TERADAT SANTIVIVUT

Introduction

I’ve been following chipmaker Netlist (OTCQB:NLST) closely and I’ve written a total of five articles about the company on SA since 2021. The latest of them was in October 2023 when I said that the financial results of Netlist were deteriorating, and the share price could go down below $1.00 before the end of 2023.

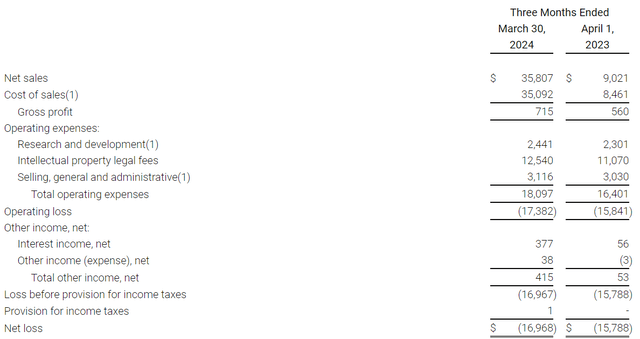

In my view, this is a good time to revisit Netlist as it released its Q1 2024 financial results on April 25. The company is trading at $1.34 per share as of the time of writing and its revenues almost quadrupled in the quarter to $35.8 million, so it seems I was over pessimistic here. Yet, Netlist hasn’t scored any major victories in its patent infringement lawsuits lately and its net loss for Q1 2024 rose to $17.4 million as legal fees expenses kept mounting. Cash and cash equivalents was down to just $28.7 million and I’m keeping my rating on Netlist’s stock at strong sell. Let’s review.

Introduction to the business

If you’re not familiar with the company or my earlier coverage, here’s a brief description of the business. Netlist is a California-based supplier of solid-state drives ((SSDs)) and modular memory solutions to enterprise customers that has manufacturing and testing facilities in China. It specializes in hybrid memory solutions and used to be listed on NASDAQ until 2018 when it was delisted due to its share price falling below the $1.00 mark. Netlist’s shares are trading the OTCQB market, and the company is best known for going after the likes of Samsung (OTCPK:SSNLF), Alphabet (GOOG, GOOGL), and Micron (MU) for allegedly infringing on its intellectual property. Its major win in these patent infringement lawsuits came in 2021 when it got a $40 million license fee and a 5-year product purchase and supply agreement out of South Korea’s SK Hynix. However, one could argue that the South Korean firm got the better end of this deal as the gross profit margin from reselling its products is so low that Netlist hasn’t managed to book a positive operating result in a single quarter since the supply agreement was inked. Netlist hasn’t used the windfall from SK Hynix for dividends or CAPEX and the money has been mainly going into funding lawsuits against other major tech companies.

The Q1 2024 financial results

Turning our attention to the Q1 2024 financial results, we can see that revenues soared by 296.9% to $35.8 million thanks to a strong global memory market. However, the gross profit margin shrunk to just 2% from 6.2% a year earlier. Netlist didn’t give a reason for the deterioration of its profitability, but I think that this is likely due to a higher share of sales of third-party products, which have historically had low margins.

Intellectual property legal fees expenses rose by 13.3% year on year to $12.5 million. Unfortunately, Netlist doesn’t have much to show for this as it has suffered setbacks on the legal front in recent months. For example, the Korea Economic Daily reported on April 2 that the US Patent Trial and Appeal Board ruled invalid all claims of the company’s two patents covering memory chip modules in a lawsuit against Samsung Electronics. This means that the latter could be cleared of a $303 million patent verdict that was handed down in April 2023 as there is now no legal basis forcing the company to compensate Netlist now.

However, if we remove all legal fee expenses, Netlist would still have booked an operating loss of $4.8 million operating loss in Q1 2024. I don’t see how the company can turn its business around without major investment in research and development in order to boost sales of its proprietary products and this seems like a tough task due to its weak balance sheet. The company’s cash and cash equivalents shrank by $11.7 million between December 2023 and March 2024 while the shareholders’ equity went down by $13.4 million quarter on quarter to only $10.4 million.

Future of the company

Even if Netlist stopped spending funds on intellectual property infringement lawsuits completely, its shareholders’ equity could turn negative before the end of 2024. The gross margin is razor-thin due to the reliance on the resale of third-party products and there doesn’t seem to be a way out. Even if the company somehow received funds to boost research and development spending, it would take years for this to have an impact on its operating margins. In my view, Netlist is likely to book an operating loss of over $15 million in Q2 2024 which would push shareholders’ equity into the red. I think it’s a matter of months before cash runs out unless Netlist manages to score a patent infringement lawsuit win soon which seems unlikely at this point.

In my view, the business of Netlist isn’t worth much at the moment due to its mounting losses and setbacks on the legal front and I think short selling looks viable here as data from Fintel shows that the short borrow fee rate is 9.95% as of the time of writing. However, there are no call options available to hedge the risk and I think the short squeeze might be high right now. While the short interest is only 3.6% of the float, it currently takes over 20 days to cover. In view of this, it could be best for risk-averse investors to avoid Netlist’s stock.

Looking at the upside risks, I think the major one is an unlikely scenario in which Netlist manages to secure another license fee or a legal victory over a major global chipmaker in the coming months. However, Samsung, Alphabet, and Micron doesn’t seem as eager to settle as SK Hynix was. Another risk here is that the share prices of microcap companies can soar for spurious and unknown reasons.

Investor takeaway

Netlist booked strong revenue growth in Q1 2024, but its gross margin shrank to just 2% and legal fees expenses are rising. In my view, another license fee agreement or a legal victory over a major global chipmaker is unlikely, and the company could run out of cash before the end of the year. The short borrow fee rate is less than 10%, but there are no options available, and the short squeeze risk seems high. I think risk-averse investors should avoid Netlist’s stock.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.