kasezo

Overview

NexGen Energy (NYSE:NXE) is a Canadian uranium development company that is listed in both the U.S. and Canada (TSX:NXE:CA). The company reports in Canadian Dollars.

I have written about NexGen here on Seeking Alpha in the past, even if it is now almost 5 years since my last article on the stock. However, it has up until very recently been a core holding in my uranium portfolio, so I have covered the stock very frequently in my investing group over the last few years.

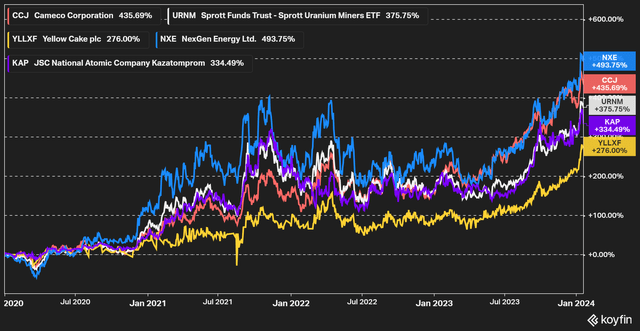

The stock price performance of NexGen has been very good over the years, it is up 494% since the beginning of the decade and has outperformed the Sprott Uranium Miners ETF (URNM) and many of its peers during that period.

Figure 1 – Source: Koyfin

Balance Sheet

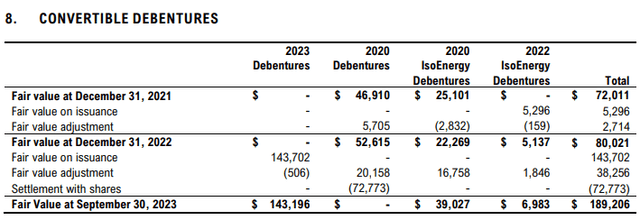

NexGen has a very strong balance sheet, with C$370M in cash as of Q3-23, while total liabilities are only C$220M. C$46M of those liabilities are also IsoEnergy (ISO:CA) convertibles. The company itself has C$143M in convertibles and no other debt.

Figure 2 – Source: NexGen Q3-23 FS

One asset that is far from fully reflected on the balance sheet is the ownership of IsoEnergy. IsoEnergy was spun out of NexGen many years back now, but NexGen has continued to have a very substantial ownership.

The IsoEnergy ownership percentage was at the last reporting date 49.7%, but IsoEnergy merged with Consolidate Uranium after the reporting data. According to IsoEnergy’s latest corporate presentation, NexGen now owns 34% of the combined company, and that ownership interest comes to about C$260M using the latest share price.

Rook I

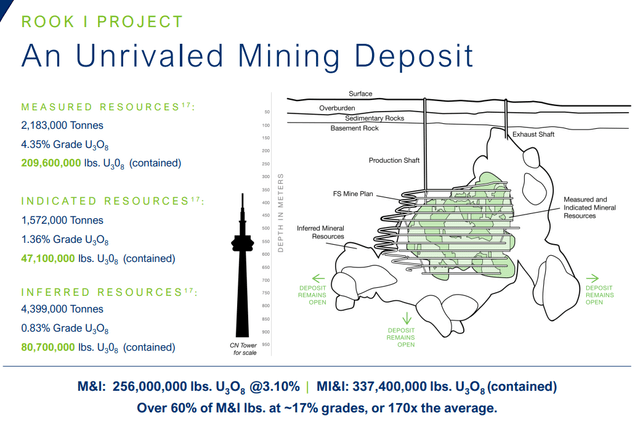

NexGen gets most of its value from the extremely impressive Rook I project, which hosts the Arrow deposit. Rook I is the largest development stage high-grade uranium project in the world, located in the western portion of the Athabasca Basin, Saskatchewan, Canada.

Figure 3 – Source: NexGen Corporate Presentation

Rook I has 257Mlbs of measured & indicated uranium resources, with a grade of 3.10% uranium. Note that the high-grade portion, which is about 60% of measured & indicated resources, has a substantially higher uranium grade of 17%. Much of those resources are also reserves, where the feasibility study (“FS”), that was released in 2021, showed 240Mlbs of uranium reserves, with a uranium grade of 2.37%.

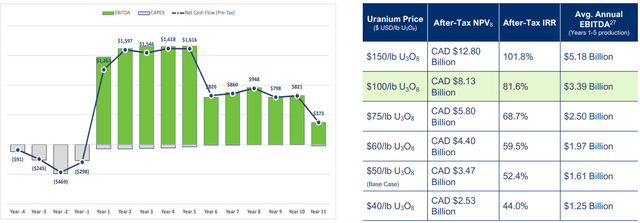

The main drawback with Rook I is that it is located in the western portion of the Athabasca Basin, where there is less infrastructure. The FS has consequently estimated the initial capital cost of C$1.3B, which includes a lot of infrastructure investments. However, given the large size, high grade, and low projected operating costs of the project, the after-tax payback period is less than a year. The EBITDA is for example estimated to average around C$1.5B per year in the first 5 years of operations.

Figure 4 – Source: NexGen Corporate Presentation

The net present value of Rook I is at current uranium spot prices more than C$8B, using an 8% discount rate. So, this is truly a one-of-a-kind uranium project.

NexGen has spent a long time developing Rook I and did in November of 2023 receive the provincial approval for the project, and is expecting a federal approval during 2024.

Valuation

I have for the valuation used the financials as of Q3-23 together with the latest share price. Note that I have used the fully diluted share count, which has given us a market cap of C$5.8B.

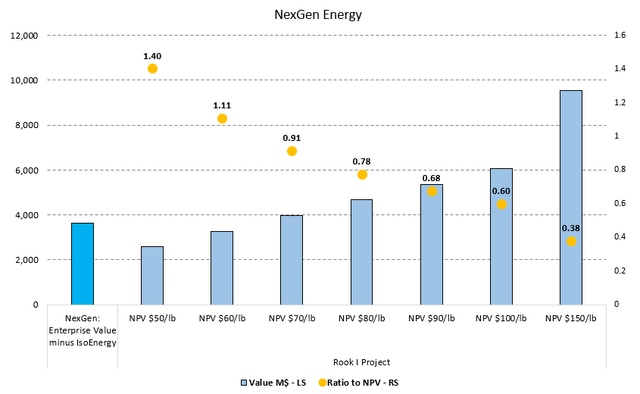

If we instead use U.S. Dollars, the market cap is $4.3B and the enterprise value is $4.0B. I have for simplicity assumed IsoEnergy is fairly valued here and excluded it from both the enterprise and only included Rook I on the asset side of the equation.

Figure 5 – Source: Feasibility Study & My Adjustments

We then get an enterprise value to NPV of 0.60 for NexGen, assuming uranium price of $100/lb.

Concerns & Conclusion

I do consider Rook I a world-class uranium project, which is likely to be fully permitted in the near future. Given the extremely good economics, we can likely expect much of the initial capital cost to get debt-financed, which should at least minimize the dilution. With that said, NexGen has been using its ATM program aggressively in 2023 and did in December of 2023 upsize the program to C$500M. So, shareholders can likely expect some near-term dilution.

My main concern with NexGen is that it might soon transform into a 4-5-year long construction project. A large multi-year C$1.3B construction project in a remote part of Canada is rather risky in my view. Where I would not rule out construction delays or cost overruns. If NexGen does move forward with this project alone, delays or cost inflation have the potential to put pressure on the share price.

Another drawback with NexGen is the excessive management and board-level compensation. This is something most investors just accept with NexGen, but it is certainly not a desirable feature that instills trust in my view.

All-in-all, Rook I is very impressive, but NexGen is not without concerns, and I would argue the stock is not trading at a bargain price, with an enterprise value to net present value of 0.60, using a relatively aggressive uranium price. Keep in mind that Rook I is still in the best of circumstances 4-5 years from production.

I don’t doubt NexGen will continue to benefit if the uranium bull market continues, which is my base, but the risk-reward has worsened with the stellar performance. I don’t think NexGen is likely to outperform smaller uranium miners and near-term producers going forward. If there is a buy-out of NexGen relatively soon, I could be wrong, but buy-outs of this size are relatively rare even if Rook I might make NexGen a prime candidate.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.