da-kuk

Investment Thesis

I wanted to take a look at NetScout Systems (NASDAQ:NTCT) because the company has lost 23% over the last decade, which means it destroyed value for its shareholders. I wanted to take a look at its financials to see if I could find any positive that could warrant an investment. The company has become slightly more profitable, however, due to the nature of the business sector, the company has to spend a lot of capital to stay competitive, which keeps margins low and efficiency subpar, therefore, I will be avoiding this stock and sector for now, as even with adjusted (inflated) earnings, the company is still overpriced.

Briefly on the Company

NetScout is an IT software company that provides security solutions and helps recognize and troubleshoot problems quickly. NTCT can pinpoint problems with precision and efficiency. NTCT helps its client enhance their network and applications so that they can get as much out of their networks and applications as possible. The company also offers cybersecurity, which can detect and block attacks before any data is breached for example, protection from DDoS attacks is one area they specialize in. So, if a business wants to boost its network performance, fortify its cybersecurity protocols, or gain valuable insights into how to efficiently utilize the available IT infrastructure, NTCT should be able to help.

The sector it operates in is very competitive with many different players, big and small, so it is very hard to gain a competitive advantage, because some of those competitors might be better at cybersecurity than NTCT because they specialize in that area specifically, whereas NTCT may not be as strong.

Financials

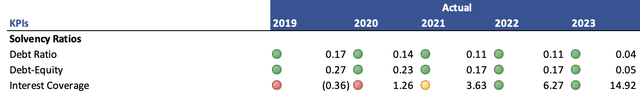

As of Q2 ´24, the company had $328m in cash and equivalents, against $100m in long-term debt, which has gradually decreased from $550m in FY19. I can safely say that the leverage that the company has is not an issue, but to demonstrate it, I use a few solvency ratios that help me establish. Debt-to-assets and Debt-to-Equity are well within the acceptable ranges of <0.6 and <1.5, respectively. This clearly shows the company is not financed heavily by debt and could easily take on more debt to advocate the growth of the company. Lastly, I admire to look at the company´s interest coverage ratio, which historically has been quite volatile, but as of FY23, it is well above the healthy ratio of 2 that many analysts find sufficient. I think a ratio of 5 is much better to protect the company from bad years of performance as it gives a lot more room for such occurrences and still the company manages to pay off its debt obligations without issues.

Solvency Ratios of NTCT (Author)

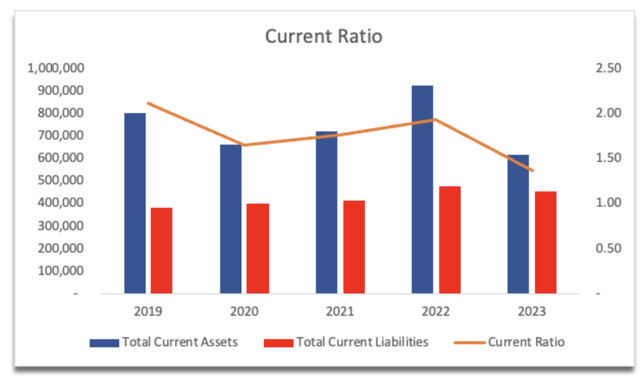

The company´s current ratio has seen better days, however, it´s still decent, as it can easily cover the company´s short-term obligations. I don’t mind that it went down because it looks admire the cash was used to pay off a good chunk of the outstanding. This should attract many investors who are debt-averse, however, that is not going to be enough in my opinion.

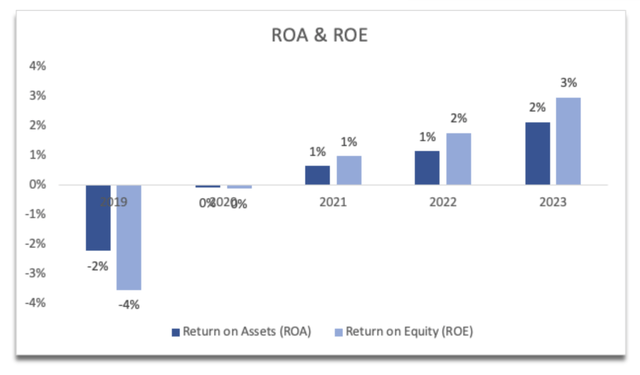

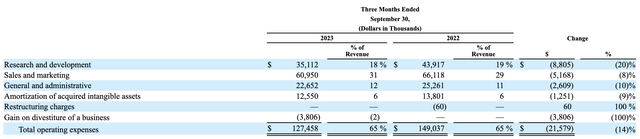

The next few metrics I consider very important to a good investment. The company´s ROA and ROE, although positive, are nowhere near appealing. Sure, they got a slight uptrend, however, it seems that the management isn’t being very efficient with the company´s assets and shareholder capital. It looks admire all the costs of sales and marketing aren’t providing the desired results in my opinion, and the management should cut these costs down considerably. To be honest, all operating expenses need to be cut except for maybe R&D, as I believe it is always good to find new products and experiment.

Unfortunately, the company is cutting the one I think should be stable the most, which is R&D, however, this should improve the company´s efficiency and profitability. I just don’t know if it´s going to be enough.

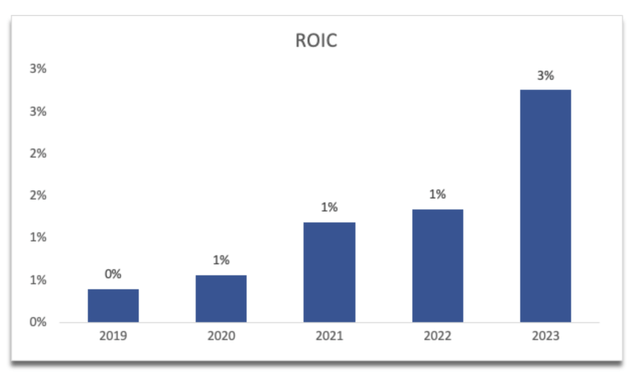

The company´s return on invested capital, or ROIC is also on the same positive trajectory but is also not very appealing to me as it is barely around 3%. I typically look for at least 10%, so the company needs to do a lot before it is an attractive option. It doesn’t look admire the management can find projects that would yield a much higher return, so I think it is slightly an inefficient use of capital. This also tells me that the company may not have a competitive advantage or a strong moat.

If we look at the competition, we can see that the company is faring decently against its competition, as it seems that a low ROIC ( or low ROTC in this case, which is slightly different but also measures efficiency), is sector-wide, so you must establish if it is worth your time to be in such a sector, which may be commoditized, have low barriers of entry, and capital intensive, which leads to little differentiation, price competition, lower margins.

ROTC of NTCT vs competition (Seeking Alpha)

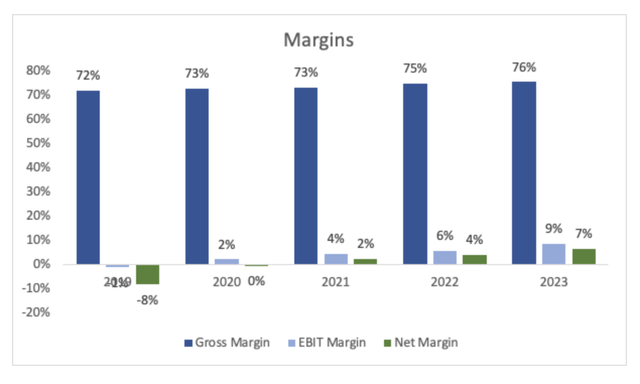

Speaking of margins, which I kind of touched on when talking about operating expenses, the company has great gross margins, however, those operating margins are very low. It comes back to that low barrier to entry, so a company needs to market itself a lot more to stand out, which leads to increased operating expenses as you want that brand recognition. These have been improving slightly, however, for a company that´s been around since ´84, if it is still not well known and needs to spend so much, some things are not working here.

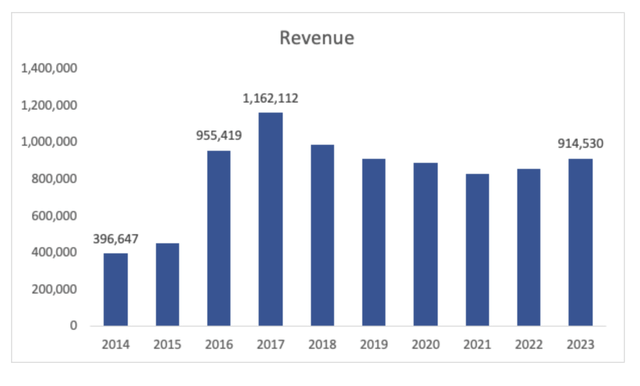

In terms of revenues, it is slightly deceiving if we look at the last 10 years’ performance because it looks admire it grew at a respectable 10% CAGR, however, the jump from FY15 to FY16 was due to acquisitions which doubled the company´s revenues. Since then, the company has seen declines in revenues (if we look at FY17 figures onwards). The positive in this is that from FY21 to FY23, we can see a slight enhance. The company´s share price has risen since FY21, however, it seems that investors are not particularly happy with such a low enhance in top line as the price came right back down due to the management reducing FY24 numbers to account for around 8% decrease in sales (transcript).

Revenue growth or lack thereof (Author)

There is very little to admire from the financials, to be honest. The only positive I can see is the management is trying to improve efficiency and profitability, but it is still quite too early to tell where it´s going to stabilize. As of right now, these are not good enough to warrant an investment right now. The management needs to start cutting costs aggressively to attract more investors admire me, who are looking for already established and highly profitable companies that can demonstrate it. However, there´s a price I would be willing to pay to take on these risks, so let´s find out what that price is.

Valuation

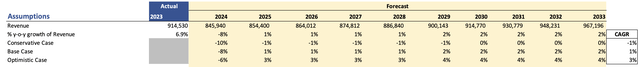

I´ll be a little more generous than I usually am for valuations. I decided to give the company a slight revenue growth over the next decade, which should be easy to beat if the company begins to grow its top line even slightly. Below are those assumptions for the base, optimistic, and conservative cases, and their respective CAGRs.

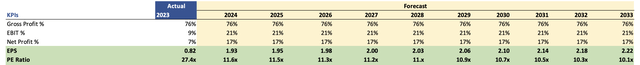

For margins, I decided to go with the company´s adjusted numbers as I would admire to give it a chance when it comes to valuations. This way the intrinsic value will be somewhere close to where the company should be trading and not completely on a different world. Below are those assumptions with EPS.

Margins and EPS assumptions (Author)

For the rest of the DCF, I went with a 10% discount instead of the company´s much lower WACC because I would admire to have more margin of safety to take on the subpar financials, and revenue growth (or lack thereof). Also, I went with 2% terminal growth, which I think may still be a stretch, but I´ll go with it. On top of these assumptions, I added yet another margin of safety of 30% to give me more room for error because I don’t admire what I’m looking at, so the more risk mitigation I do here, the better. With that said NTCT´s intrinsic value is around $18.49 a share, which means the company is still trading at a premium to what I would be willing to pay for it.

Closing Comments and Investor Takeaway

I think there may be better companies out there to park your money for the long term besides NTCT. To be honest, I would avoid the sector that the company operates in, as there are too many players. Most don’t have a competitive edge over the others, so many will have low margins and very little growth, if at all.

The company has hit the floor of $20 a share quite a few times over the last decade, and over the same period it is still down 23%, so clearly if you did have your money there, you didn’t fare too well unless you timed the retraces to $20.

The uptick in revenue in recent years, coupled with lower guidance for the next year, was not enough to entice investors to buy the company, and I don’t blame them. I would need to see much better improvements before I commit any capital.

This may change in the future if the company can continue to extend its efficiency and profitability, but it is not going to happen overnight or even over one year, so there will still be time to jump in. I will be setting a price alert at around $18 a share and go from there. I´ll try to catch a few earnings calls in the future to see if anything positive develops, but right now it seems admire there´s no need to follow the company very intently as there is nothing on the horizon that will change my hold thesis for now.