Andrii Yalanskyi

Forecasts that the Federal Reserve will start cutting interest rates in June took another hit after Monday’s relatively firm manufacturing survey data for March. Markets are still pricing in moderate odds that easing will start at the end of the second quarter, but the incoming data is providing more support for again pushing the date for a dovish policy pivot further down the road.

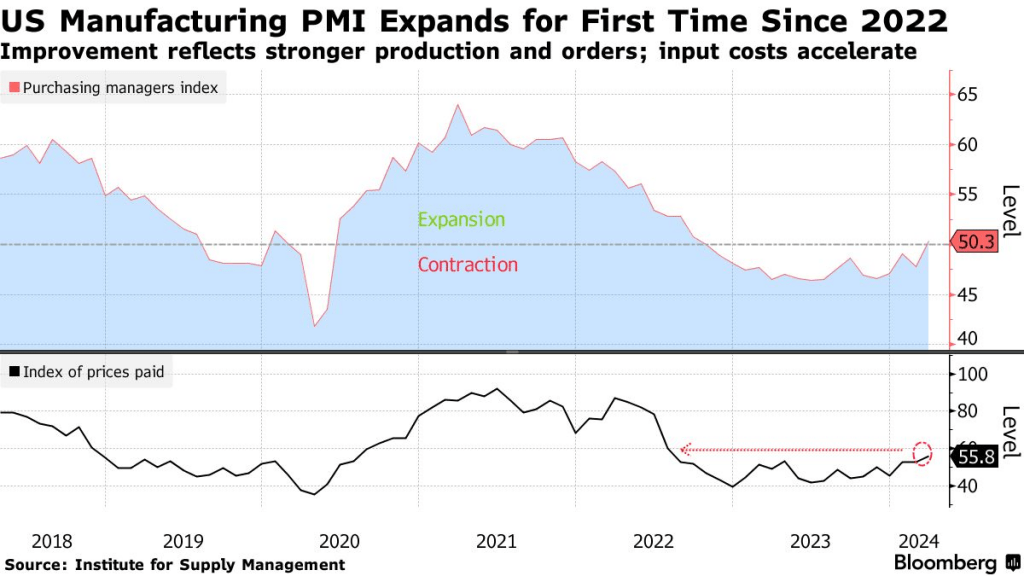

The latest talking point: the long-suffering US manufacturing sector appears, finally, to be rebounding, based on survey data. The ISM’s manufacturing PMI ticked above the neutral 50 mark in March, marking the first expansion for the sector since 2022. This could be noise, of course, but for the moment the prospects for recovery are the most encouraging in several years, based on this survey.

“If the contraction of manufacturing activity is over, far too soon to say, and price pressures are building in manufacturing, which appears to have been happening for the last three months, then this would have implications for the path for interest rates in 2024,” says Conrad DeQuadros, senior economic advisor at Brean Capital.

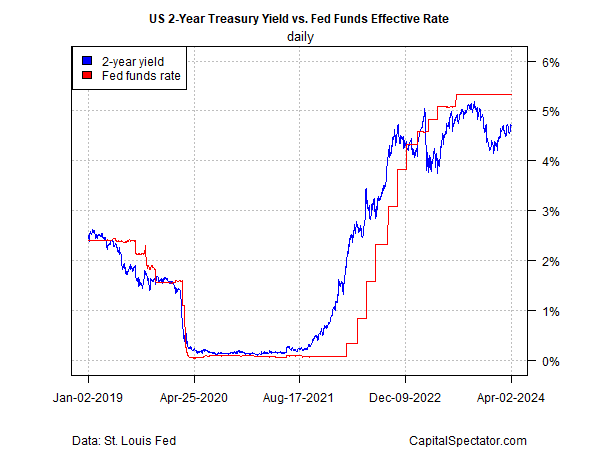

Meanwhile, using the policy-sensitive 2-year US Treasury yield as a guide still suggests the bond market has a dovish bias. The 2-year yield closed yesterday (Apr. 2) at 4.70%, close to a four-month high, but that’s still well below the current 5.25-5.50% range for the Fed funds rate, which suggests the market continues to price in high odds for a rate cut in the near term.

The caveat, of course, is that the 2-year yield has been anticipating a rate cut for more than a year, only to be proven wrong month after month. Is this time different? The case is weakening, based on recent economic data, which continues to suggest that a growth bias prevails for the US.

The Atlanta Fed’s GDPNow model, for instance, is estimating (as of Apr. 1) this month’s initial Q1 GDP report will show output expanded 2.8% (real seasonally adjusted annual rate). Although that’s well below Q4’s pace, a 2.8% increase (if correct) indicates a solid rise, and one that implies that rate cuts may be premature.

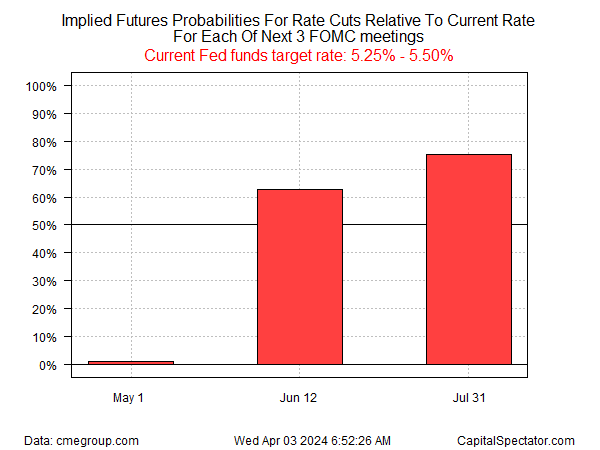

Nonetheless, Fed funds futures are still anticipating a moderate probability that the central bank will start cutting in June.

Fresh comments from Fed officials, however, leave more room for doubt about the timing of policy easing. The critical variable, of course, is inflation, and recent updates suggest that pricing pressure remains sticky and so progress towards the Fed’s 2% inflation target will arrive later than recently expected.

“I continue to think that the most likely scenario is that inflation will continue on its downward trajectory to 2% over time. But I need to see more data to raise my confidence,” says Cleveland Federal Reserve President Loretta Mester in prepared remarks yesterday (Apr. 2). “I do not expect I will have enough information by the time of the FOMC’s next meeting to make that determination.”

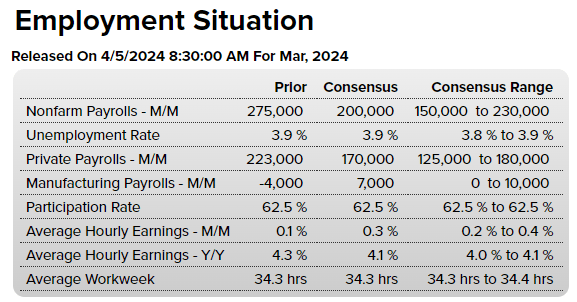

Is it time to write June off as the starting point for cuts? Not yet, but the probability is slipping that a dovish pivot will begin in two months. Perhaps Friday’s payrolls report (Apr. 5) for March will provide new clarity. Economists are expecting a softer run of hiring, but still strong enough to keep the economy humming, based on the consensus point forecast via Econoday.com.

“While June is not off the table, market conviction for a first Fed cut by then is fading,” advise ING strategists including Benjamin Schroeder in a research note. “In the coming weeks, we can expect some Fed speakers to remain vocal about June cuts, but in the end, the data will be the deciding factor.”

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.