champc

New offering summaries:

CDX3Investor.com

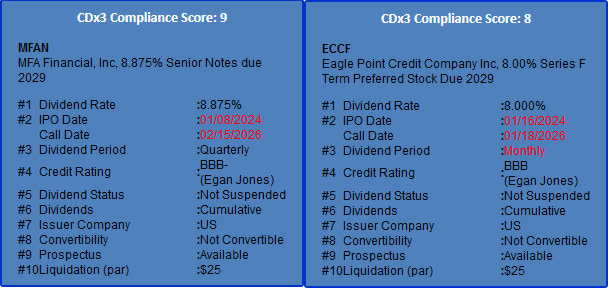

Eagle Point Credit Company (ECC), a closed-end externally managed investment company, priced an offering of 1.4 million shares of new series F term preferred stock due 2029, offering a fixed dividend of 8%, paid monthly. The new shares received a credit rating of BBB from Egan-Jones Ratings Company, and traded temporarily on the OTC under symbol EPCCP before moving to permanent symbol ECCF on the New York Stock Exchange.

And specialty finance company MFA Financial, Inc. (MFA), an investor in residential mortgage loans and securities, priced an offering of $100 million of new 8.875% senior notes due 2029. The company indicated that proceeds will be used to make new residential mortgage-related investments, along with repayment of existing indebtedness including its 6.25% convertible senior notes due in 2024. The new notes were rated BBB- by Egan-Jones Ratings Company and trade on the New York Stock Exchange under symbol MFAN.

In the cast of both of these new offerings, the companies have an option for early repayment in February of 2026. See these SEC filings for further information: MFAN, ECCF.

Buying new shares for wholesale

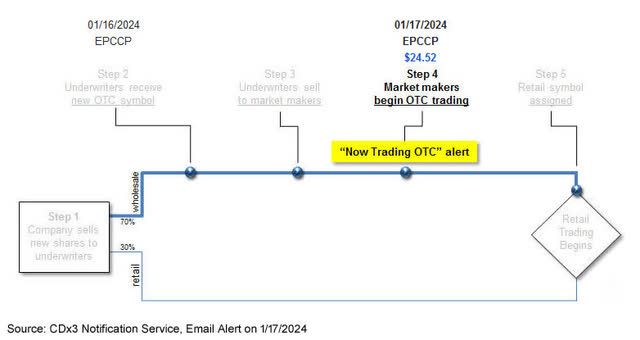

Preferred stock IPOs often involve a temporary period during which OTC trading symbols are assigned until these securities move to their retail exchange, at which time they will receive their permanent symbols. For example the new Eagle Point preferred discussed above, which initially traded under symbol EPCCP on the OTC:

Individual investors, armed with a web browser and an online trading account, can often purchase newly introduced preferred stock shares at wholesale prices just like the big guys (see “Preferred Stock Buyers Change Tactics For Double-Digit Returns” for an explanation of how the OTC can be used to purchase shares for discounted prices).

Those who have been following this strategy of using the wholesale OTC exchange to buy newly introduced shares for less than $25 are more able to avoid a capital loss if prices drop (if they choose to sell). Note that in the cast of the new Eagle Point preferred, on 1/17/2024 shares were changing hands around $24.52; as of this writing ECCF is trading at $24.84 on the New York Stock Exchange.

Your broker will automatically update the trading symbols of any shares you purchase on the OTC, once they move to their permanent symbols. A special note regarding preferred stock trading symbols: Annoyingly, unlike common stock trading symbols, the format used by exchanges, brokers and other online quoting services for preferred stock symbols is not standardized.

For example, a given Series A preferred stock might have a symbol ending in “-A” at TDAmeritrade, Google Finance and several others but this same security may end in “PR.A” at E*Trade and “.PA” at Seeking Alpha. For a cross-reference table of how preferred stock symbols are denoted by sixteen popular brokers and other online quoting services, see “Preferred Stock Trading Symbol Cross-Reference Table.”

Past preferred stock IPOs below par

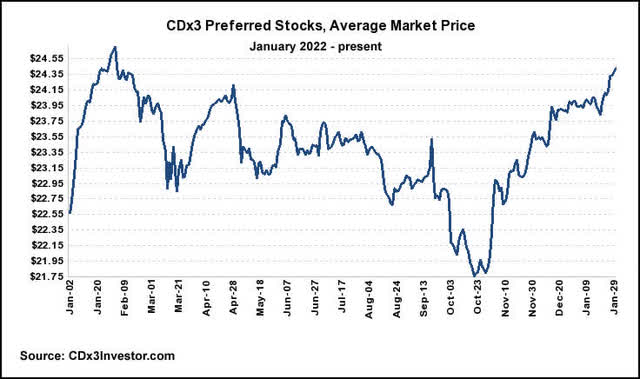

In addition to covering new preferred stock and ETD offerings, here at CDx3 we also track past offerings, with alerts when securities fall below their par values. For all of 2023, the basket of CDx3-compliant preferred stocks and ETDs (i.e. scoring 10 out of 10 on our compliance scale), traded below par value of $25 as a group, but since the low in October have delivered a steady climb, with a recent basket price of $24.42.

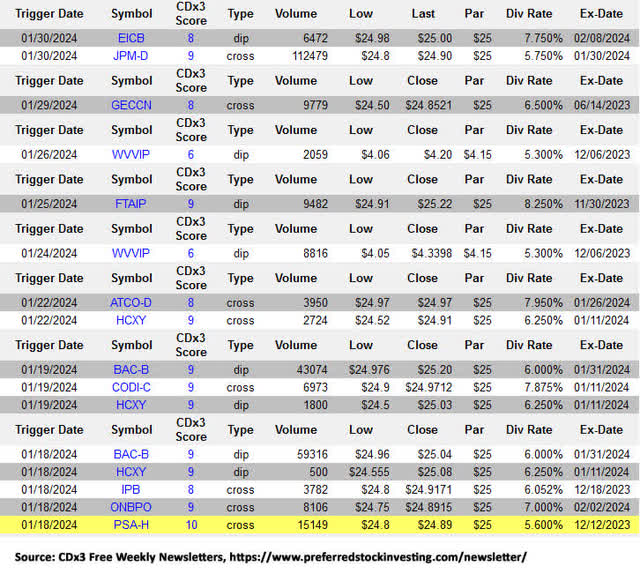

We track when different securities become available below par, and to close this article, we would like to share with you some of the most recent dips/crosses below par we have observed among individual securities (note that yellow highlighted entries indicate highly rated securities eligible for the “CDx3 Bargain Table”):

For those preferred stock (and ETD) investors interested not just in new IPOs but previously issued securities, following par crosses can provide useful insight into which securities have recently become available in the marketplace below their initial offering prices; for example PSA-H is a 10 out of 10 CDx3-compliant security (highlighted in yellow), which crossed below par value on 1/18 and trades at $25.51 as of the time of this writing.

Investor Takeaway

In our monthly Seeking Alpha articles, we here at CDx3 Notification Service typically summarize all the new preferred stock and exchange traded debt offerings observed over the course of the month; we also highlight past offerings that have begun to trade below par value. Our goal is to keep fixed-income investors up-to-date on the various investments available in the current marketplace, and we hope this month’s article has served this purpose. See you next time, and thanks for reading!