Nikada

Investment Thesis

NetApp, Inc. (NASDAQ:NTAP) delivered a very strong set of fiscal Q3 2024 results. But what’s most alluring is that its revenue guidance for its upcoming quarter is expected to come slightly ahead of analysts’ expectations.

Consequently, not only has NetApp reached record profitability, but it turns out that there’s still some growth left in this business.

Therefore, I’m upwards revising my rating to a buy.

Rapid Recap

Back in September, in my neutral analysis, I said,

Yes, the business’ growth rates leave a lot to be desired. And yes, as I noted in my previous analysis, tech stocks are either thriving or dying, and I don’t believe this business is thriving, at least not at the moment. But I also believe it’s important to change one’s mind if the situation warrants it.

Accordingly, I have to say that I’m positively drawn towards NetApp. Even if I don’t quite feel comfortable recommending this stock, I have to say, if the business continues on its mission to return capital to shareholders, and its valuation becomes attractive enough, I will have to reconsider my stance on this stock.

Author’s work on NTAP

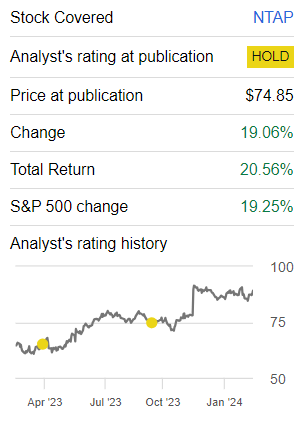

Up until the close yesterday, NetApp had mostly matched the S&P 500’s (SPY) return. But now, on the back of these highly profitable results, the investment thesis has changed.

NetApp’s Near-Term Prospects

NetApp is an IT storage provider that offers data-centric software solutions. They empower customers to manage, protect, and optimize data across different cloud environments.

NetApp’s focus is on simplifying operations in the cloud landscape. They provide services for major public clouds like Amazon AWS (AMZN), Microsoft Azure (MSFT), and Google Cloud (GOOG), helping customers efficiently store data.

NetApp is witnessing solid momentum in its all-flash business, which witnessed an impressive 21% year-over-year growth, reaching an annualized revenue run rate of $3.4 billion. The strategic focus on modernizing legacy infrastructure and providing scalable, high-performance data pipelines for AI workloads positions NetApp as a key player in addressing contemporary IT challenges.

Additionally, NetApp’s diverse product offerings, ranging from on-premises solutions to cloud-native options, cater to evolving customer preferences and budget flexibility.

However, there are also challenges. One concern lies in the potential headwinds in the Public Cloud segment. Despite a 1% year-over-year growth in revenue, the company anticipates approximately $20 million in annual recurring revenue headwinds from unrenewed subscriptions in Q4.

Furthermore, the increase in commodity costs, particularly NAND prices, poses a challenge to product gross margins. While the shift to higher-margin all-flash products is expected to partially offset this.

Given this context, let’s now turn to discussing its fundamentals.

Revenue Growth Rates for Fiscal 2025 Could Reach ~8% CAGR

In my previous analysis, I said,

NetApp believes that the second half of fiscal 2024, starting November 2023, should see NetApp’s revenue growth rates stabilize and possibly even deliver some top line growth.

Needless to say, if this ultimately transpires to be the case, this would be very welcome news for shareholders here.

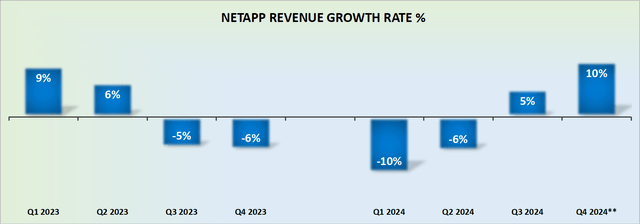

That unfolded as I expected. But I hadn’t expected to see NetApp’s guidance point towards a double-digit top revenue growth rate for fiscal Q4 2024.

What’s more, given that the next couple of quarters’ comparables are very easy to compare against, this will allow NetApp to deliver close to double-digit growth rates all the way into fiscal H1 2025, simply from the business performing “as is”, without a lot of new customer growth.

Simply put, there’s a situation where the status quo will allow NetApp to shine, and for management to put forth an alluring turnaround narrative.

NTAP Stock Valuation — 13x Forward EPS

Right away, consider that NetApp has a net cash balance sheet with $500 million of cash. For a business that’s valued at approximately $20 billion (including the premarket jump), this is a fair amount of cash, at 2.5% of its market cap.

But on top of that, NetApp’s guidance for fiscal Q4 2024 points to $1.74 of EPS at the high end. This implies that its EPS will be up 13% y/y.

What’s more, if we look further ahead, at this pace, there’s a potential for NetApp to deliver $7.85 of non-GAAP EPS at some point in the coming twelve months, as a forward run-rate.

This implies that NetApp is priced at approximately 13x forward non-GAAP EPS. A figure that is undoubtedly appealing, particularly if NetApp continues to deliver high single-digits or perhaps even double-digit growth rates on its topline.

The Bottom Line

Given NetApp’s remarkable fiscal Q3 2024 results and the positive revenue guidance for the upcoming quarter, I’m upgrading my rating to a buy. The company’s record profitability and the potential for continued growth make it an attractive investment.

What’s particularly appealing is NetApp’s valuation at approximately 13x forward non-GAAP EPS, showcasing an attractive figure, especially considering its net cash balance sheet. With the potential for sustained high single-digit or even double-digit growth rates, NetApp appears well-positioned for a favorable risk-reward scenario, making it a compelling choice for investors seeking value in the technology sector.