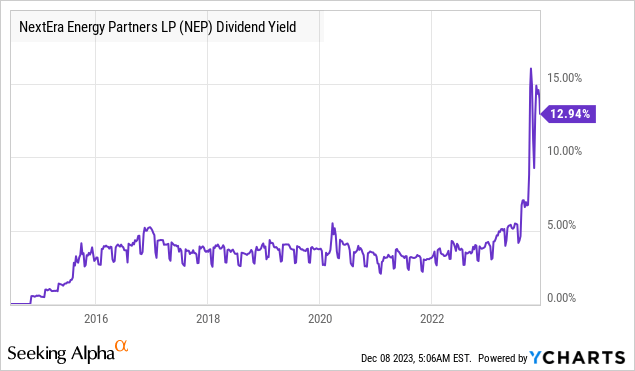

NextEra Energy Partners, LP (NYSE:NEP), yielding 13.3%, acquires, owns, and manages contracted clean energy projects in the U.S., as well as contracted natural gas pipeline assets. NEP was once a value stock that traded appreciate a Growth stock. Green energy was all the rage, and it was able to leverage its high valuation to issue equity at high prices and uphold a double-digit distribution growth rate. Growth investors piled in, and NEP frequently traded with what I considered an uninvestible yield.

With rising interest rates, NEP’s price declined, and the yield started getting into a range that was interesting to me. North of 5%, let’s talk. Then, NEP committed the greatest sin any “growth” stock can do: it slashed forward guidance. The price crashed, and the yield soared. Within a year, NEP went from Growth darling to deep value.

A company with a 3-4% yield needs growth to uphold any investment. A company with a double-digit yield doesn’t need to grow at all. Yet management’s outlook remains for 5-8% long-term growth and, in the near future, for 6% annual distribution growth. It declared a Q3 distribution raise and has telegraphed a Q4 raise to $0.88/quarter (for February).

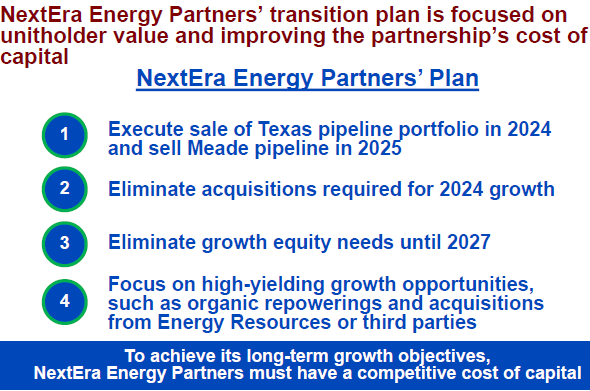

However, NEP does have work ahead of it. To preserve 6%+ growth indefinitely, NEP will need to get its cost of capital back to a reasonable level. It doesn’t need to be able to issue equity at the nosebleed prices it was in 2022 (though that would be nice), but it likely does need to get its cost of equity down from the high single digits.

Here is NEP’s scheme: Source.

EEI Financial Conference Presentation

NEP is cutting back on its need to raise equity through 2027. NEP management understands that investors aren’t exactly trusting after the guidance was slashed nearly in half. 5-8% is a far cry from the 12-15% that NEP management has been touting (and achieving) for years.

By providing growth to shareholders without needing to issue new equity, NEP should be able to rebuild trust with shareholders and eventually reach a point where the price stabilizes at a more reasonable level that will allow it to issue equity for modest growth.

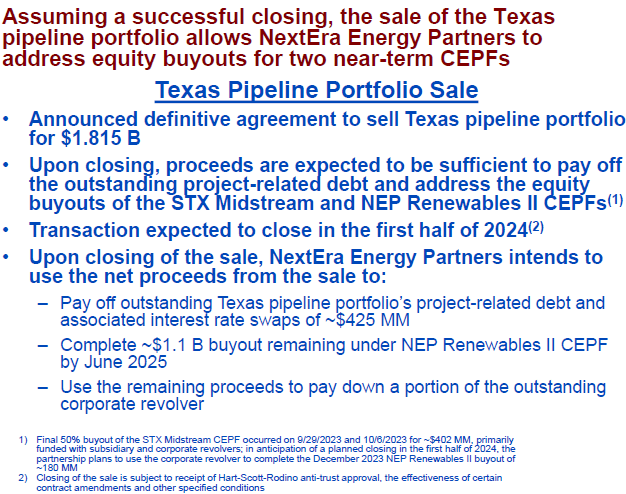

NEP completed the first major step of its scheme, with an agreement to sell its Texas pipeline portfolio for $1.815 billion.

EEI Financial Conference Presentation

This price is sufficient to repay the CEPF (Convertible Equity Portfolio Financing) of STX Midstream, and pay off the NEP Renewables II CEPF, which isn’t due until June 2025. We assume that $1.1 billion will be used to pay down the revolving line of credit until the cash is actually needed for the buyout, which will reduce interest expense in the meantime. NEP expects to sell the Meade pipeline in 2025, which will supply another lump sum.

NEP can’t do anything about interest rates, although if they do refuse as the market is increasingly projecting, that would be a significant benefit to the debt side of the cost of capital. What NEP needs to do now is regain the market’s trust and demonstrate that it can have modest growth without needing to issue equity.

In the meantime, NEP is providing investors with a very high current yield, along with modest growth, with the next distribution raise coming in February.

Tax Efficient

U.S. tax laws are currently very favorable to NEP and NEP investors. Management does not expect NEP to have meaningful U.S. taxes for at least 15 years. As a result, investors can expect that nearly 100% of their dividends will be “return of capital.” This is a benefit of depreciation and the various tax credits NEP’s assets qualify for.

This makes NEP particularly attractive for taxable accounts because ROC is not taxed. Instead, it reduces your cost basis, and you will pay capital gains taxes when you sell shares, based on your adjusted cost basis. This defers your tax bill until you sell, and historically, capital gains tax rates have been lower than income tax rates.

Conclusion

With NEP, you can acquire double-digit tax-deferred income, not having to pay a penny of taxes on it today, unless you’re selling shares. Management expects that this tax-deferred status will last for another 15 years, which means if you bought it today at age 65, you would not have to pay a penny of taxes on those shares until you’re 80!

The growth story has been smashed, and the share price has cratered. The yield has climbed higher, but the dividend continues to grow. The biggest punishment management received was due to having to slash their guidance and reduce their dividend growth expectations in half – something investors did not appreciate or care for. Yet, as a professional income investor, I welcome their exit because I am now able to acquire sky-high yields that are still fully covered by the income the company is producing.

When it comes to retirement, often simple is better. You want your income to come from boring places that aren’t necessarily viewed as “exciting” or “sexy.” I don’t think a single person in this world is going to find a solar panel highly attractive, but they’re going to grasp the benefits of it when it’s attached to the power grid. Very few people find getting dividends in the mail or in their brokerage account to be the most exciting part of their day. Yet, every time another dollar appears in my account, I have a provoke for celebration. Let me tell you, I have a lot of causes for celebration in that regard every single month, and so could you.

That’s the beauty of my Income Method. That’s the beauty of income investing.