Mario Tama

I believe Netflix (NASDAQ:NFLX) is an exceptional stock to own, but there is a significant valuation risk that must be considered, and ample evidence that the growth of the firm is plateauing. I think the present valuation supposes increased growth rates to come, and I think the evidence for this is not clear in historical data and forward strategies. The new video game growth plan doesn’t provide enough to justify the current valuation yet.

Video Game Growth Strategy

Netflix has expanded towards games as well as simply movies and TV shows. This is part of the company’s strategy to become a full entertainment service, critically diversifying its portfolio in an attempt to both unlock more growth and retain attention from customers who may have looked for specific products not previously featured on Netflix elsewhere.

The firm is also looking at monetization strategies for its gaming platform. Such tactics include potential in-app purchases, premium pricing for sophisticated games, and ads in games for subscribers of its ad-supported tier. This could indicate higher growth for the company, as their initial stance was ad-free and no in-app purchases for gaming.

The company is actively seeking and hiring talent for developing AAA games, which have high development costs associated. This focus on higher quality is evidenced by the hire of prominent industry figures such as Joseph Staten, formerly of Microsoft (MSFT) and Bungie. Around 90 new games are being developed. The potential to leverage successful Netflix movies and shows and convert the content for a gaming audience could be a strong growth opportunity. The company has spent around $1 billion on gaming studio acquisitions and IPs.

Financials To Consider

This increased revenue diversification and attempt to grow subscriber engagement also comes at a short-term cost in terms of developing and marketing the initiatives. There may be lower margins in the short term as a result of the new expansion, but the medium-to-long-term upside is significant if the strategy executes as planned.

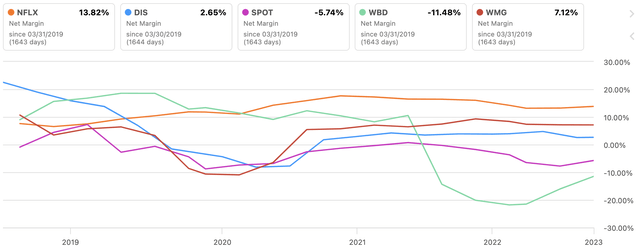

Netflix has very high margins at the moment, the top of its major industry peers, so any moderate reduction to this for long-term gain is a reasonable price to pay:

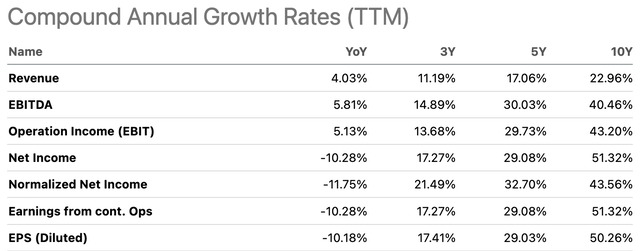

Netflix has had slowing growth rates for the last ten years on average, both in terms of its top and bottom lines. These are now at 4.03% and -10.28% YoY respectively, an anomalous result considering the firm’s three-year average of 11.19% and 17.27%:

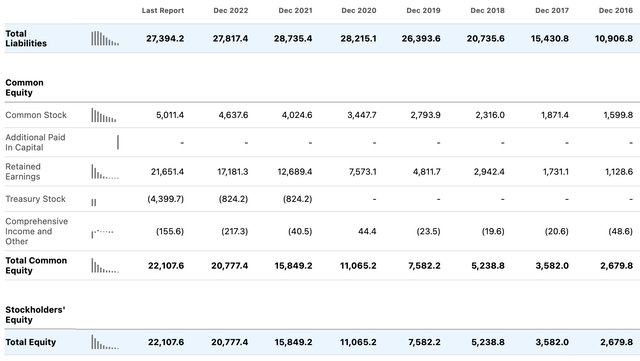

The firm’s balance sheet is very strong at the moment, showing continued opportunity in financing expansions into new areas of entertainment and potential growth. To illustrate this, look at the growth in total equity compared to the static nature of total liabilities recently:

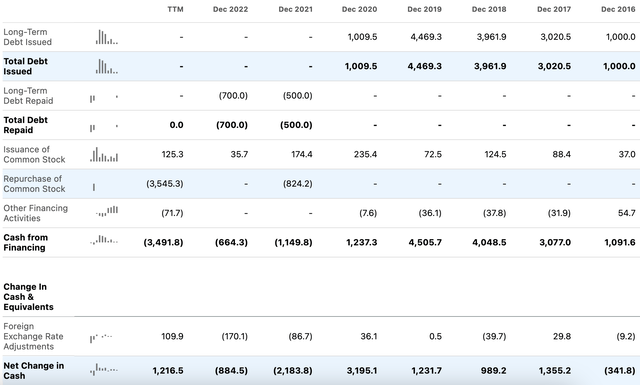

The company has also not issued any debt since 2020 and has repurchased $3.545 billion of common stock in the last trailing twelve months. The firm’s net change in cash is positive for this period, too, up from -$884.5 million in 2022 and -$2.184 billion in 2021 to $1.217 billion today:

Overall, the company’s financials reveal themselves to be strong. I think investors need to prepare for a slower growth period that should then moderately increase if the video game strategy is a medium-to-long-term success.

Overvalued

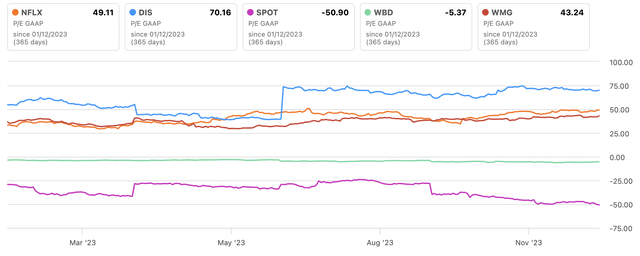

While the firm’s financials look promising, there is reason to believe that the company is overvalued, especially on a discounted cash flow basis. However, first of all, I am going to look at the company on a chart next to its major peers to get an understanding of its P/E GAAP ratio relatively:

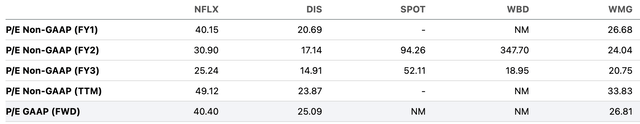

Netflix is highly valued and is the second most valued firm behind only Disney (DIS). Looking at Netflix against Disney and Warner Music Group (WMG) on forward P/E ratio, however, tells a different story:

The company is more highly valued than both of the traditional entertainment peers on a forward basis.

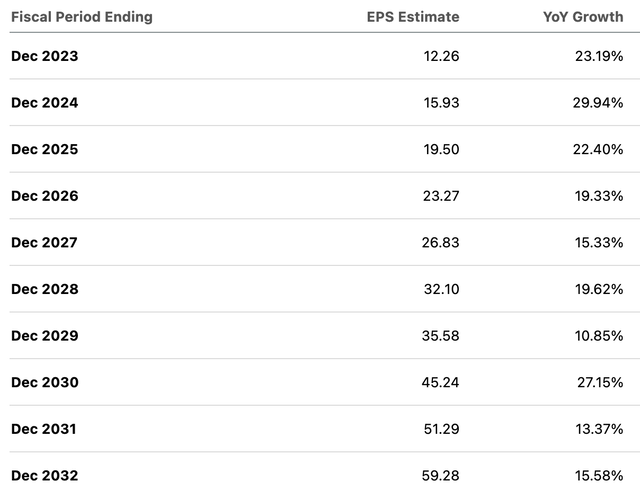

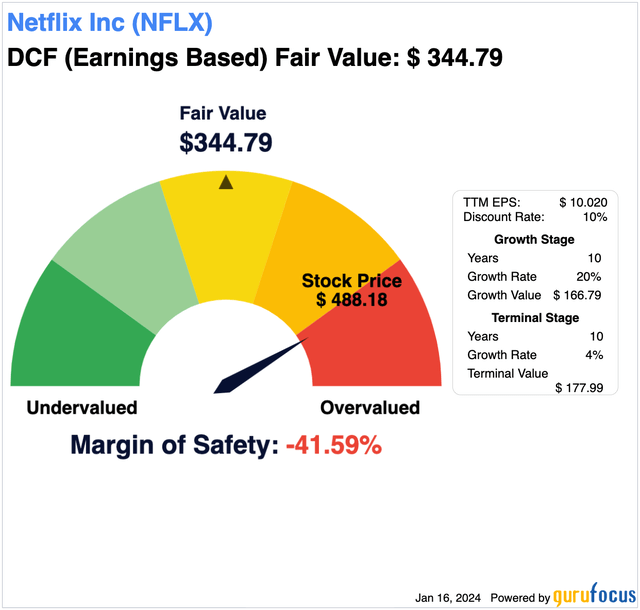

Netflix’s high valuation is concerning in general when considering the slowing growth rates elicited in my financial analysis above. Such slower growth puts the stock in a less than favorable position when considering an earnings-based discounted cash flow analysis. Considering the earnings estimates and YoY growth predicted as consensus, I think a 10-year average annual growth rate of around 20% is reasonable, as this is approximately the average of the analyst estimates presented below:

I think a fair value for the stock, based on a traditional DCF method, is around $345, around 42% below the current stock price of around $488. While DCF analysis is by no means definitive, and stock prices can grow independently of valuation models, this estimate presents a considerable risk to investors. I do not think that the growth tactics outlined above in relation to a video game division will make the earnings YoY growth rates above 20% as a next-10-year average.

It’s worth addressing that the stock has been on a strong rally since mid-2022. Taking a wider approach based on momentum and growth prospects, the stock is considered fairly valued by some.

Further Risks

I believe the company is going to face significant hurdles in competing in AAA games, even though it is hiring industry-tested talent to develop its sophisticated products. The games market is highly selective, with certain titles taking a large proportion of the attention and gameplay. There is a substantial risk that Netflix’s efforts in competing with the likes of Take-Two Interactive (TTWO) with Rockstar Games and the likes of Activision will be unsuccessful. Mastering the art of game development is not easy and arguably harder than TV and movie content creation. The gaming segment is also only approximately 1% of its user base at current, so the near-term revenue impact is likely to be limited.

While Netflix does have room for expansion, its growth is going to face limitations now, particularly in regions like the US and Canada. There may be significant growth opportunities in EMEA and the Asia-Pacific, but there are lower internet access and income disparities, which do not offer the same market potential here. The fact that the firm is at such a late stage in its global development and still has such a highly valued stock is an important concern to address, in my opinion. I think some volatility in the stock price should be expected as such.

Conclusion

I think Netflix is an exceptional company and one that is worth owning. However, at the current valuation and taking into consideration the slowdown in growth rates the firm has seen over the last ten years, I do not feel comfortable buying the company right now. Therefore, my rating for the firm is a Hold, largely based on its potential overvaluation at this time.